Short Iron Condors

A Strategic Approach to Consistent Profitability in Sideway Markets

All the simulations are available in Thales Options Strategy Simulator.

In options trading, the short Iron Condor stands out as a flexible and effective strategy, especially when employed in stable market environments. Combining two credit spreads—one put and one call—it allows traders to define a price range where the underlying asset can move without incurring significant losses. When applied to Bitcoin, this strategy takes on an exciting dimension, offering the potential to earn consistent returns while managing risk. Let's explore how to effectively implement this strategy, evaluate the factors influencing its success, and use simulations to visualize its performance under different conditions.

Crafting a Short Iron Condor: The Key Setup

To initiate a short Iron Condor, we simultaneously sell a put and a call at different out-of-the-money strikes and purchase further out-of-the-money options for protection. This structure allows us to limit both our maximum potential loss and gain, providing a high-probability, low-risk strategy.

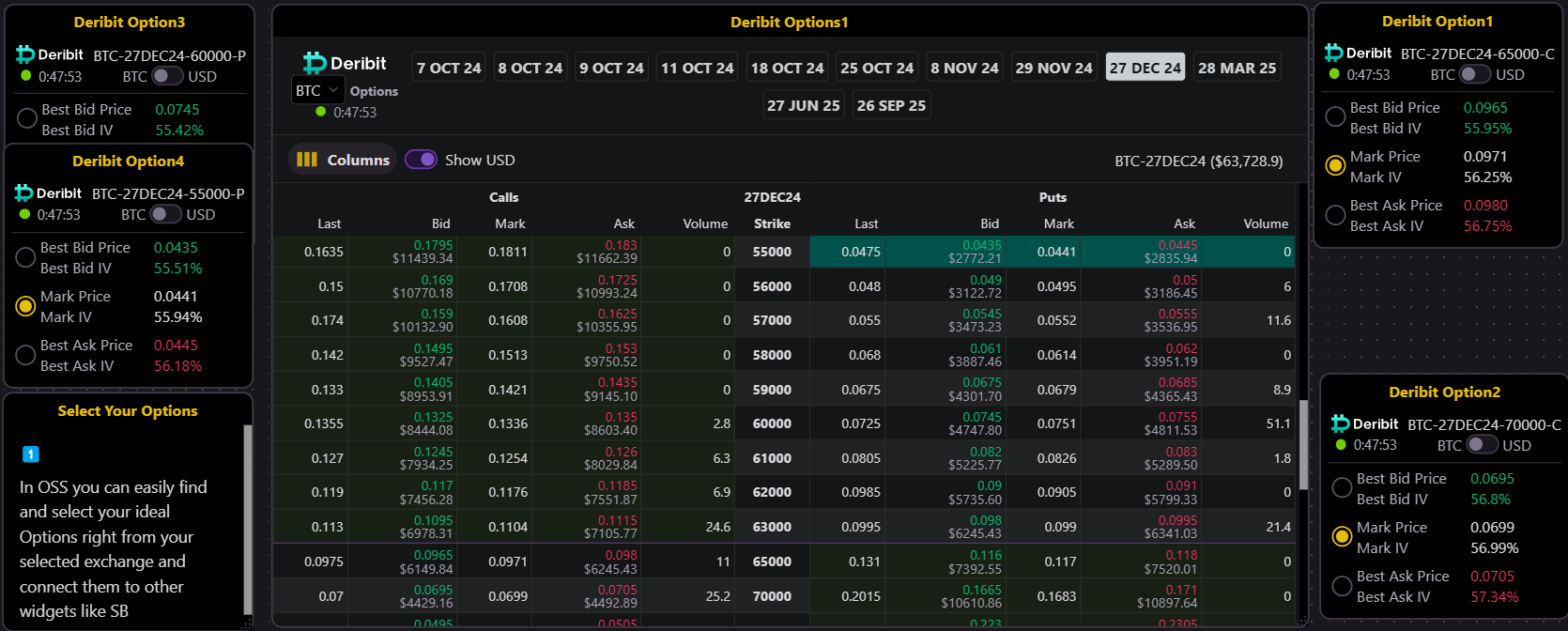

In the case of Bitcoin options, we select appropriate strikes that capture the underlying’s price range. Using Thales OSS integrated dashboard, we can select these strikes without the need for manual data imports.

The Options for our example are chosen as seen in the imabe below.

(Simulation 🔗)

Understanding the Risk-Reward Tradeoff

At first glance, the strategy may appear to have an unfavorable risk-to-reward ratio. However, it offers a key advantage: the probability of success is higher than that of many other strategies. The wide range between the two short strikes increases the likelihood of the underlying asset remaining within the profit zone, allowing traders to capture premium while minimizing exposure.

(Simulation 🔗)

Implied Volatility: A Double-Edged Sword

Implied Volatility (IV) is a major influence on the performance of the short Iron Condor. When volatility rises, the premiums of both the short and long options increase. Although this sounds favorable, the position can still incur losses because the short options—being closer to the current price—experience a larger jump in value.

To illustrate, let’s simulate a 20% increase in implied volatility. In this case, although all options increase in value, the overall position dips into loss territory as the short options become significantly more expensive.

(Simulation 🔗)

However, if volatility decreases, the opposite occurs. The short options lose value faster than the long options, allowing the trader to capture more premium and ultimately profit from the shrinking volatility.

(Simulation 🔗)

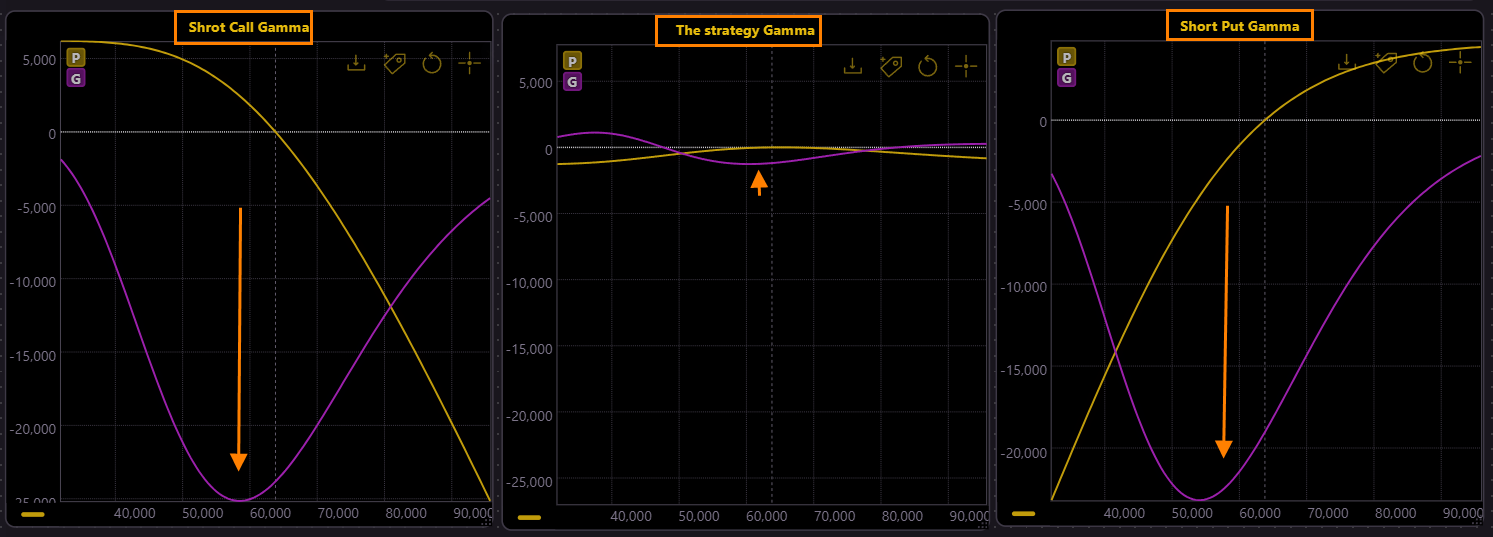

Gamma Protection: Mitigating Price Shocks

The key benefit of the short Iron Condor is its ability to mitigate sudden price shocks. This is achieved through the reduced gamma in the position. Gamma measures the rate of change in delta, and in a spread like the Iron Condor, gamma is lower compared to selling naked options. Lower gamma means that the position is less sensitive to rapid changes in the underlying price, allowing the trader to better manage risk during market volatility.

(Simulation 🔗)

Passage of Time: Profiting from Theta Decay

Time decay—or theta—plays a central role in the success of the short Iron Condor. As time passes, the short options lose value faster than the long options due to their higher theta. This gradual loss in value works in favor of the trader as long as the price of Bitcoin remains within the profit range.

If you check the dashboard, there you can see the effect of time passage as the yellow curve (current value) moves toward the red curve (value at expiry). As expiry nears, the position becomes more profitable due to the accelerating rate of time decay.

(Simulation 🔗)

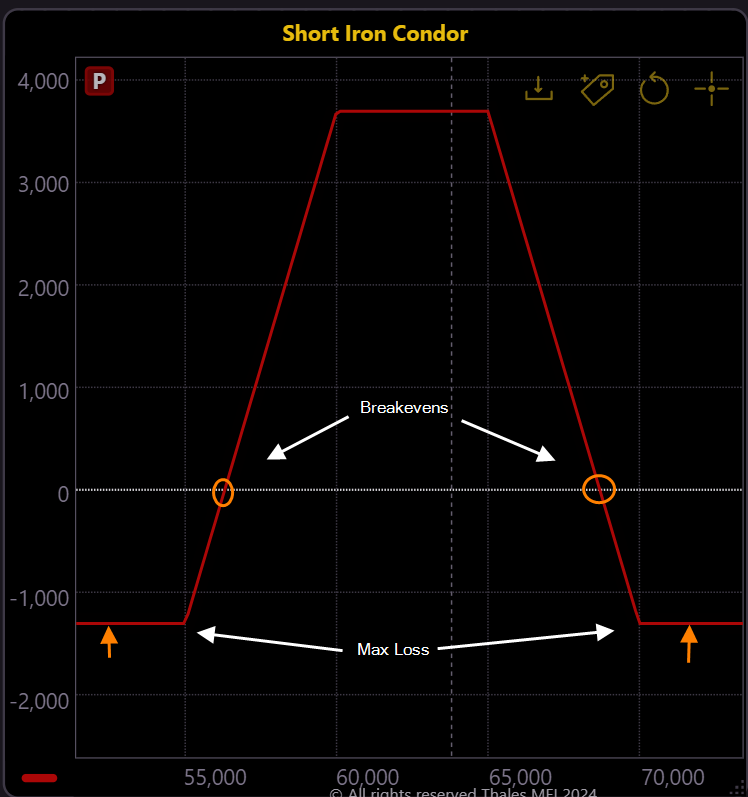

So, ideally, the underlying asset stays within the defined profit range until the options expire, allowing us to retain the premium collected. However, as shown in the simulation, the breakeven points illustrate the thresholds where the strategy shifts from profit to loss.

(Simulation 🔗)

It’s essential to keep risk management in mind when trading a strategy like the short Iron Condor. The maximum loss is predetermined at the moment the position is opened and does not change regardless of where the price ends up by expiration. This feature allows traders to define their risk from the outset, providing more control over potential outcomes and preventing any surprises along the way. As demonstrated in the graph above, the maximum loss is capped, offering a level of certainty in the event of adverse price movements.

Conclusion

The short Iron Condor is a strategic, high-probability trade that allows traders to profit from chopping markets. While the risk-to-reward ratio may appear unbalanced, the higher probability of success and the ability to capitalize on time decay make this strategy particularly effective in the right market conditions. Through careful strike selection, low-delta options, and a focus on managing gamma and volatility, traders can achieve consistent, controlled profits.

Disclaimer

The content provided in this blog is for informational and educational purposes only and should not be considered financial or investment advice. Options trading carries significant risk and may not be suitable for all investors. Be sure to assess your own financial situation, risk tolerance, and consult with a qualified financial advisor before engaging in any trading strategies. The examples and simulations shown here are for illustrative purposes and are not guarantees of future results. Always conduct your own research and be aware that trading losses may exceed your initial investment.