Blog

-

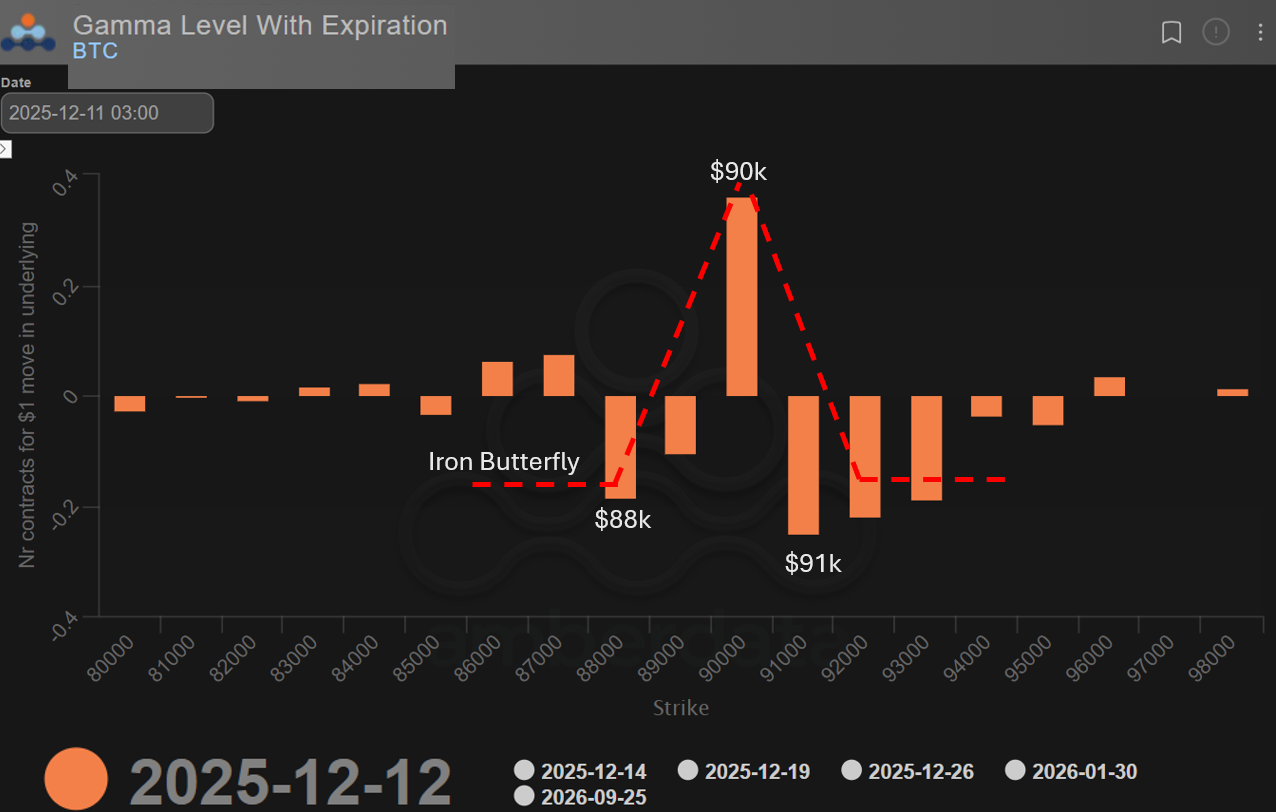

Volatility for Sale: A Limited-Volatility Structure Dominates the December 12 Expiry

Market makers’ gamma positioning reveals a deliberate volatility-selling footprint around 90k, with sharp short-gamma pockets poised to influence Friday’s BTC expiry.

-

OUTLOOK 16NOV25: Inside the Box; A New Regime

A packed week of downside pressure, capped volatility, and exploding box-spread activity signals a new regime in Bitcoin options—defined by arbitrage, discipline, and deep liquidity.

-

OUTLOOK 09NOV25: Dealers' Positive Gamma Profile

Bitcoin’s correction below its all-time high has pushed volatility near 50% and brought balance to the put/call ratio. Traders are increasingly selling options, creating a positive gamma environment and tighter price ranges around the $100K level. This Outlook examines that shift toward a more mature, strategically driven Bitcoin options market.

-

OUTLOOK 27JUL25: Eying Upside with Caution

Bitcoin’s $12.3B July expiry pinned near max pain, rewarding sellers. Post-expiry flows show cautious bullish positioning with defined downside hedges. Diagonal spreads and risk reversals highlight traders’ strategic alignment with the 110k–120k zone.

-

OUTLOOK 13JUL25: The Rally That Didn’t Roar

Bitcoin broke above $118K as nearly all puts expired worthless. This week’s Outlook explores mixed positioning ahead of 18 July — from aggressive short puts to neutral butterflies and bearish spreads — revealing a market walking a fine line between confidence and caution.

-

OUTLOOK 08JUN25: Shifting Sentiment Under Calm Volatility

Despite record-low implied volatility, Bitcoin options positioning is shifting: from a failed risk reversal to growing downside hedges and strategic long calls. In this Outlook, we explore the market’s evolving sentiment, from the near-term 13 June expiry to long-dated bets — and spotlight two large block trades revealing diverging outlooks.

-

OUTLOOK 31MAY25: Composure at the Top

Despite five consecutive bullish expiries and a fresh ATH, the Bitcoin options market remains calm. In this Outlook, we explore what declining volatility, balanced positioning, and two distinct block trades reveal about trader sentiment heading into June.

-

OUTLOOK 24MAY25: A Rally with One Foot on the Brake

Bitcoin’s fourth straight expiry above max pain signals bullish resilience—but options traders aren’t fully convinced. With muted implied volatility, cautious hedging, and tactical structures like the $115K butterfly, this Outlook decodes a market walking the line between conviction and caution.

-

OUTLOOK 17MAY25: Between Confidence and Concern

As Bitcoin hovers above $100K, the options market tells a deeper story — fading volatility, cautious put buying, and tactical plays like bear spreads hint at growing short-term unease beneath a calm surface.

-

OUTLOOK 11MAY25: Calm Markets, Bold Bets

As Bitcoin breaks above $100,000, the options market tells a deeper story—one of restrained volatility, strategic positioning, and cautious optimism. This Outlook unpacks expiry outcomes, evolving open interest trends, subtle shifts in call-put skew, and how traders are quietly preparing for the weeks ahead. From near-term hedging to a bold Bull Call Ladder targeting $135K, discover what’s shaping sentiment beneath the surface.