Market Outlook 10OCT24

Bitcoin Options IV Moves Ahead of the U.S. Election

As traders, we are constantly faced with the question: Where is Bitcoin headed next? Whether the price will climb or fall is a debate driven by market sentiment, macroeconomic factors, and, of course, the intricacies of the options market.

In a world dominated by algorithmic trading and structured products, it’s easy to forget that behind every trade are human decisions, emotions, and expectations. Our proprietary tools—crafted specifically for analyzing the options market—allow us to delve into the heart of this decision-making process, revealing how traders are positioning themselves as we approach critical expirations.

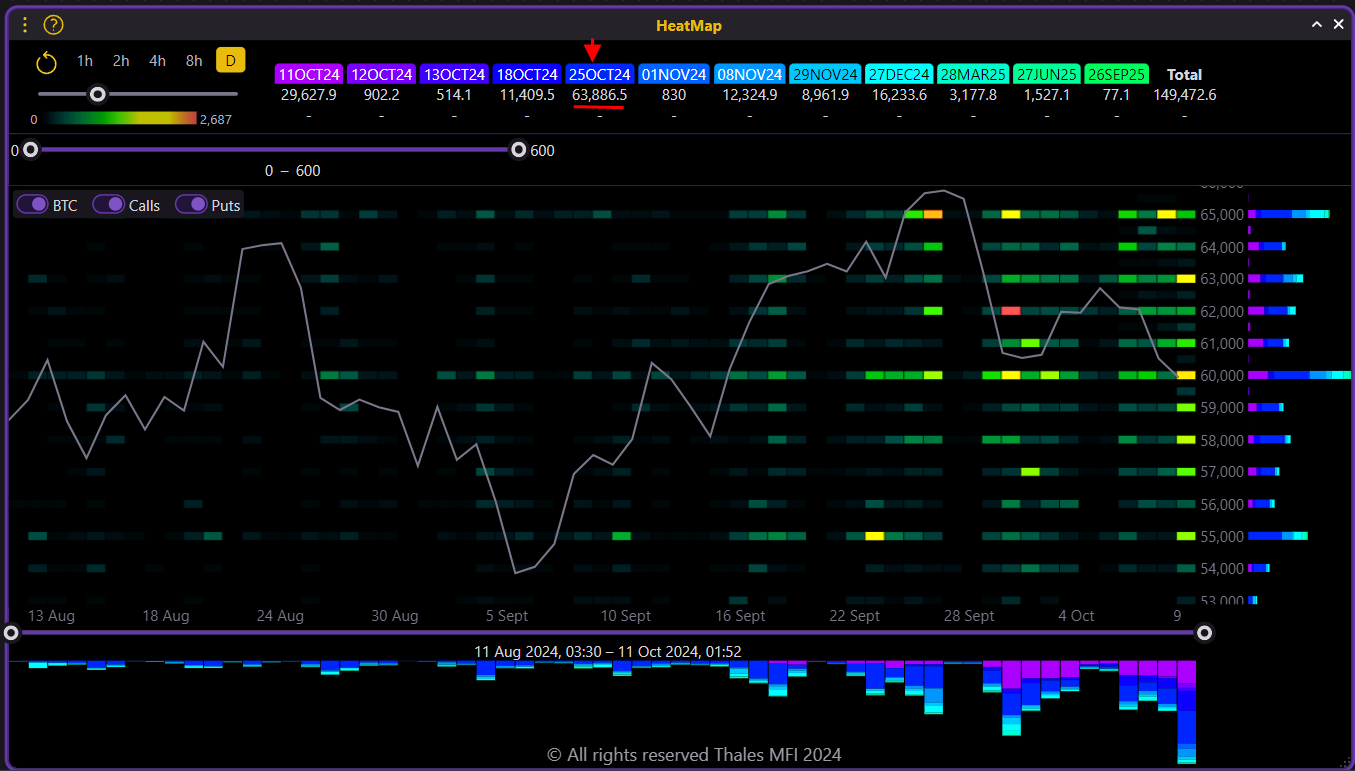

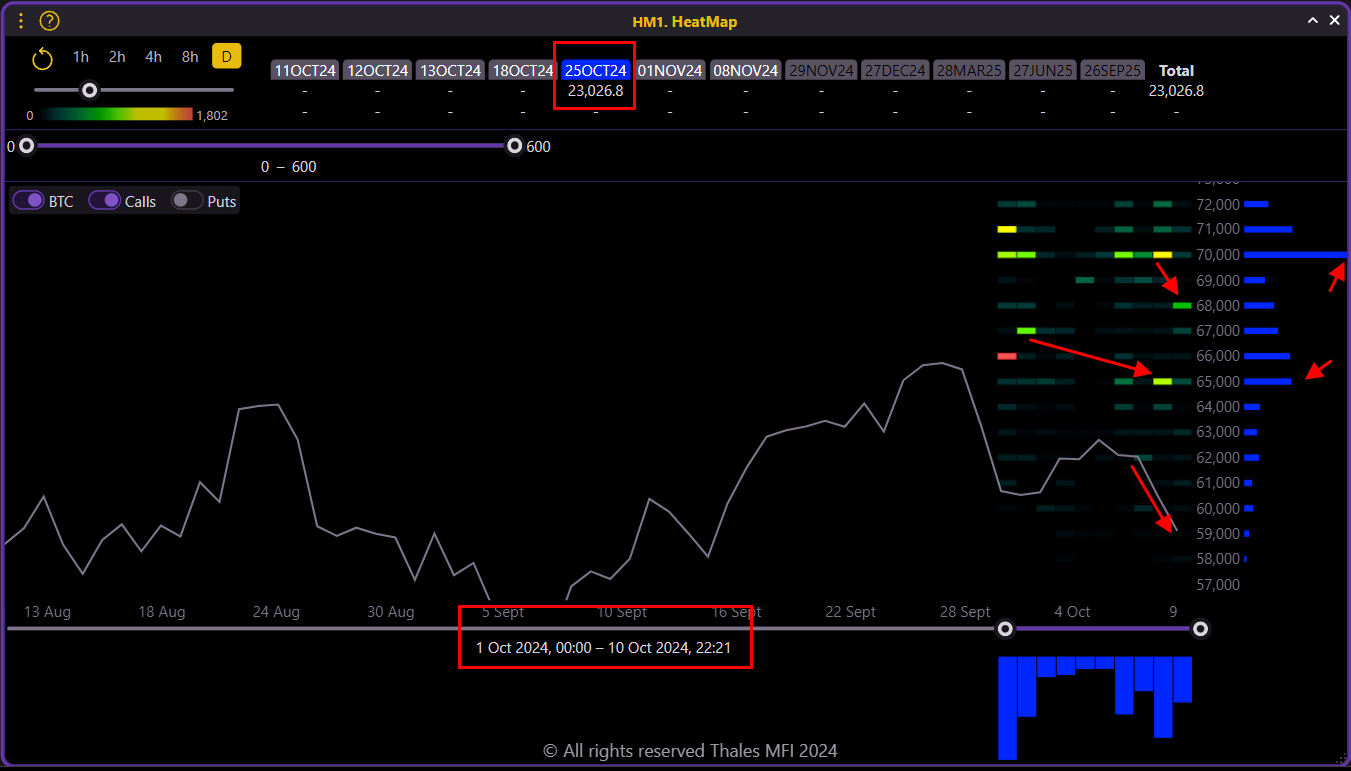

At the center of this narrative is the October 25th expiration, which, as the heat map shows, has captured the attention of the market. (this can be seen either from the total contracts below each expiration on the top, or from the color code of expirations on the columns on the below and the right of the widget.

October 25th: The Focal Point of Market Activity

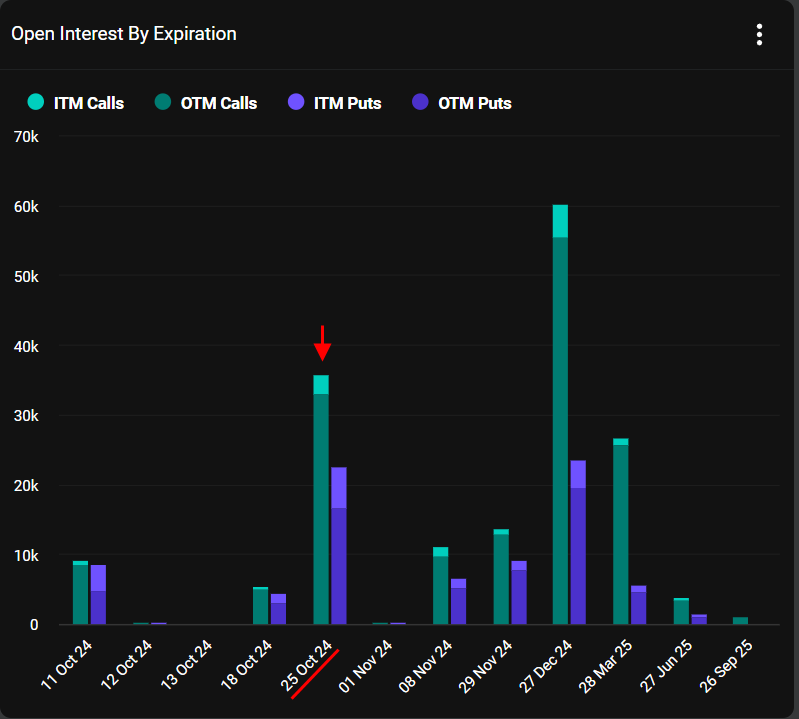

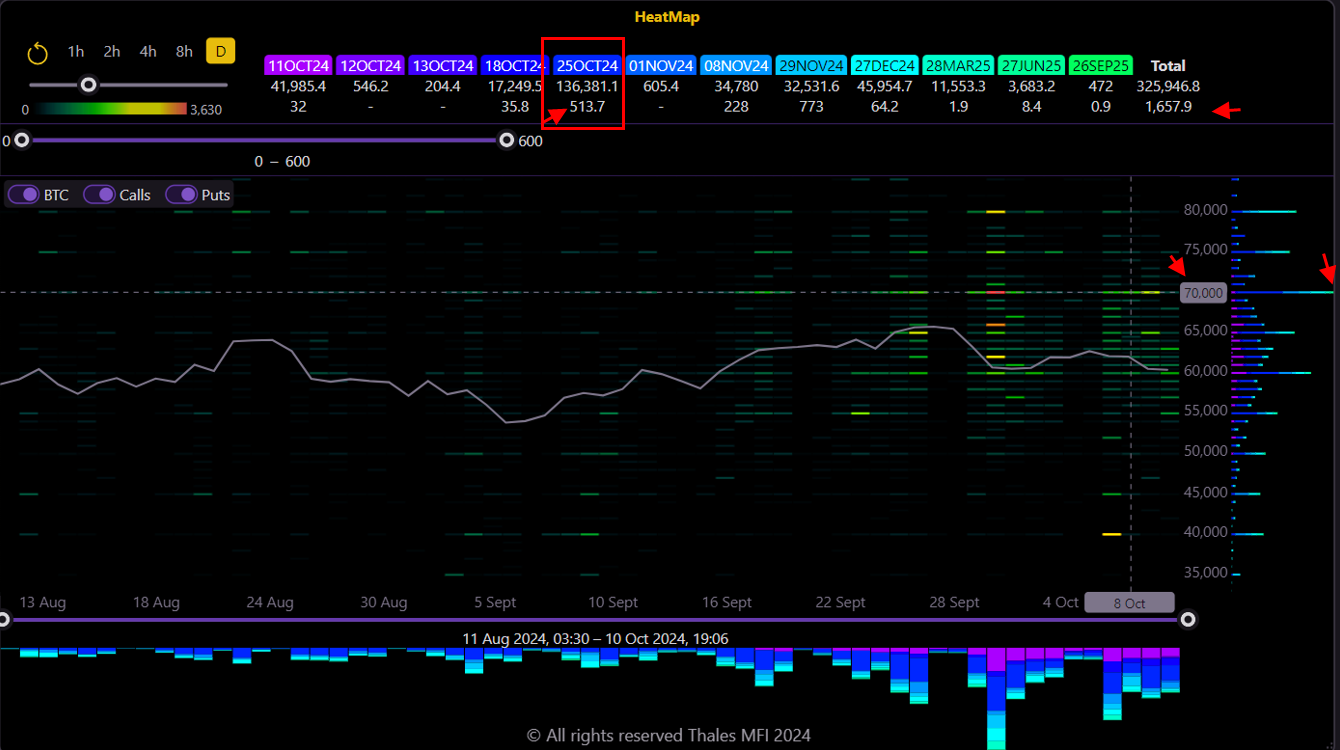

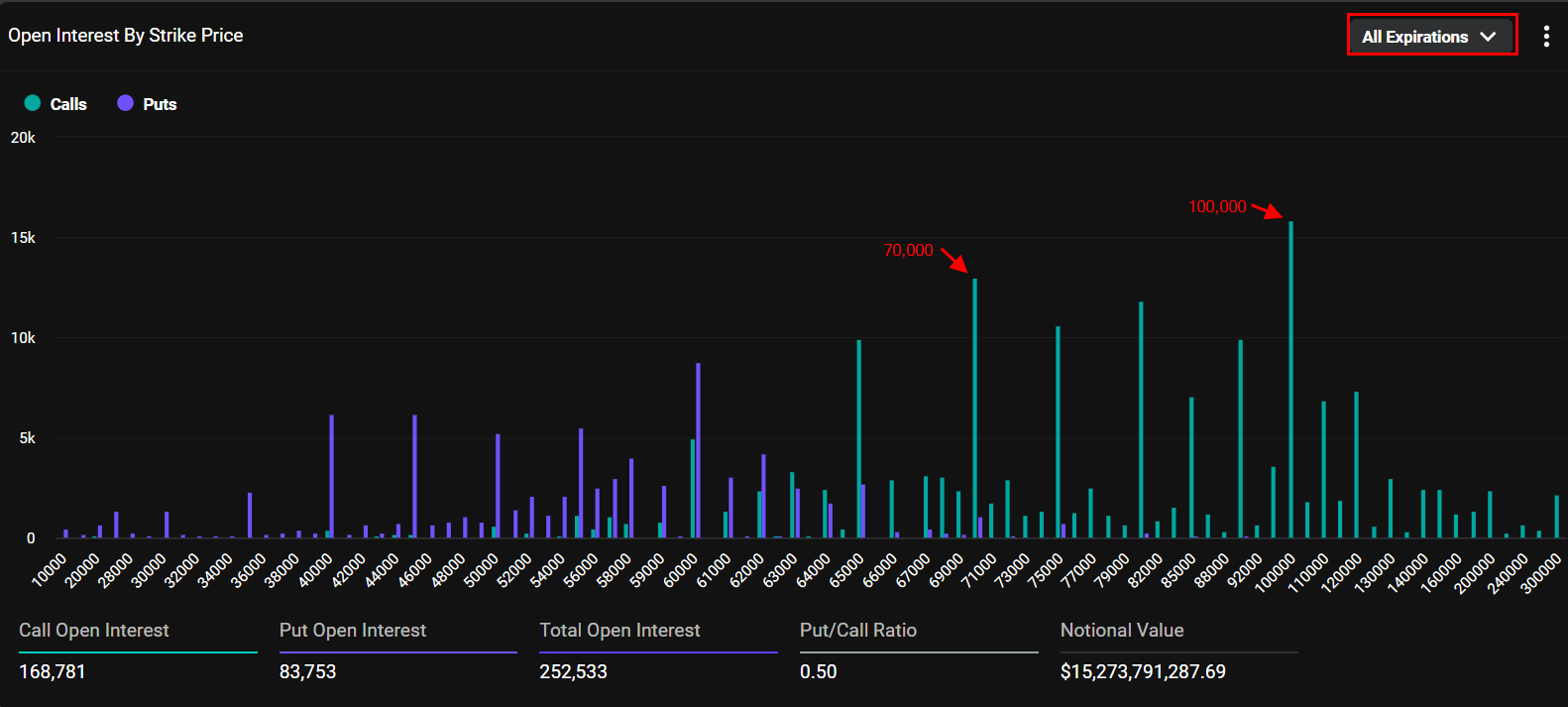

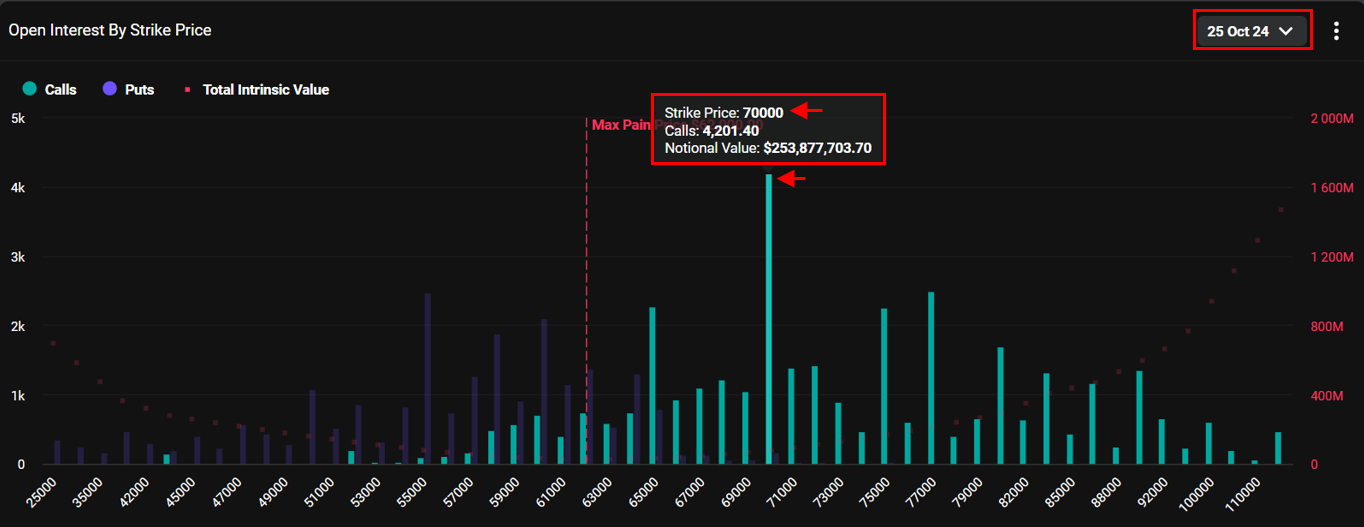

As depicted above, October 25th is a significant expiry among all active Bitcoin options. But is there a specific strike within this expiry that contributes more heavily to the open interest (OI)? Let's return to our Heatmap and apply a more precise analysis:

It’s clear from the highlighted column that the $70,000 strike has seen the most activity within the selected timeframe. This strike stands out as the primary focal point for traders, contributing significantly to the overall open interest for the October 25th expiration.

As the price line indicates, Bitcoin's price has recently fallen to $60,000 and consequently there is a shift in activity towards lower strikes, particularly on $66,000 and $65,000.

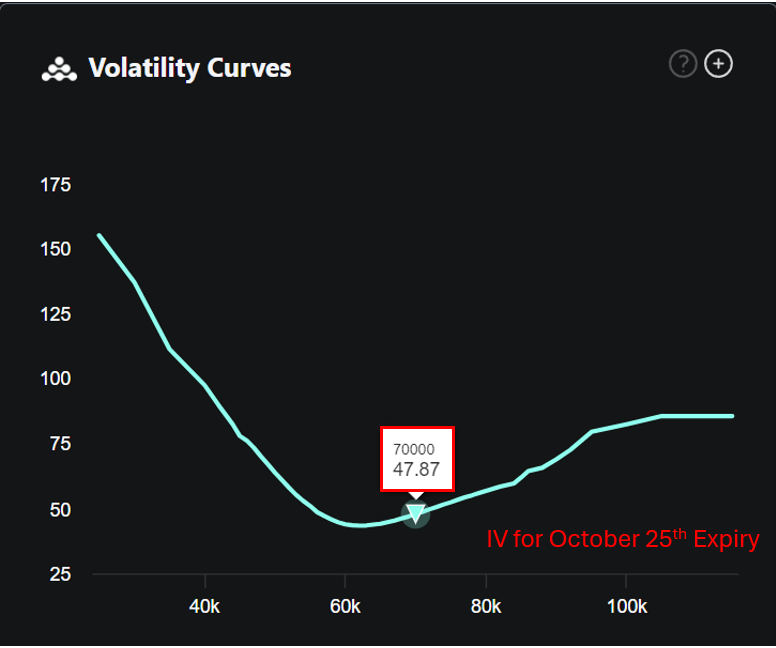

Deribit price chart of the contract shows this more clearly. As seen in the chart, the price of this call option has significantly decreased, reflecting the broader market downturn and the lower probability of Bitcoin reaching this strike by expiration. This drop confirms that while interest remains high, the option has become notably cheaper.

Despite this shift, the $70,000 strike remains the largest in terms of open interest, highlighting it as a key level traders are watching.

The Role of Volatility: Is a Storm Brewing?

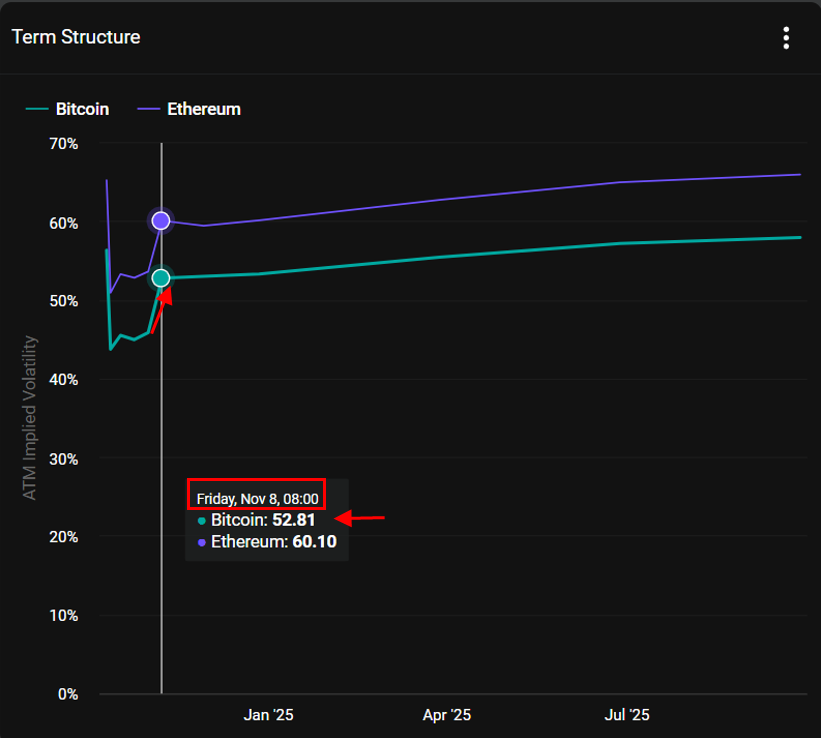

As we edge closer toward the end of October, several factors are at play. The upcoming U.S. elections on November 5th loom large, adding an element of geopolitical uncertainty that the market is keenly aware of. Historically, Bitcoin has shown a tendency to react to macroeconomic events, particularly those tied to global liquidity shifts.

The chart above highlights the term structure of implied volatility (IV) for Bitcoin. Notably, there is a clear increase in IV leading up to November 8th, likely tied to the uncertainty surrounding the U.S. elections. Historically, major macroeconomic and political events have triggered significant volatility in the crypto markets, and traders are positioning for a potential spike in market movement around this date. This increase reinforces the anticipation of heightened volatility as we approach November.

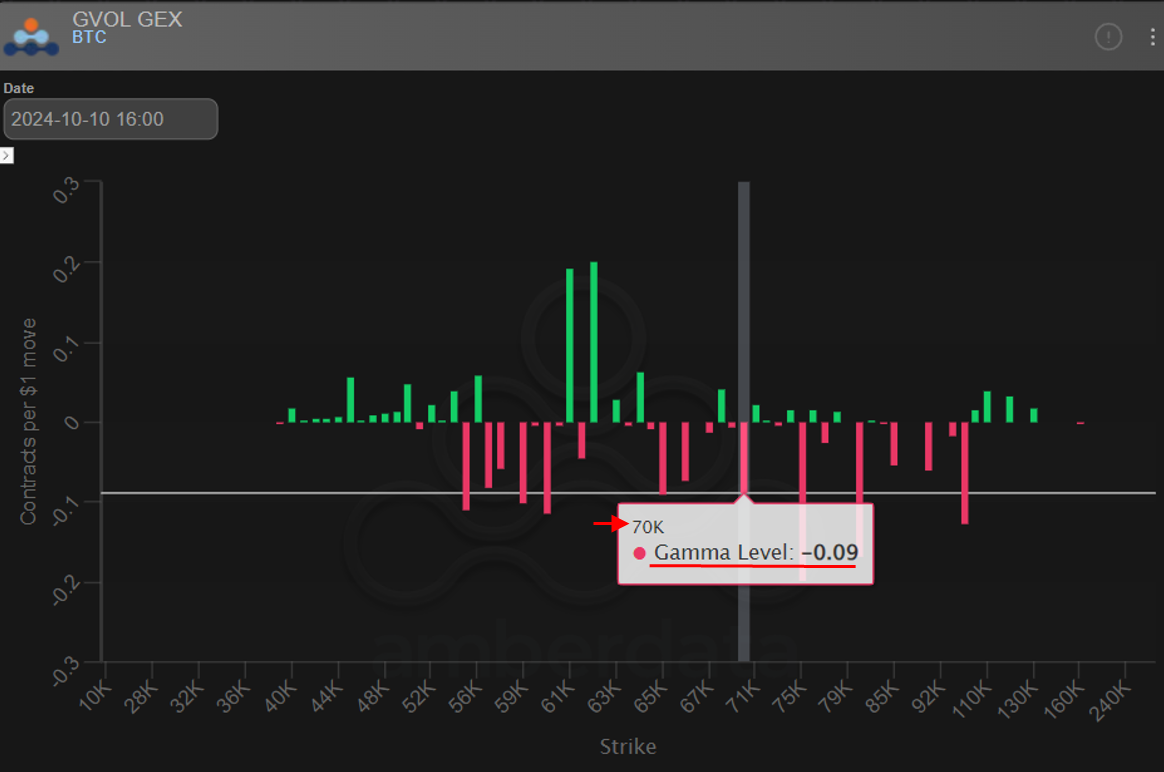

Gamma Exposure: Volatility on the Horizon?

Gamma exposure is like an undercurrent in the options market, often unseen but powerful. The negative gamma we are observing at the $70,000 strike (chart above) tells us that if Bitcoin begins to approach this level, market makers will need to aggressively hedge their positions, potentially creating large price swings. This could lead to a feedback loop, where price movements beget more volatility, especially as we get closer to October 25th.

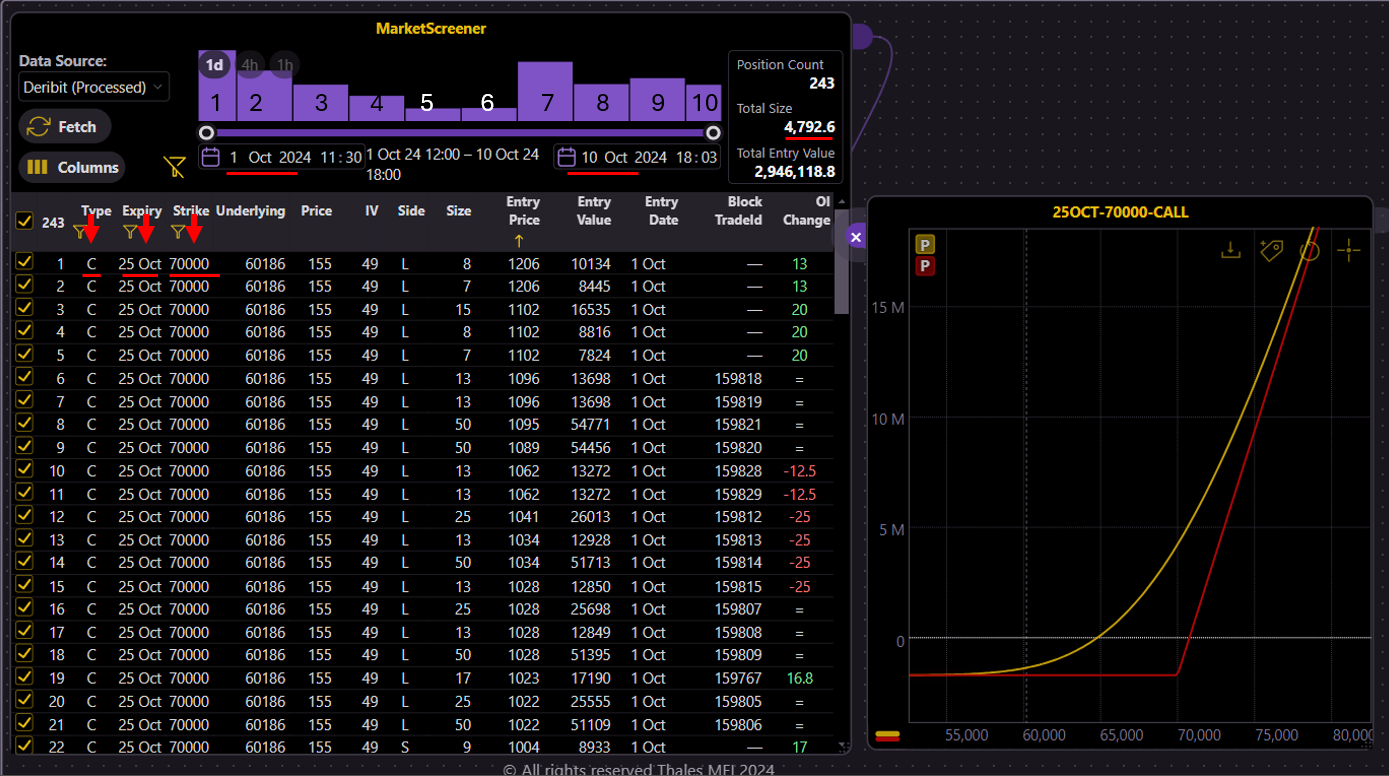

In the Mirror of the Market Screener

To find a clear vision of the market, fortunately we have access to its proper tool: Market Screener. We have tuned the data by adjusting some filters: Entry is set in to the recent 10 days, type is filtered to Call, expiry is set to October 25th, and strike is limited to $70,000. The graph represent the overall market trades as a long call, while the purple columns represent the trading volume for each day within this time frame, giving us insight into the activity on a day-by-day basis.

The large volume of trades going long on this option could indicate an optimistic speculation as we approach the end of October. The hopeful holders of the call option may view it as a fairly priced lottery ticket, poised to make them happy as the long-anticipated bullish market is to be triggered by the U.S. elections. Even if the price fails -once again- to break through the resistance lines, implied volatility has the chance to fly and pull the PnL above the breakevens. Technically speaking, positive Delta and Vega appear to outweigh the cost of Theta. Yet the dynamism of the market left more experienced participants in an agnostic state carefully monitoring the market and getting ready for every scenario.

Disclaimer

The information provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Trading options involves significant risk, and readers should conduct their own research before making any decisions.