synthetic call: A Solution to Shallow Options Markets

All the simulations are available in Thales Options Strategy Simulator.

Introduction

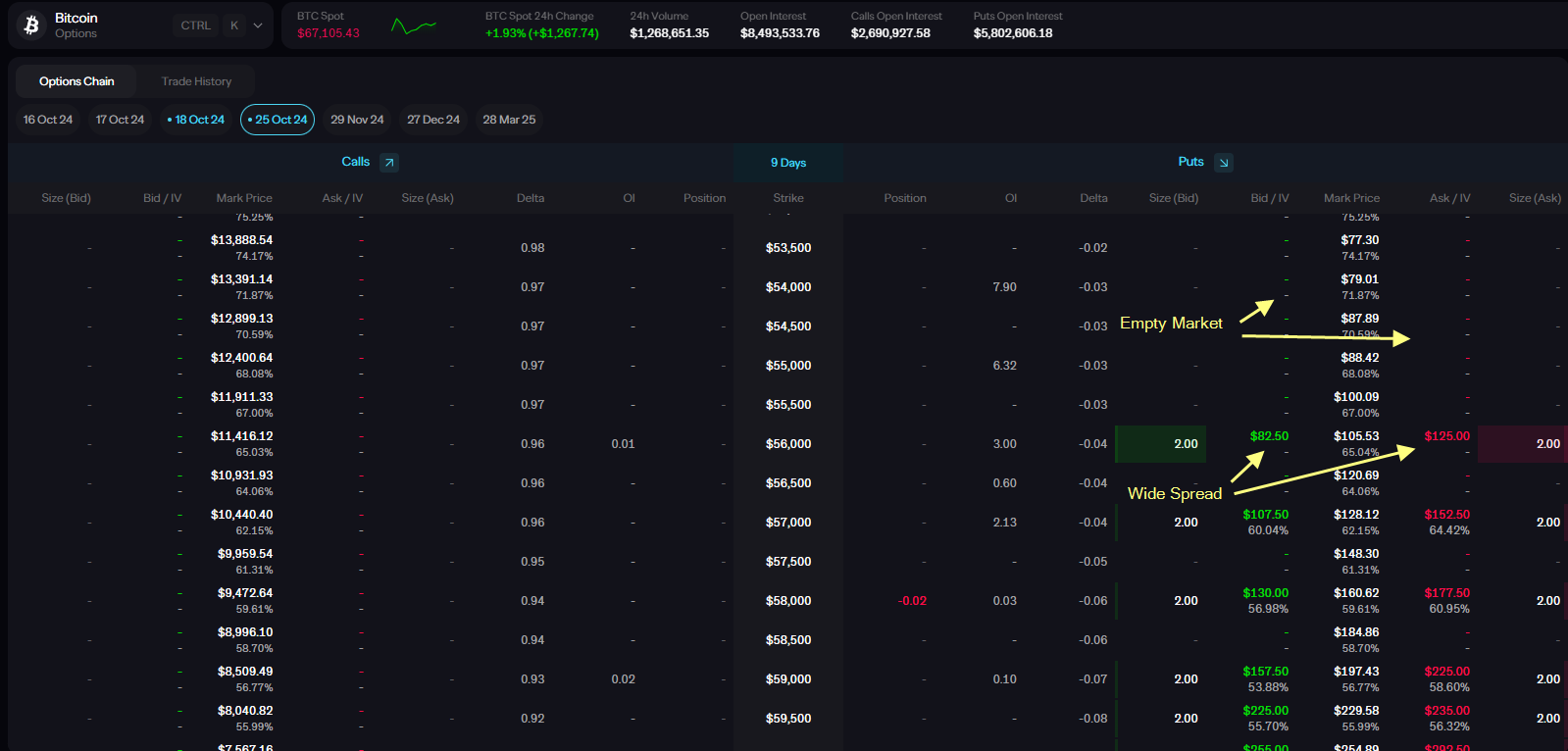

For many traders, the thrill of trading options can quickly fade when faced with the reality of shallow markets. Particularly in emerging decentralized finance (DeFi) protocols, where liquidity isn’t as deep as one might expect, and the spread between bids and asks can widen dramatically. The deeper the option goes into the money, the wider the bid-ask spread may become, making it harder to close positions at a fair price.

However, options traders have long been resourceful, and where liquidity falters, creative strategies arise. One such solution is the synthetic call strategy—a powerful approach that not only solves liquidity problems but also offers a flexible way to navigate volatile markets. In this blog, we explore how pairing a perpetual long position with a protective put can replace a long call position to give traders an edge, especially in shallow markets where the bid-ask spread can make it difficult to close deep in-the-money (ITM) call option at a fair price.

The Synthetic Call: Breaking Down the Strategy

At its core, the synthetic call is a bullish strategy, designed to benefit from rising asset prices, much like a traditional long call. It combines a long underlying (UL) position—which can be taken in perpetual futures—with a long put option. This combination replicates the payoff of a traditional long call option: S + P = C, where S is the underlying asset (Stock), P is the Put option, and C is the Call option. On the surface, the payoff structure seems the same, but the advantages extend beyond that, especially when dealing with liquidity issues.

Let’s simulate real-world positions from the Bitcoin options market. Suppose Bitcoin’s price is $67,000, and there are ATM options available in the market at the same price. Using OSS, we can consider the following positions:

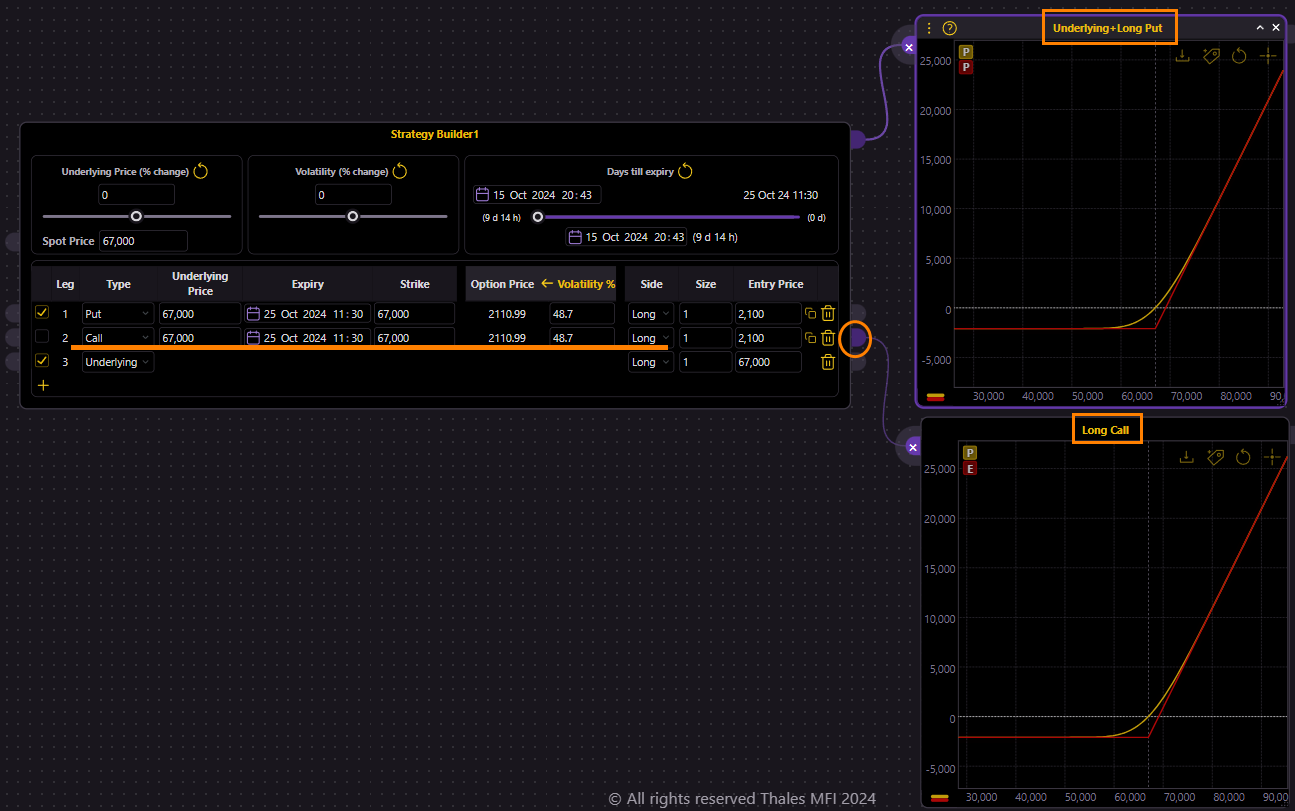

(Simulation 🔗)

One of the graphs depicts the synthetic call (UL+ long put), while the other represents a traditional long call. Both options are created with ATM strikes—$67,000 for both the put and call—meaning the market price is exactly at the strike level when the positions are opened. The same premium was paid for both the put and call options, allowing for a direct comparison between the two strategies.

Both simulations result in the same PnL, as shown in the graphs, illustrating how the synthetic call effectively mirrors the long call in terms of risk and reward.

Different bases, similar outcome

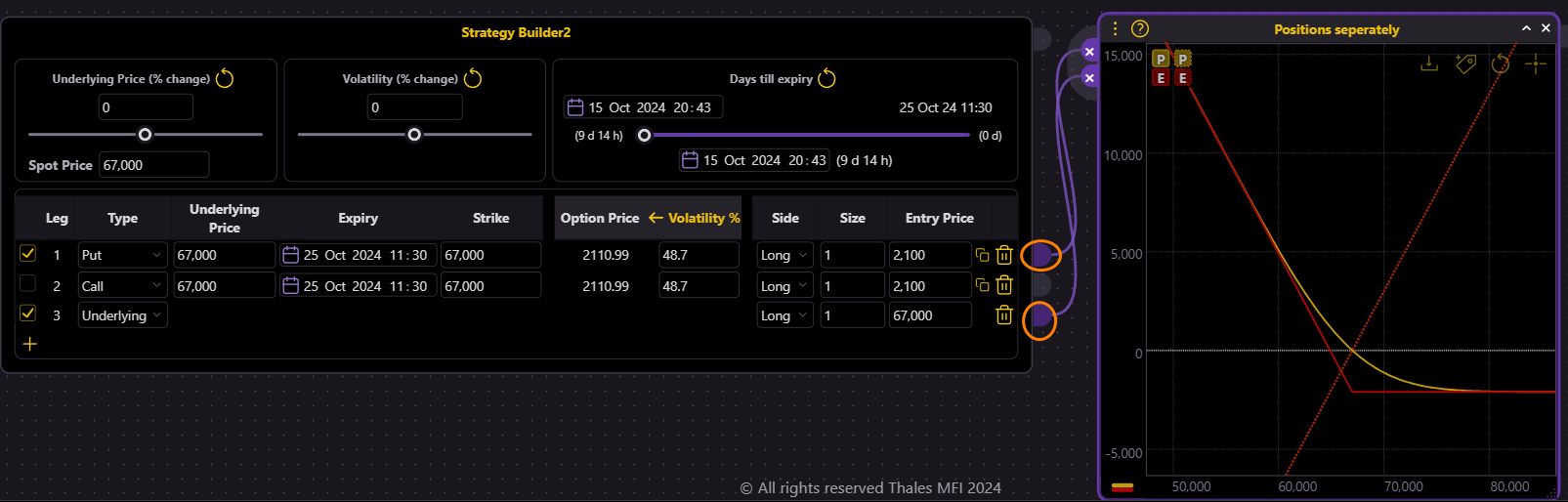

(Simulation 🔗)

Using Markers, we can examine how similar the two strategies can work if the price of UL goes up or down. As it is seen above, at both price levels, the PnL of the synthetic call matches exactly with that of the long call. We should notice however that in our example, the price of both ATM options is the same which is not always the case.

Individual Analysis

(Simulation 🔗)

To further clarify how a synthetic call is constructed, the graph above displays the underlying and the long put option separately. When viewed individually, each component has its own distinct payoff profile. The perpetual future’s payoff (dotted line) rises steadily with the asset’s price, while the long put provides downside protection. However, when these two positions are combined, as seen in the previous graphs, their individual characteristics merge to replicate the payoff structure of a traditional long call.

Balancing Gains and Losses

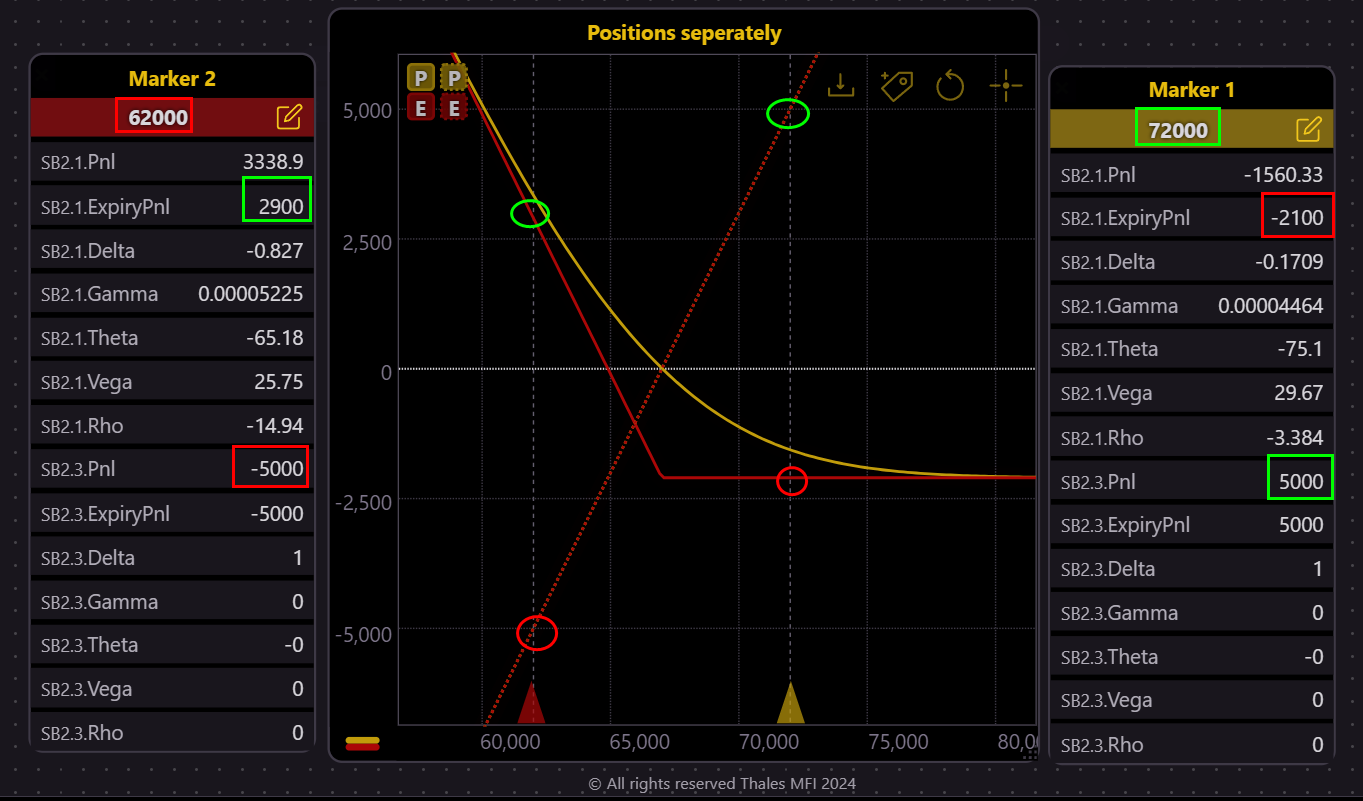

(Simulation 🔗)

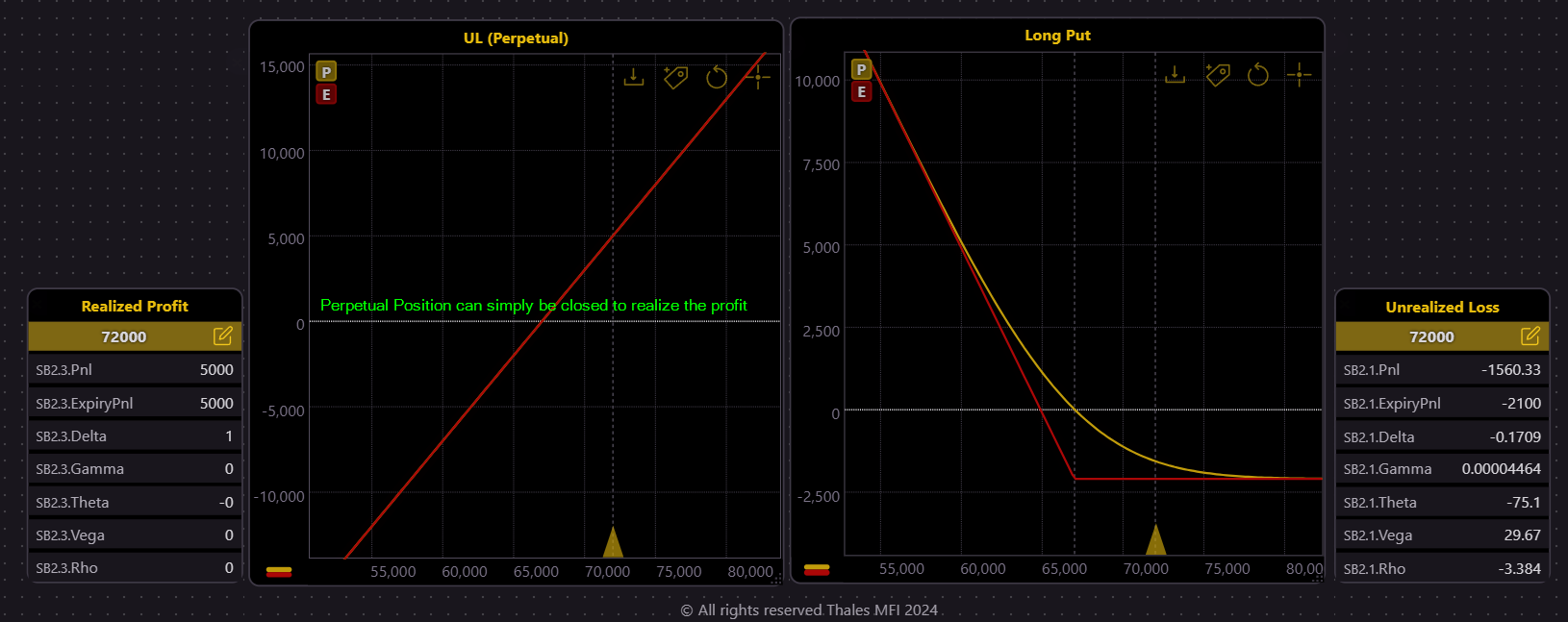

Let see how the synthetic call behaves when the UL price moves $5,000 in either direction. (see simulation above). If the price of Bitcoin rises to $72,000, the perpetual future provides (an unrealized) $5,000 profit. However, the long put option incurs maximum loss of $2,100. On the other hand, if the price drops to $62,000, the perpetual future experiences a $5,000 loss. Yet, this is offset by the long put option, which generates a $2,900 profit. In both cases, the combined payoff between the UL and the long put option illustrates how the synthetic call works to balance gains and losses across different price points. We can expect the same from a simple long call option at expiry. But what about managing the strategy before the expiration?

Flexibility

Here we should remind that in this strategy, we have had a bullish approach, expecting the price of Bitcoin to rise. Yet for the bearish scenario -which is always on the table- we have the protected put ensuring us that no matter how far the UL price falls, the put will compensate our loss so that the premium we have paid for the put is the maximum amount we can lose. But if the price moves in our favor—let’s say it reaches $72,000—this is where the advantage of the synthetic call really shines. Let visualize the scenario to see it better.

(Simulation 🔗)

As it is seen in the graphs above, the UL position which is taken in our example in Perpetual market, due to its liquid market can easily get closed, securing a $5,000 profit. The key benefit here is the ease of execution: unlike options market, where liquidity constraints or wide bid-ask spreads can make it difficult to exit at a fair price, perpetual futures allow us to realize our profit instantly, without concern for market depth or spread issues.

Furthermore, while the perpetual future position is closed and the profit is locked in, the long put option remains open (the left Graph). This gives us added flexibility. We can hold the put option and wait for more favorable market conditions to sell it at a higher price, or set a limit order to capitalize on potential market volatility. This separation between profit realization and risk management offers traders greater control. The synthetic call strategy, in this case, not only mitigates liquidity problems but also provides two clear paths: one to capture upside profit and another to hedge downside risk. This flexibility is a significant advantage for bullish traders seeking both protection and profit in less liquid markets.

Bottom Line

The synthetic call strategy offers traders a flexible solution to the challenges of liquidity and wide spreads in shallow options markets, such as newly developed DeFi platforms. By combining a perpetual future with a protective put option, traders can replicate the payoff of a long call, while retaining the flexibility to close positions easily and optimize their outcomes. This strategy not only provides unlimited upside potential but also limits downside risk, making it a practical choice for traders navigating less liquid environments.

You can try the strategy here in Thales Options Strategy Simulator.

Disclaimer

The content provided in this blog is for informational and educational purposes only and should not be construed as financial or investment advice. Trading options and perpetual futures involves substantial risk and is not suitable for every investor. The strategies and simulations discussed are hypothetical and may not reflect real market conditions. Before implementing any trading strategy, readers should carefully assess their financial situation, risk tolerance, and consult with a qualified financial advisor. The use of synthetic strategies, such as the synthetic call, can carry significant risks, including potential losses. Past performance is not indicative of future results.