Market Outlook 22OCT24

Bitcoin Traders Bet on $75K as Election Nears

In our previous report, Bitcoin Options IV Moves Ahead of the U.S. Election, we analyzed the October 25th expiration, revealing the high activity around the $70,000 strike. We observed that implied volatility was already on the rise, reflecting growing anticipation for the U.S. Presidential Election scheduled for November 5th. Now, as we approach this key political event, it’s important to explore what the market is telling us about the next crucial expiration: November 8th.

While big events like the election can sometimes trigger market moves, the reality is that the market is often driven by underlying forces already in play. These potentialities may simply be catalyzed by significant moments in the news cycle. With that in mind, we’ll use our heatmap and a deeper analysis of open interest to explore how traders are positioning themselves as we approach November 8th.

Key Areas of Interest

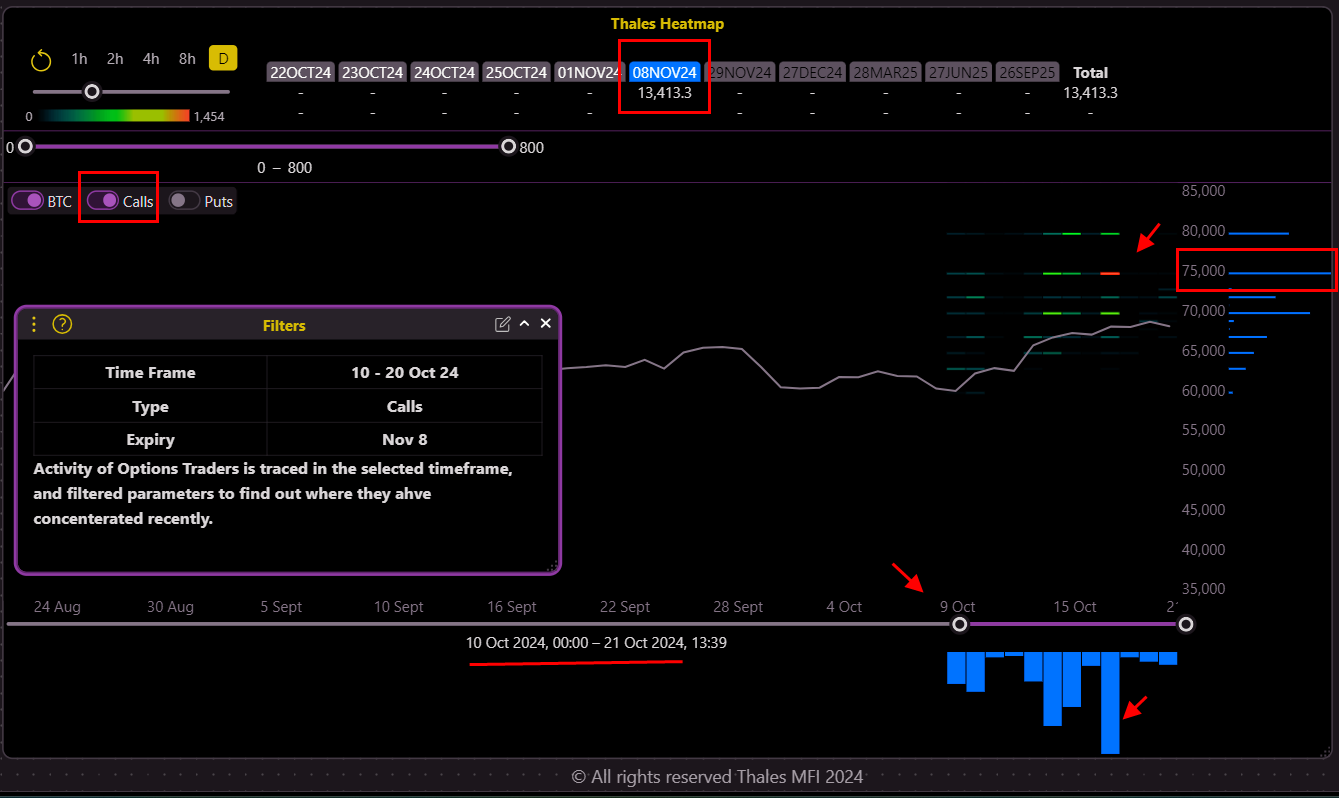

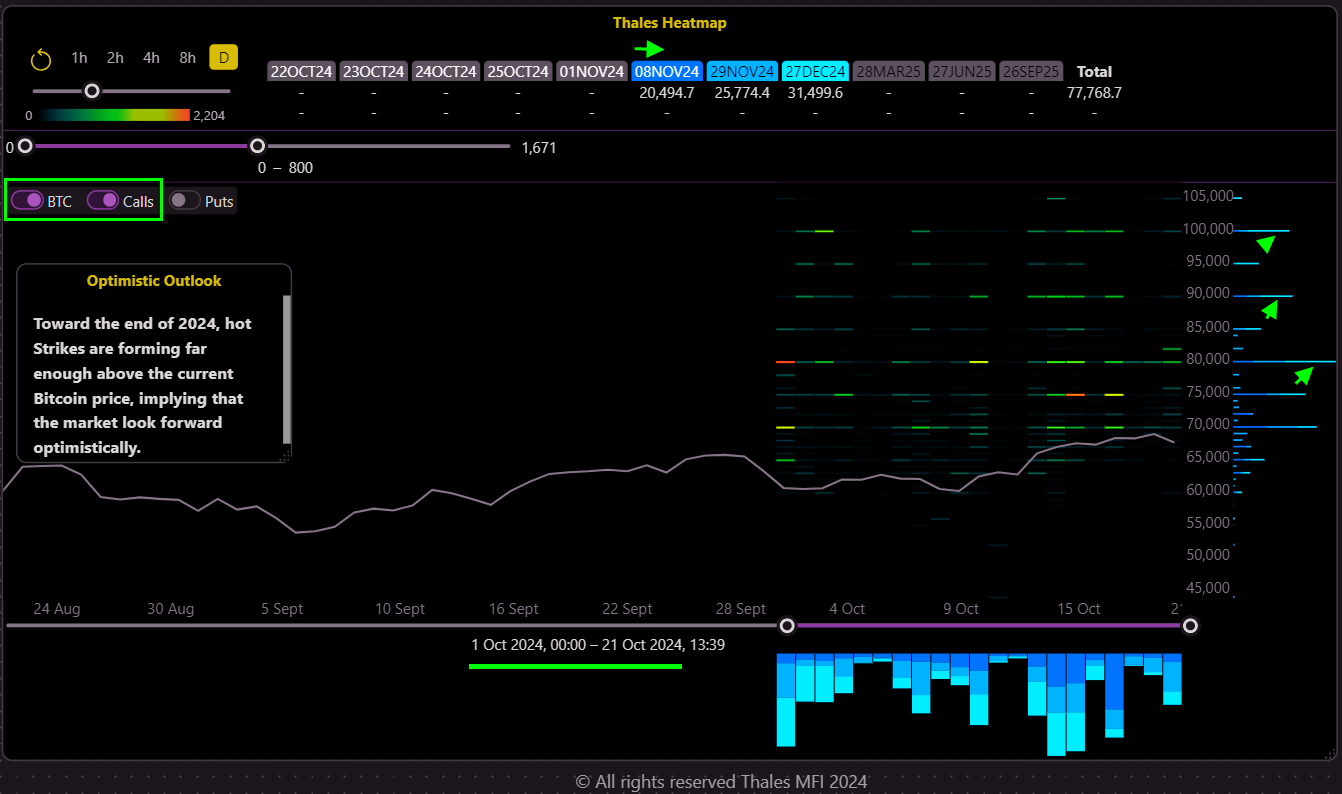

To begin, let’s examine the areas of the market where traders are showing the most activity in the last 10 days. The Heatmap, which tracks options trading activity, highlights the hot areas around the $75,000 strike price for the November 8th expiry.

As shown in the Heatmap above, the $75,000 strike has turned red, indicating significant trading volume and open interest around this price level. The filters applied focus on call options expiring on November 8th, and the activity suggests that traders are particularly focused on this strike. With concentrated activity around this level, we turn to open interest data to explore what this might indicate about market sentiment.

Open Interest for the $75,000 Strike

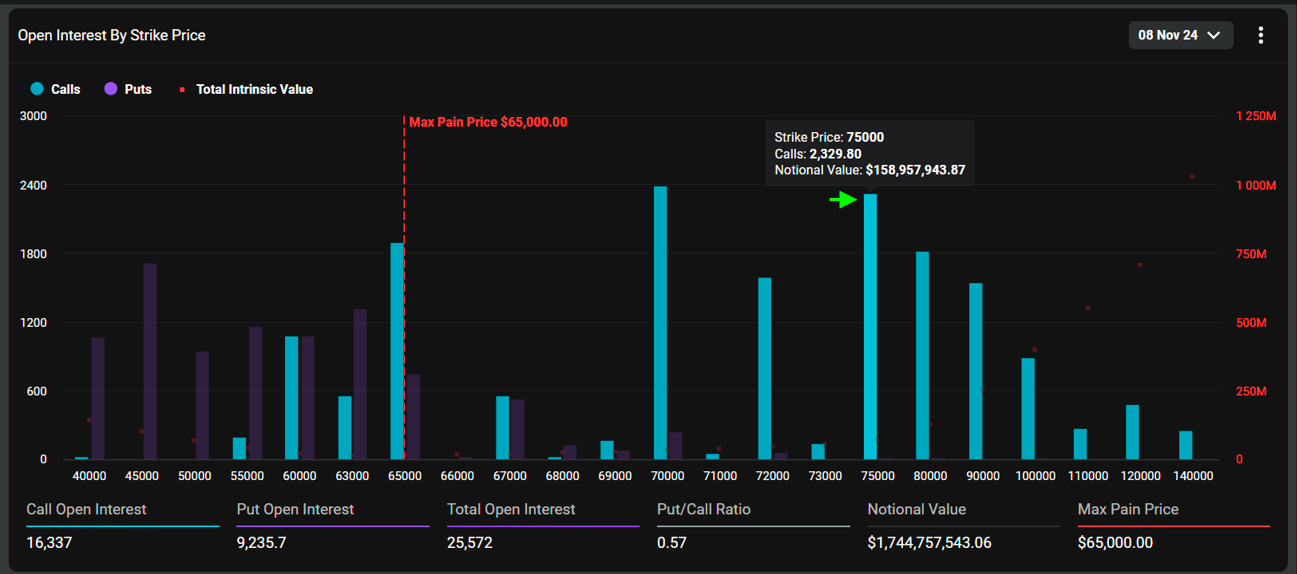

To gain further insight, let's compare the open interest of this option with others expiring on November 8th.

It has the second-largest open interest for this expiry. This substantial interest suggests that traders are betting on a potential price move toward or beyond $75,000, but there’s more to consider.

Right Side of the Market

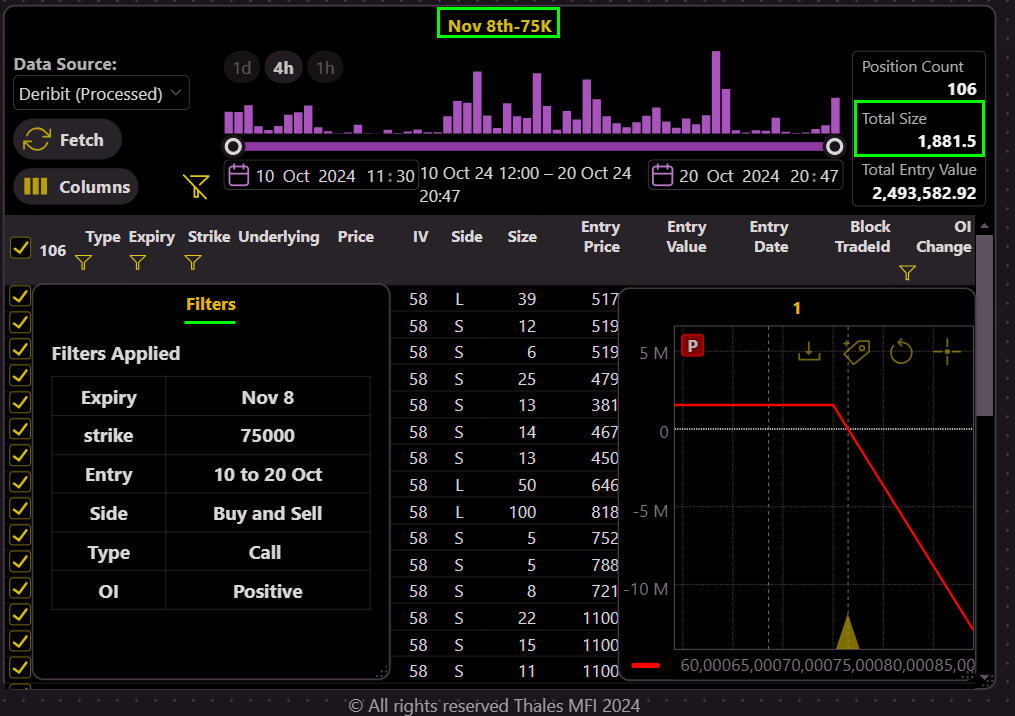

Let's go to Market Screener and tune some filtering (see the image below) to see how the trades are forming around this option.

The Graph resembles a short call. But it is accumulative position. Let's separate Shorts from Longs.

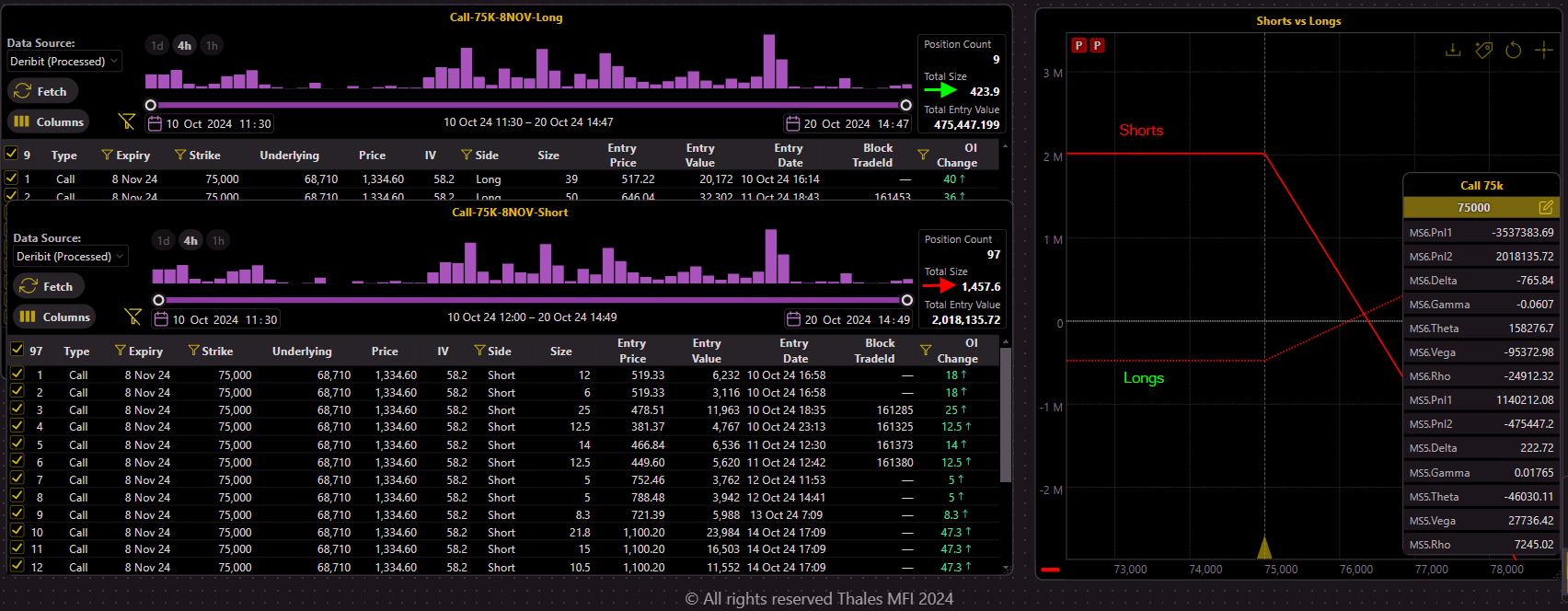

As depicted above, the short side holds a significantly larger position, indicating that traders are betting the Bitcoin price will not exceed far from $75,000 by the expiry date. It worth mentioning that in options markets, sellers are often considered to be more informed and professional traders, as they are typically the ones taking on the obligation, while hedging and managing risk. So we may take their position more seriously.

Ground Evidences

Now we can take a look at price chart of this option as it has actually traded on Deribit.

The price of our instrument has increased in recent days, providing a healthy premium to the sellers.

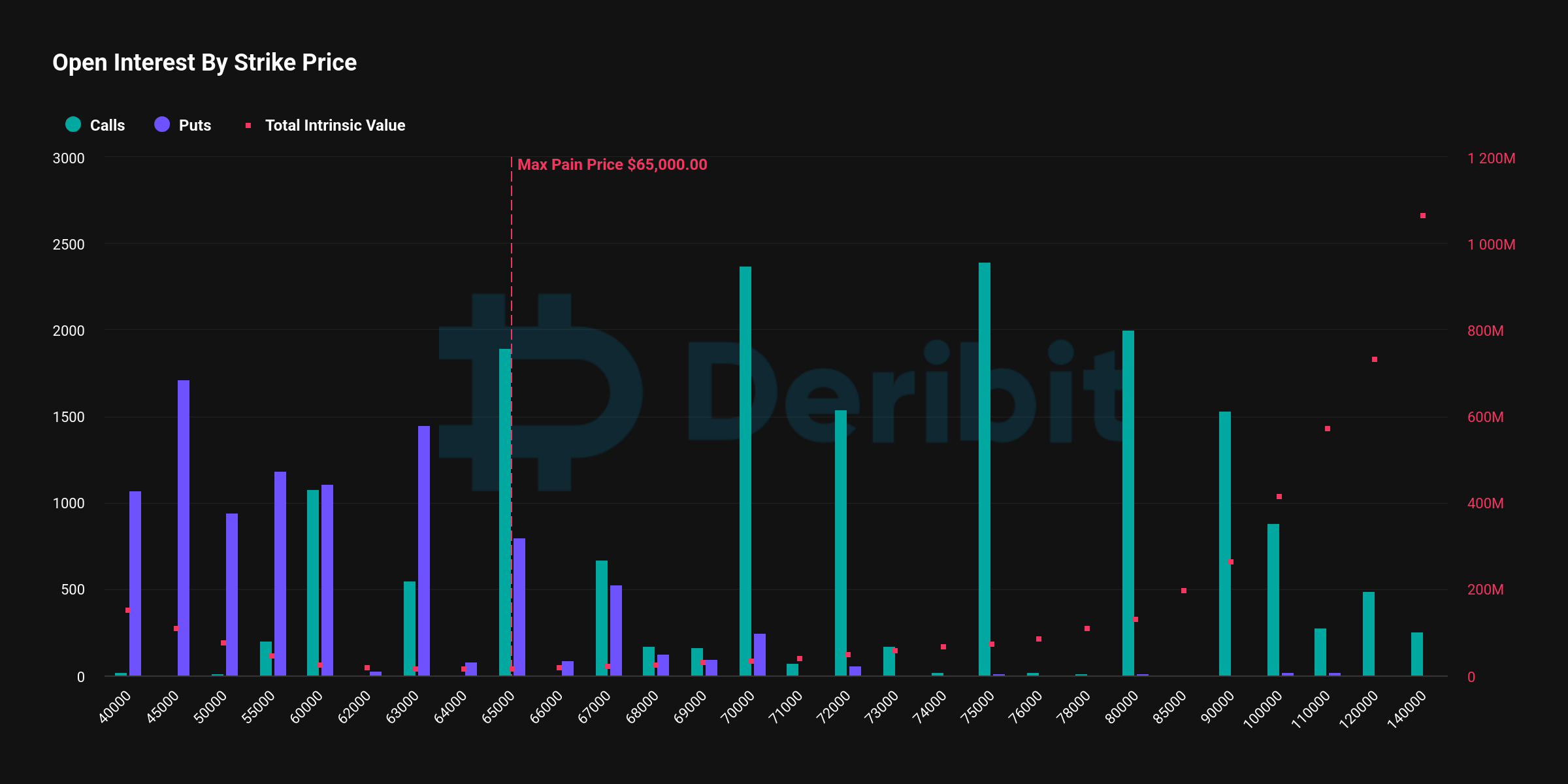

Where is Max Pain?

Max Pain indicates a price level for underlying at which minimum of options end In-The-Money (ITM) by the expiry (good for option writers).

For the November 8th expiry, Max Pain is positioned around $65,000. While this isn’t a guaranteed predictor of price movement, it offers valuable insight into the preferences of option sellers, as it reflects the price at which the fewest options would expire in the money. Notably, this doesn’t conflict with the $75,000 resistance level, which remains in focus until expiration.

The Bigger Picture

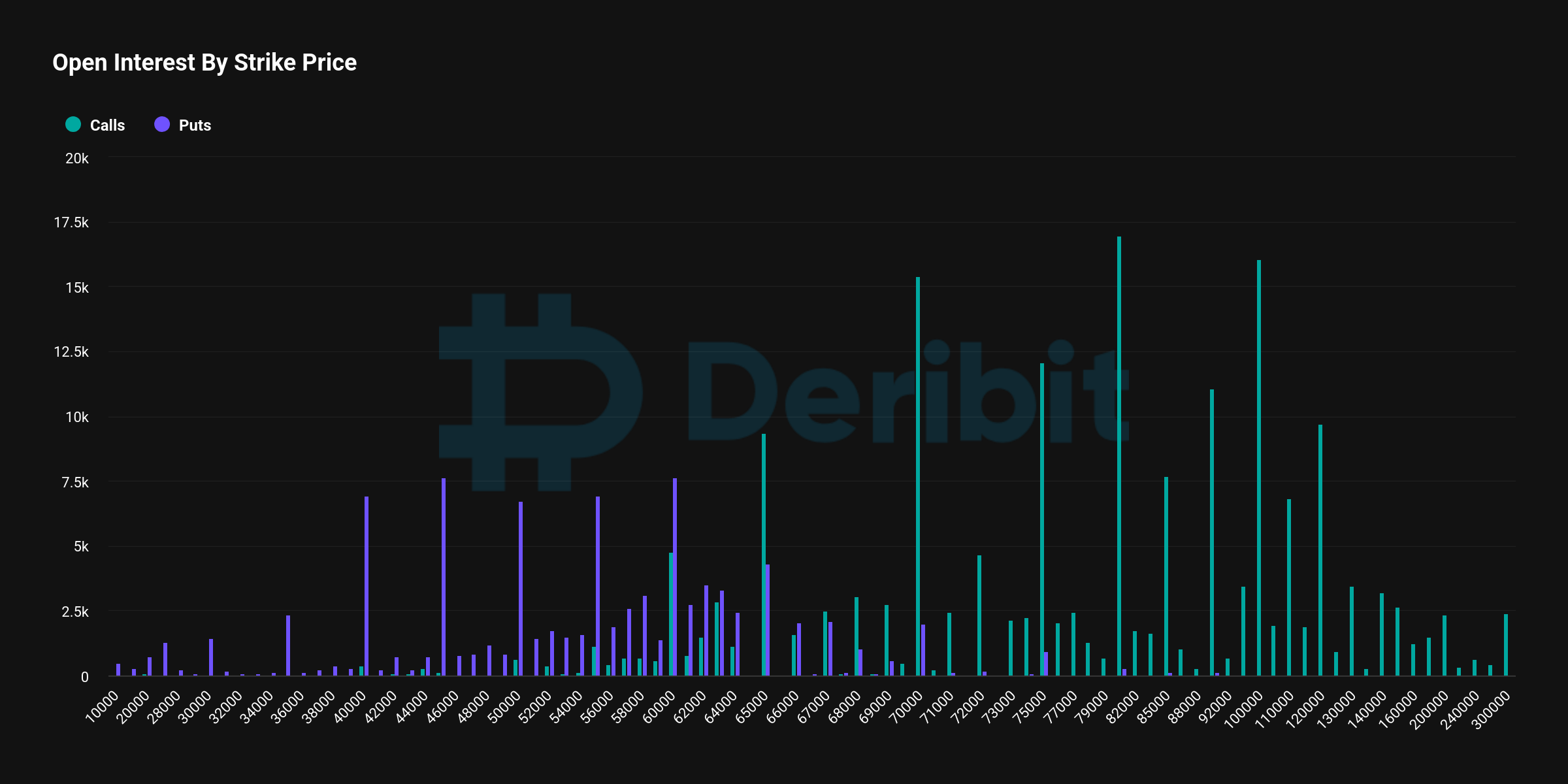

Despite the short-term caution around the $75,000 strike, the overall outlook for Bitcoin appears optimistic when we consider further-out expiries. Higher strikes, particularly those above $80,000 and even $90,000, are seeing increasing activity.

Just as it usually has been the case for Bitcoin, open interest for further-out expiries confirms a growing optimism among traders, with significant positions being opened at strikes well above the current price.

The Heatmap reveals that traders have recently been interseted on key levels well above current price, indicating a more optimistic outlook for the market.

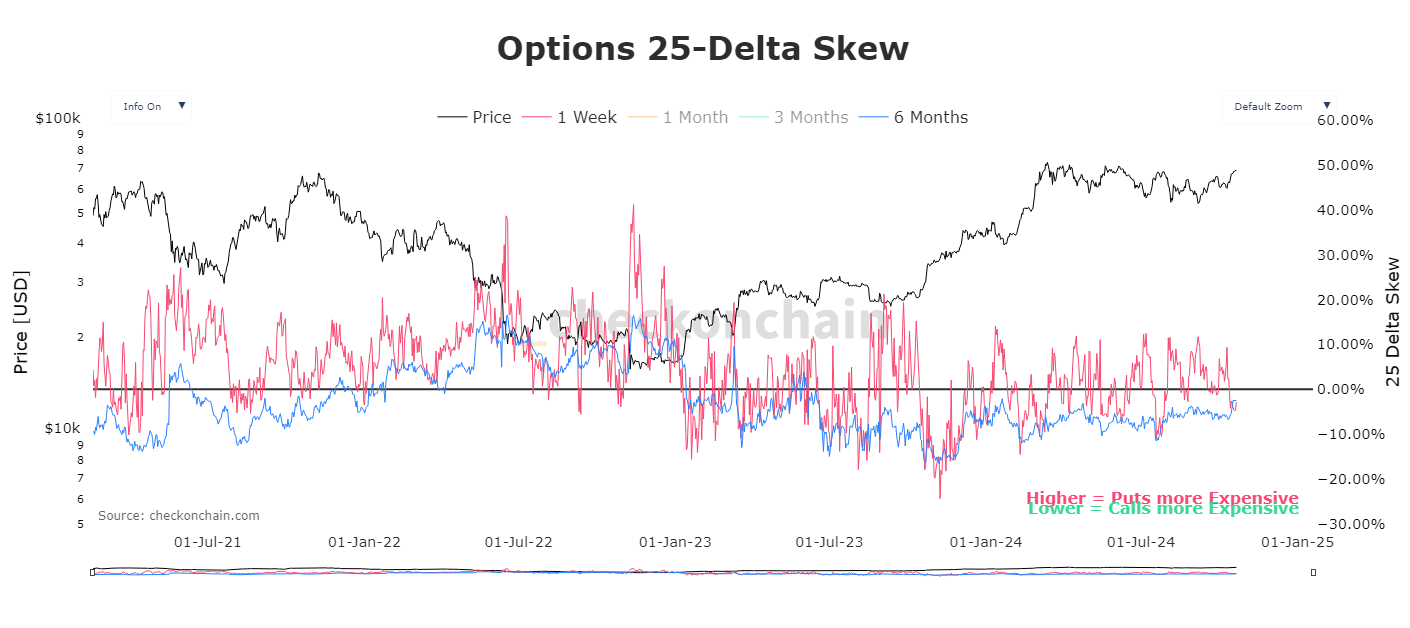

Skew

25-Delta Skew (above) also confirms the optimistic outlook of option traders showing that traders are willing to pay a premium for calls over puts. The chart shows that 1-month options (the blue line), in particular, have a negative skew, suggesting a bullish bias in the short term.

Even Bigger Picture: On-Chain

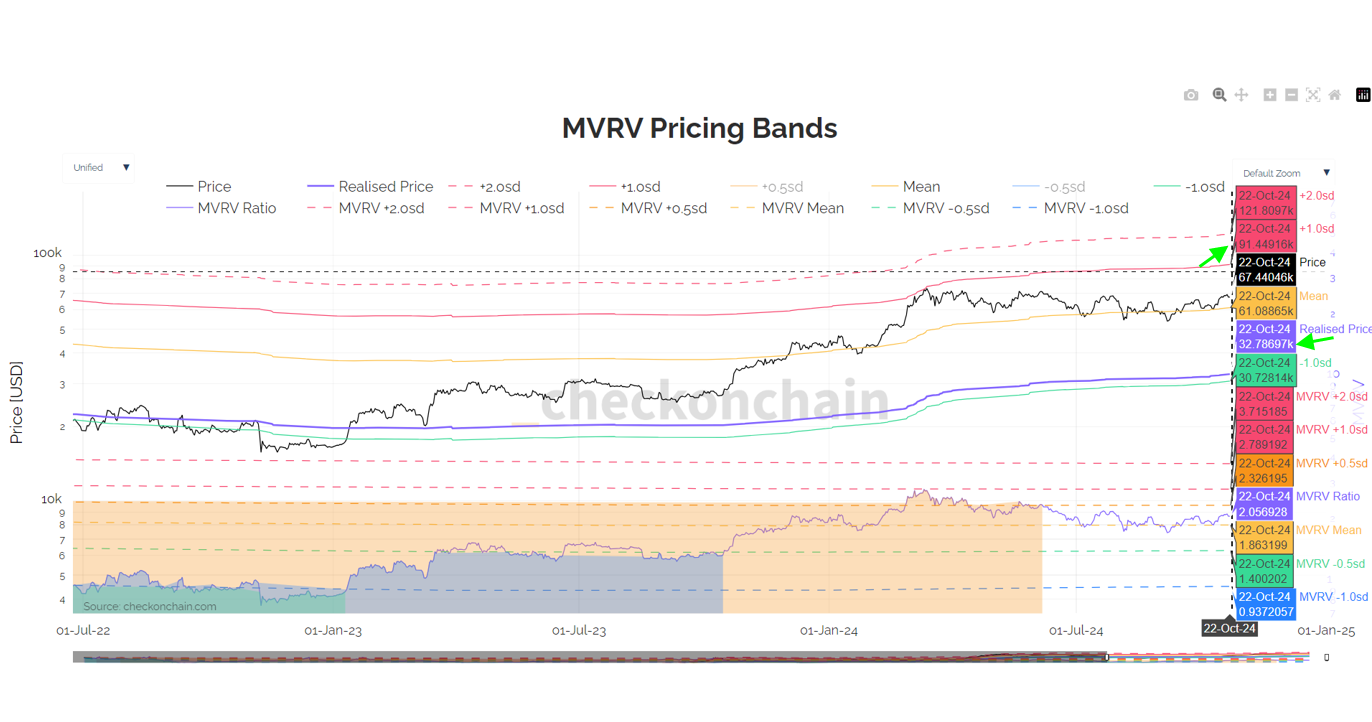

On-chain data adds another layer of insight. The MVRV (Market Value to Realized Value) ratio shows where the current price stands in relation to the realized price, providing a broader context for both upside and downside scenarios.

Currently, Bitcoin price (black line) is in a middle zone, with upside potential reaching as high as $91,000—1 standard deviation above the realized price. This metric is typically considered a long-term, more fundamental indicator. In the current cycle, we have yet to make significant gains above the realized price, something the market is closely watching.

However, the risk of a correction remains, with the possibility of Bitcoin dropping toward the realized price still on the table.

Bottom Line

As we approach the U.S. presidential election and the November 8th expiry, the Bitcoin options market offers us valuable insights into traders' expectations. While significant short positions at the $75,000 strike indicate a bearish outlook for that specific expiry, the broader market outlook, supported by open interest at higher strikes and on-chain data, suggests a more optimistic long-term sentiment.

Moreover, metrics like the 25-Delta skew and MVRV pricing bands imply that while caution is warranted, the market still holds substantial potential for upward movement. This dual perspective—where short-term caution meets long-term optimism—requires traders to remain agile and well-informed as events unfold.

Disclaimer

This blog is for educational purposes only and does not constitute financial advice. Options trading carries risk, and traders should conduct their own research before making any financial decisions.