An Opportunity for Speculators and Premium Accumulators

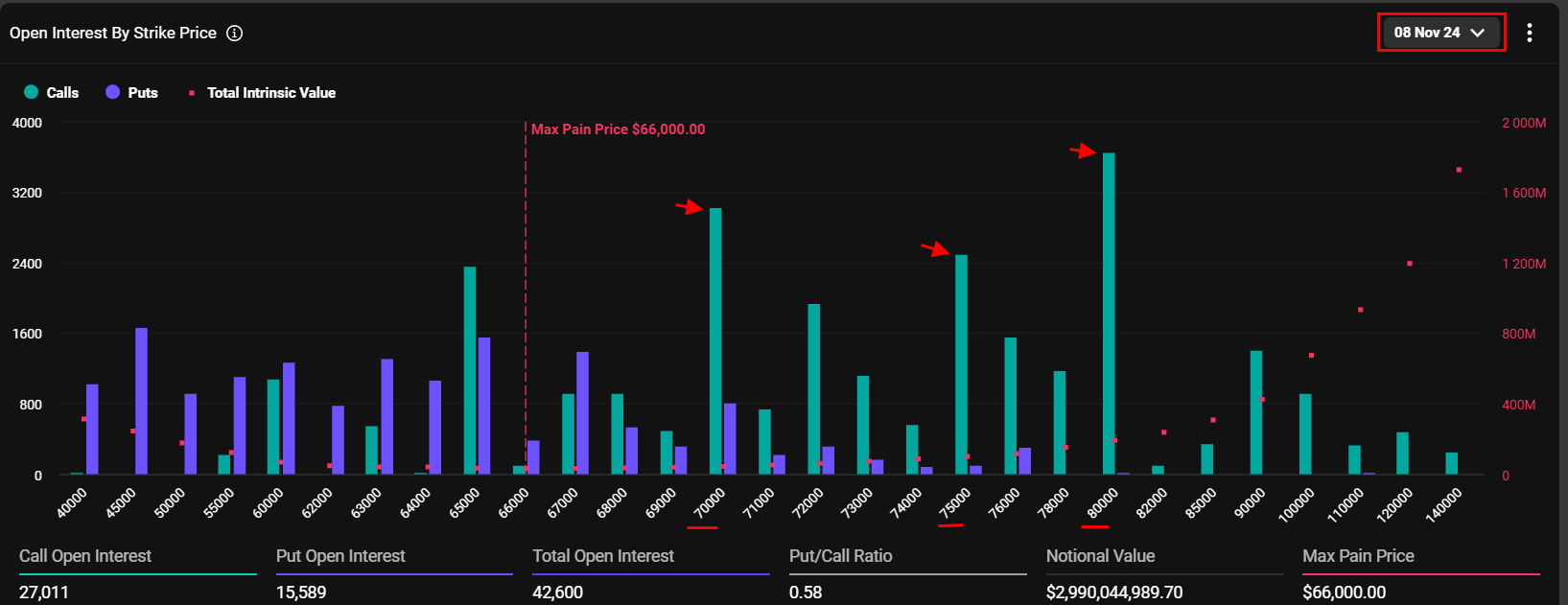

The upcoming expiry on November 8 has created a surge in implied volatility (IV) within the Bitcoin options market, signaling traders’ anticipation of significant price movement, as well as premium collection. By analyzing open interest (OI) and market sentiment at key strike levels—70k, 75k, and 80k—we observe a divergence in positioning, likely due to differing expectations around the impact of the US presidential election.

Introduction

November 8 presents a pivotal moment in the Bitcoin options market as this key expiry aligns with the timing of the US presidential election. With potential macroeconomic implications, options traders are positioning themselves in anticipation of significant price movements. This analysis dives into the elevated IV, sentiment around specific strike levels, and the potential for market turbulence as election results unfold.

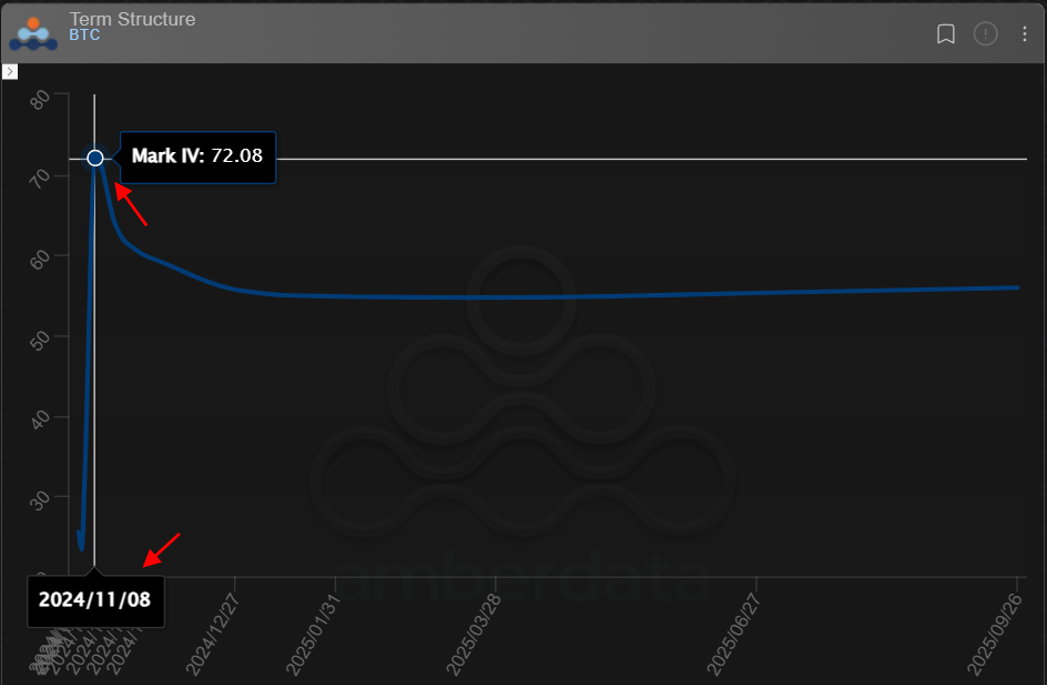

Implied Volatility (IV) Spike for November 8

A distinct spike in IV for the November 8 expiry suggests that options traders are bracing for a possible surge in Bitcoin’s price volatility. This IV spike stands out, with generally lower volatility levels on dates before and after November 8.

IV spikes of this nature often indicate market expectations of upcoming events that could trigger large price swings.

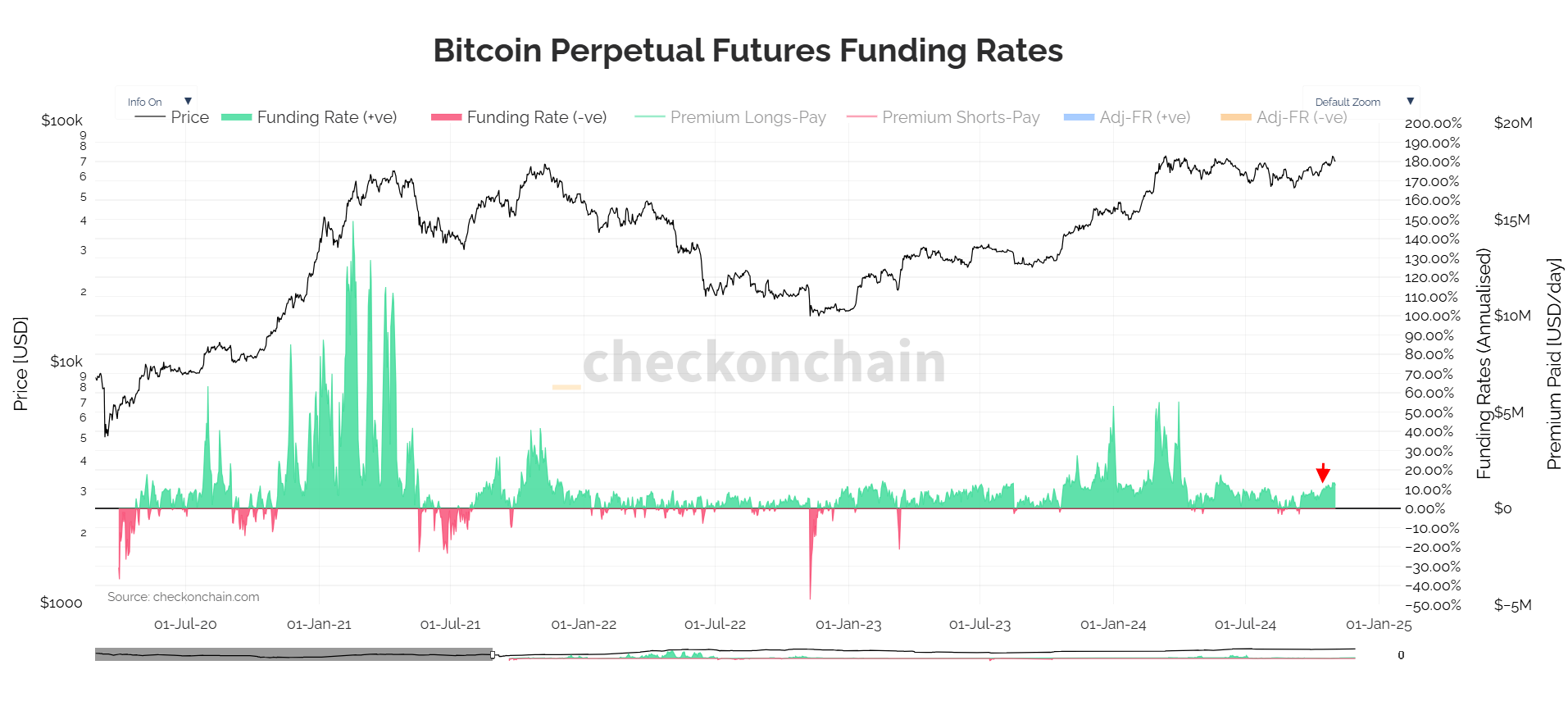

While the options market anticipates heightened volatility, this sentiment is not -yet- mirrored in the perpetual market, where funding rates have remained relatively stable. The lack of a notable shift in funding rates suggests a more neutral or cautious stance among futures traders (you can call them retails, if you like).

Perhaps this stable funding rate reflects a calm before the storm.

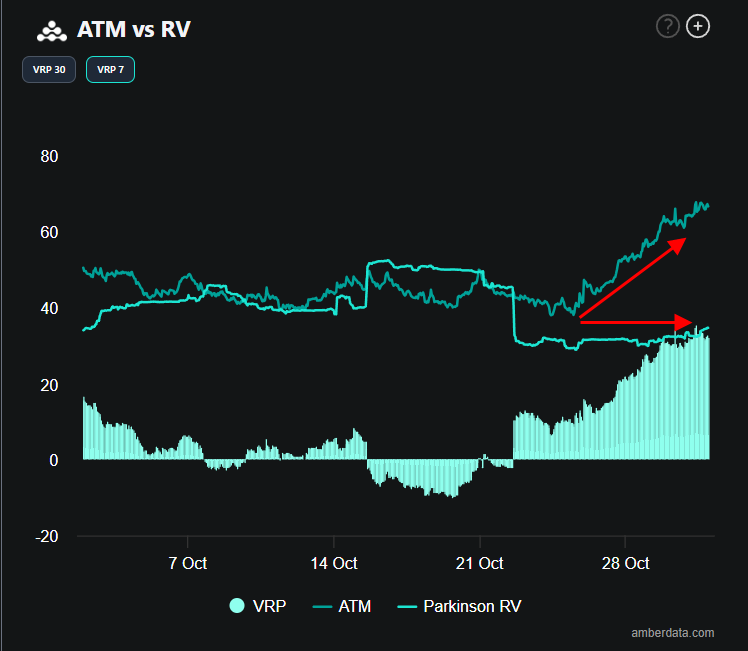

Volatility Risk Premium (VRP)

Complementing the IV spike, the Volatility Risk Premium (VRP) adds another layer to our analysis. The VRP measures the difference between implied and realized volatility, and in this case, it shows a substantial gap, reinforcing the notion that options traders anticipate higher volatility than what’s currently observed in the spot market.

This elevated VRP suggests that options traders are hedging against potential volatility spikes. The combination of high IV and VRP supports the notion that the market expects substantial movement around November 8, likely due to the uncertainty surrounding the US election.

Key Strike Levels: 70k, 75k, and 80k

Analyzing the open interest at the 70k, 75k, and 80k strike levels provides valuable insight into market sentiment and positioning for November 8. Each of these strikes reflects distinct trader motivations, ranging from gathering premium to speculative activity.

70k Strike (Short Position by Hedged Sellers)

Using our Market Screener and applying relevant filters, we analyzed the 70k strike for the November 8 expiry. The data reveals that this option has an overall short position, with a substantial number of traders selling calls to collect premium.

In the limited timeframe chosen for this analysis, the dashboard shows a net premium of $523,000 and a total short side size of 326 contracts compared to 125 on the long side, highlighting a strong inclination toward income generation at this level. Since the 70k strike has recently been tested, with the possibility of the price moving beyond this level in the coming week, it can be assumed that these sellers are using hedged positions to manage delta risk while aiming to accumulate premium income.

Given this positioning, there’s an inherent risk of a gamma squeeze if Bitcoin’s price approaches 70k and -as we see later in the blog- 75k as we get near to the expiry, which could lead to amplified price fluctuations as market makers adjust their positions to manage gamma exposure. (See the chart below.)

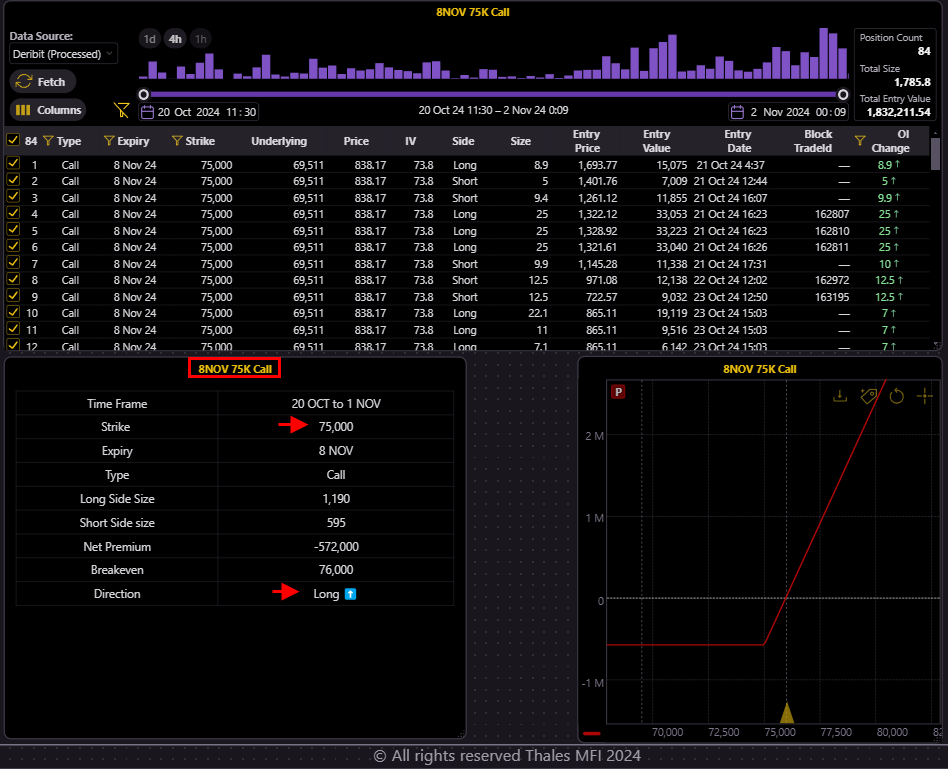

75k Strike (Speculative Long Position)

Similarly, we analyzed the 75k strike for the November 8 expiry. Unlike the 70k strike, this one faces a hard to break ATH resistance level around 73k, making the long position—with limited days to expiry—a speculative play.

Here, we observe 1,190 contracts on the long side versus 595 on the short side, with a net premium of -572,000, indicating strong bullish sentiment. This setup suggests that traders -recently- are speculating on an upward movement, potentially driven by post-election developments in the US.

80k Strike (Neutral Position)

The 80k strike displays a more balanced sentiment, with comparable levels of long and short positions. This neutrality could indicate a lack of strong directional conviction, suggesting that traders may view 80k as a psychological boundary that’s unlikely to be breached within the current timeframe.

The dashboard shows a nearly equal distribution of open interest, reinforcing this balanced outlook. This neutral stance contrasts with the hedging-focused activity at the 70k strike and the speculative positioning at 75k, highlighting how trader expectations vary across key levels as we approach the November 8 expiry.

The divergence in sentiment across these strike levels highlights a fragmented outlook, with some traders positioning defensively and others speculating on significant upside.

A Look at On-Chain

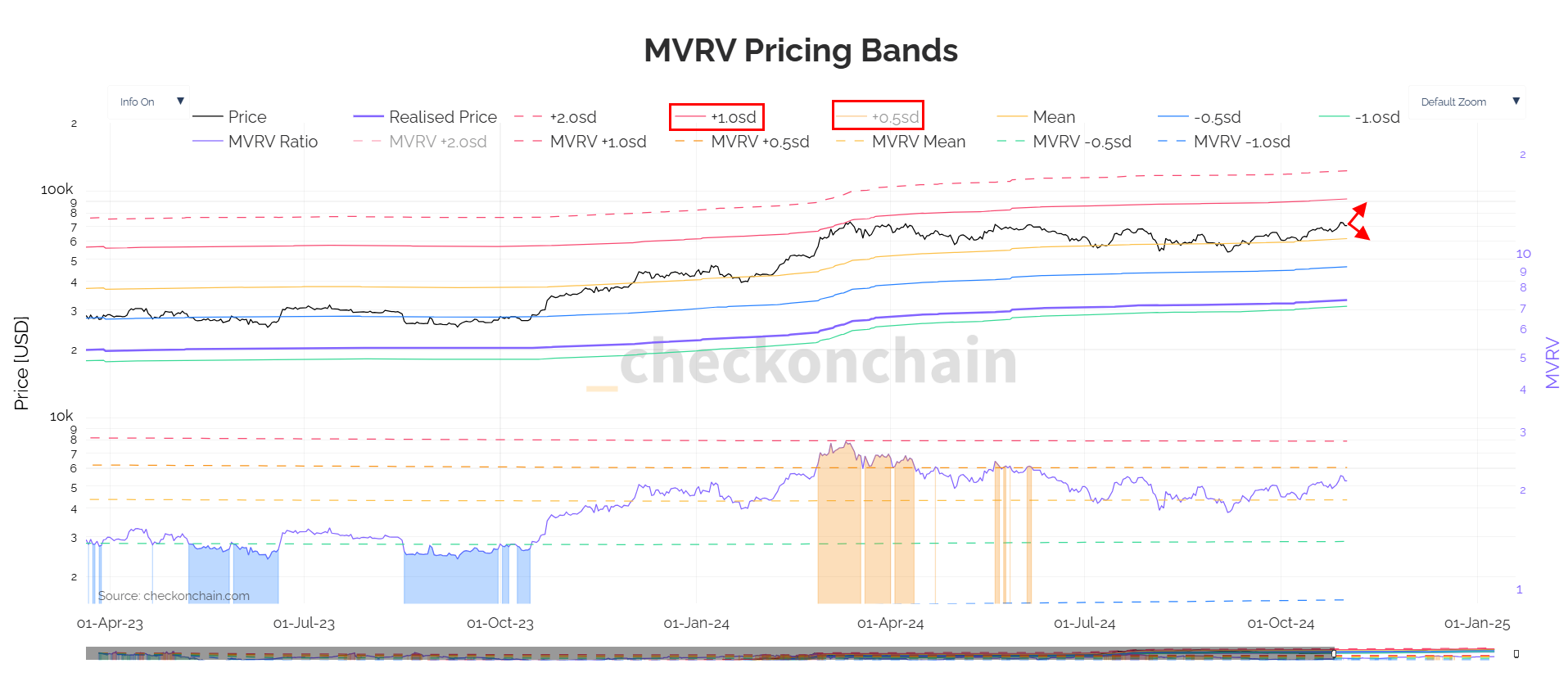

Reading the market is not complete without examining the behavioral tendencies of Bitcoin holders, particularly short-term holders. This perspective considers how far the market price is from the "realized price" and evaluates the available room for movement up or down. This dynamic is illustrated in the MVRV Pricing Bands chart, which captures Bitcoin’s valuation within historical bands.

Much on-chain data supports the potential for a bullish sentiment ahead, though a correction remains a on the table. While it’s expected that holders, even short-term ones, may refrain from selling to allow the price to rise, many are already in profit and could be inclined to sell if certain conditions arise. The current MVRV positioning suggests that Bitcoin is neither overvalued nor undervalued, mirroring the mixed sentiment in the options market. This neutral stance underscores the market's ambivalence, as traders and holders alike appear to be waiting for clearer signals on the direction ahead.

Bottom Line

The Bitcoin options market reveals a high level of IV and a mixed sentiment across the 70k, 75k, and 80k strikes. Hedged sellers at the 70k level and speculative long positions at 75k illustrate the divergent outlooks that characterize the current market environment.

Key Takeaways

- The spike in IV and elevated VRP suggest that options traders are preparing for significant volatility, potentially linked to the upcoming US election.

- Different strike levels reveal distinct trader motivations: income-focused hedging at 70k, speculative bets on an upside at 75k, and a more neutral stance at 80k.

- While options traders brace for volatility, perpetual funding rates remain stable, highlighting a divergence between the expectations of the spot and options markets.

- On-chain data supports a cautiously bullish sentiment, though the possibility of a correction remains, as many holders are in profit and may choose to sell under certain conditions.

Disclaimer

This analysis is for informational purposes only and should not be considered financial advice. Trading in cryptocurrency options and futures involves substantial risk and may not be suitable for all investors. Please conduct your own research and consult with a qualified financial advisor before making any trading decisions.