Visit Thales OSS for real-time insights.

Introduction: Post-Election Shifts and Bitcoin's All-Time High

In the aftermath of the U.S. presidential election, Bitcoin has reached unprecedented levels, touching nearly $90,000 as of November 12. This surge follows a period of calm in the options market, where implied volatility (IV) initially dropped, but strategic positioning around specific strike prices hinted at what lay ahead. This report examines the evolving landscape of the Bitcoin options market, focusing on how traders positioned themselves pre-rally and where they are focusing now, as Bitcoin consolidates around its all-time high (ATH).

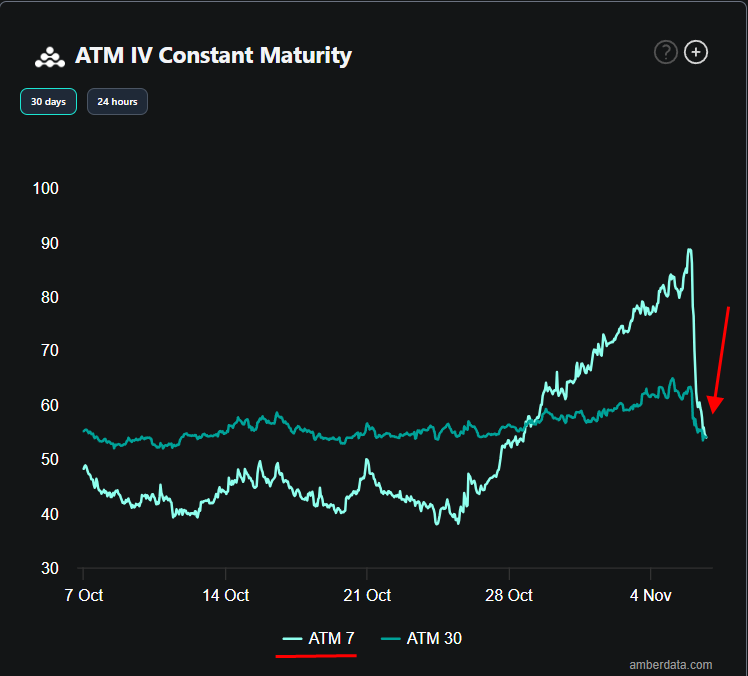

Implied Volatility Decline and Price Surge: A Two-Stage Shift

Following the U.S. election, the at-the-money (ATM) implied volatility for Bitcoin options experienced a rapid decline. This fall reflects the release of pre-election tension as the event concluded with no immediate market disruptions.

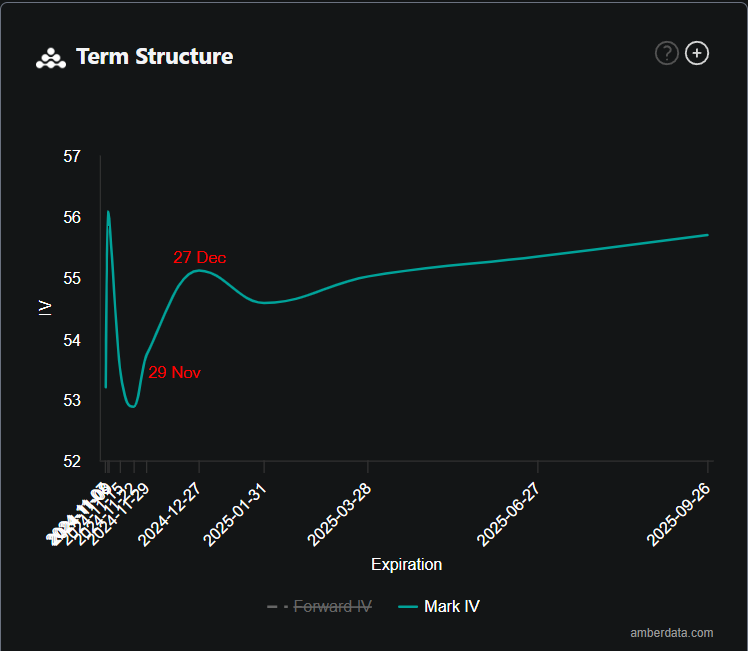

The term structure (below) reveals the similar: while early November showed high IV, it quickly fell post-election, only to stabilize and rise again slightly toward year-end.

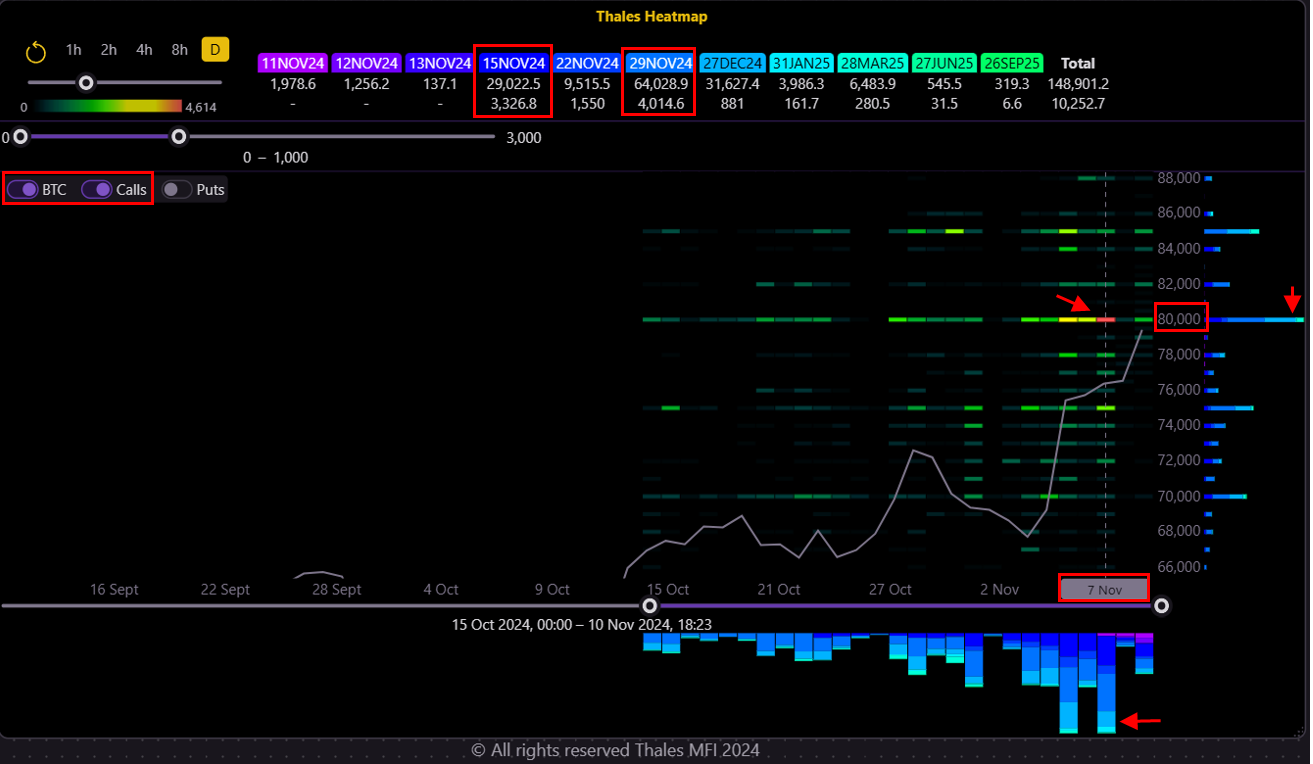

Heatmap Analysis: Early Signals and Strategic Strike Levels

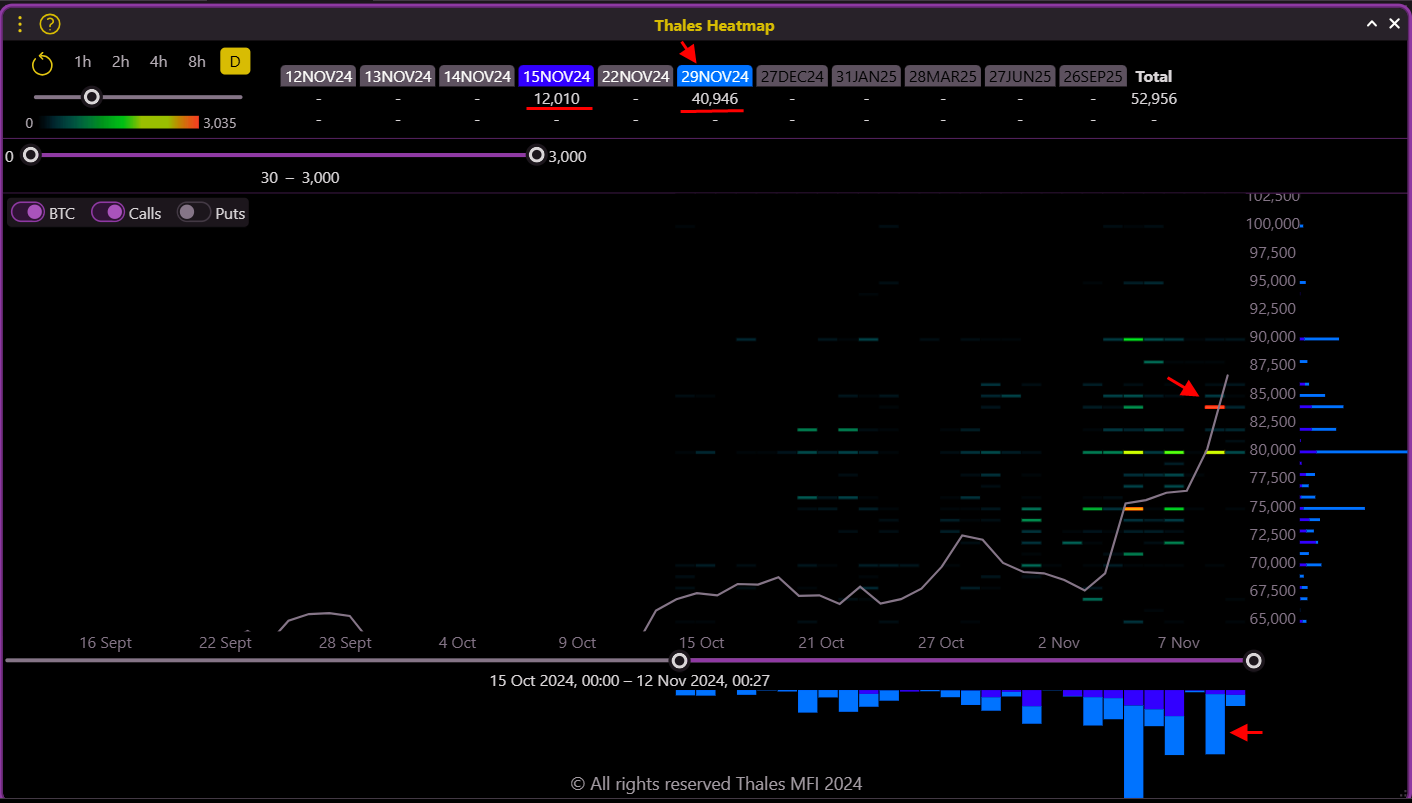

$80,000 Call Options: Early Positioning Before the Rally

In the days following the election, as IV dropped and the spot market appeared quiet, the options market was far from inactive. Traders began concentrating trades around the $80,000 strike, especially for the November 15 and November 29 expiries, even as Bitcoin’s price was still well below this level.

The early activity at $80,000 calls hints at strategic foresight on the part of options traders, who were positioning for an upside move before Bitcoin’s price began its ascent. As it turned out, this positioning would soon become profitable as Bitcoin surged toward and beyond the $80,000 level, underscoring the value of monitoring options market sentiment, even when the spot market appears dormant.

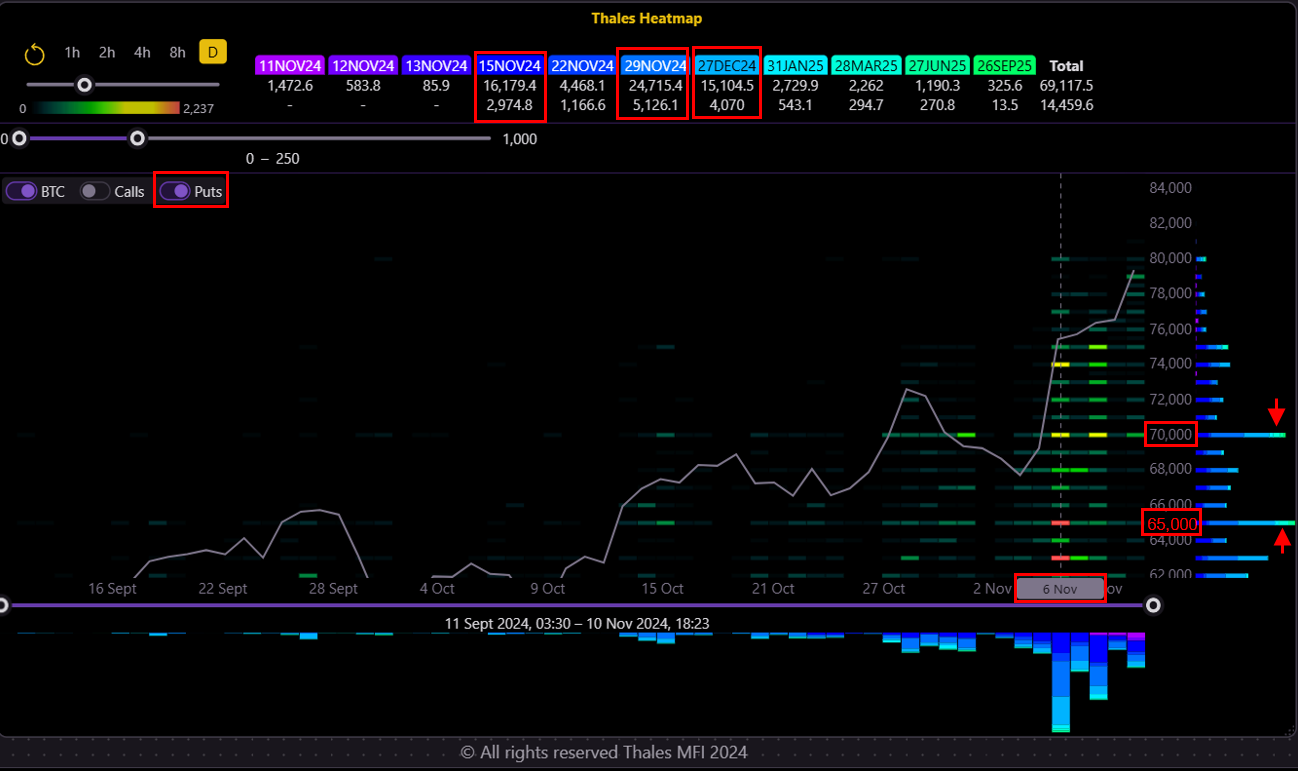

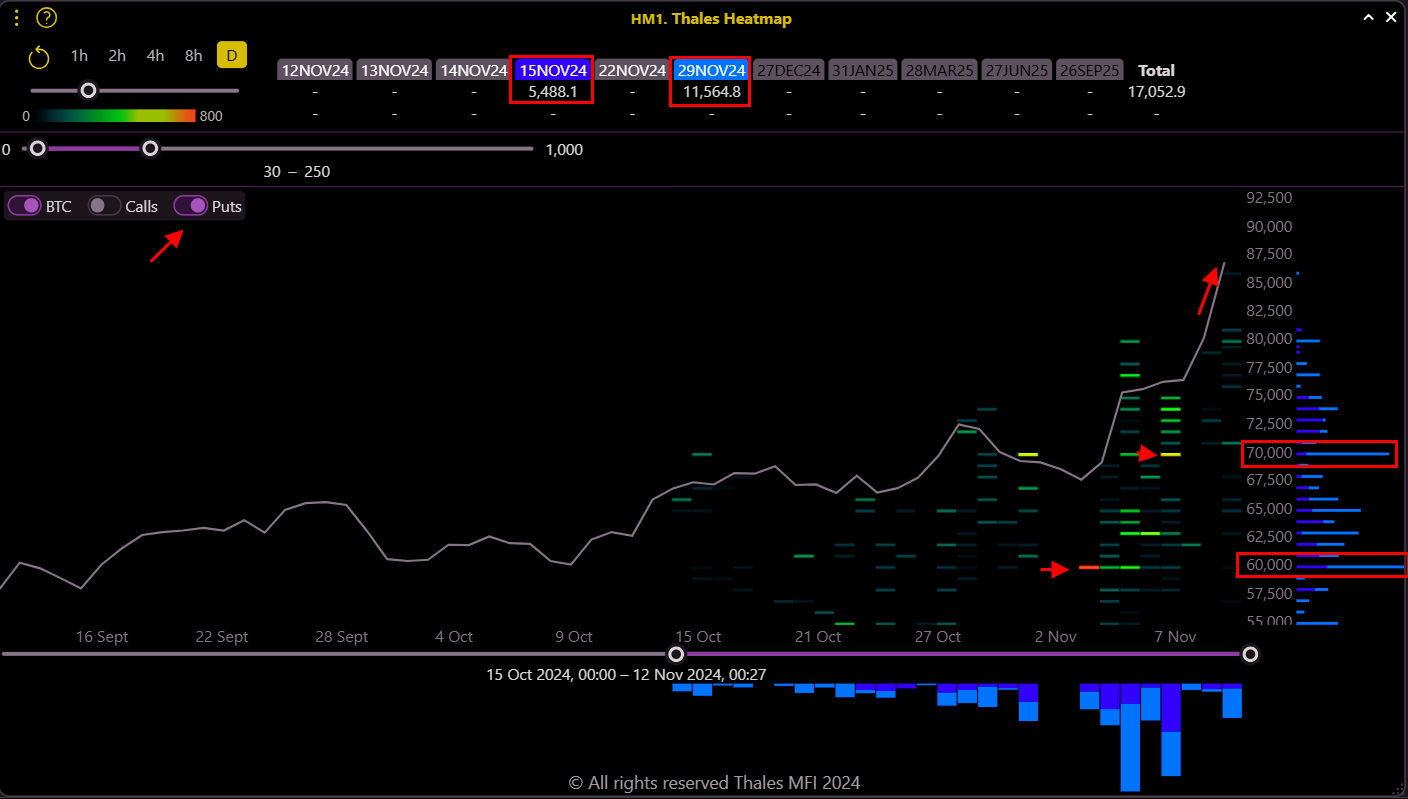

Defensive Put Options at $65,000 and $70,000

Simultaneously, our Heatmap shows notable activity in put options at $65,000 and $70,000, reflecting a hedging stance amid potential price volatility. The focus on these strike levels suggests that some traders balanced their exposure with downside protection, even as optimism grew in the call options.

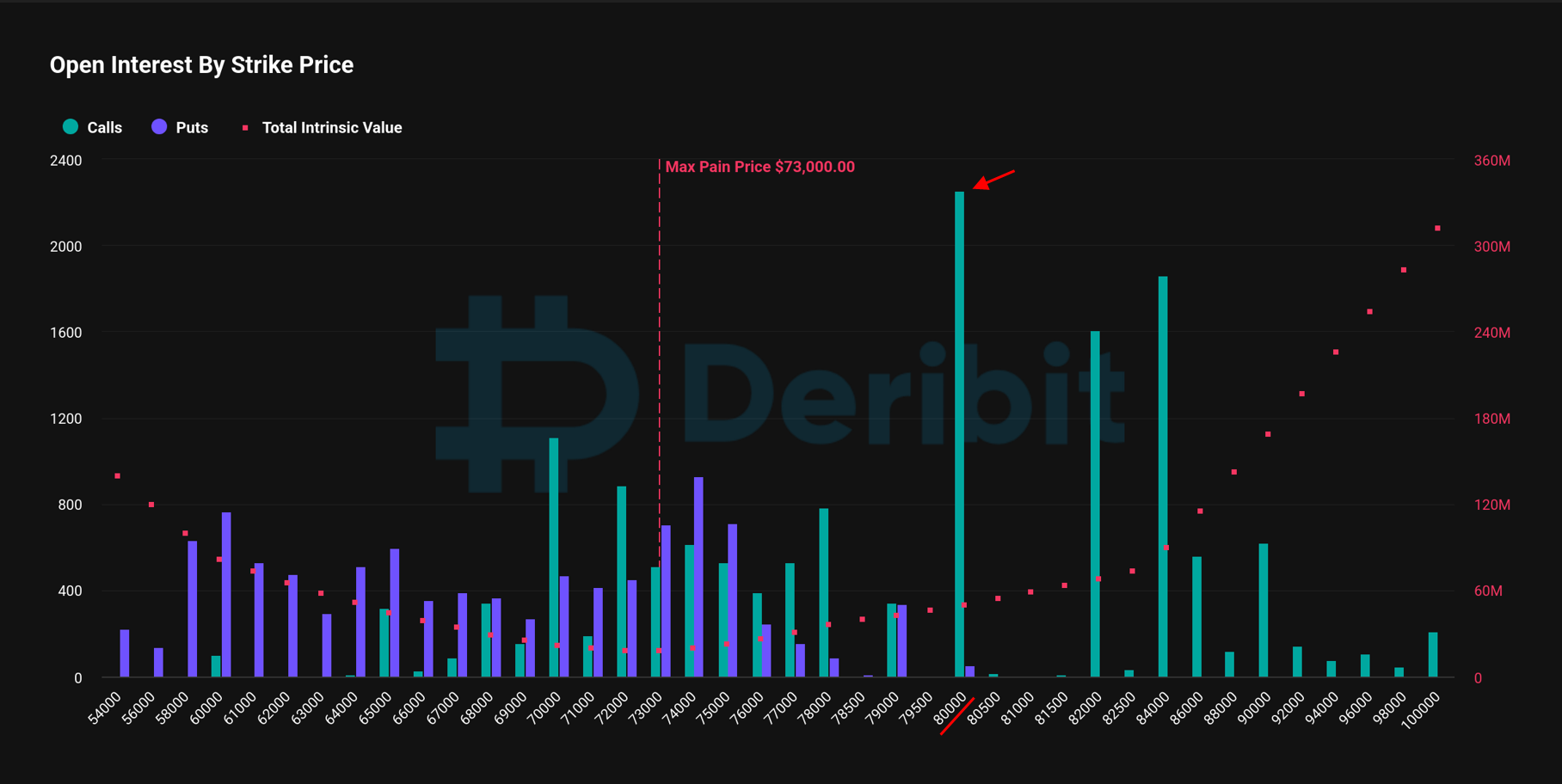

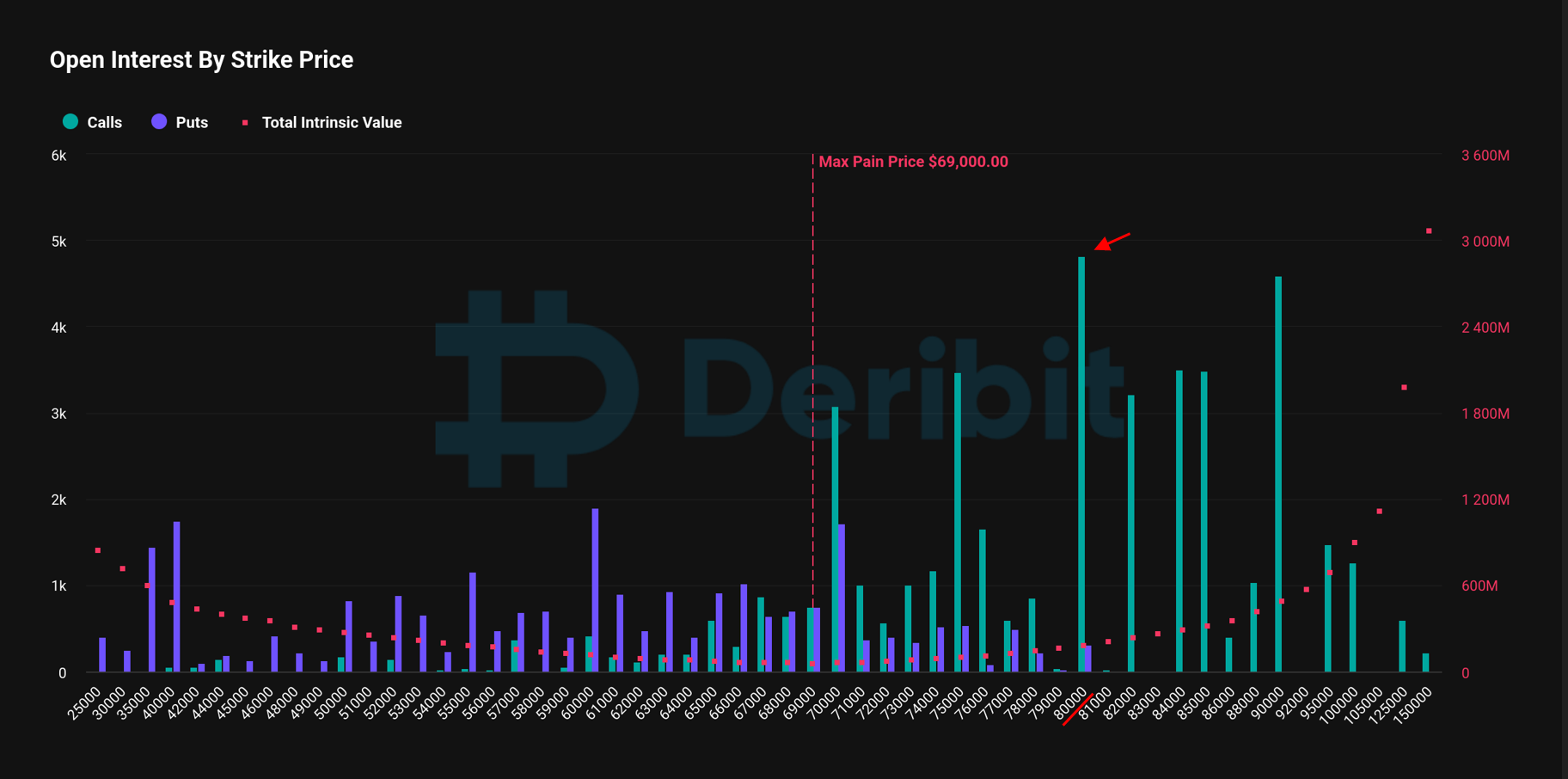

Key Strike Levels and Open Interest Confirmation

Data from Deribit’s open interest metrics confirms this, showing the $80,000 strike as heavily traded for November 15 and November 29 expirations.

For the November 29 expiry, interest also began to shift toward the $90,000 strike—a level that the spot market was still shy of but seemed within reach.

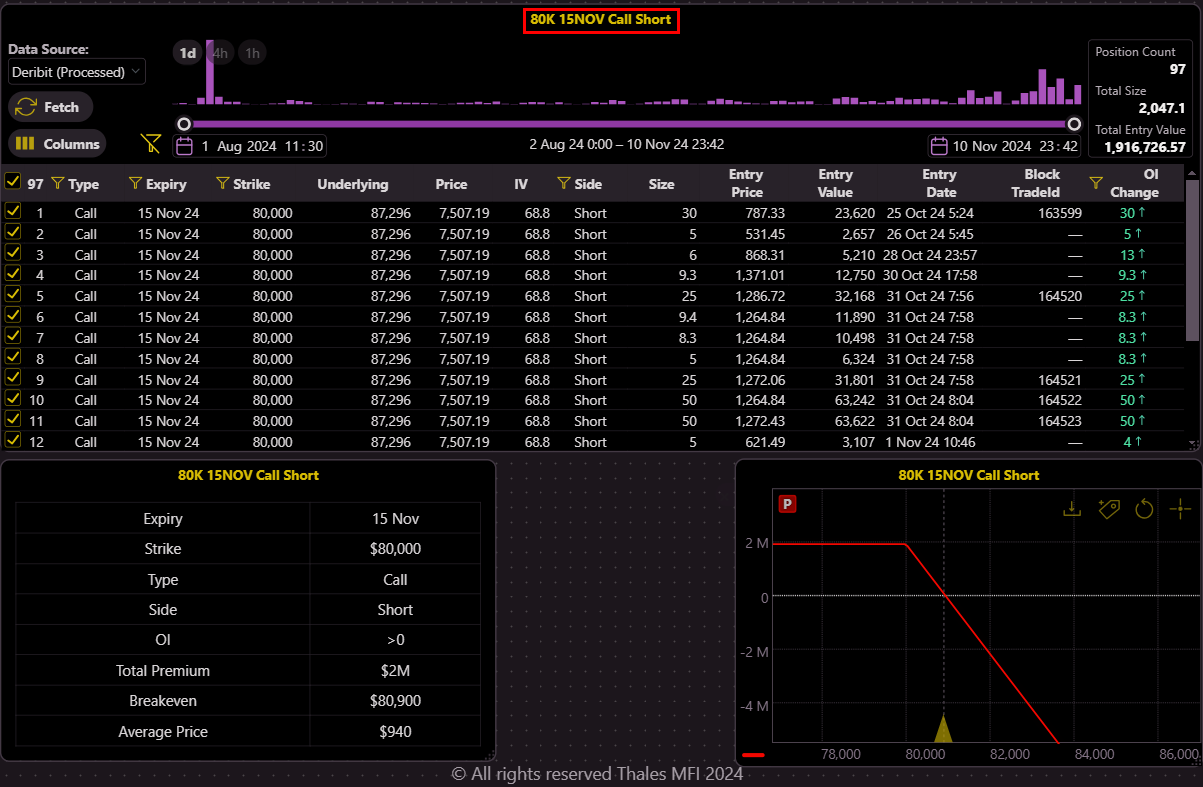

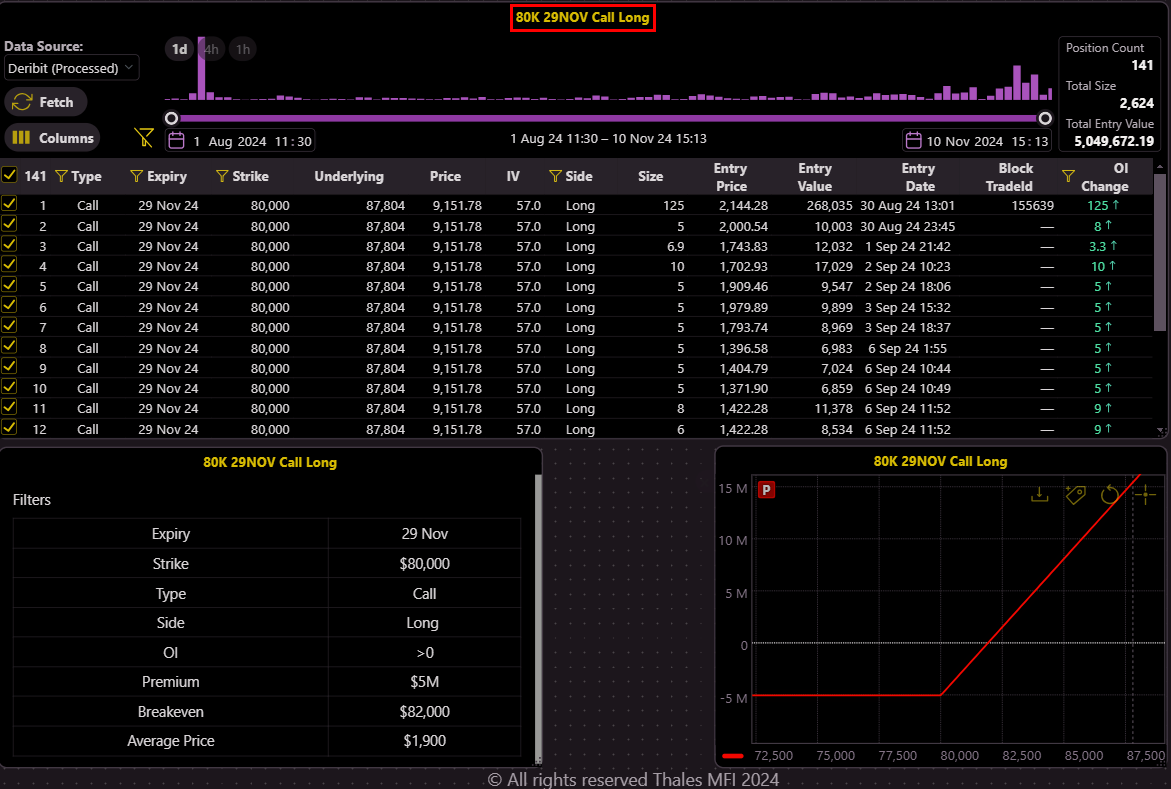

Options Analysis by Market Screener

Using the Thales Market Screener, we analyzed both the long and short sides for the $80,000 call options expiring on November 15 and 29 to assess the sentiment and premium dynamics.

Long Side Analysis: Speculative Bullish Positioning

Filtered for long positions, the data shows that buyers paid approximately $720,000 in total premiums for the $80,000 strike call options expiring on November 15, with each contract averaging around $760 in option premium. For these buyers, the break-even price for Bitcoin at expiration would be approximately $80,700. This strong interest in long positions at the $80,000 strike reflects a speculative outlook anticipating significant upward movement, which ultimately proved accurate as Bitcoin’s price surged.

Short Side Analysis: Premium Collection Strategy

On the short side, sellers of the $80,000 calls collected approximately $2,000,000 in premiums, with an average price of $940 per contract and a breakeven point around $80,900. These sellers could be employing various strategies, possibly anticipating that Bitcoin’s price would remain below $80,000 by expiration. Alternatively, they might be hedging existing positions or using covered calls to generate income, indicating a diverse range of views and approaches rather than a definitive stance on resistance levels.

Similar for 29 Nov Expiry

With Bitcoin now trading above 85K, these options have moved significantly in the money, setting buyers up for substantial gains at expiration. If Bitcoin’s price holds above this level, the buyers stand to earn a substantial profit from the settlement, far exceeding the initial premium they paid. This scenario illustrates the power of leverage in options trading, where a relatively small upfront cost can translate into a large payoff when the market moves in their favor.

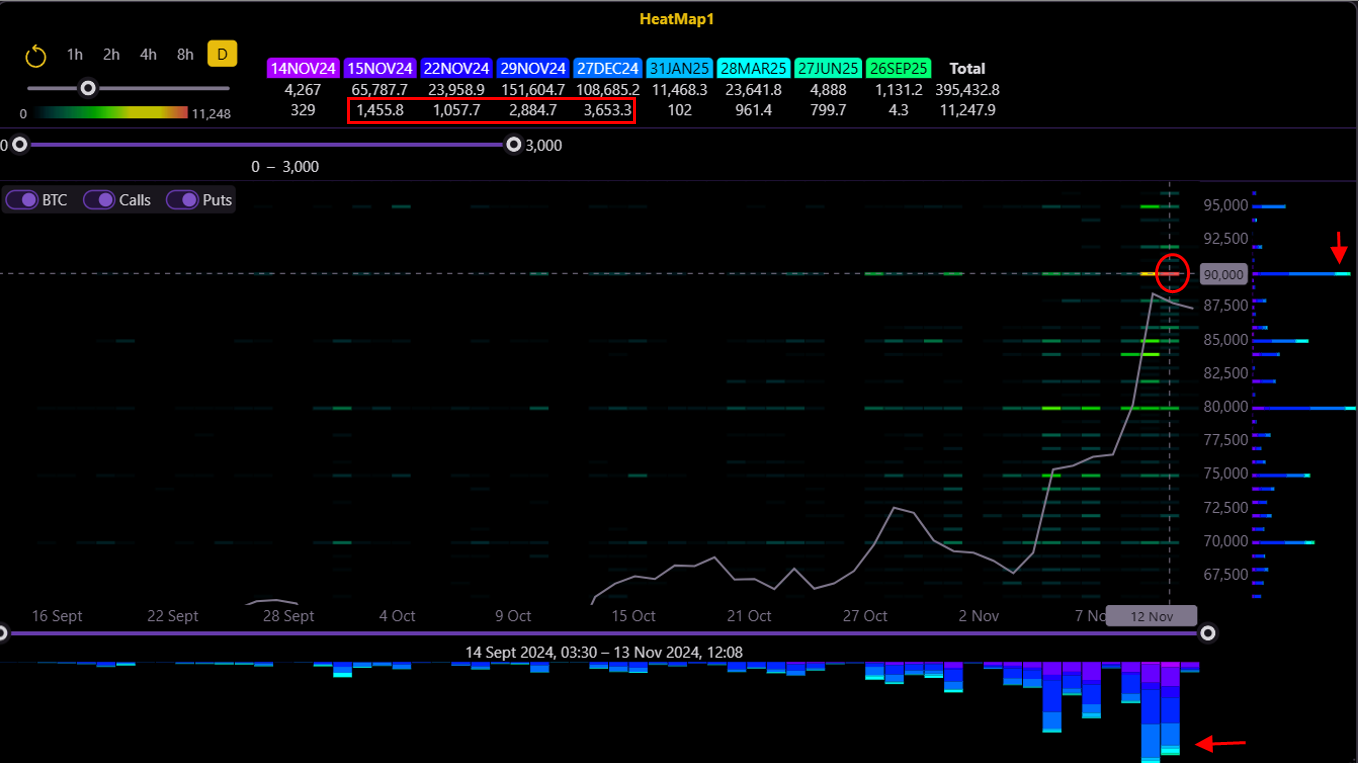

Higher Strike Levels Following Bitcoin’s Price Spike

After Bitcoin’s rapid rise on November 9, trader interest began to shift to the $84,000 strike for expirations on November 15 and November 29, reflecting recalibrated expectations following the ATH.

The shift toward $84,000 for calls indicates that traders were quick to adapt, targeting new highs as Bitcoin’s price approached uncharted territory.

Puts at Higher Levels Amid ATH

As Bitcoin hit record highs on November 11 and 12, we observed increased interest in puts at $70,000 and higer. This higher-strike put activity likely reflects defensive positioning, as traders hedged potential downside risk in response to the ATH.

This defensive adjustment demonstrates how, despite the bullish trend, options traders remain cautious, aligning their positions with both optimism and preparedness for volatility.

Emerging Focus on $90,000 for Late November and December

As of mid-November, with Bitcoin fluctuating between $85,000 and $90,000, traders have begun focusing on the $90,000 strike for later expiries, including November 29 and December 27. This new focus hints that traders see the potential for Bitcoin to test or even surpass this level as the year progresses, despite recent highs.

Bottom Line

In the post-election, ATH-driven environment, the Bitcoin options market reflects both speculative optimism and prudent caution. The significant early trading at the $80,000 strike, followed by renewed interest at $90,000, underscores the options market’s ability to position ahead of major price shifts. As Bitcoin fluctuates near $90,000, the strategic interest in higher strikes highlights how options traders anticipate possible future moves while positioning themselves to manage risks effectively.

Key Takeaways

- Implied volatility dropped sharply after the election, but Bitcoin’s ATH quickly recalibrated market sentiment to higher strike levels.

- Heavy call activity at $80,000 before the rally shows early positioning, while recent focus on $90,000 reflects continued upward anticipation.

- The ATH spurred recalibration to higher strikes, with $84,000 and $86,000 drawing additional interest.

Disclaimer

This analysis is for informational purposes only and is not financial advice. Trading in cryptocurrency options and futures involves significant risk and may not be suitable for all investors. Conduct your own research and consult a qualified financial advisor before making any trading decisions.