Bitcoin Repair Strategy with Options

All the simulations are available in Thales Options Strategy Simulator.

In the rollercoaster world of cryptocurrency, Bitcoin investors are no strangers to the stomach-churning dips and exhilarating highs. For those who have seen the value of their Bitcoin holdings take a significant hit, the traditional "hold-and-hope" strategy, while optimistic, may not always seem the most appealing or proactive approach. Enter the "Bitcoin Repair Strategy," a more nuanced alternative that aims to accelerate the recovery of lost capital without increasing the downside risk.

Understanding the "Bitcoin Repair Strategy"

The core of the "Bitcoin Repair Strategy" lies in its application for investors who find themselves in the red, holding Bitcoin purchased at higher prices now facing substantial unrealized losses. Rather than doubling down or waiting it out, this strategy employs a ratio spread using options to potentially mend the financial damage more swiftly.

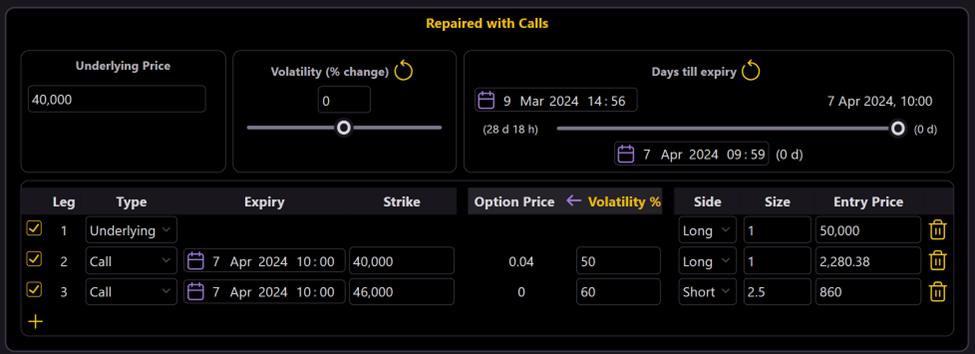

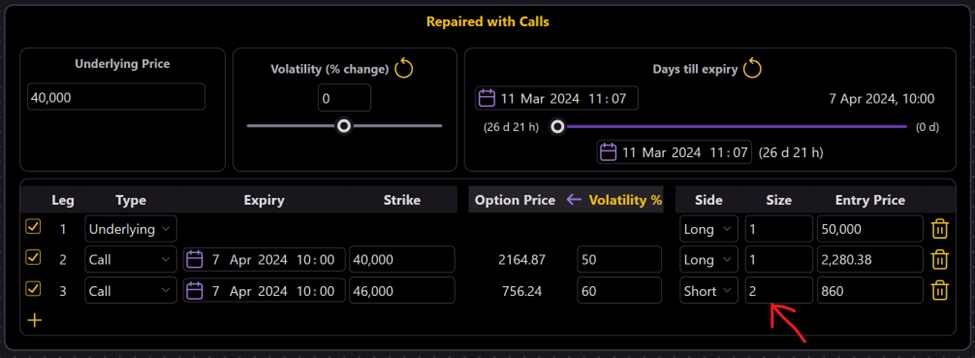

Here's how it works: If you bought for example 1 Bitcoin at $50,000 and its current value is $40,000, you're looking at an unrealized loss of $10,000. By engaging in a calculated options play—buying one call option on Bitcoin and selling two or more at a higher strike price—you aim to set up a scenario where the increase in Bitcoin's price not only recovers losses but does so more efficiently.

Strategy Structure and Execution

The strategy's effectiveness hinges on reducing the break-even point, in our case, from $50,000 down to $45,000. By leveraging call options, you essentially double the delta within a specific price range ($40,000 to $45,000 in this example), allowing for a quicker recoupment of the $10,000 loss with just a $5,000 increase in Bitcoin's price, without additional risk if the price falls.

However, this strategy is not without its challenges. It requires a keen understanding of options and their dynamics. The profit-loss outlook of an options strategy at expiration can be markedly different from its appearance at any point beforehand. This means that while the repair strategy might show less favorable outcomes in the short term, its true potential shines as the expiration date approaches.

Addressing the Challenges

Every strategy comes with trade-offs. In the case of the Bitcoin Repair Strategy, one notable downside is the potential for a negative delta beyond a certain price threshold, meaning the strategy could start incurring losses if Bitcoin's price skyrockets beyond our adjusted break-even point.

One way to mitigate this is by fine-tuning the size of the short call position. For example, scaling it down from 2.5 to 2 could alleviate the negative delta effect, albeit at the cost of introducing a slight loss into the strategy. This delicate balancing act highlights the strategy's complexity and the importance of strategic planning and timing.

A Real-World Example

For instance, you acquired 1 Bitcoin for $50,000 previously. Presently, the price is at $40,000. Consequently, your holding registers an unrealized loss of $10,000. The delta for this holding is 1, indicating that the Bitcoin price needs to ascend by $10,000 for your holding to emerge from the unrealized loss.

(Simulation 🔗)

Now, by utilizing two call option positions, you can effectively repair your Bitcoin position so that any increase in price will more quickly neutralize your unrealized losses.

In our case, we're able to reduce our break-even point from $50,000 to about $45,000. Essentially, through the strategic use of call options, we generate twice the delta over a certain price range, allowing us to offset a $10,000 unrealized loss with only a $5,000 increase in price, without amplifying the risk of a price decline in the underlying value.

(Simulation 🔗)

Please note that we have adjusted the date slider within the Strategy Builder widget to the expiration date. Consequently, the graph now presents the profit and loss status of the strategies exactly at their expiration date.

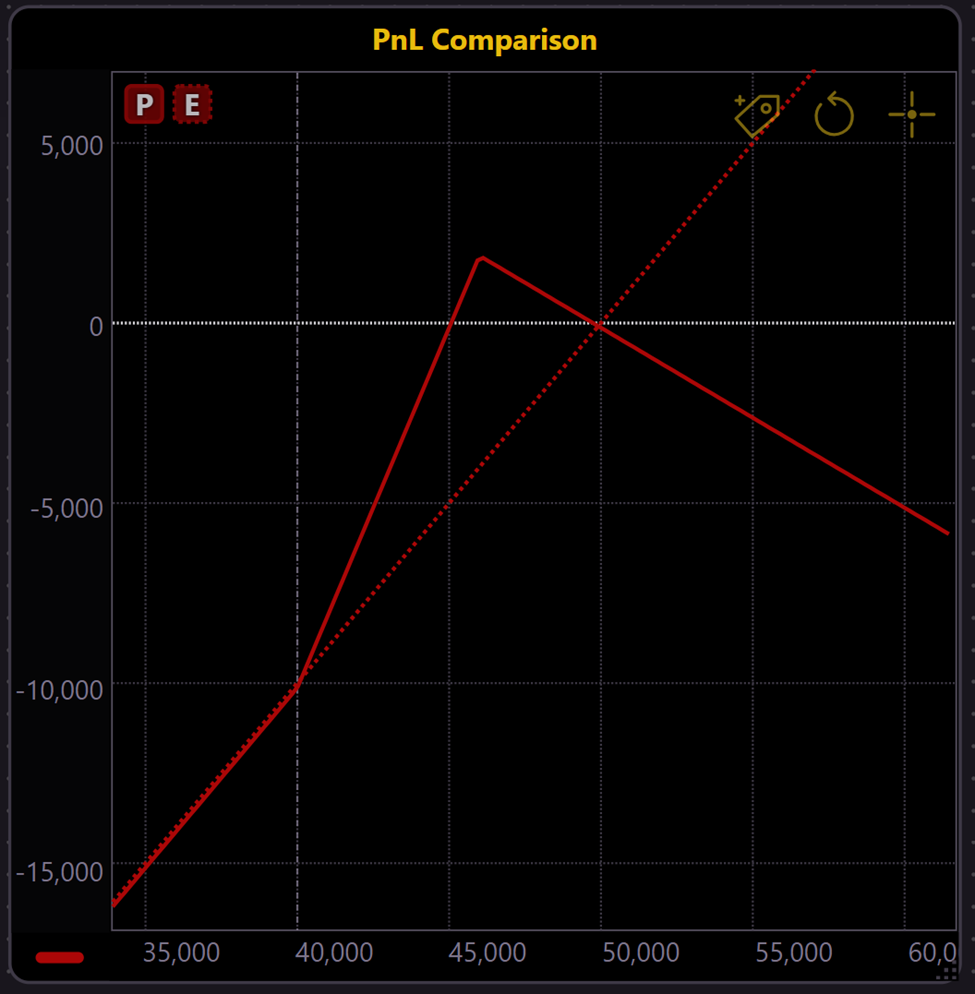

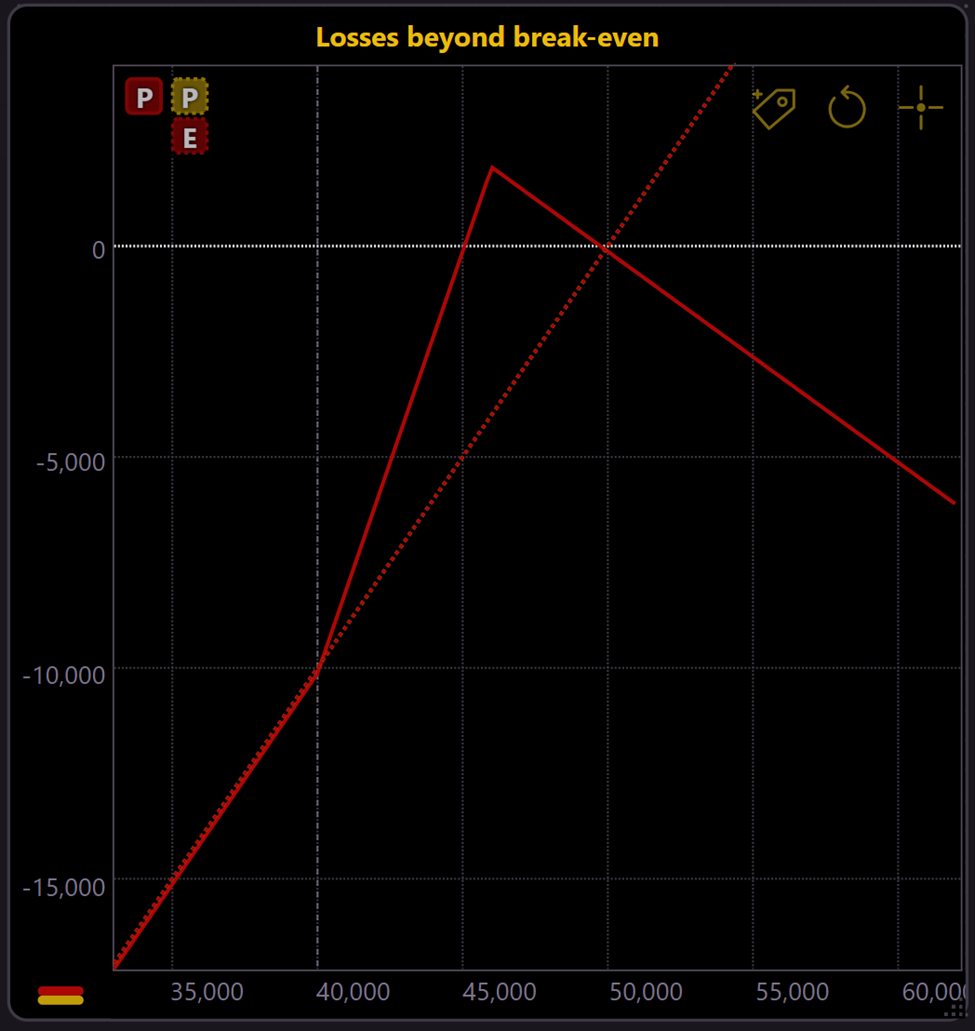

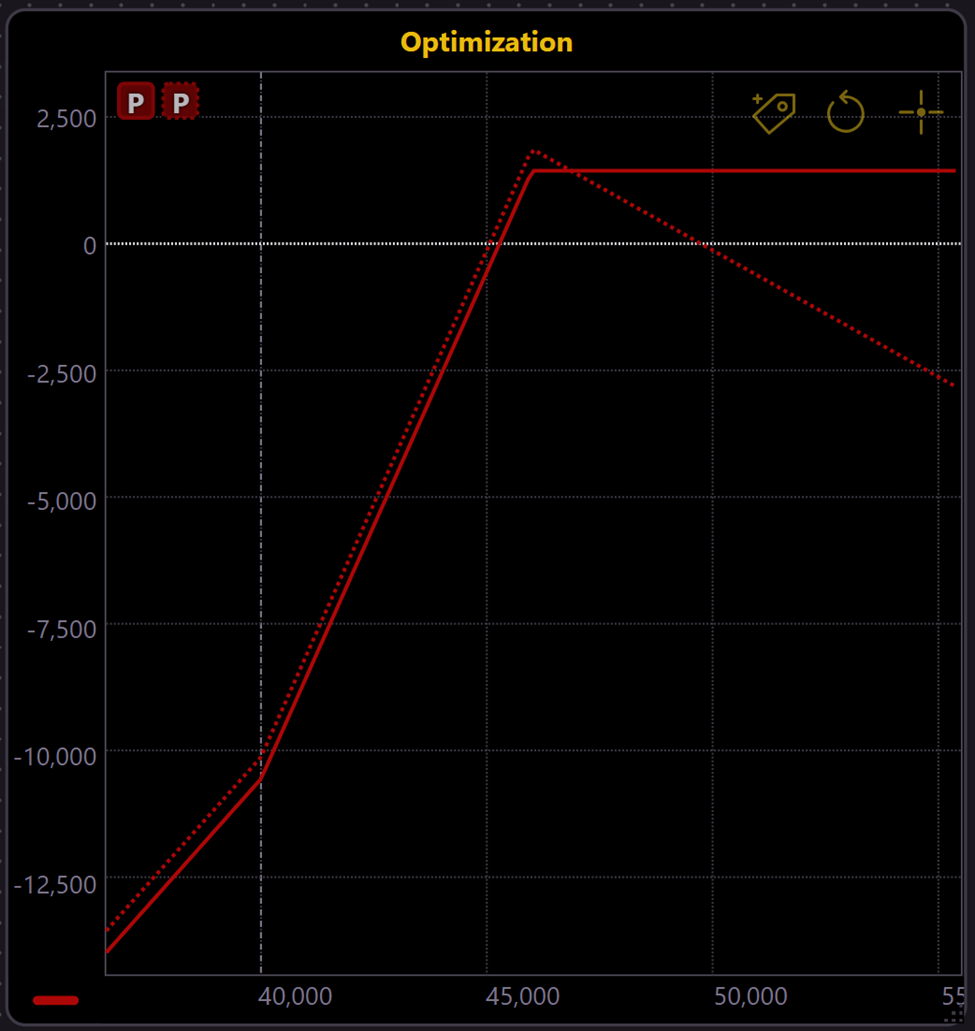

This graph illustrates the outcome of the repaired strategy compared to the original strategy. It visually represents how the repair strategy can potentially improve the investment position.

(Simulation 🔗)

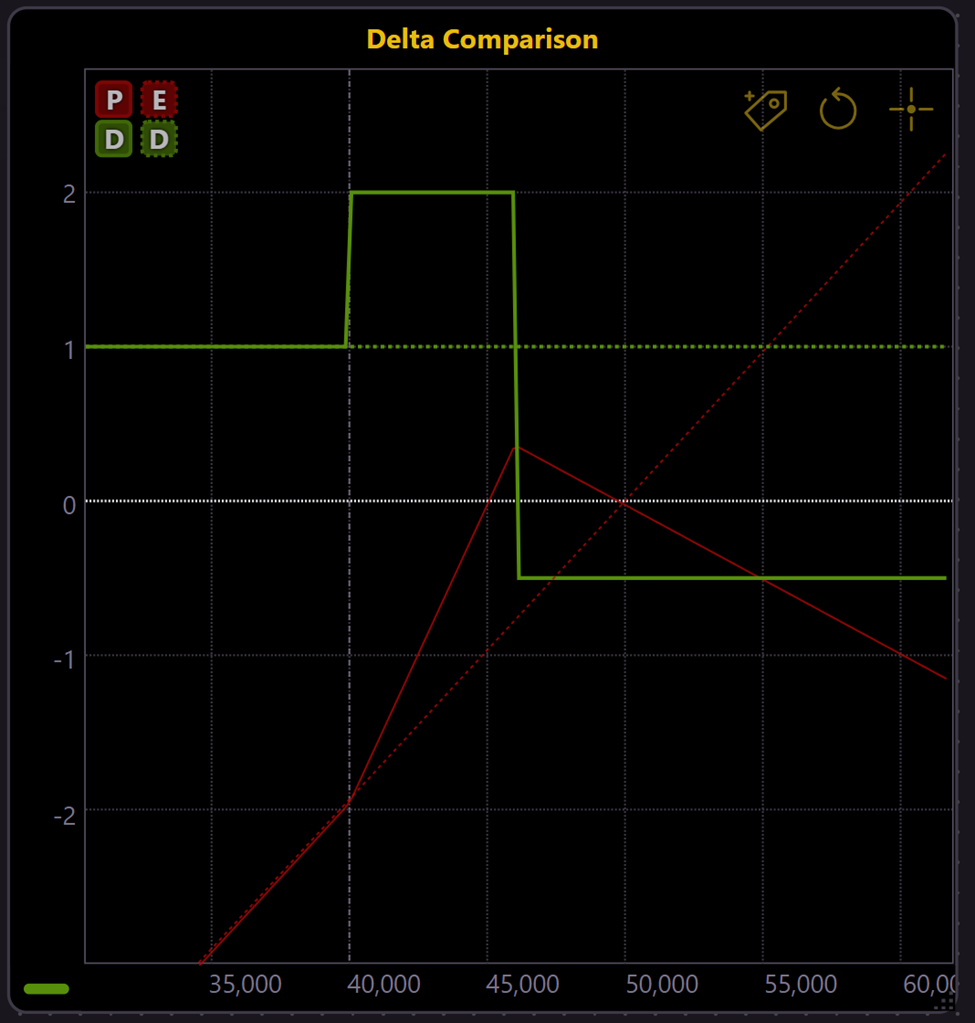

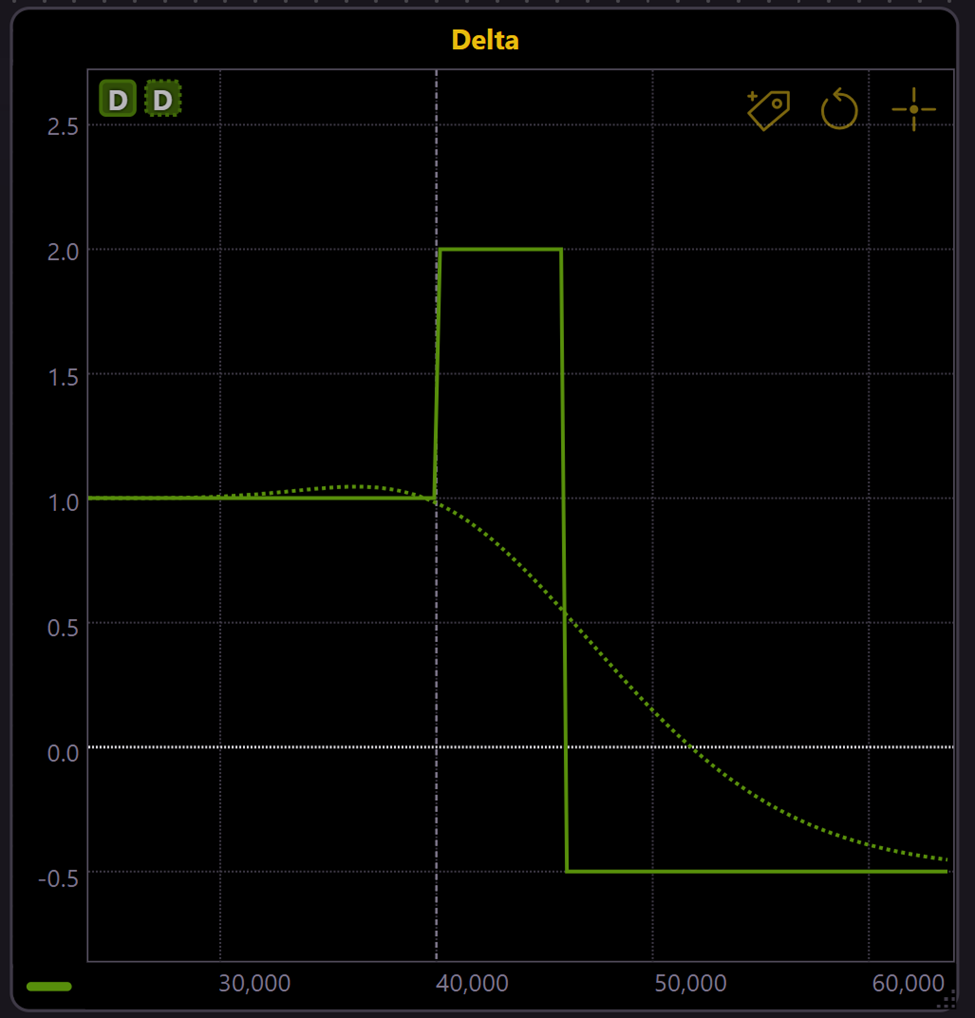

The graph below showcases a comparison between the delta values of the original and the repaired strategies. In the original strategy, the delta was 1, meaning that for each $1 increase in Bitcoin's price, the strategy realized a $1 increase in profit (or a $1 reduction in loss), and vice versa for a $1 price decrease.

(Simulation 🔗)

The repaired strategy's graph is more complex, with a delta of 2 within the price range of $40,000 to $45,000. This implies that for this specific range, the strategy is designed to double the rate of recovery from losses with the Bitcoin price movement.

It's important to note that in a certain price range, the delta of the repaired strategy can actually become negative. This means that in this specific range, as the Bitcoin price increases, the position incurs greater losses or lesser gains, as clearly demonstrated in the graph. This effect is a trade-off for employing this strategy, and there are additional disadvantages to consider, which will be discussed further.

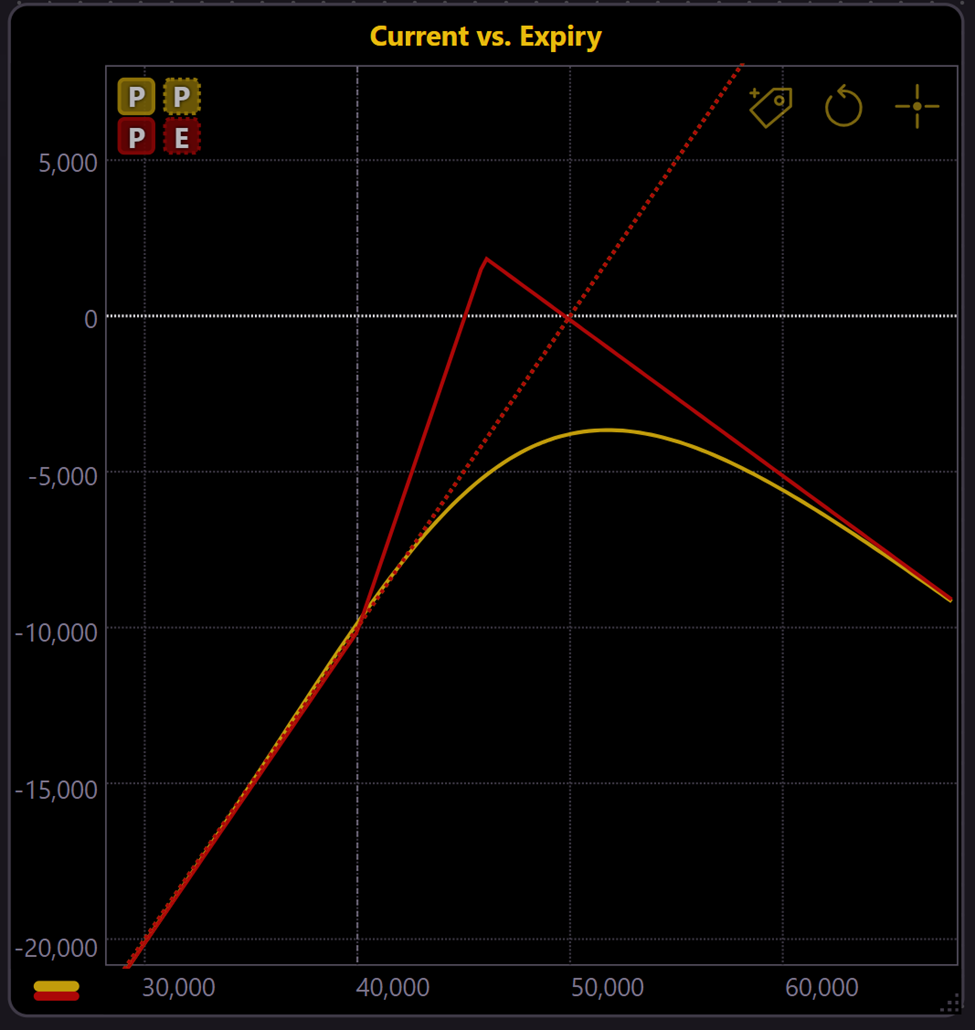

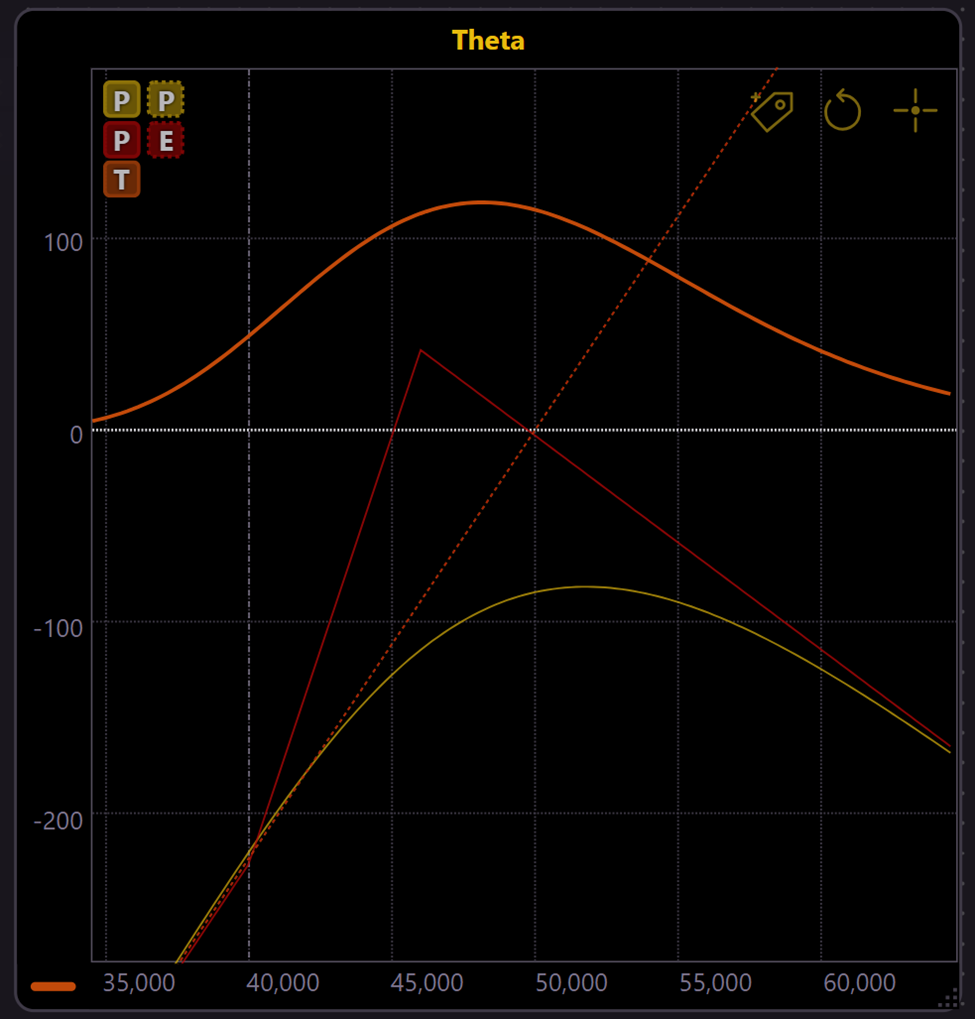

Initially, we analyzed the strategy at its expiration date. However, it's crucial to remember that the profit-loss diagram for an option strategy at the expiration date differs from that on any given day before expiration.

In our graph, the curve representing the current date before expiration is shown in yellow, while the curve for the expiration date itself is in red.

(Simulation 🔗)

As observed, the profit-loss curve of this strategy before expiration tends to deliver poorer results than the original spot long Bitcoin strategy. The benefits of the Bitcoin Repair Strategy become more apparent over time, meaning that a rapid and significant upward price movement yields better results for the original spot long strategy than for the Repair Strategy.

This phenomenon, where profit increases over time, is quantified by Theta. The graph indicates our strategy's Theta is positive, suggesting the strategy's performance improves as we approach expiration. The yellow curve, representing our strategy before expiration, gradually aligns with the red curve of the expiration day, ultimately surpassing it, reflecting enhanced outcomes as time elapses.

(Simulation 🔗)

The Delta phenomenon also manifests over time, underscoring the temporal realization of the Bitcoin Repair Strategy's benefits. Initially, the strategy's Delta may be less favorable compared to the original long spot Bitcoin strategy. However, as we approach expiration, the strategy's Delta advantage becomes evident, particularly in specific price ranges where the Delta reaches two, illustrating the strategy's effectiveness and efficiency increase with time.

(Simulation 🔗)

Another clear downside of the Bitcoin Repair Strategy is the negative Delta that emerges once the asset's price exceeds a certain threshold. If the asset's price rises beyond our break-even point, the strategy might incur losses. Normally, this isn't an issue if positions are closed in a timely manner, but failure to do so can lead to complications.

(Simulation 🔗)

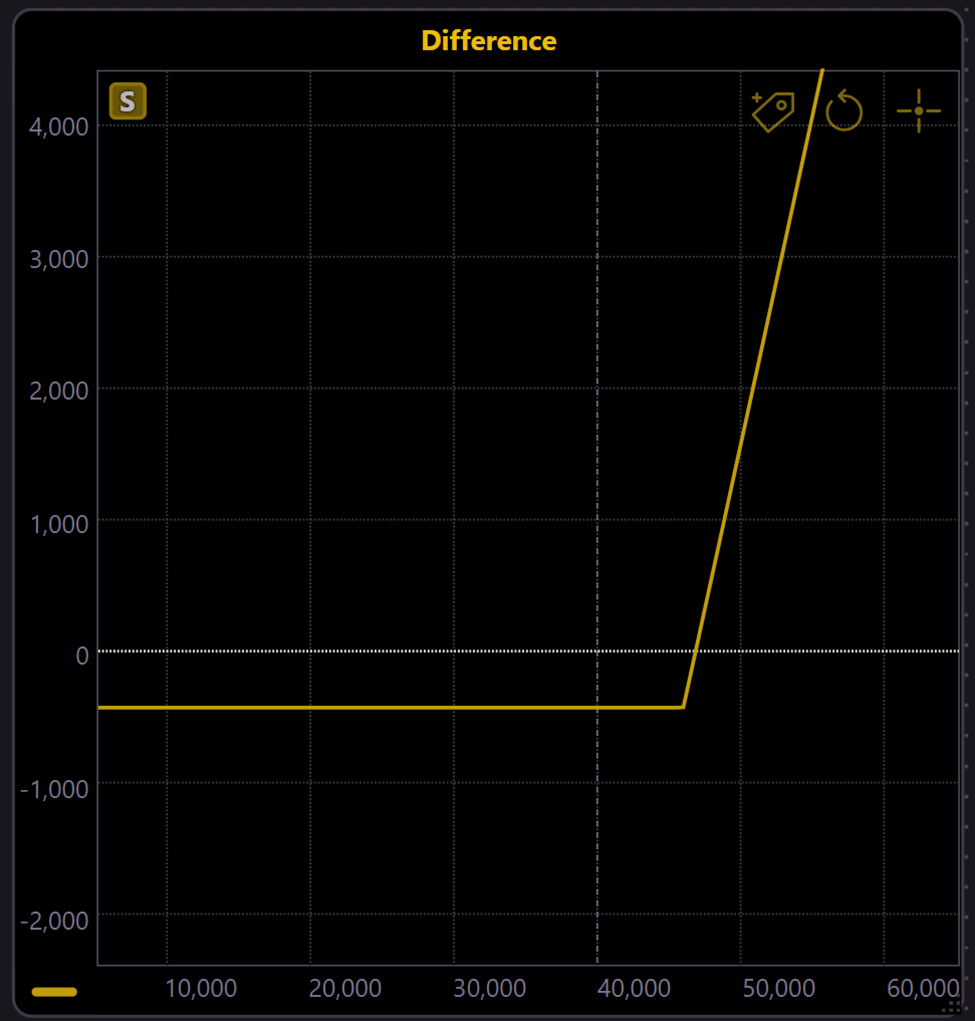

The issue with Delta can be mitigated by slightly reducing the size of the short call position. For instance, reducing it from 2.5 to 2 in our example can rectify the negative Delta effect and flatten the descending part of the profit-loss curve. However, such an optimization comes at a cost: a closer examination of both graphs reveals that this adjustment shifts the profit-loss curve slightly downwards, thereby programming a small loss into our strategy.

(Simulation 🔗)

The difference between the strategies is more clearly illustrated by abstracting and plotting the delta of the two curves. This chart shows that the cost of optimization for this strategy is approximately $ 400. At the same time, it highlights the benefit as the difference in strategies steadily increases beyond a certain price point.

(Simulation 🔗)

Conclusion and Key Takeaways

In summary, the "Bitcoin Repair Strategy" offers a nuanced approach for investors looking to mitigate losses from dips in Bitcoin's value. Unlike the conventional "hold-and-hope" strategy, this method utilizes options in a calculated manner to potentially expedite the recovery process without increasing the downside risk. Key points to remember include:

- The strategy is suitable for investors facing substantial unrealized losses, aiming to reduce the break-even point without additional risk.

- Execution involves a strategic use of call options to create a favorable scenario for loss recovery.

- While promising, the strategy requires a solid understanding of options trading and market dynamics.

- Investors must be aware of potential downsides, such as the negative delta in certain price ranges, and plan accordingly.

- Adjustments, such as fine-tuning the size of the short call position, can mitigate some risks but may introduce minor losses.

Embracing the "Bitcoin Repair Strategy" can potentially provide a more proactive and strategic path to portfolio recovery. However, it's crucial to approach with caution, equipped with thorough knowledge and a clear risk management plan.

All the simulations are available in Thales Options Strategy Simulator.