Introduction

Bitcoin’s options market has been a hub of activity in recent weeks, with traders positioning themselves strategically around key expiries and strikes. This report analyzes the period from 7th to 23rd November, leveraging tools like the Thales Heatmap and Market Screener alongside data from Deribit Metrics to uncover significant trends.

Our focus centers on the 29th November expiry, which exhibits notable activity across both calls and puts, highlighting shifts in trader sentiment and market dynamics. Additionally, we explore the implications of this activity, including heightened interest in specific strikes and the strategies employed by traders as they hedge or speculate on Bitcoin’s next moves. Finally, we provide insights into how these dynamics reflect broader trends and set the stage for the next key expiry on 27th December.

Background: Market Adaptation Over Time

In our previous research, we highlighted the dynamic nature of the Bitcoin options market, where trader positioning and strike price preferences evolved in response to shifting conditions. Building on that foundation, this report narrows its focus to the recent trading activity from 18th–23rd November, particularly around the 29th November expiry. This period captures how traders adapt their strategies, emphasizing options as a versatile tool for managing risk and capturing opportunities.

Heatmap Overview: Identifying Key Expiries and Strikes

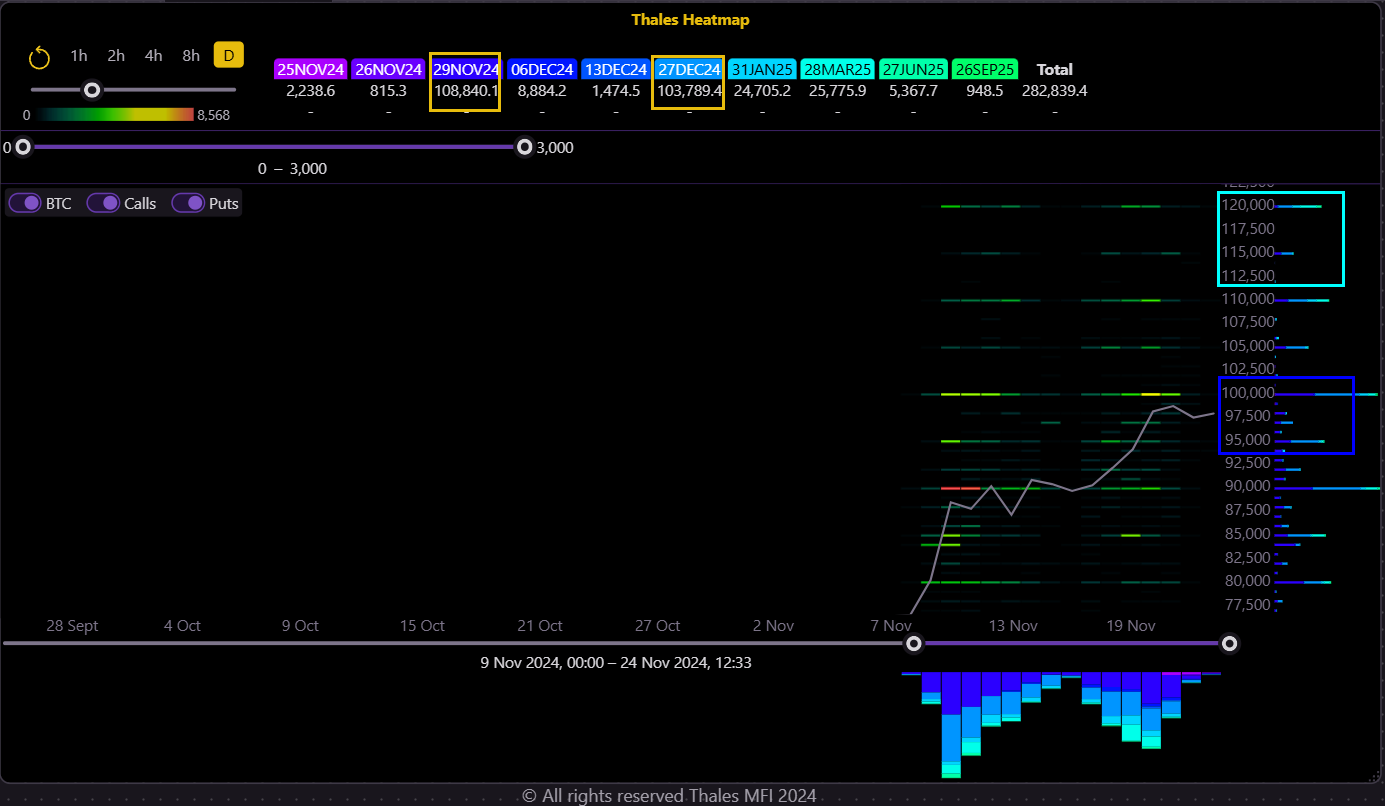

Thales Heatmap provides a bird’s-eye view of Bitcoin options trading for the selected range (7th–23rd November), showcasing activity across expiries and strikes:

- Key expiries: The 29th November (purple) and 27th December (blue) stand out as the most actively traded expiries. This is visible both on the horizontal axis (recent trades) and the vertical axis (volume distribution by strike price).

- Dominant strikes: For the 29th November expiry, $90,000, $95,000, and $100,000 are the most traded strikes, reflecting concentrated interest.

- Higher strikes for longer expiries: For higher strike prices ($110,000 and above), significant trades are observed for later expiries, as indicated by the color gradient. This implies that as Bitcoin’s price increases, traders focus on higher strike options with longer expiration dates.

Increased Attention to Puts

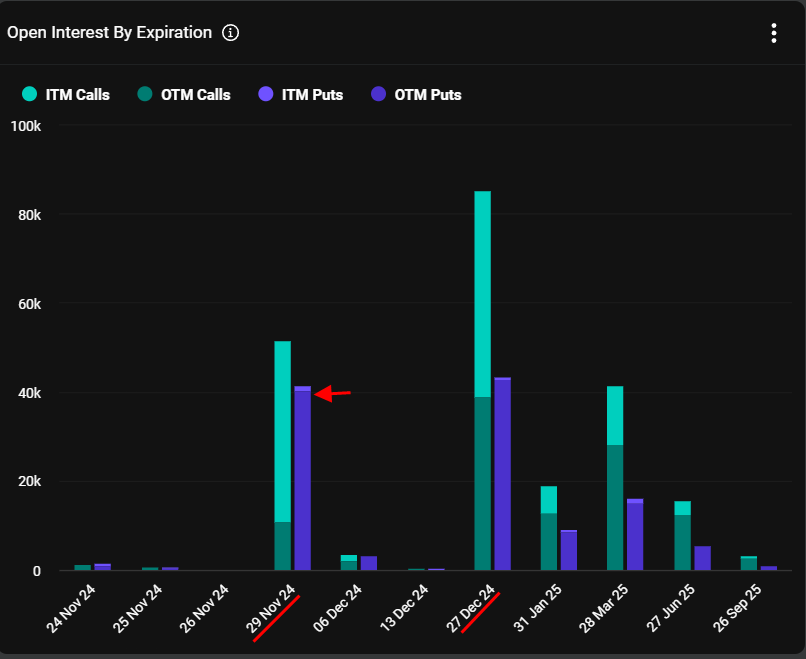

Data from Deribit Metrics reinforces the heatmap findings, showing that:

- Key expiries: The 29th November and 27th December expiries hold the highest levels of open interest in the Bitcoin options market.

- Significant increase in put options: A closer look at the 29th November expiry reveals a notable rise in put option activity. While calls still dominate overall, the increase in puts reflects traders’ potential concerns about a price correction or bearish outlook for Bitcoin.

- Increase in ITM Call Options: The graph also reveals a higher number of in-the-money (ITM) call options, indicating that traders who previously purchased these calls are now enjoying profits as Bitcoin's price aligns with their expectations.

Market Dynamics for 29th November

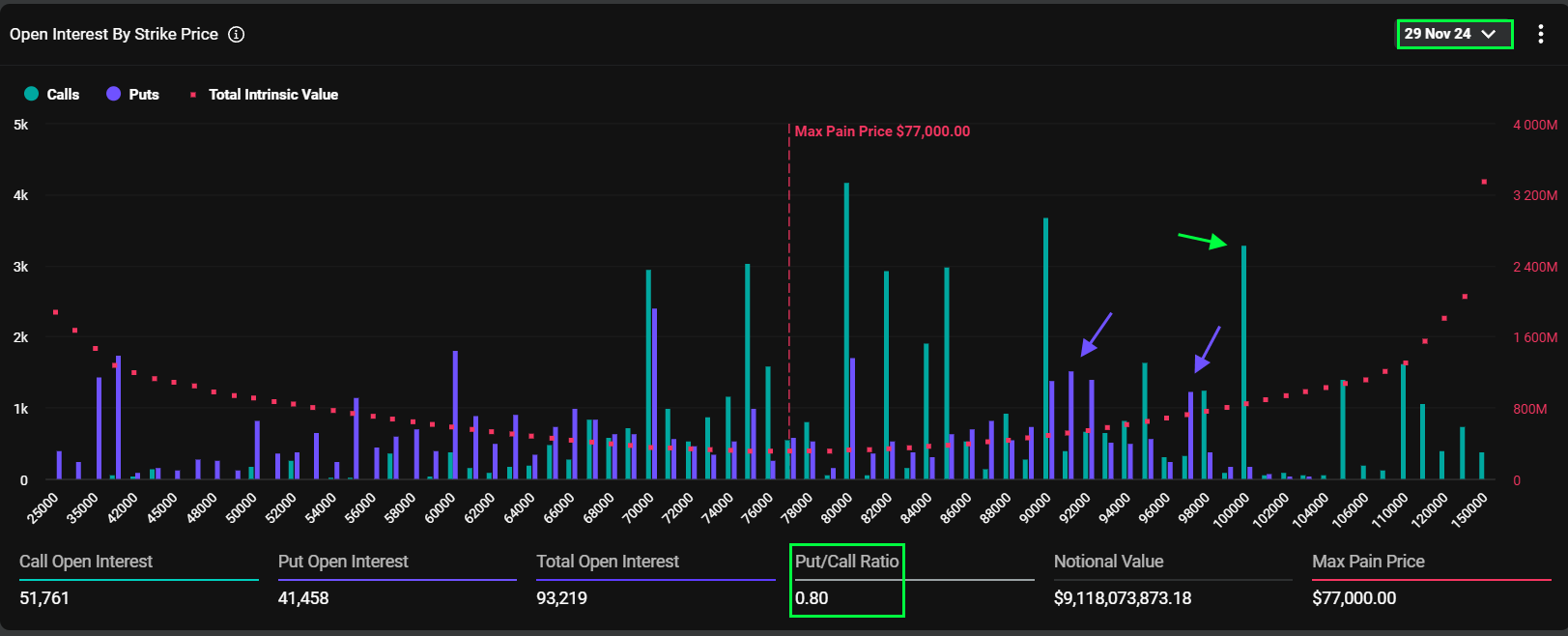

To understand recent trading behavior, we analyzed MarketScreener data filtered for the 29th November expiry from 18th–23rd November:

- Put-Call Ratio: The ratio stands at a relatively high 0.8, reflecting a stronger interest in put options compared to calls.

- Dominance of puts: For strike prices around $87,000 to $98,000, put options dominate, potentially signaling trader concerns about a price correction after Bitcoin's all-time high.

- Higher Open Interest: Strikes at $80,000, $90,000, and $100,000 show significant open interest, highlighting the dynamism of the market and key price levels of interest.

- Max Pain Movement: Referring to our previous analysis, the max pain for this expiry has shifted upward, aligning with recent market trends and reflecting adjustments in trader positioning.

Through the Lens of Market Screener: A Focused Dive

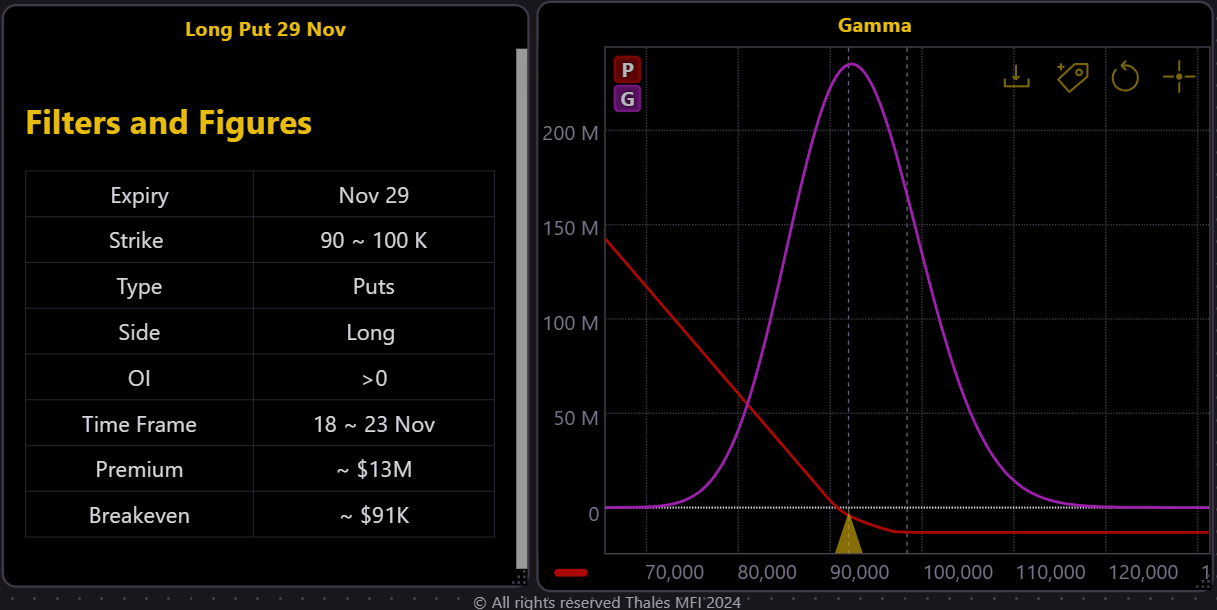

After analyzing the market from a broader perspective using the heatmap and identifying the most traded expiries and strikes, we now turn to the Thales Market Screener for a deeper, more focused examination. This tool allows us to refine the analysis by selecting specific time frames, strike ranges, expiries, option types, and sides (long or short). By narrowing down the data to the significant expiry (29th November) and strikes ($90,000 to $100,000), we can visualize and analyze the filtered market data.

- Dominance of Buyers: The overall positioning closely resembles a long put strategy, indicating that buyers of puts dominate the selected time frame.

- Gamma Analysis: The gamma visualization pinpoints $91,000 as the approximate average strike price for these long puts.

Long Put

Focusing specifically on the long puts within the $90,000–$100,000 strike range for the 29th November expiry, we observe several key points:

- Premiums Paid: Traders paid a total premium of approximately $13 million during the selected timeframe (18th–23rd November). This substantial figure highlights the significance of these trades in shaping the market sentiment.

- Gamma Analysis for Weighted Average Strike: Since multiple strike prices fall within this range, we utilize the gamma visualization to pinpoint the weighted average strike price. The analysis reveals that $91,000 stands as the approximate strike, serving as the center of this concentrated activity.

This refined approach allows us to extract deeper insights into the structure and sentiment of the options market, illustrating the strategic positioning of traders hedging or speculating on potential corrections in Bitcoin’s price.

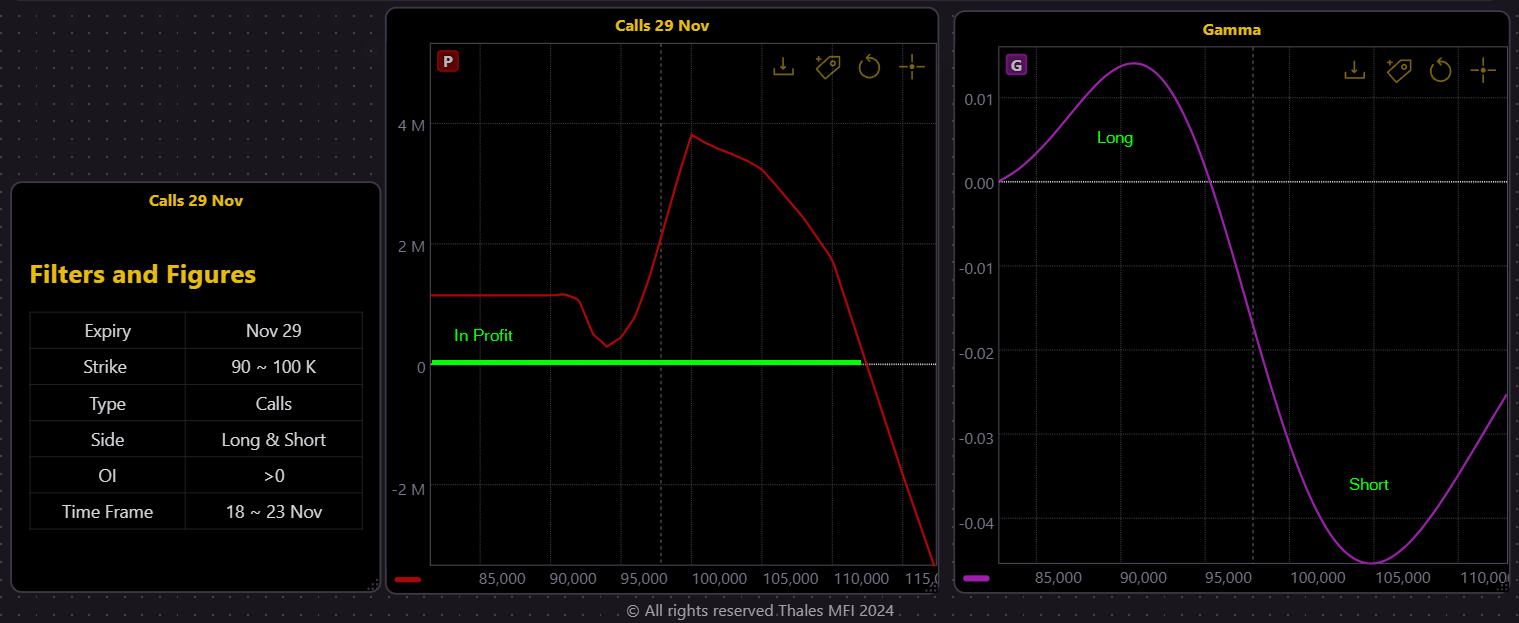

Examining the Call Side: Market Dynamics and Insights

Shifting our focus to the call options for the same time frame (18th–23rd November) and expiry (29th November), we observe the following insights based on the filtered data:

- Market Position Overview: The collective market positioning, as reflected by the red PnL graph, shows a mix of buy (long) and sell (short) positions for strikes within the $90,000–$100,000 range.

- Using Gamma for Clarity: Leveraging gamma analysis, we identify a distinct trend:

- For strikes below $100,000, the market is predominantly long, indicating speculative buying activity.

- For strikes above $100,000, the market is predominantly short, suggesting premium collection by traders.

This positioning implies that the market anticipates Bitcoin's price remaining below $100,000 until the expiry on 29th November.

- Profitability and Dynamics: Traders on both sides—speculators aiming for price movements and premium collectors—are currently in profit, as the PnL graph confirms. However, market dynamics are ever-changing, and these positions could shift as the expiry date approaches.

Here it should be reminded that the market is dynamic and needs ongoing analysis and monitoring. In future reports, we will extend our analysis to the next significant expiry—27th December—to provide further insights into market sentiment and trends.

Takeaways

Heightened Put Activity

Traders' increased focus on put options for 29th November suggests potential concerns over a Bitcoin price correction or a desire to hedge against downside risks.

Insights into Strategic Positioning

Through advanced tools like gamma analysis, we identified $91,000 as the weighted average strike price for puts, underscoring how traders align their strategies with evolving market trends.

Call Options and Profitability

Call options for strikes below $100,000 reflect speculative buying, while higher strikes exhibit premium collection. Both approaches have proven profitable during the analyzed timeframe.

Dynamic Market Behavior

The shifts in strike preferences and changes in max pain highlight the flexibility of traders in responding to evolving market conditions.

Future Analysis

While this report focuses on 29th November, we will analyze the 27th December expiry in our next research, shedding light on its emerging significance in the Bitcoin options market.

Disclaimer

This report is for informational purposes only and should not be considered financial or investment advice. The analysis provided reflects market trends and data as of the specified period and may not predict future outcomes. Trading Bitcoin options involves significant risk, and individuals should conduct their own research or consult with a professional advisor before making any financial decisions.