Short Risk Reversal for Dec 6th

(Visit Thales Market Screener)

An Emerging Expiry: December 6th

The highly anticipated November 29th Bitcoin options expiry concluded yesterday, marking a pivotal moment for speculators and option writers who appeared content with its outcomes. As the market shifts its focus to the major December 27th expiry and even further into 2025, a new, intriguing expiry date has emerged on the horizon: December 6th, just a week away. This report delves into the activity surrounding this near-term expiry, analyzing trends and uncovering strategic positioning that could shape the market narrative in the coming days.

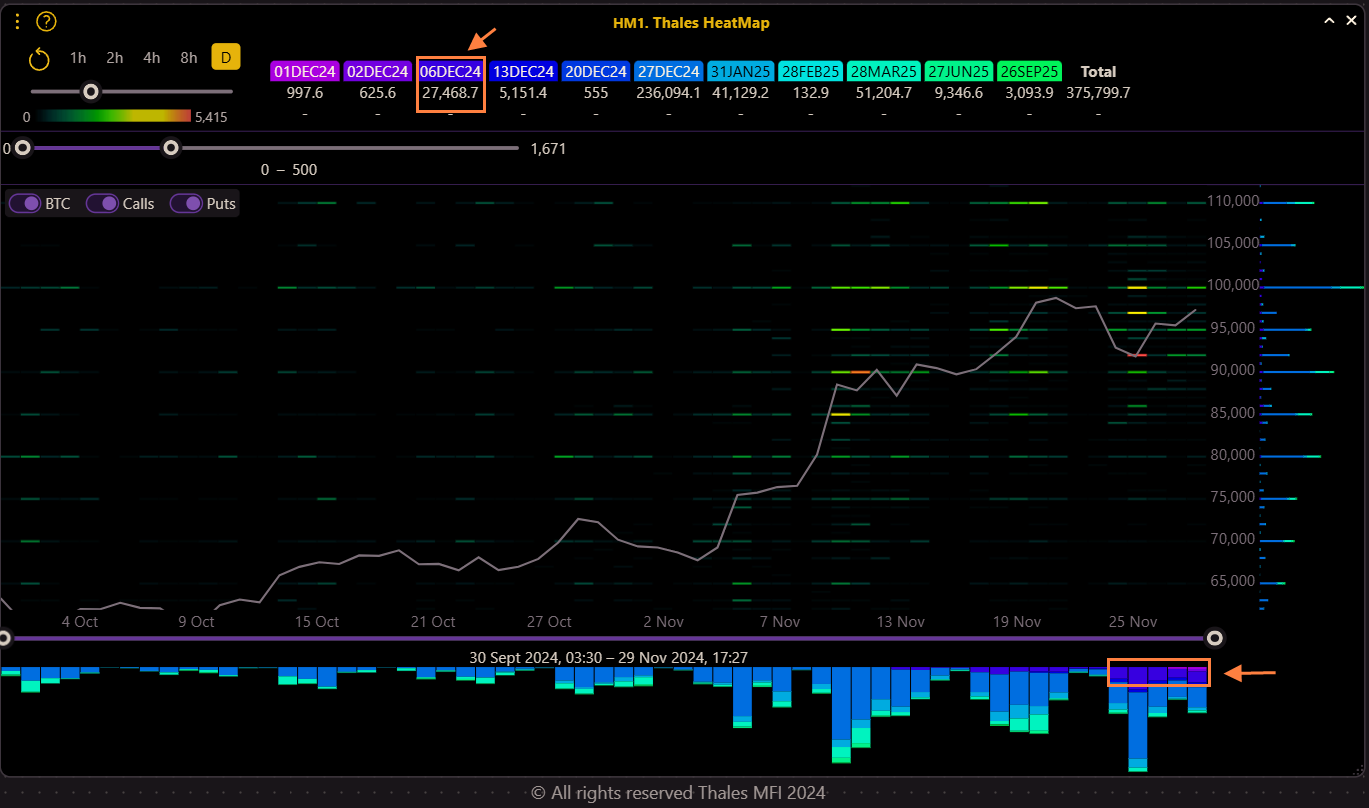

Spotlight on the Heatmap: Activity Shifts Post-29 Nov Expiry

Following the significant 29 November expiry, traders have shifted their focus, and the Thales Heatmap reveals intriguing insights. Over the last three days, the 6 December expiry has emerged as a hotspot, capturing considerable trading activity.

A closer look at the heatmap data shows that the $90,000 and $100,000 strikes have been particularly active.

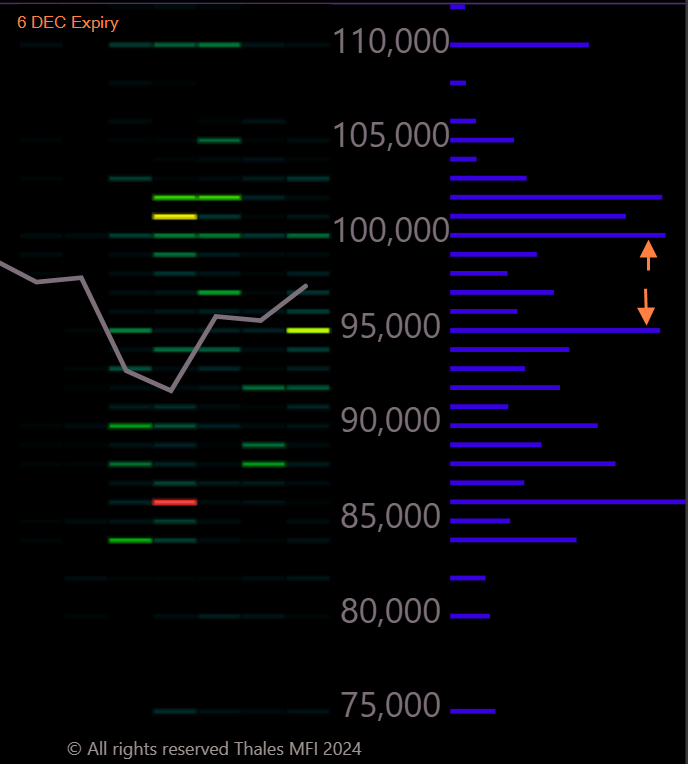

To understand these dynamics better, two heatmap visuals are included:

- Overall Market View: Highlights the 6 December expiry as the next focal point following 29 November.

- Filtered View for 6 December: This zooms in on strike activity within the $90,000 to $100,000 range, aligning closely with the mark price, which has fluctuated between $96,000 and $98,000 during this timeframe.

Interestingly, the most traded options are not at-the-money (ATM), as one might expect, but out-of-the-money (OTM) calls and puts. This highlights a potential speculative approach, possibly as part of advanced strategies—something we will delve deeper into later in the report.

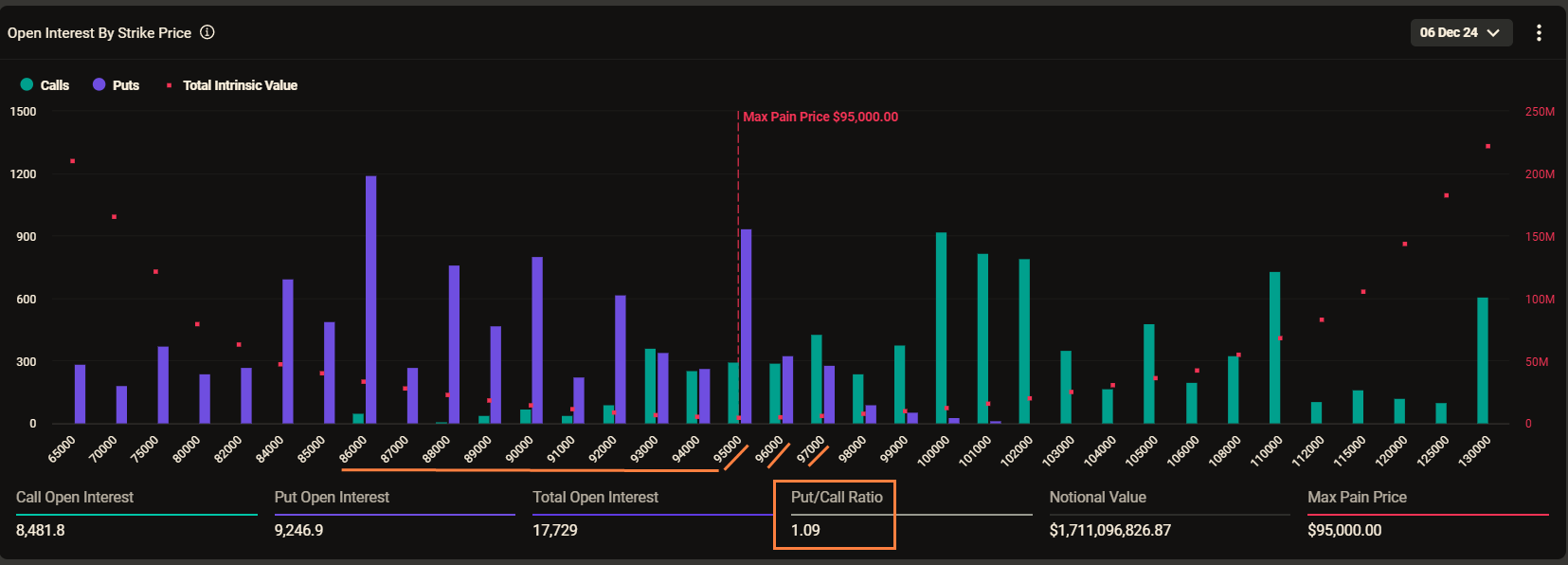

Open Interest Highlights: An Expiry Gaining Momentum

The 6 December expiry has rapidly gained substantial open interest, underscoring its growing relevance in the market. Notably, out-of-the-money (OTM) puts exhibit higher open interest compared to calls, which may suggest that traders are positioning themselves for a potential downside or hedging against a price correction in Bitcoin.

This intriguing development aligns with insights from the heatmap, reinforcing the idea that this expiry deserves closer examination. Does this heightened put activity reflect growing caution among market participants? Let’s delve deeper into the data to uncover more details.

The Put/Call Ratio for the 6 December expiry stands at 1.09, affirming the cautious sentiment highlighted in previous analyses. This metric underscores the dominance of puts over calls, consistent with the patterns observed in the heatmap and open interest data.

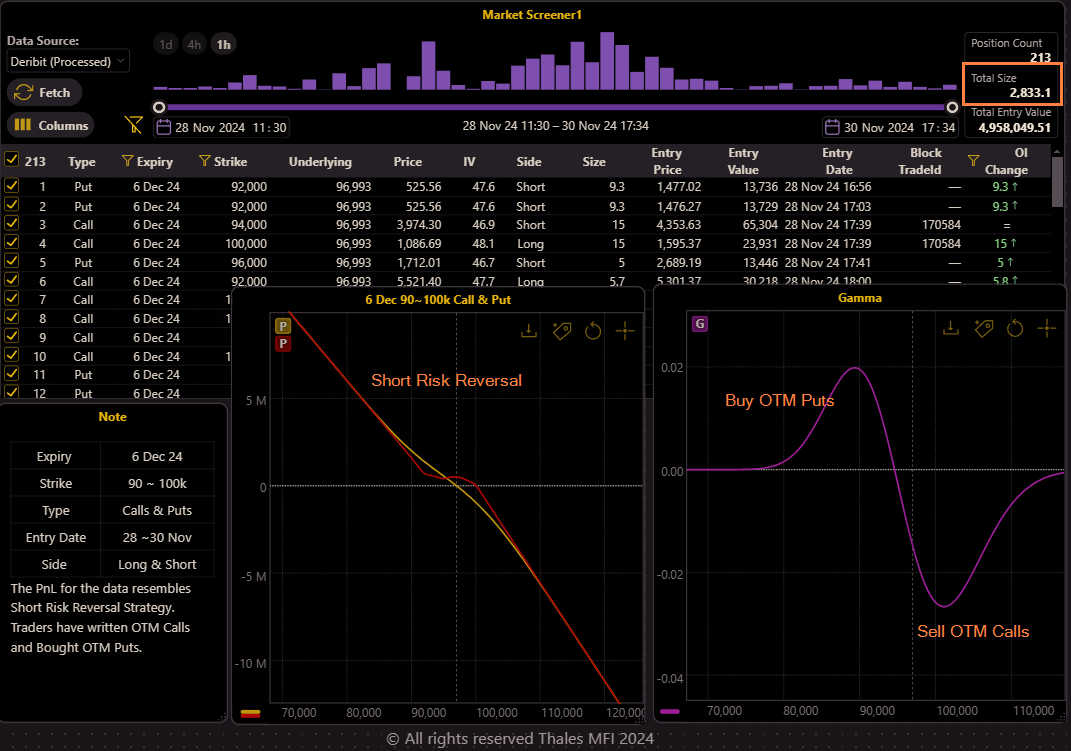

Focus on Market Screener: Identifying a Key Strategy for December 6th

(Visit Thales Market Screener)

Turning to the Market Screener, we filtered data from the past three days, focusing on the December 6th expiry and the strike range between $90,000 and $100,000. The insights revealed by this tool provide a fascinating look at the prevailing sentiment and strategy in the market.

Emerging Strategy: Short Risk Reversal

Upon exporting the data to the PnL graph, a clear pattern emerges—market participants are favoring a Short Risk Reversal strategy. This is characterized by:

- Selling OTM Calls around the $100,000 strike.

- Buying OTM Puts near the $92,000 strike.

This combination generally reflects a bearish outlook, suggesting that traders might either be hedging their long positions or speculating on a potential correction in Bitcoin's price.

We still have a dynamic week ahead until this expiry and the market's behavior may shift significantly. Continuous monitoring is essential to capture any changes in sentiment or strategy. Stay tuned for future Outlooks, where we’ll provide updates and deeper analysis of market developments.

Disclaimer

This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research before making trading decisions.