Introduction

In the world of options trading, the decision between at-the-money (ATM) and out-of-the-money (OTM) options isn’t just about cost—it’s a question of strategy. Each has its own strengths and weaknesses, appealing to traders with different objectives and risk appetites.

So why do some traders opt for OTM options, which are often considered riskier? What makes them attractive compared to their ATM counterparts? This blog explores these questions by diving into a real-world example of Bitcoin options. We’ll assess the unique characteristics of ATM and OTM options across three critical dimensions: price movement, implied volatility, and time decay.

Before we dive into the analysis, it’s essential to remember: there are always trade-offs. No option is universally better—it all depends on the trader's goals and expectations. Let’s set the stage with a practical example to see how these factors come into play.

A. The Setup: A Real-World Comparison

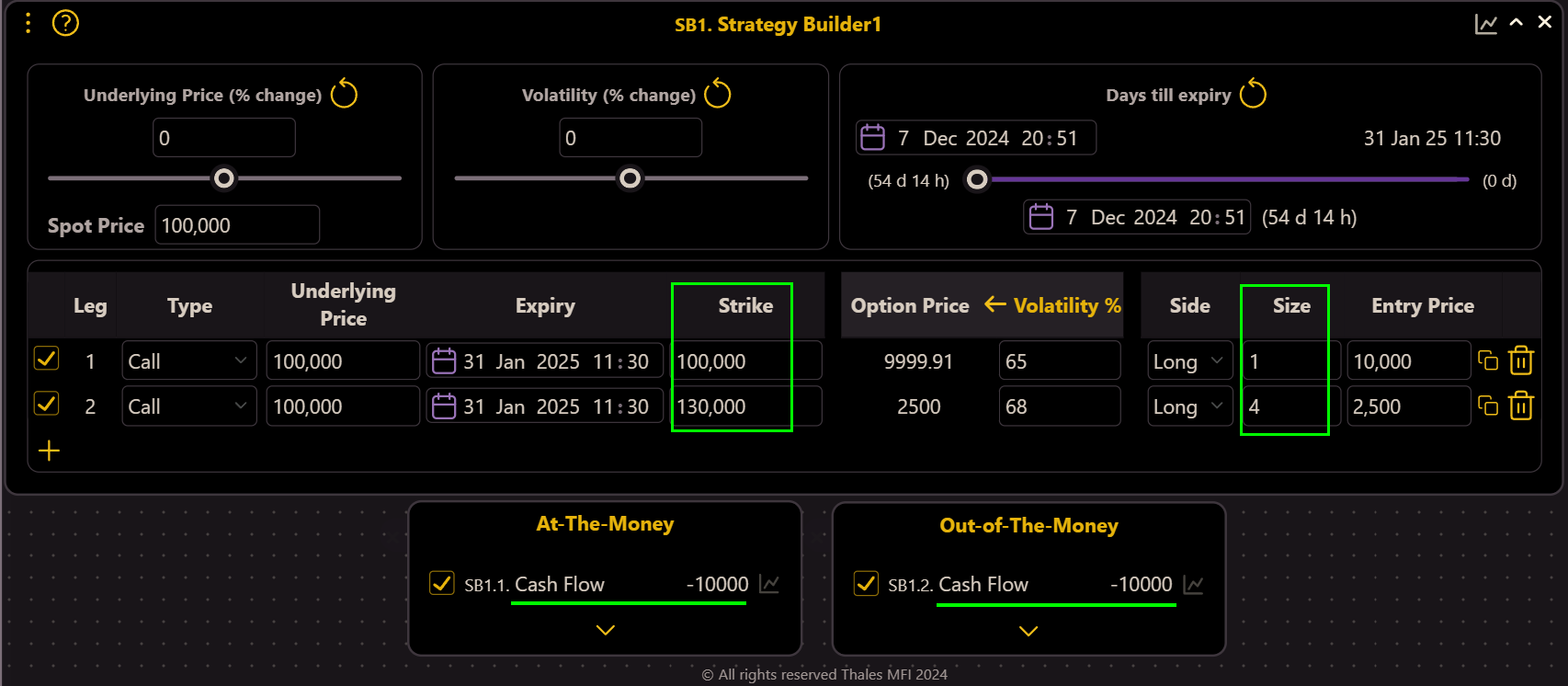

To illustrate the differences between ATM and OTM options, let’s consider two Bitcoin call options with the same expiration date. (see below)

(OSS)

- ATM Option: Strike price of $100,000.

- OTM Option: Strike price of $130,000.

- Equal Investment: $10,000 is allocated to both options. For the ATM option, this buys one contract. For the OTM option, this buys four contracts, as they are much cheaper.

This setup ensures a level playing field for comparison, with equal cash flow invested in both options.

With the foundation laid, let’s analyze how these options perform under different market conditions.

B. Price Movements: How Delta Impacts PnL

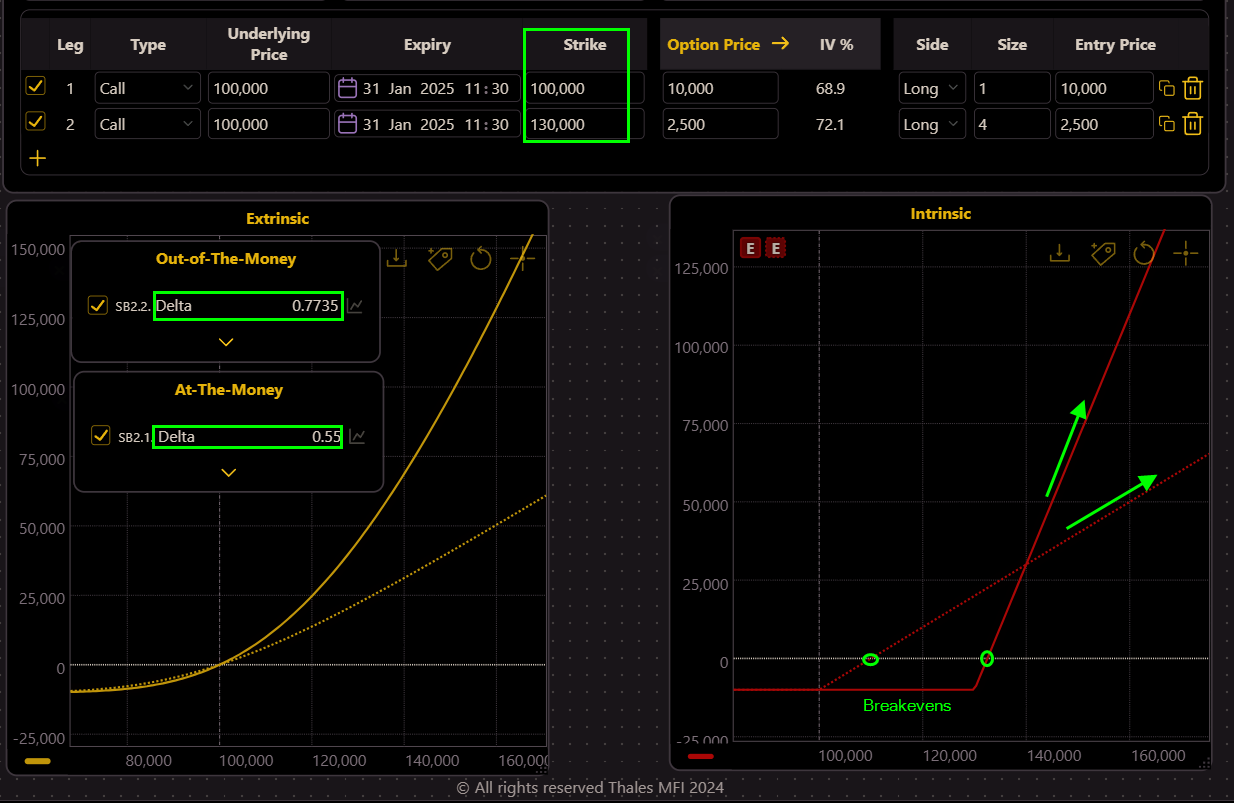

Delta measures how much an option’s price changes with a $1 movement in the underlying asset. It is a critical factor in understanding how ATM and OTM options react to price movements.

(OSS)

- In the left graph, the solid line represents the current PnL of the OTM option, while the dotted line corresponds to the ATM option. The steeper slope of the OTM PnL curve highlights a key advantage: if the price rises as expected, the OTM position generates profits more quickly. This advantage is also reflected in the delta values. Although the delta of a single OTM call is lower than that of an ATM call, the combined delta of the four OTM calls exceeds that of the ATM position, amplifying the profit potential.

The right graph visualizes the intrinsic value of the options, or the PnL of positions at expiry. It further illustrates the steeper slope of the OTM position, which indicates higher gains if the price rises significantly. However, the trade-off is evident in the break-even points: the ATM option has a closer break-even to the current price, whereas the OTM position requires a much larger price increase to end in-the-money (ITM) at expiry. This underscores an important consideration for traders—while OTM options offer higher profit potential, they also demand more substantial price movements to achieve profitability.

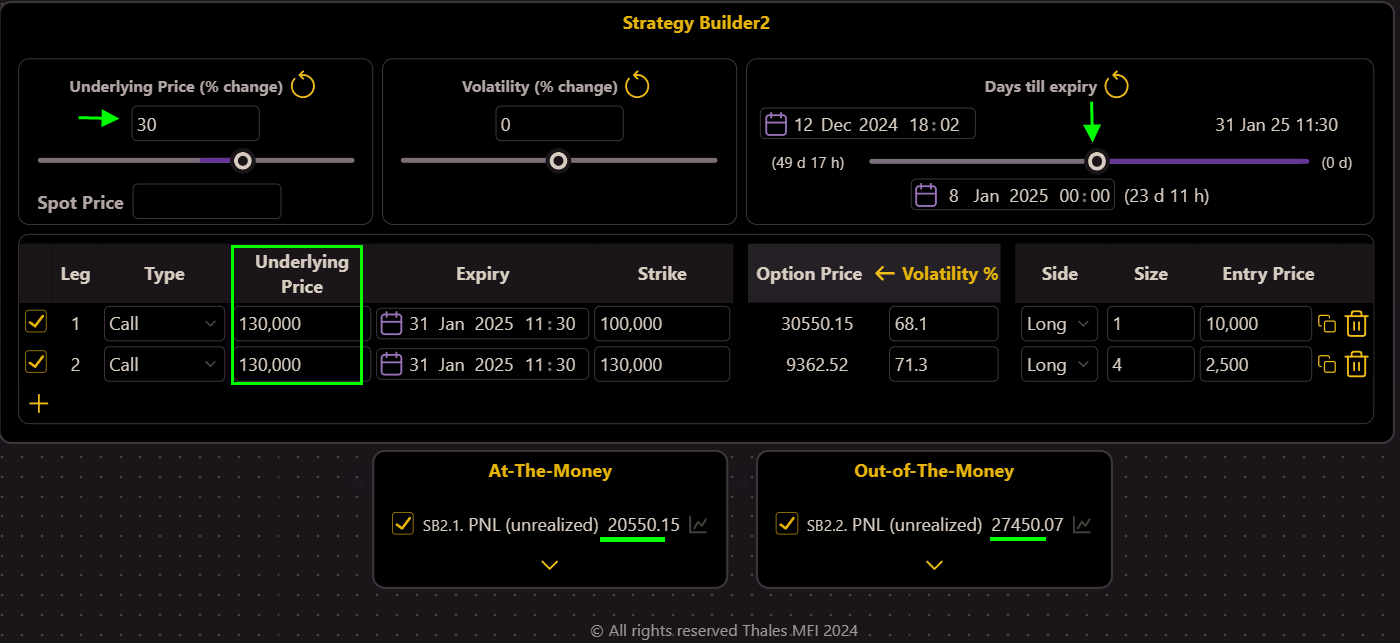

A Price Surge

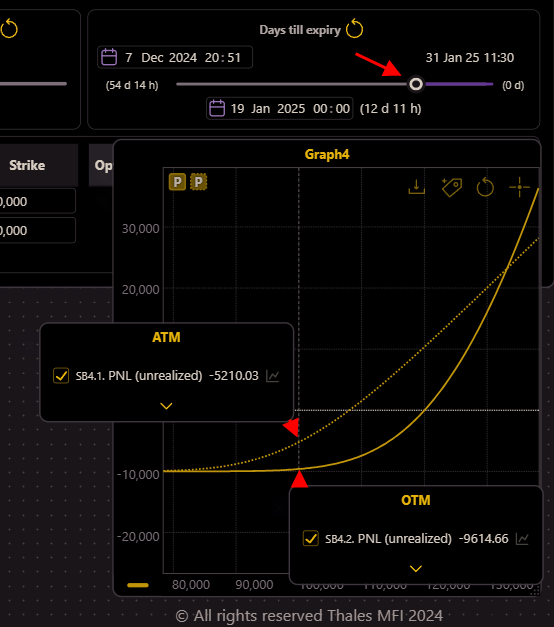

- In this scenario, we examine the effect of a 30% increase in the underlying price (BTC) while simultaneously assuming that half of the days-to-expiry (DTE) have passed. These changes are modeled using the Strategy Builder widget.

- OTM Option Performance:

Despite the $130,000 strike option being OTM at the start, it outperforms the ATM option in terms of unrealized PnL after the 30% price increase. The aggregate delta of the OTM position (composed of 4 contracts) allows it to capture larger gains as the price moves upward. - ATM Option Now ITM:

The ATM $100,000 strike option has become ITM, with intrinsic value contributing to its PnL. However, even with this advantage, the PnL of the ATM position is lower than the OTM position. - This outcome highlights the power of OTM options in leveraged returns. Although the $130,000 strike option remains just at the money and lacks intrinsic value, its higher delta across 4 contracts magnifies the gains from price movement.

However, this leverage is a double-edged sword: while OTM options amplify gains, they also expose traders to greater losses if the price moves in the opposite direction.

Price Decline

When the underlying price decreases by 5%, combined with a reduction in the days-to-expiry, the impact on OTM options is more severe. As shown, the OTM position incurs a significantly higher unrealized loss compared to the ATM option. This highlights the higher risk associated with OTM options in bearish scenarios, where their lower intrinsic value accelerates their decline in value.

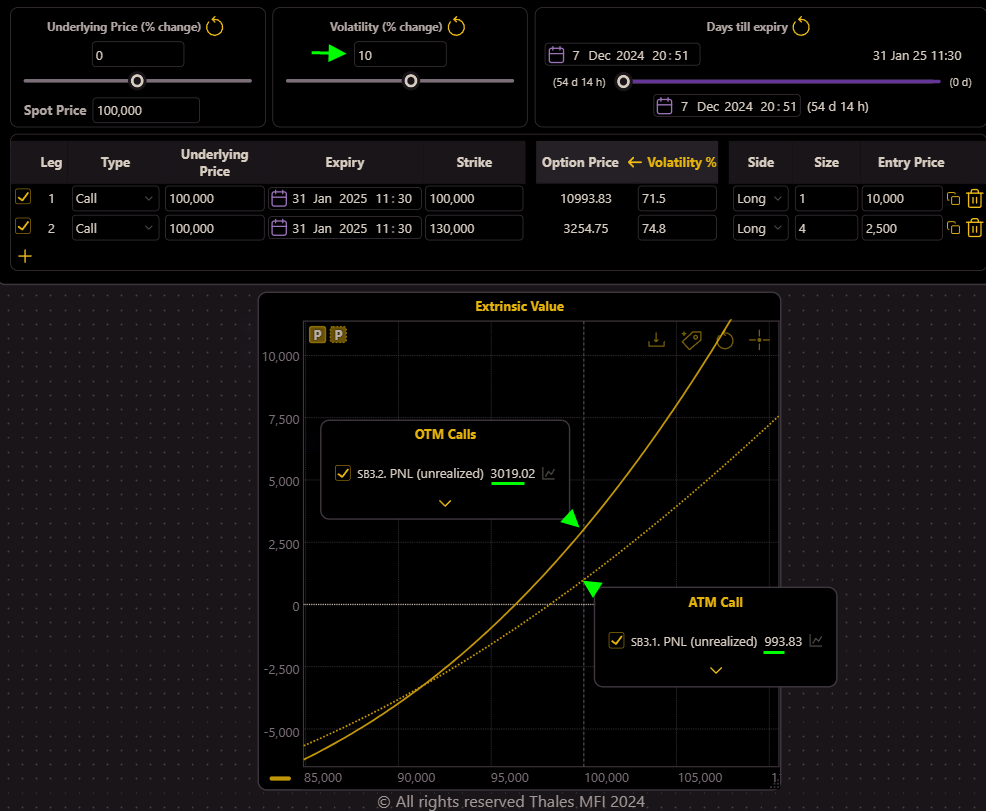

C. Implied Volatility: The Vega Advantage

Implied volatility (IV) plays a significant role in options pricing, with its impact varying between ATM and OTM options.

(OSS)

- OTM Option: OTM options derive a significant portion of their value from extrinsic factors like IV. A rise in IV disproportionately benefits OTM options, leading to a larger increase in their price compared to ATM options.

- ATM Option: While ATM options also gain from rising IV, the impact is less pronounced, as they already hold a higher intrinsic value.

This makes OTM options particularly appealing in volatile markets, where IV spikes are anticipated. But remember, in stable markets, the lack of IV movement can leave OTM options underperforming.

D. Time Decay

As time progresses toward expiry, the passage of time significantly erodes the value of both ATM and OTM options.

(OSS)

However, the OTM position experiences a steeper decline in unrealized PnL. This reflects the higher sensitivity of OTM options to time decay, as their lack of intrinsic value makes them more reliant on extrinsic value, which diminishes faster as expiry nears. This trade-off underscores the critical role of timing in trading OTM options.

Bottom line

OTM options can be a better choice for traders who are confident about a rapid and significant price move—such as a surge in price for OTM calls or a sharp drop for OTM puts. One key advantage is their lower cost; with the same amount of capital invested (as premium), traders can control a larger portion of the underlying asset compared to ATM options. Additionally, traders may exit their positions before expiration, perhaps after achieving a predefined profit target, like a 50% gain on their initial investment.

Another important factor is implied volatility (IV): OTM options are particularly favorable when IV is low and expected to rise, as this can significantly increase their value.

While OTM options offer higher profit potential, traders must carefully weigh the associated risks and trade-offs, including the need for more substantial price movements to achieve profitability.

Disclaimer

This article is for informational purposes only and should not be considered financial or investment advice. Trading options involves significant risk and is not suitable for all investors. Always conduct your own research or consult with a financial advisor before making any trading decisions.