Introduction

The Bitcoin options market has been a vibrant landscape for traders in December, marked by key expiries and intriguing trends. Among these, the December 20th expiry stands out for its significant Open Interest (OI) and its ability to reflect traders’ sentiment. This blog unpacks the dynamics of this expiry, exploring how puts and calls were traded, what the heatmaps reveal, and how smart traders positioned themselves amid Bitcoin’s price movements.

By examining these elements, we aim to provide readers with actionable insights into the evolving Bitcoin options market, using data-driven evidence from our tools and Deribit’s comprehensive options data.

Try Thales OSS for Simulating your own strategies and Market Analysis.

1. Macro Outlook on the Bitcoin Options Market

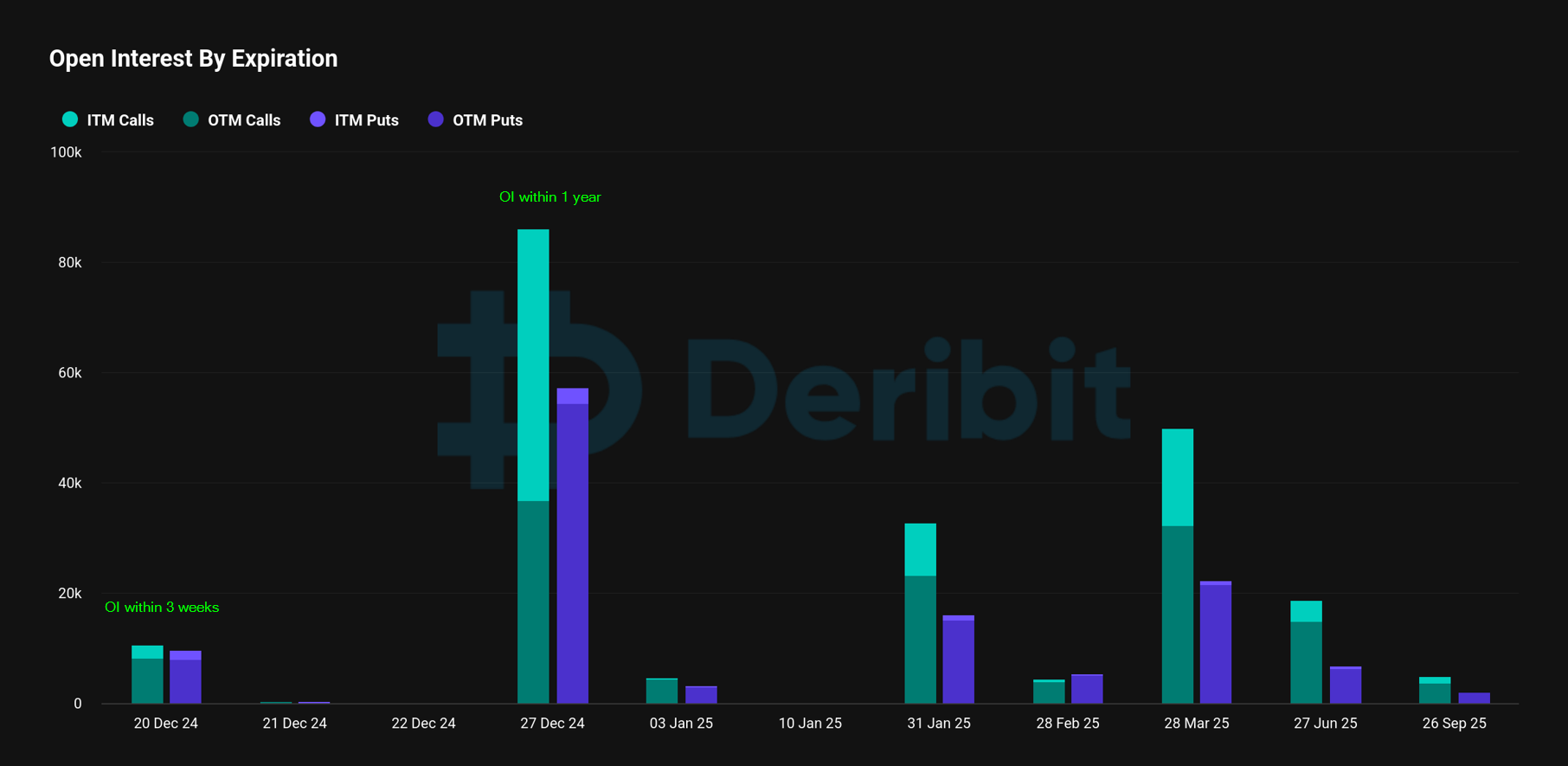

December has been pivotal for Bitcoin options, with notable activity centered around two key expirations: December 27th and December 20th. While the former holds the highest OI overall, the latter is intriguing due to its issuance only three weeks prior, at the end of November.

Key observations:

- OI for December 20th expiry: Approximately 20,000 contracts (9,000 puts and 11,000 calls), with a put-call ratio of 0.9.

- This ratio, combined with the high OI, suggests traders’ heightened focus on this expiry and their concerns about potential price corrections.

2. Analysis of Put Options for December 20th Expiry

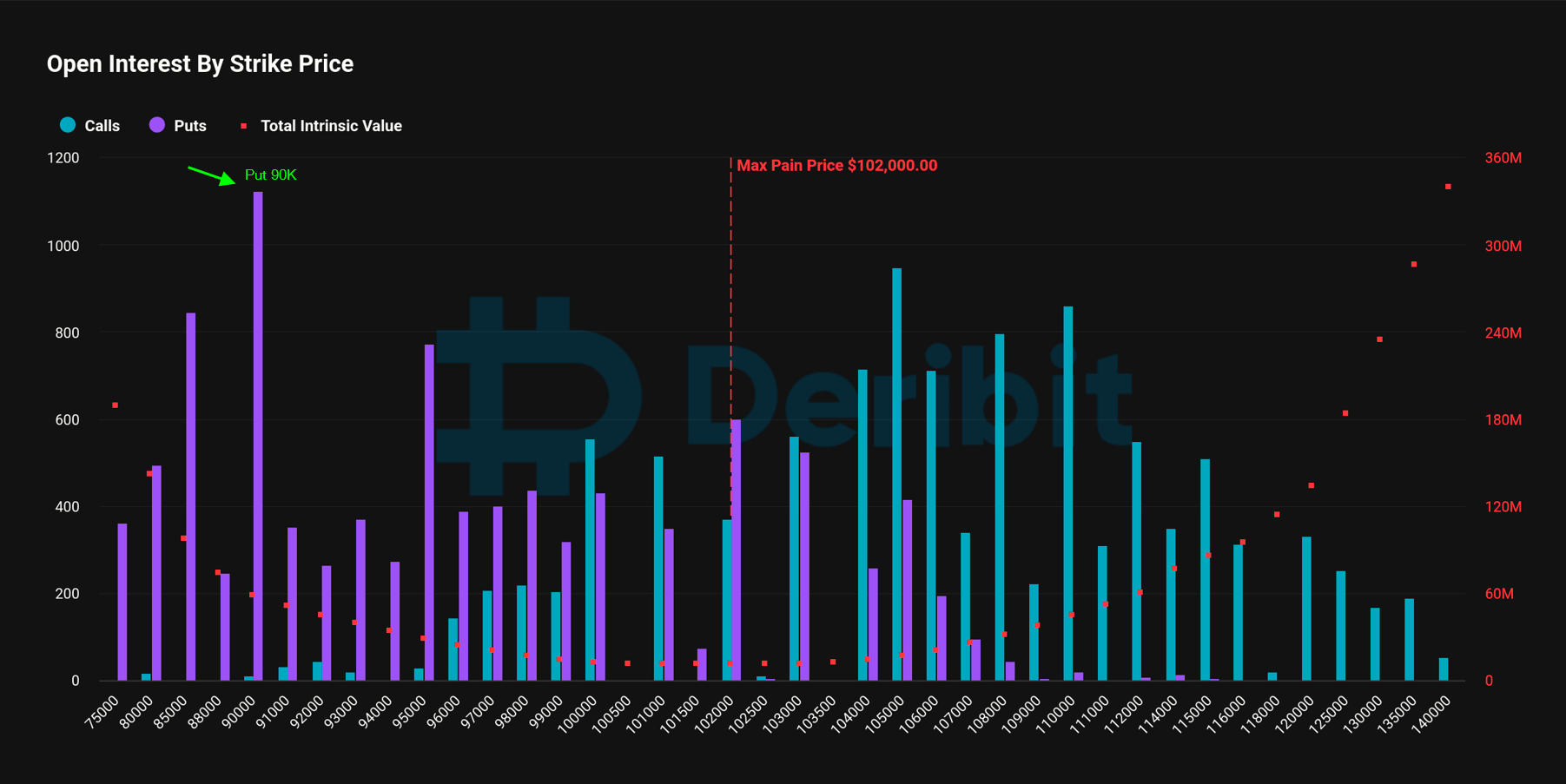

Open Interest by Strike Price

The distribution of OI for puts on December 20th reveals significant activity at the $90,000 strike, which holds the highest OI. Strikes beyond $90,000 also show notable interest, indicating traders’ concerns about a potential Bitcoin price correction.

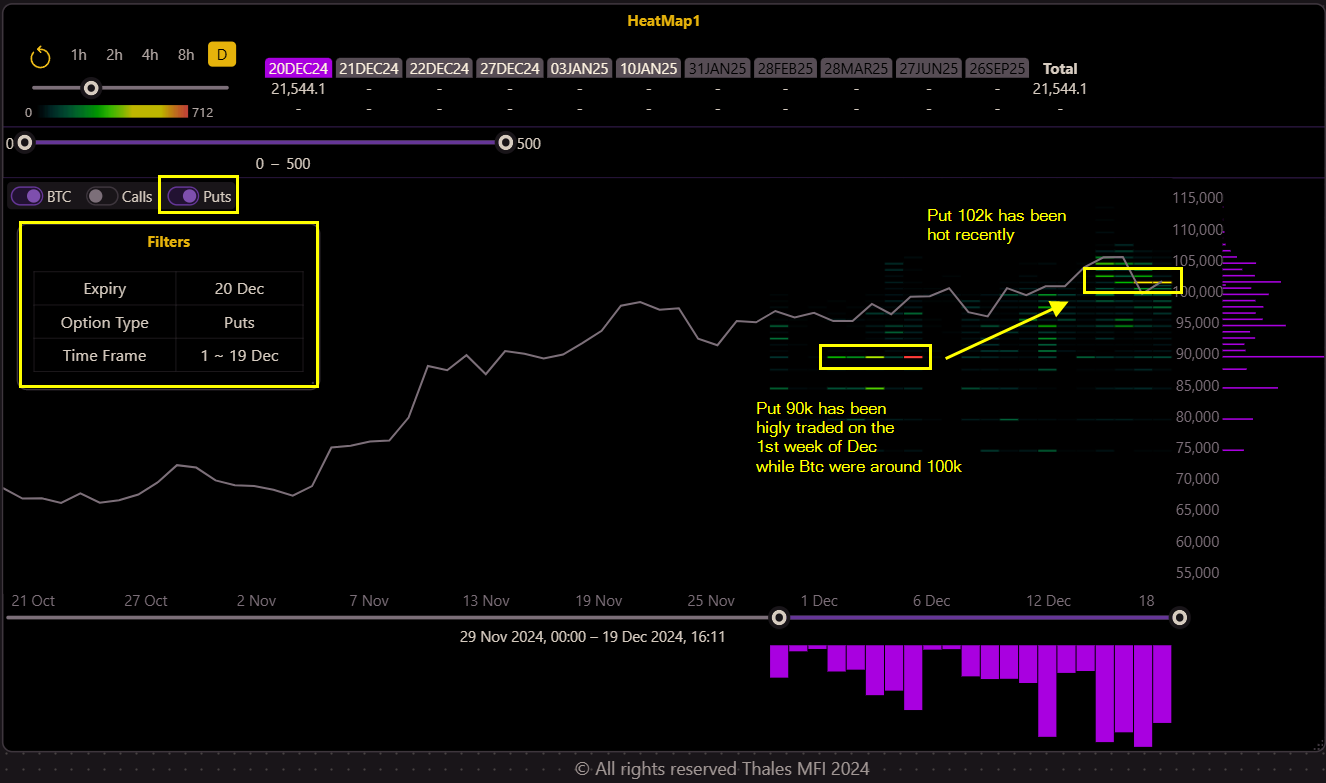

Heatmap Insights

Filtered heatmaps provide a closer look at trader sentiment:

- High activity for $90,000 puts: As Bitcoin’s price hovered around $100,000, traders actively sought protection.

- Shift to higher strikes: As Bitcoin’s price climbed, traders turned to $101,000, $102,000, and $103,000 puts.

- These patterns underscore the market’s growing unease about a potential reversal.

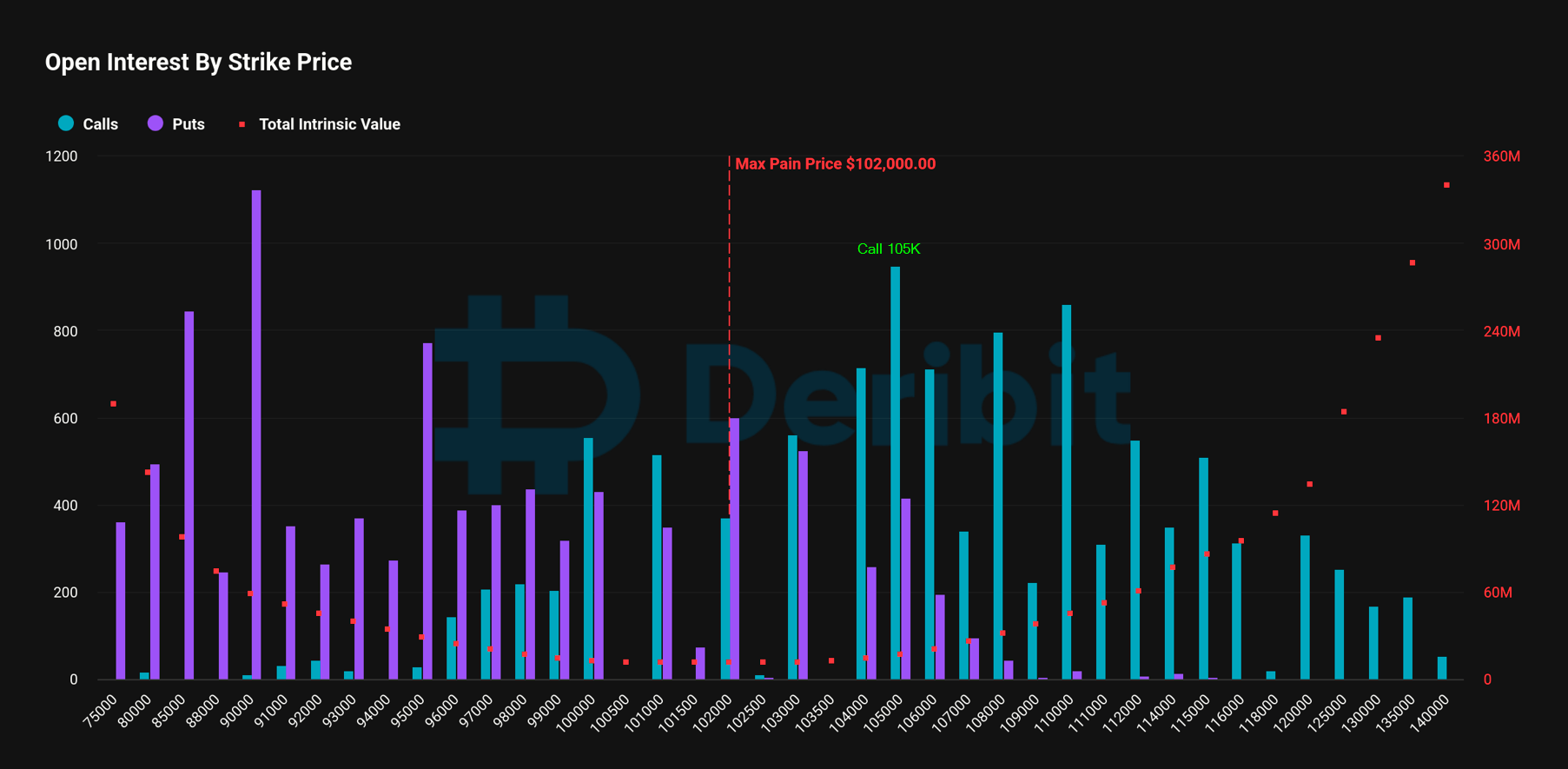

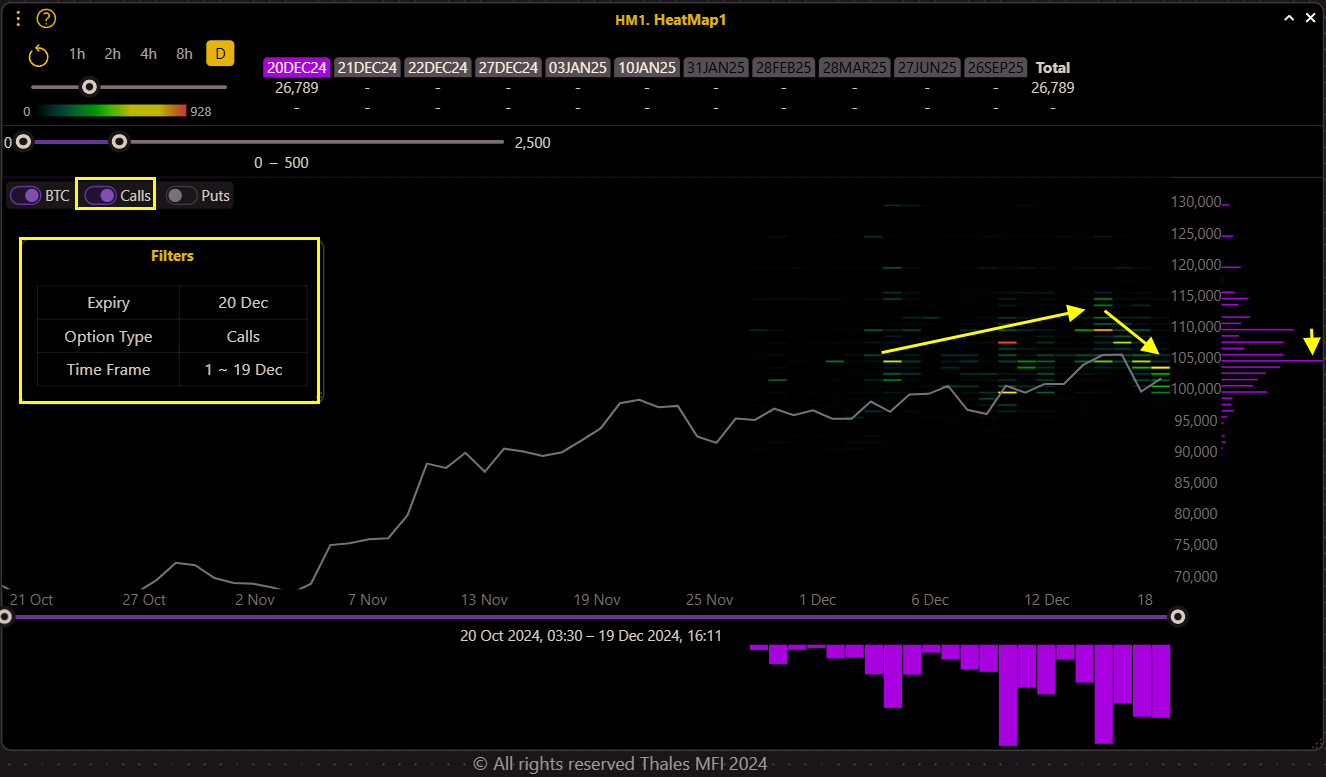

3. Analysis of Call Options for December 20th Expiry

Open Interest by Strike Price

The $105,000 strike leads in OI for calls, reflecting bullish sentiment as Bitcoin reached new all-time highs (ATHs). However, as prices corrected, traders shifted focus to lower strikes, adapting to changing market conditions.

Heatmap Insights

The heatmap for calls reveals:

- High activity at $105,000 strikes: During Bitcoin’s climb to new ATHs.

- Dynamic shifts: Higher strikes like $110,000 gained traction during the rally but waned after Bitcoin’s correction.

4. Expiry Outcomes and Settlement Insights

As the December 20th expiry settled at ~ $97,600, the outcomes were telling:

- Puts in-the-money (ITM): Contracts at $98,000 and higher strikes yielded profits for their holders through cash settlements.

- Max Pain Point: Taking another look at OI for the expiry, we can see the max pain is positioned at $102,000 (higher than the settlement price ~ $97,600), it highlights the fact that put holders for this expiry were the main winners.

This dynamic illustrates how traders who anticipated a price correction effectively used put options to protect their positions or profit from the downturn.

Bottom Line

The December 20th expiry showcases the nuanced ways in which traders utilize Bitcoin options to hedge risks and speculate on price movements. By leveraging tools like Heatmap and tracking OI trends, traders can gain invaluable insights into market sentiment and prepare for shifts in Bitcoin’s volatile landscape.

Smart traders who foresaw the potential for correction were either rewarded with profits or insulated from losses. Meanwhile, those engaging in speculative calls faced limited downside due to the nature of options—a testament to their versatility in managing risk.

Try Thales OSS for Simulating your own strategies and Market Analysis.

Disclaimer

This blog is intended for informational purposes only and does not constitute financial advice. Readers are encouraged to evaluate their own financial circumstances and consult professionals before engaging in options trading.