Introduction

In the ever-evolving world of options trading, understanding the mechanics and strategic applications of debit and credit spreads is crucial. This blog delves into these two fundamental concepts, helping traders navigate through various market conditions with greater confidence.

(Visit Thales Options Strategy Simulator)

Debit Spreads: Betting on Movement

Debit spreads involve purchasing options that cost more than the options sold, leading to a net payment. This strategy is particularly effective in low implied volatility environments, where significant price movements in the underlying asset are anticipated. It's simpler for beginners due to its straightforward risk and potential rewards, making it a staple in many trading arsenals.

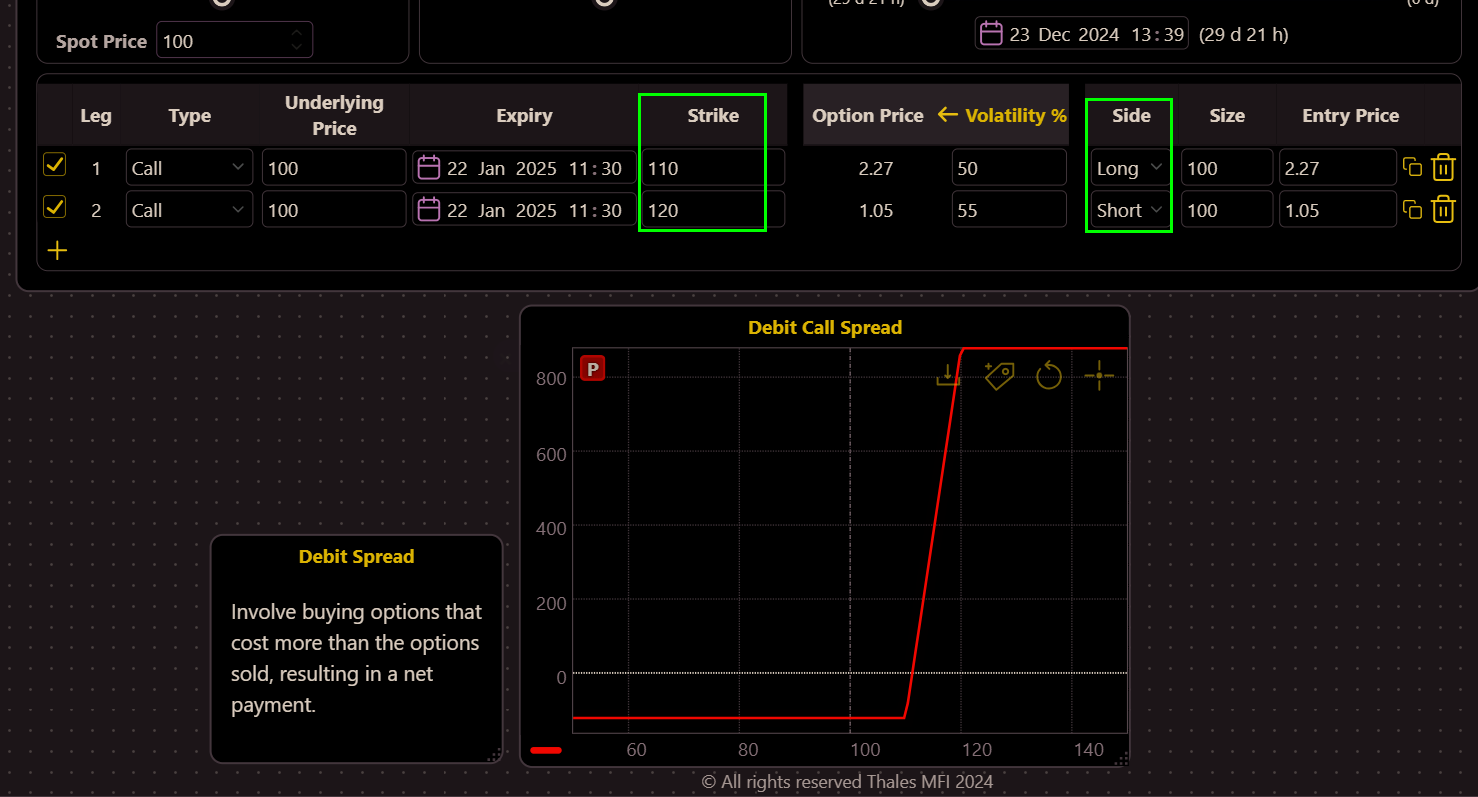

(OSS)

In our debit call spread example, we strategically choose two call options to optimize our potential returns while managing costs. We buy a call option with a strike price of 110, which is closer to the current underlying price of 100, giving it a higher delta and a higher cost due to its greater likelihood of ending in-the-money. Conversely, we sell a call option with a strike price of 120, which is more out-of-the-money and therefore cheaper, reflecting its lower probability of finishing in-the-money.

This configuration results in a net outflow of premium, classifying this setup as a 'debit' spread. The principle behind this strategy is similar to making an investment: you pay a premium upfront with the expectation that the underlying asset's price will rise significantly above your higher strike price, leading to potential profits. This method mirrors investing in an asset in anticipation of future gains, aligning well with the asset management principles in accounting.

Credit Spreads: Earning from Stability

Contrasting debit spreads, credit spreads consist of selling options that outweigh the cost of purchased ones, resulting in a net receipt. Although they offer a higher risk profile, the upfront income and potential for profit even in stable markets make them appealing to more experienced traders.

(OSS)

In the strategy of credit call spreads, we focus on generating immediate income through the strategic sale and purchase of call options. In the provided example, a call option is sold with a strike price of 110 and another call option is purchased with a higher strike price of 120. The option sold is closer to the current underlying price of 100, thus it commands a higher premium than the option bought, resulting in a net receipt of premium.

Comparative Analysis: Debit vs. Credit Spreads

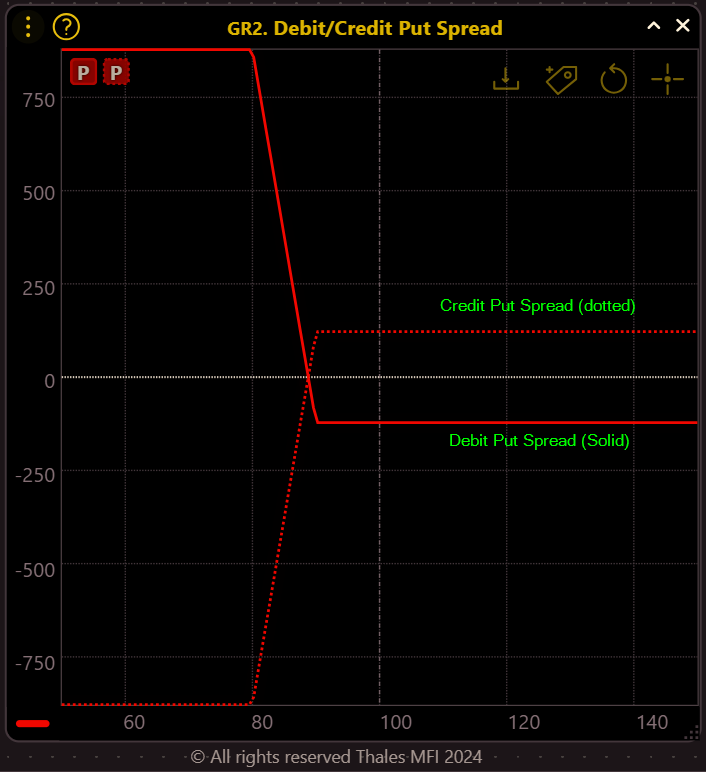

By comparing simulations of both debit and credit call spreads, we observe that gains in one correspond to losses in the other, highlighting their inverse relationship.

(OSS)

Similarly, when applied to put options, the patterns remain consistent, underscoring the versatility and strategic depth these spreads offer across various scenarios.

(OSS)

Strategic Flexibility: Bearish and Bullish Perspectives

Whether you're bullish or bearish, both debit and credit spreads offer strategic flexibility. For instance, a bearish outlook can be tackled using either a debit put spread or a credit call spread, demonstrating that your market view doesn't restrict the type of spread you can utilize.

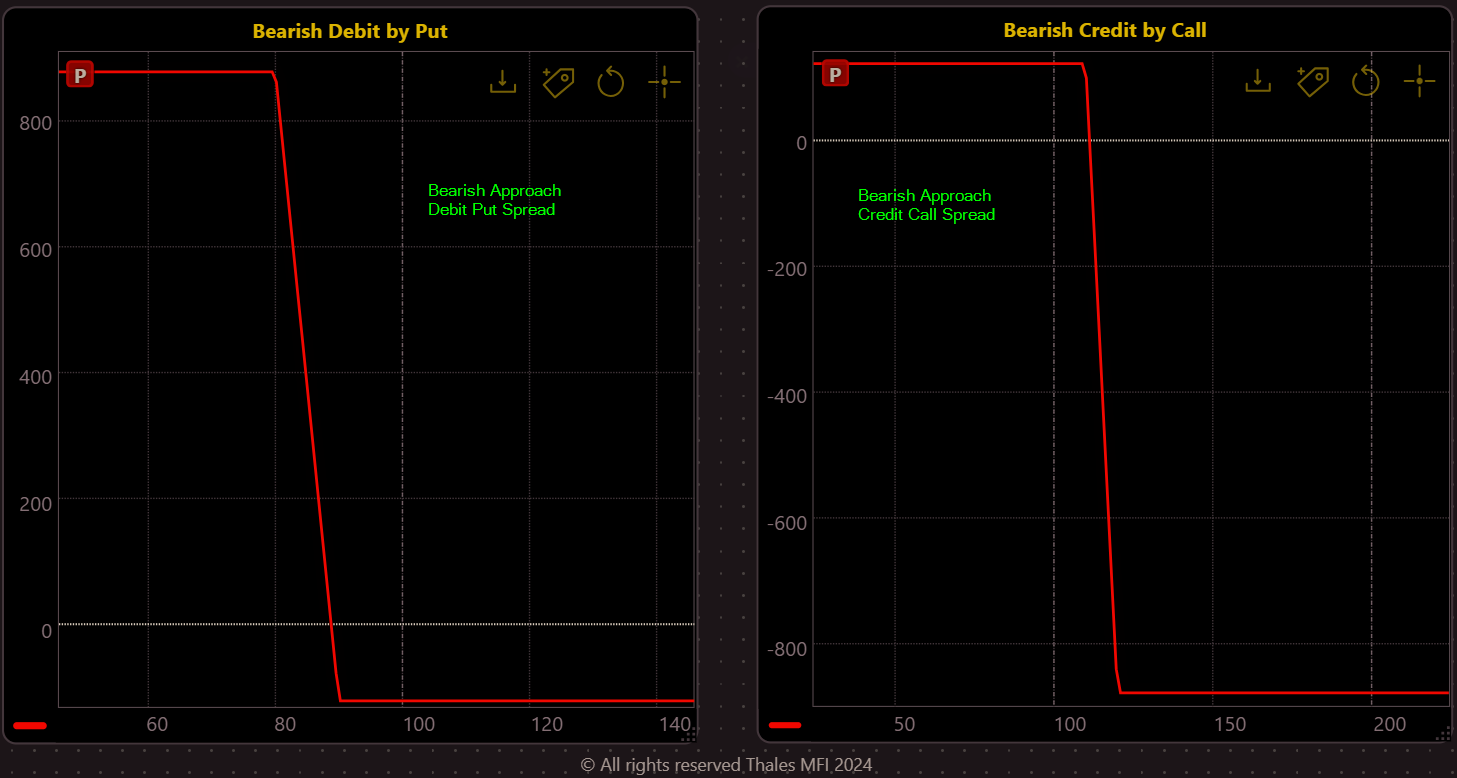

Bearish Outlook

(OSS)

For those anticipating a decline in the underlying asset's price, a debit put spread is a strategic choice. This involves buying a put option with a strike price close to the current market price (higher absolute delta) and selling a more out-of-the-money (OTM) put. This setup results in a net debit, meaning the trader pays more for the option they buy than they receive from the option they sell (Left Graph).

Alternatively, traders with a bearish outlook might opt for a credit strategy by employing a credit call spread (Right Graph). This involves selling a call option at a lower strike price and buying a higher strike option, creating a net credit. This strategy is advantageous as it allows traders to profit not only from a stable price but also from a moderate decline. The trader receives an upfront premium that represents the maximum profit potential if the asset price remains below the lower strike price sold.

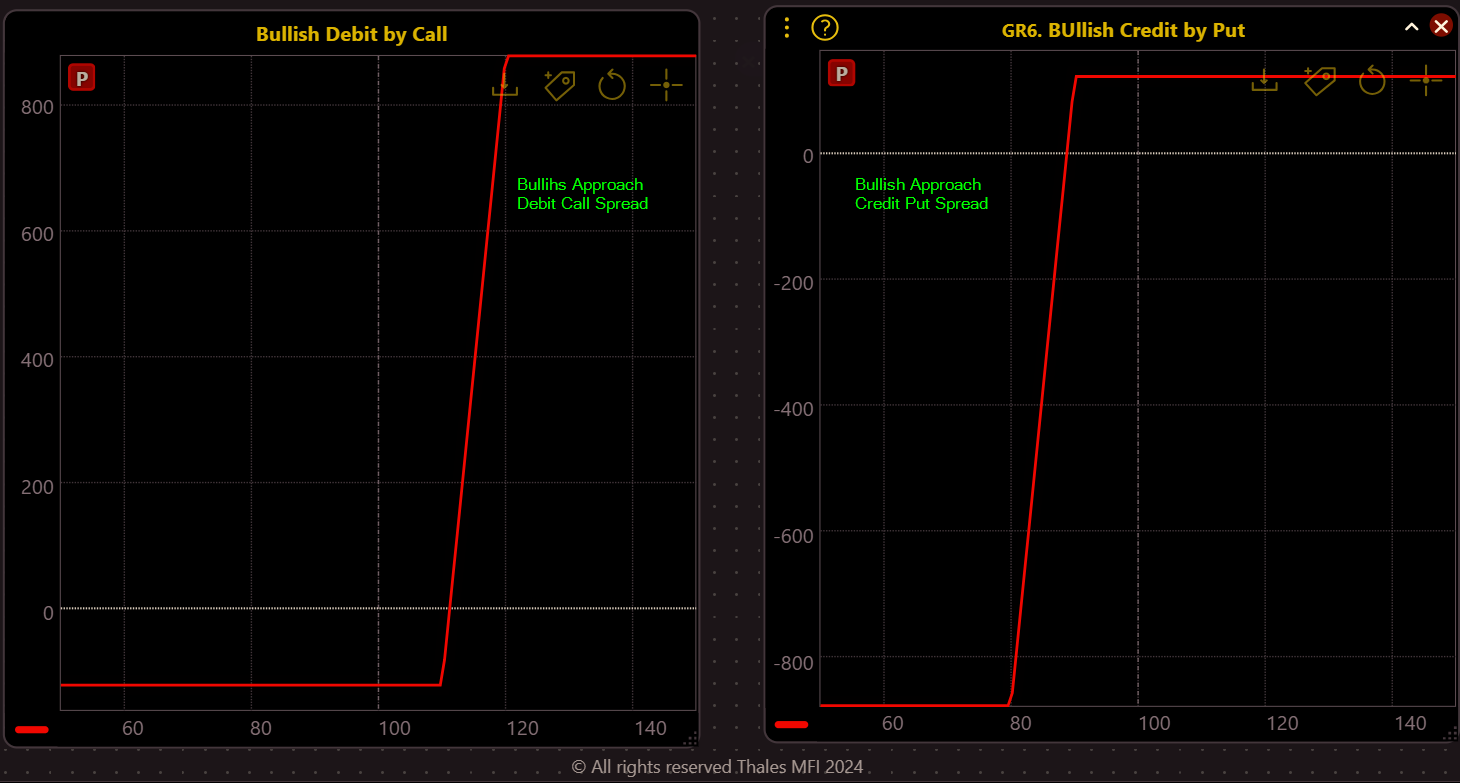

Bullish Outlook

(OSS)

In bullish market conditions, traders have potent strategies at their disposal, such as the debit call spread and the credit put spread. The debit call spread, illustrated in the left graph, involves buying a lower strike call option and selling a higher strike call option. This strategy benefits from an expected rise in the underlying asset's price, leveraging the upward movement to maximize profits while maintaining defined risk. Alternatively, the credit put spread, shown in the right graph, combines selling a higher strike put and buying a lower strike put, resulting in a net credit. This strategy is profitable if the underlying price remains above the higher strike price sold, thus suitable for scenarios where slight bullish movement or even stability is anticipated. Both strategies offer tailored approaches to capitalize on bullish expectations, allowing traders to manage risk effectively while seeking to maximize returns from favorable market movements.

Risk and Reward: A Balancing Act

The risk-reward dynamics of these strategies also differ significantly. Debit spreads often present a higher reward potential relative to risk, appealing to traders with strong directional biases (or those entering positions during periods of low implied volatility). On the other hand, credit spreads involve risking more for potentially lower returns, suitable for those seeking to accumulate premiums while managing risks cautiously.

(OSS)

Bottom Line

Understanding debit and credit spreads is akin to mastering the fundamental assets and income concepts in accounting. With debit spreads, traders invest with the hope of future profits, whereas credit spreads are akin to generating immediate income through strategic positioning.

Disclaimer

This blog is for educational purposes only. Options trading involves risks, and it's recommended to consult with a financial advisor to tailor strategies to your individual financial situation.