After the Storm: Insights from the 27 December Bitcoin Options Expiry

Introduction

The expiry of 27 December 2024 marked a pivotal moment in the Bitcoin options market, with its unprecedented size and impact capturing traders’ attention globally. In this blog, we examine the aftermath of this significant event, analyzing its implications for market sentiment, implied volatility, and trader positioning. By leveraging tools such as the Thales Heatmap and Market Screener, we explore the shifts in activity toward the upcoming key expiries of 31 January and 28 March 2025. From the optimistic bets on call options to the cautious hedging with puts, this post provides a detailed assessment of how traders are preparing for the new year and what these positions reveal about the broader market outlook.

Try Thales OSS for Simulating your own strategies and Market Analysis.

The Historic Expiry of 27 December

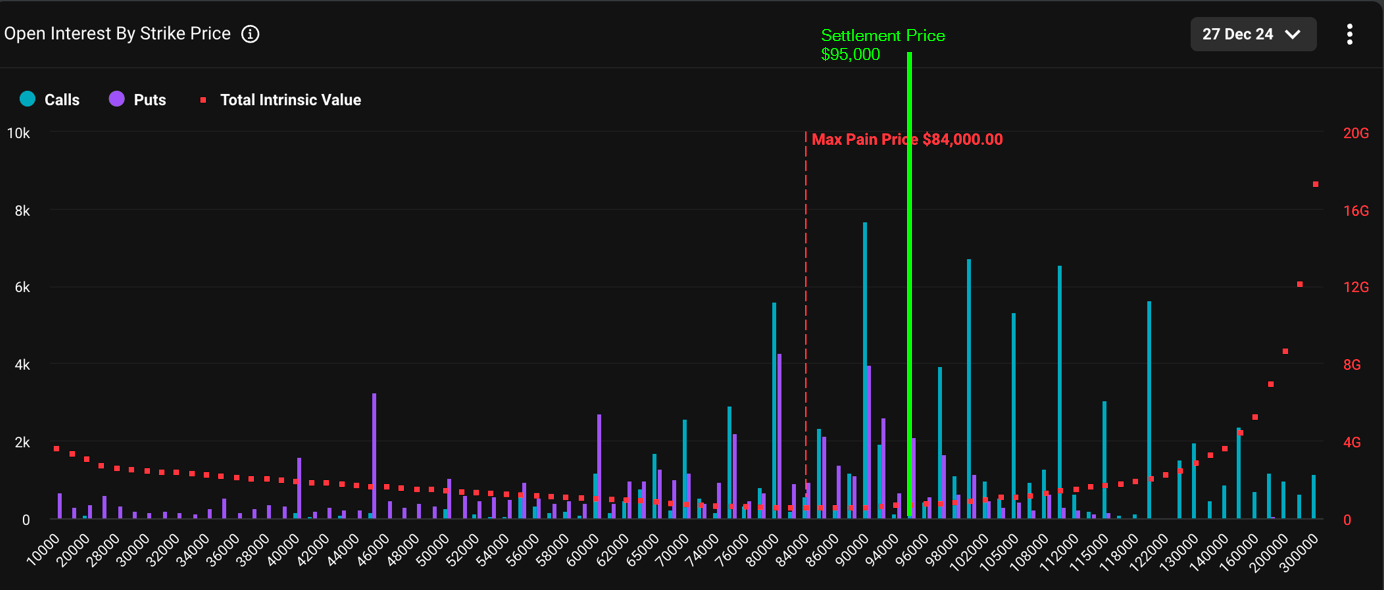

The gigantic options expiry of 27 December arrived with a massive open interest (OI), representing a notional value of approximately $14 billion. This marked one of the largest expiries in recent history.

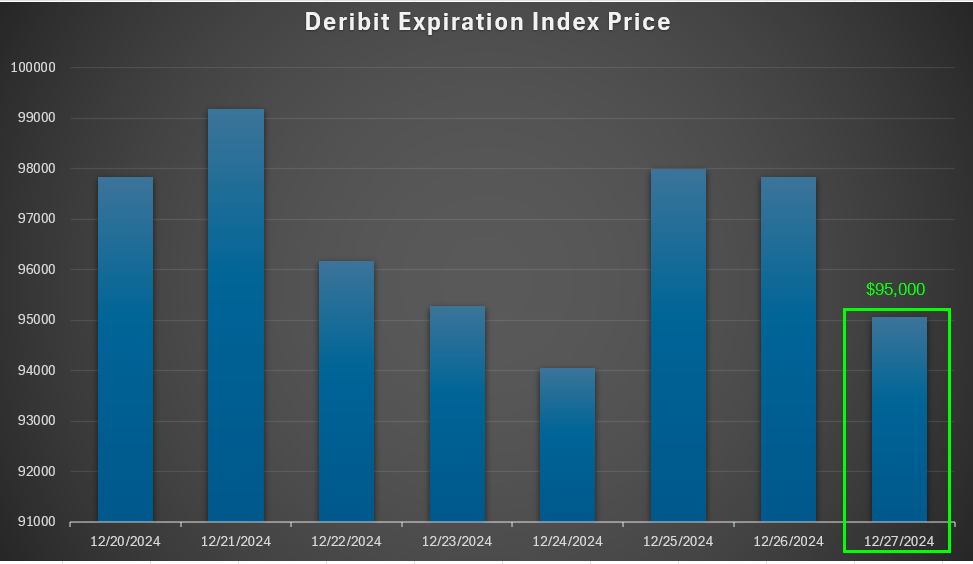

The settlement price on Deribit was $95,000, which positioned roughly one-third of the options in-the-money (ITM) at expiration.

A Disappointing Settlement Amid Optimism

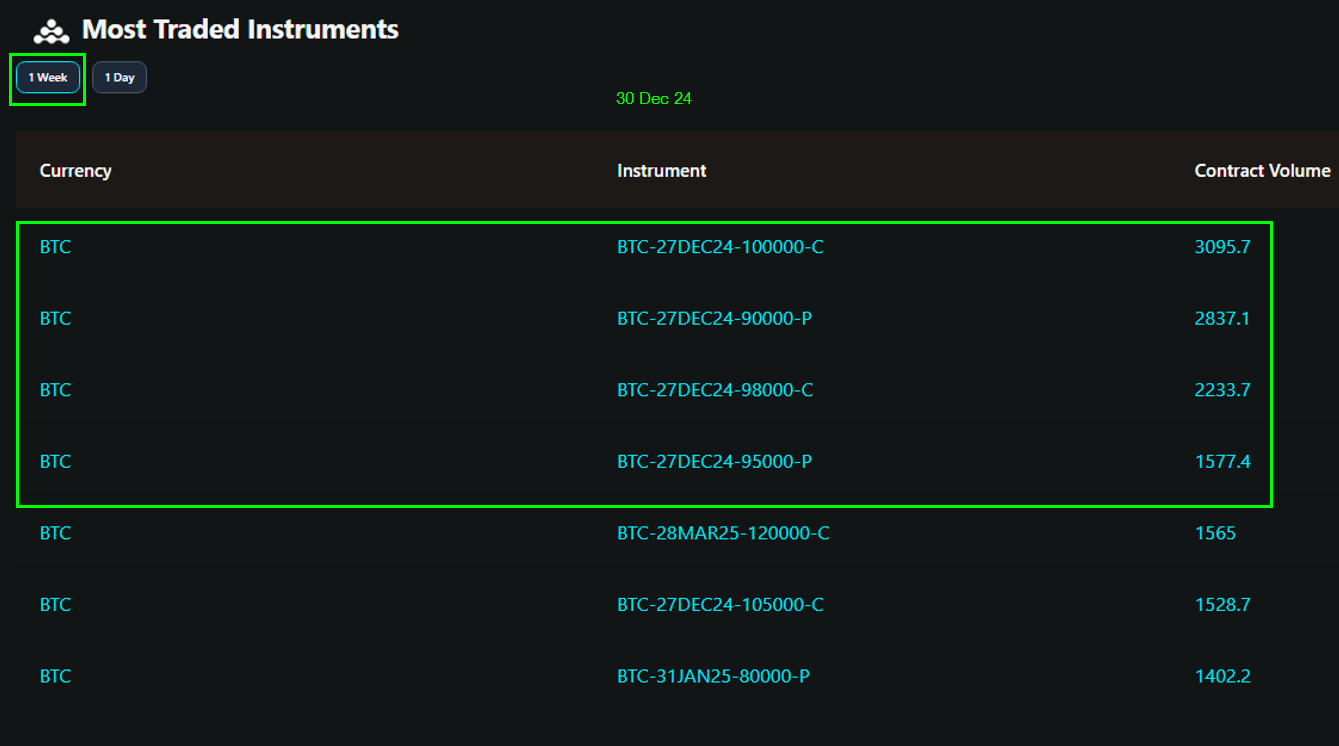

The settlement price of $95,000 was disappointing for a market that had seen Bitcoin reach an all-time high of $108,000 following the U.S. presidential election, which resulted in a crypto-friendly administration. The sentiment leading up to the expiry was highly optimistic, as reflected in the most traded options on Deribit during the last week. However, all these instruments ultimately expired out-of-the-money (OTM).

Call buyers targeting strikes of $100,000 and $98,000 were left disappointed as Bitcoin’s price fell below these levels at expiry. Similarly, traders who purchased puts with strikes of $90,000 and $95,000, anticipating further corrections, also saw their options expire OTM.

This outcome raises speculation that the sellers of these options may have worked to keep the price near the Max Pain level, minimizing their payout obligations and amplifying frustration for both bullish and bearish traders.

Post-Expiry Calm Reflected in Volatility

After the "wind" of such a significant expiry like 27 December has blown over, the market has entered a calmer and more stable phase. This is clearly reflected in the implied volatility (IV), as shown by the BTC Volatility Index (DVOL).

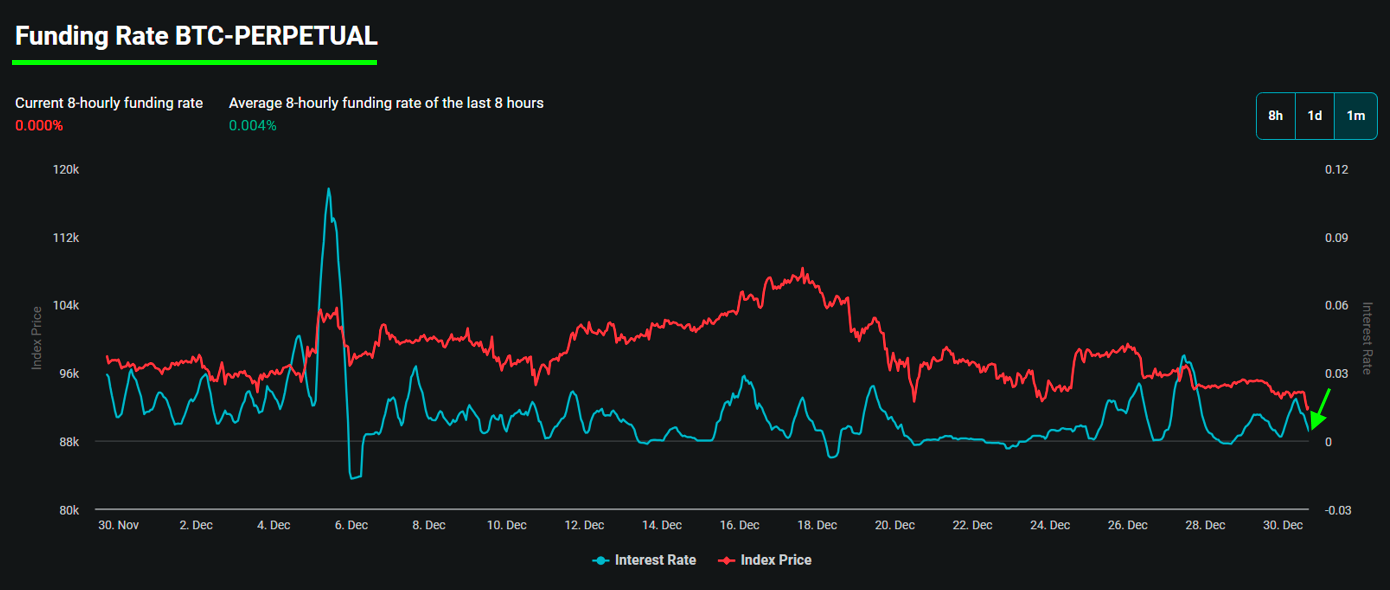

The Impact on Perpetual Traders

The recent corrections in Bitcoin’s price, combined with liquidations, seem to have cleared many perpetual traders from the market. Additionally, the timing suggests that some traders may have opted to step away during the holiday season for Christmas, leading to a noticeable drop in market activity. This is reflected in the funding rate, which has returned to neutral levels, further signaling reduced speculative pressure.

Focus Shifts to New Expiries

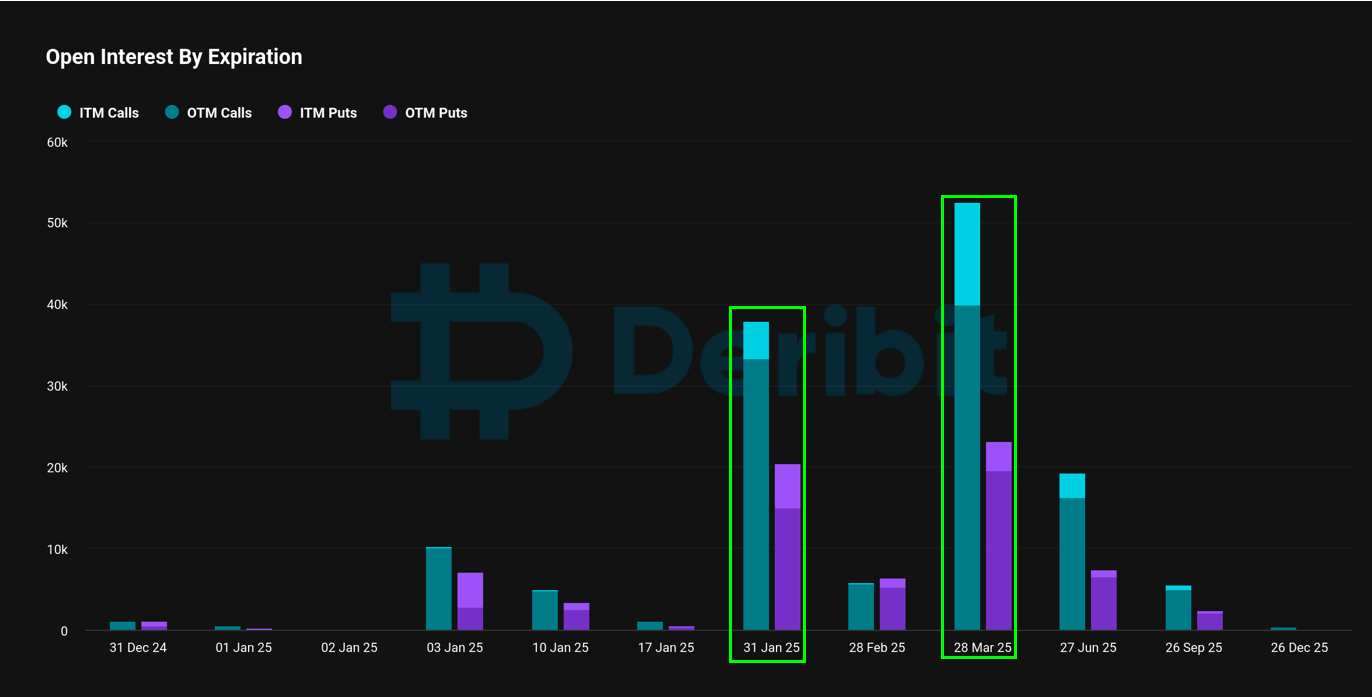

With the significant 27 December expiry behind us, the focus of options traders has shifted. According to the open interest (OI) data from Deribit, the next major expiries attracting attention are 31 January and 28 March 2025.

Call Option Trends: A Bullish Signal

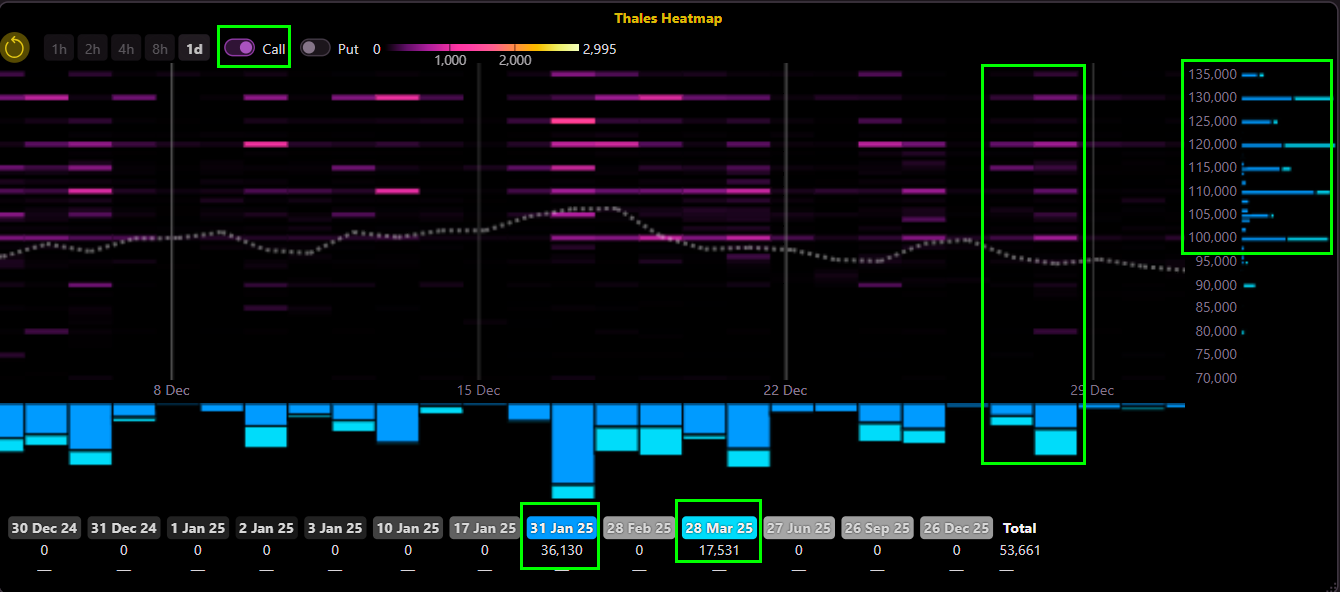

Referring to the Thales Heatmap (below), we can gain deeper insights into trading activity for the next major expiries—31 January and 28 March 2025—on 27 and 28 December.

The heatmap was filtered specifically for call options, focusing on these two expiries.

The analysis highlights significant trading activity for call options at key strikes, particularly around $100,000, $110,000, and $125,000.

Managing Downside Risks

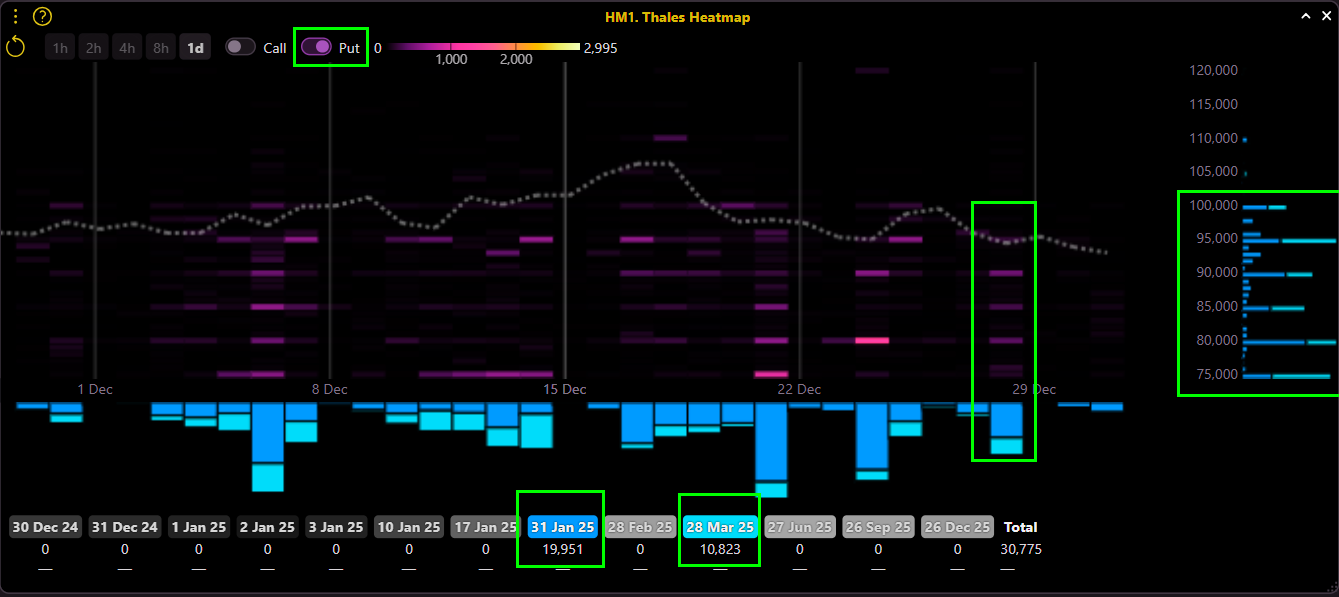

For put options on 27 and 28 December, the key strikes include $75,000, $80,000, and $95,000, reflecting traders’ hedging or speculative positioning against potential downside movements.

Details on Thales Market Screener

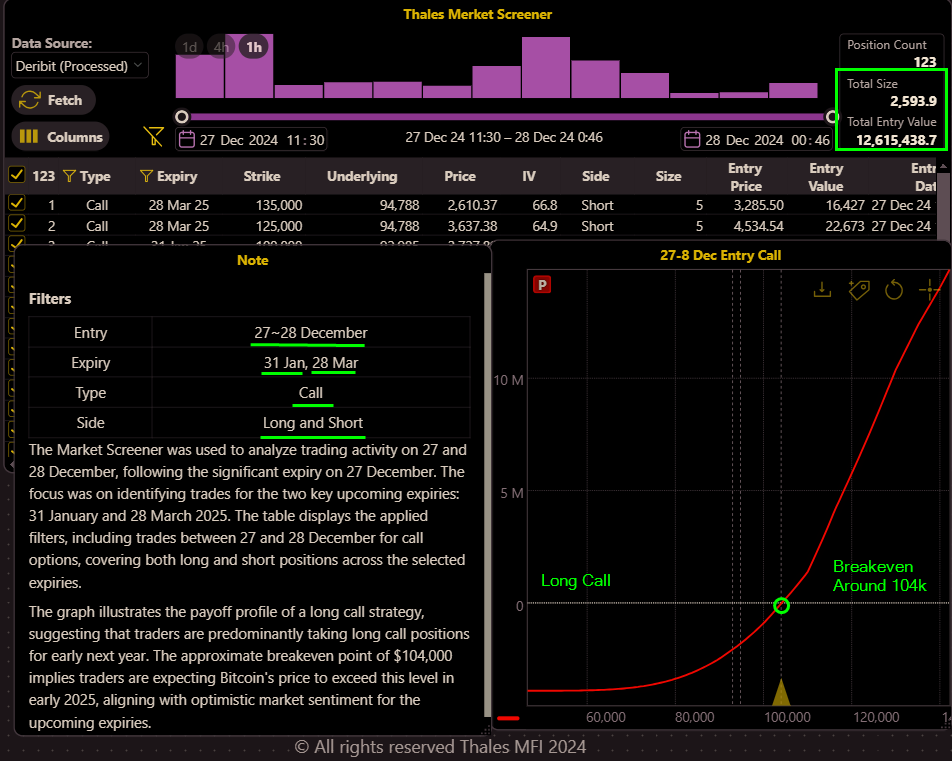

To further assess the market sentiment, we used the Market Screener to bring activity into focus with exact figures.

The screener was filtered for trades executed on 27 and 28 December (entry date) and focused on call options for the two upcoming expiries: 31 January and 28 March 2025.

The graph visualizing this data resembles the payoff profile of a long call strategy. The Market Screener collectively aggregates the filtered trades into a PnL graph, effectively representing the market sentiment as being predominantly long on calls for these expiries.

The breakeven point is approximately $104,000, suggesting that the market anticipates Bitcoin's price to exceed this level in the new year, reflecting an optimistic outlook for early 2025.

On the Put side

Similarly, when filtering the Market Screener for put options.

The data reveals a payoff profile resembling a short put strategy. This indicates that traders largely do not expect Bitcoin's price to fall below approximately $93,000. The relatively lower volume of puts compared to calls further supports the market's moderately bullish outlook, with limited concern for significant downside risks.

Bottom Line

As the monumental 27 December expiry fades into history, the market has entered a period of calm, with many traders stepping back for New Year activities and holidays. However, with the new U.S. president set to take office in January, this calm may only be the prelude to another wave of activity. As traders shift their focus to the key expiries of 31 January and 28 March 2025, the market remains poised for potential volatility in the weeks ahead.

Disclaimer

This blog is for informational purposes only and does not constitute financial or investment advice. Readers are encouraged to conduct their own research and consult with a professional advisor before making any trading decisions.