Introduction

While the past Friday expiry left Bitcoin options holders disappointed as most contracts expired worthless, traders have now shifted their focus to the upcoming Friday expiry, speculating on market fluctuations tied to President Trump’s inauguration. Amid uncertainty about the direction of the next move, many appear to favor Long Straddle strategies, betting on significant price swings in either direction. Meanwhile, concerns over recent corrections have drawn attention to put options as a protective measure. In this outlook, we explore these evolving market sentiments as they reflect in the Bitcoin options landscape.

Try Thales OSS for Simulating your own strategies and Market Analysis.

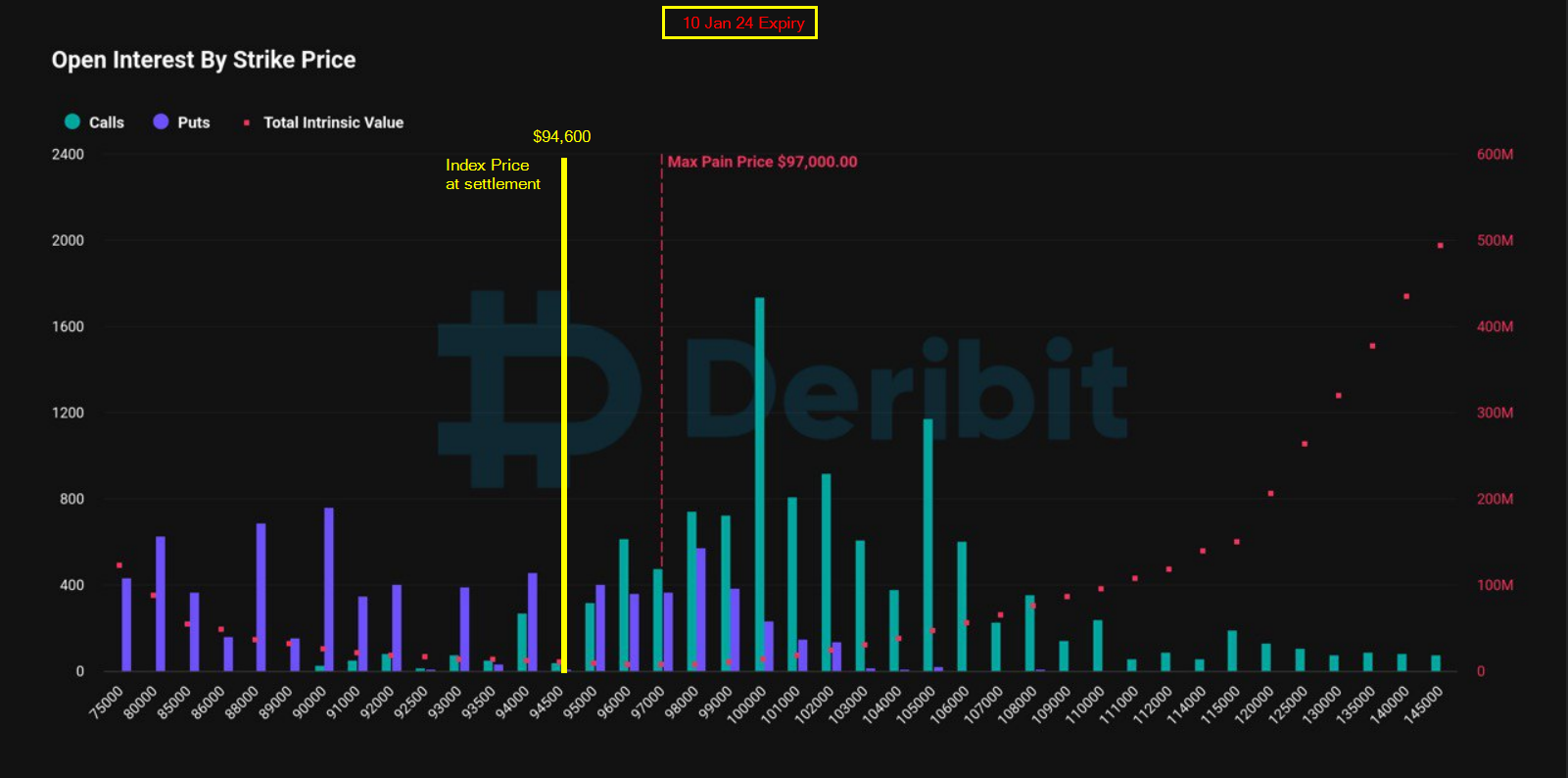

January 10 Expiry: A Victory for Option Sellers

The Bitcoin options market witnessed a notable expiration on January 10, 2025. The settlement price, around $94,600 (on Deribit), was close to the Max Pain price of $97,000, where the majority of options expired out-of-the-money (OTM). This alignment highlights how option sellers largely emerged victorious, as most options expired worthless.

On the call side, options with strikes at $95,000 and above, especially those with high open interest (such as $100,000 and $105,000), ended out-of-the-money (OTM), allowing sellers to retain their premiums while buyers walked away empty-handed.

Similarly, on the put side, which had recently gained attention due to price correction concerns, all strikes below $94,000 expired worthless, benefiting sellers.

However, for the narrow range of strikes that ended in-the-money (ITM), profitability remains uncertain for both calls and puts. Buyers of these ITM options are supposed to pay substantial premiums upfront, which may offset their realized gains.

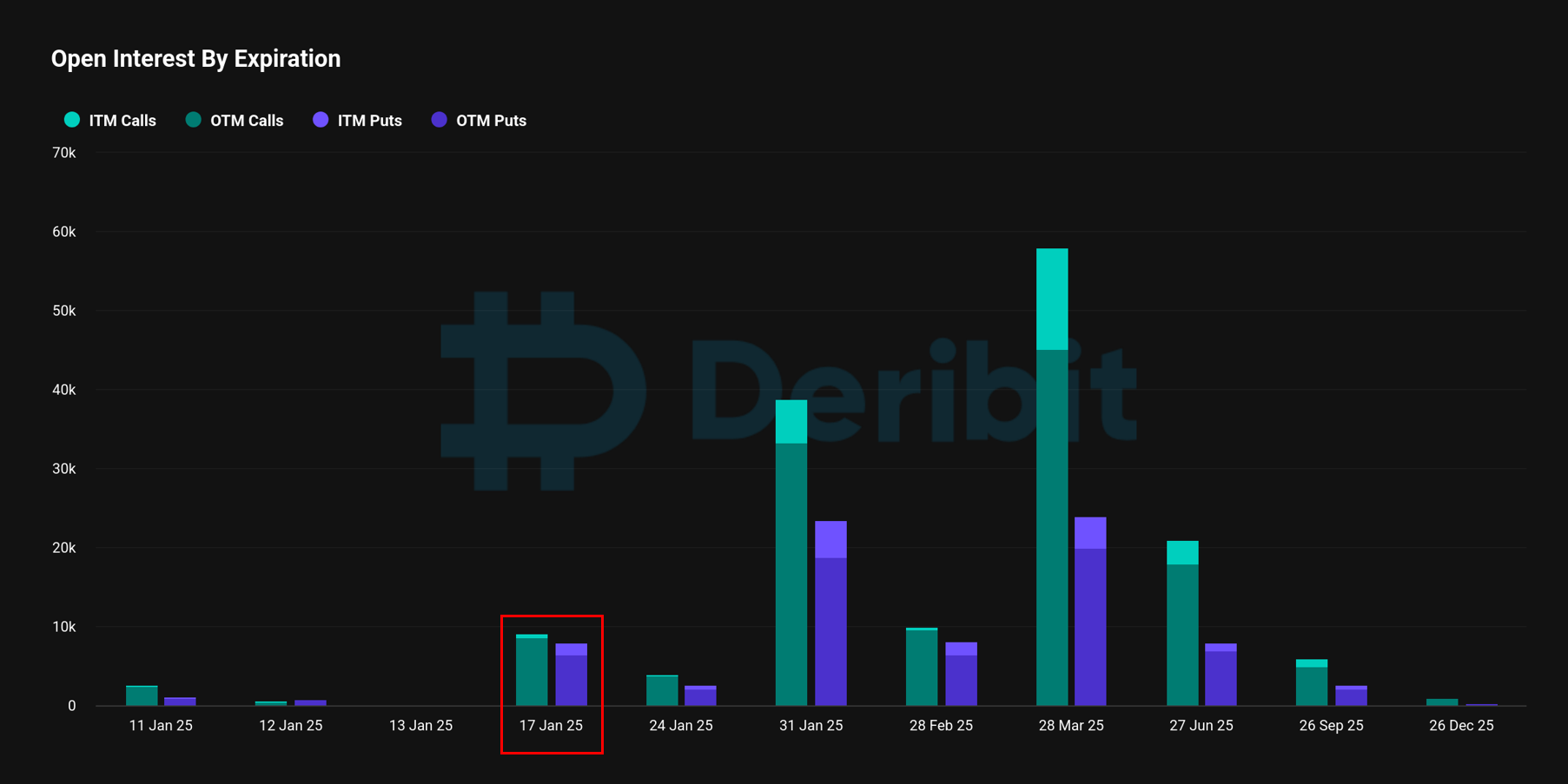

Looking ahead, the next significant expiration falls on Friday, January 17, 2025, and traders have already begun positioning themselves. Let’s dive into the data for this upcoming expiry to understand the evolving market dynamics.

January 17 Expiry: Market Gears Up for Political Uncertainty

The upcoming near-term expiry on Friday, January 17, carries significant importance as it precedes the planned inauguration of President Trump on January 20.

This expiry is expected to reflect market participants' sentiments and potentially experience heightened fluctuations as we approach the transition of power. As shown in the chart, nearly all call options for this expiry are currently out-of-the-money (OTM) (dark green), while only a small fraction of put options are in-the-money (ITM).

Notably, the put-to-call ratio is relatively high, suggesting a lack of consensus on a clear market direction, possibly reflecting the market's cautious stance amid political uncertainties. This expiry needs to be examined more precisely by Market screener.

Heatmap

(OSS)

The Thales Heatmap highlights notable trading activity for the 17 January expiry, with increased volumes observed particularly on the 6th and 10th of January. To delve deeper into these trends and gain specific insights, we turn to the Market Screener for a more detailed analysis.

Under Market Screener Lenz: Straddle

The Thales Market Screener is used to analyze traders' activity in the Bitcoin options market.

(OSS)

The data is filtered to focus on the 17 January expiry and strike prices between 85,000 and 120,000, with no filters applied to type or position (including both calls and puts, as well as long and short positions). The aggregated data is visualized across three graphs:

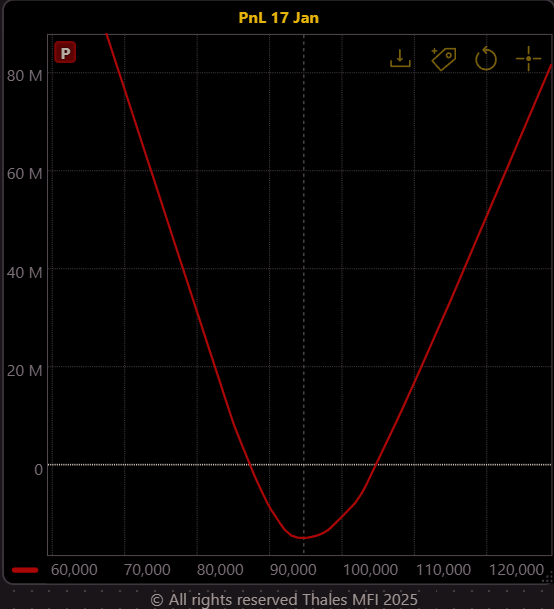

PnL Graph: Traders Bet on Volatility

This graph consolidates all trades as a single hypothetical position, resembling a Long Straddle strategy.

A Long Straddle combines a long at-the-money (ATM) call and a long ATM put, employed when traders expect significant price movement in either direction but are unsure of the direction. This strategy guarantees profit from one leg if the market moves sharply in one direction, covering the cost of both premiums. The graph implies that traders anticipate high volatility, possibly related to the upcoming presidential inauguration.

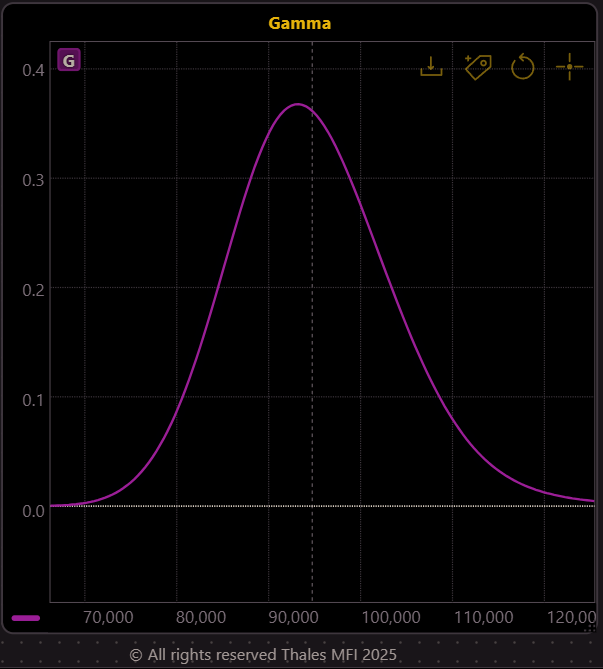

Gamma

The Gamma is positive, indicating that the market, on aggregate, is long. This aligns with the straddle strategy, which inherently involves two long positions (call and put).

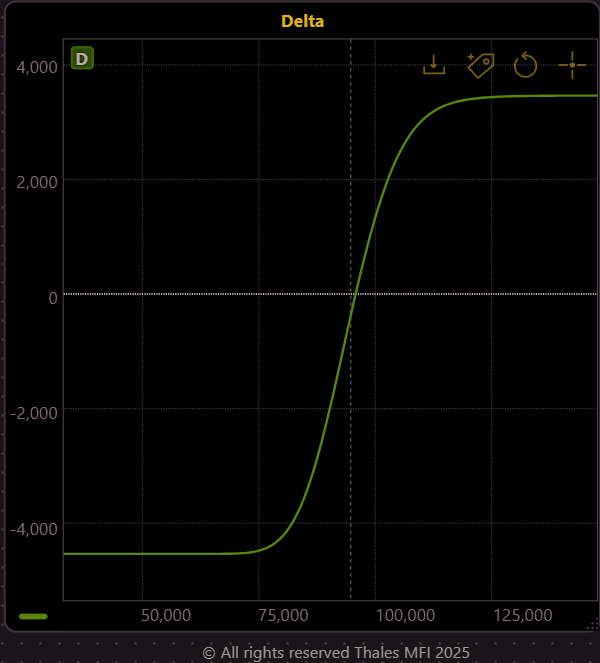

Delta

The Delta displays a balance of positive (long calls) and negative (long puts) values, with a slightly larger magnitude on the negative side, representing more long puts. This imbalance might suggest a bearish bias among traders, as the long puts outweigh the long calls in aggregate.

The combined analysis suggests that traders expect significant price volatility, potentially driven by upcoming market events, but there is a slight inclination toward bearish sentiment based on the Delta data.

Trader's Sentiment

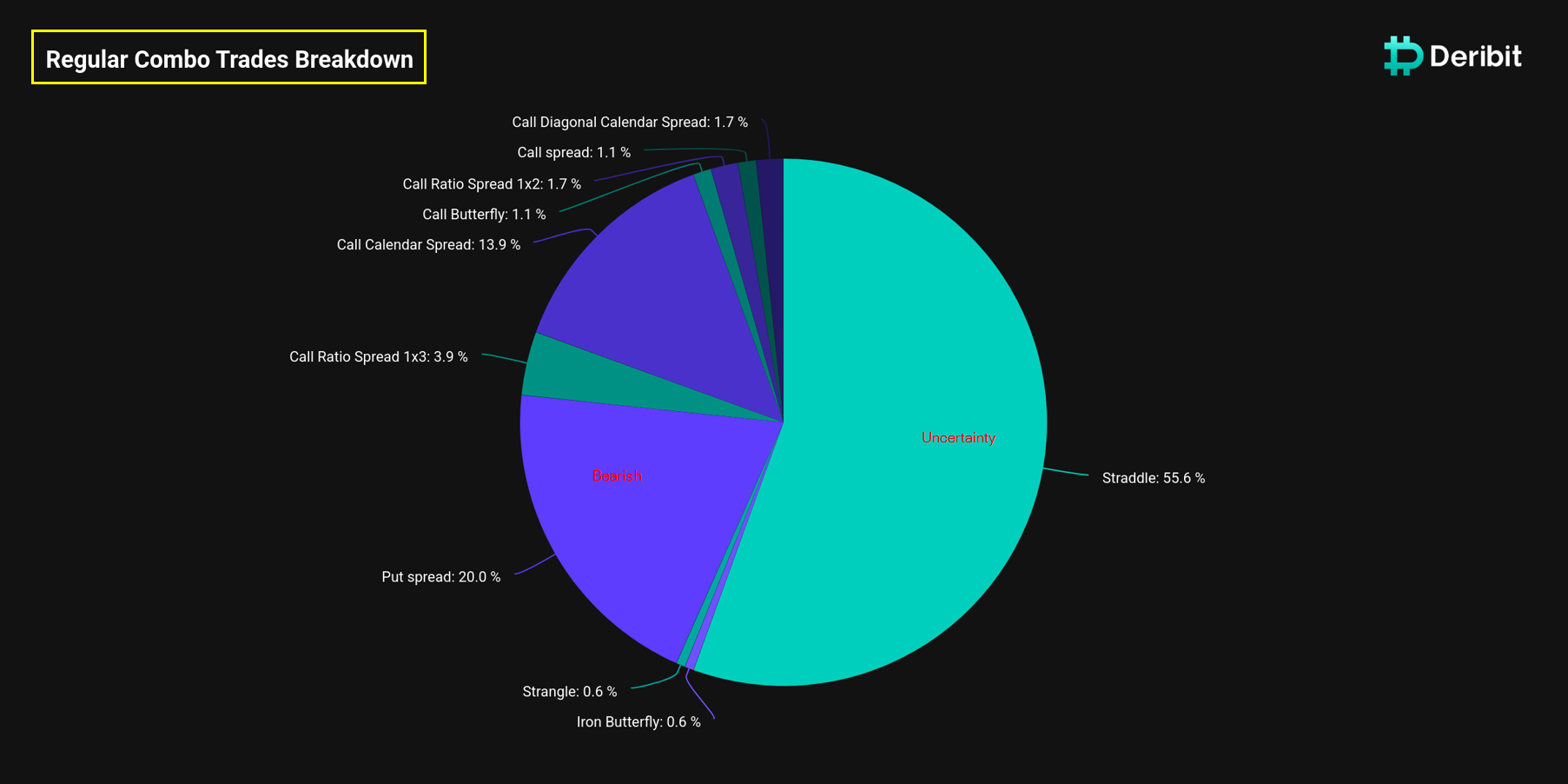

The Regular Combo Trades Breakdown data from Deribit confirms that straddle strategies hold a significant share among the most employed approaches in Bitcoin options trading, underlining traders' anticipation of substantial price movements in either direction.

It also highlights put spreads as one of the most traded strategies, which may reflect a bearish outlook among traders or a conservative approach for those insuring their long positions against potential price declines amid uncertainty surrounding Trump’s inauguration.

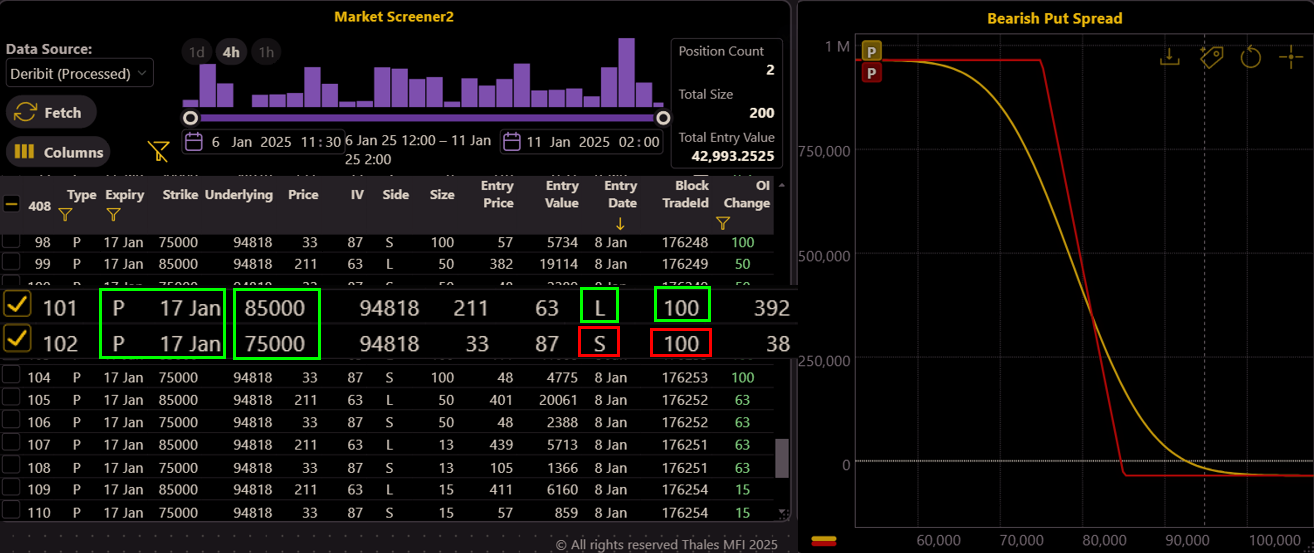

Put Spread Block Trade

The put spread also can be traced on the Market Screener by selecting specific significant block trades.

(OSS)

In this case, the graph highlights a bearish put spread executed as a block trade with a size of 100 Bitcoin. This strategy involves buying a put option with a strike price of $85,000 for the 17 January expiry while simultaneously selling a put option at a lower strike price of $75,000. The sale offsets part of the cost of the purchased put, making the strategy more cost-effective. Reflecting a bearish outlook, this trade profits if Bitcoin's price declines within this range.

Bottom Line

Bitcoin options market, currently, reflects a mix of cautious and speculative sentiment as traders position themselves for the next expiry on January 17. While the January 10 expiry favored option sellers, the focus has now shifted toward strategies like Long Straddles and Put Spreads, highlighting traders' anticipation of significant price volatility amid the political uncertainty surrounding President Trump’s inauguration. These strategies indicate a market bracing for sharp movements, with some participants leaning toward a bearish outlook. As the week progresses, all eyes will be on how these positions unfold in response to market developments.

Try Thales OSS for Simulating your own strategies and Market Analysis.

Disclaimer

This report is for informational purposes only and does not constitute financial or investment advice. Options trading involves significant risks, and readers should conduct their own research or consult with a professional before making any decisions. The analysis provided reflects market data and sentiment as of the time of writing and may not predict future outcomes.