Introduction

In shallow options markets, such as those often found in DeFi protocols, traders frequently face a unique challenge: selling deep in-the-money (ITM) options. Unlike deep markets where these contracts can often be sold for more than their intrinsic value, shallow markets may leave traders unable to sell even at fair value. This issue is particularly pronounced for European-style options, which cannot be exercised before expiration. In this blog, we explore this common dilemma and present an innovative strategy to secure profits without relying on market liquidity. Using OSS, we’ll illustrate how traders can navigate these constraints and lock in their gains, regardless of market depth.

Real-World Scenario

To illustrate the challenges traders face in shallow markets, we turn to the Bitcoin options market and examine a specific case involving a deep in-the-money (ITM) call option. This scenario sheds light on the unique difficulties of managing ITM positions in markets with limited liquidity.

Setup

(OSS)

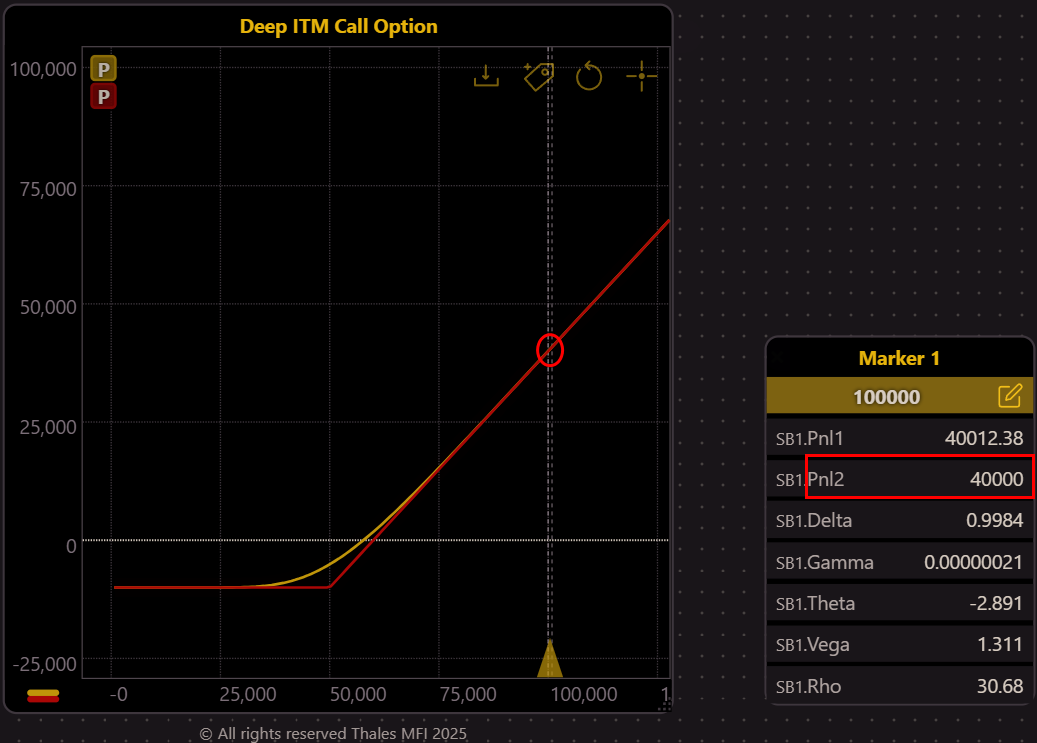

In this setup, we analyze a deep ITM call option with a strike price of $50,000, while the current spot price of Bitcoin stands at $100,000. The position is clearly profitable, as reflected in the graph, which shows the upward sloping PnL curve typical of a long call option. This deep ITM position highlights the potential value of the option at expiration. However, the situation becomes more complex when considering market conditions.

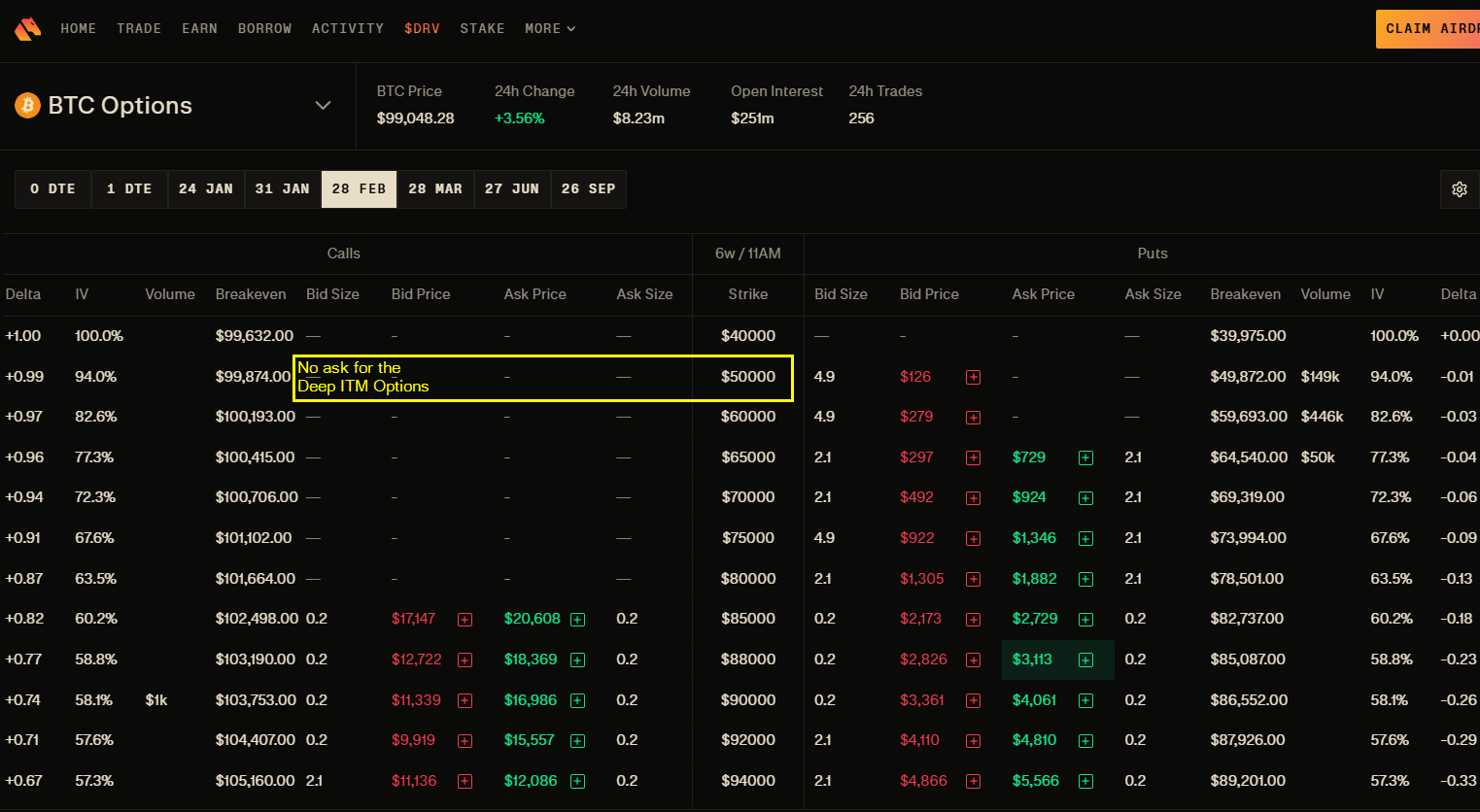

Shallow Market

In shallow markets, traders often encounter a lack of liquidity, particularly for deep ITM options. As shown in the screenshot, there is no buyer for the call option with a strike price of $50,000, while Bitcoin's spot price has reached $100,000. This lack of market depth prevents the trader from selling the option to realize their profit.

For European-style options like Bitcoin options, the challenge is even greater, as they cannot be exercised prior to expiration. If the option were American-style, the trader could simply exercise it and capture its intrinsic value. This limitation puts the trader in a vulnerable position, especially if they fear a potential price reversal that could erode the current profit. In deep markets, the trader could expect to sell the option at a price exceeding its intrinsic value, as it would include some extrinsic value. However, in shallow markets, the trader might not even be able to sell the option at its intrinsic value, leaving their profit exposed to market fluctuations.

Locking the Intrinsic Value

(OSS)

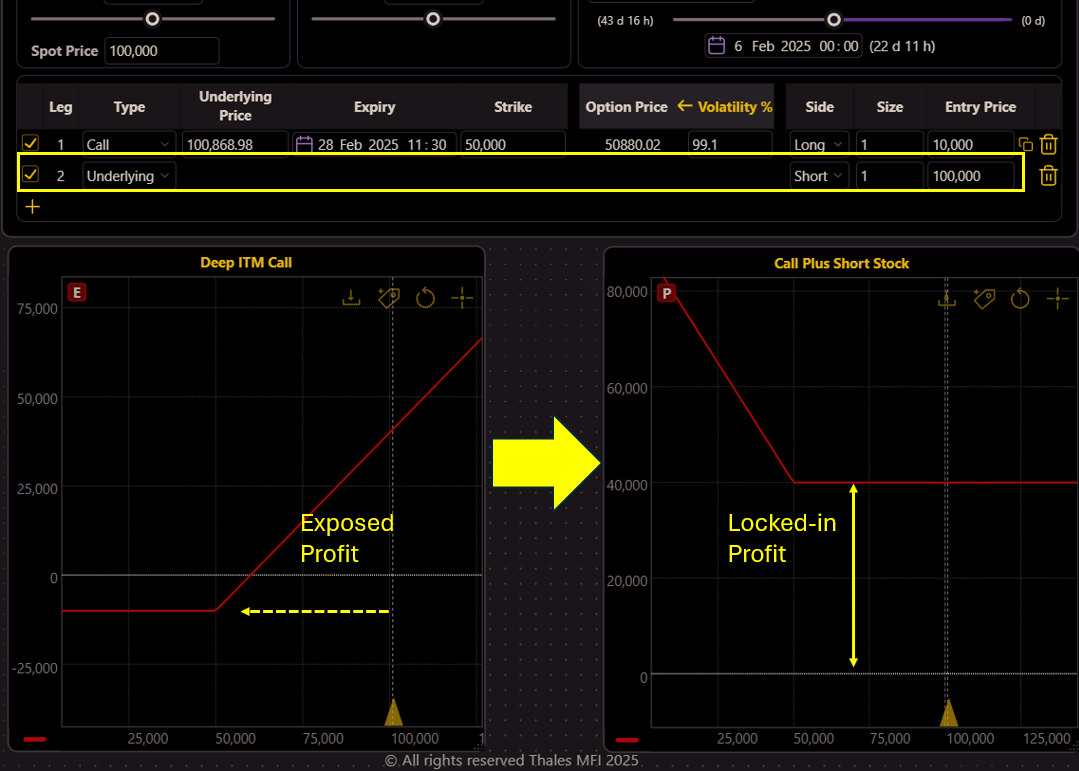

The Strategy Builder provides a practical solution to protect the profit of a deep ITM call option in shallow markets. By adding a short position in the underlying asset (Bitcoin) with the same size as the call option, the trader can safeguard the position against downward price movements. This short leg offsets potential losses from a price decline while the call option hedges the short position. At expiry, the call option's delta will match the underlying's delta, ensuring full coverage.

The simulation showcases two graphs:

- Left Graph: The PnL profile of the call option alone, demonstrating exposed profit to price movements.

- Right Graph: The updated PnL profile after adding the short position in the underlying asset. This new profile locks the intrinsic value at $40,000, creating a structure resembling a put option.

The right graph illustrates the power of this adjustment—no matter how far the price drops, the position cannot yield less than $40,000 at expiry. The term "lock" is visually and practically realized in this strategy, providing traders with peace of mind in shallow markets.

While the updated approach locks in $40,000, it caps any further gains if Bitcoin's rally continues. Traders must weigh their priorities: secure the current profit or leave room for potential upside. Ultimately, strategy choice reflects the trader's mindset and risk tolerance.

Juxtaposition: Exposed vs. Locked Profit

(OSS)

The graph above contrasts two positions: the dotted line represents the profit-and-loss (PnL) curve of the bare deep ITM call option, which is exposed to price fluctuations in both directions. The solid line, on the other hand, depicts the hedged position after adding a short spot leg, effectively locking in the profit.

To better illustrate, let's evaluate these positions under two scenarios:

- Bullish Scenario (Bitcoin to $120,000):

The bare call outperforms significantly, yielding a profit of $60,000 as the price increase drives up its intrinsic value. In contrast, the hedged position caps its profit at $40,000 due to the short spot leg offsetting further gains. - Bearish Scenario (Bitcoin to $65,000):

While the bare call suffers a dramatic reduction in profit, holding only $5,000, the hedged position maintains its locked profit of $40,000.

If Bitcoin's price falls even further (below $40,000), the synthetically created put option (via the short spot leg and the call) would begin to generate additional profit, behaving like a put option with a strike price of $40,000. Meanwhile, the bare call would incur its maximum loss, limited to its initial premium.

Bottom Line

In shallow markets, where liquidity constraints make it difficult to sell deep ITM options, traders must think creatively to manage risk and lock in profits. By hedging a deep ITM call with a short position in the underlying asset, traders can effectively secure their current gains and protect themselves from potential price declines. However, this strategy comes with trade-offs, such as capping potential upside in bullish scenarios. Ultimately, the decision to implement such strategies depends on a trader’s outlook, risk tolerance, and ability to balance potential rewards with stability.

Disclaimer

This blog is for informational purposes only and does not constitute financial or investment advice. Options trading involves significant risk and may not be suitable for all investors. Readers are advised to conduct their own research or consult a professional advisor before making any trading decisions.