Introduction

Covered call strategies are among the most popular and versatile tools in an options trader’s arsenal. They offer a unique blend of income generation and risk mitigation for traders holding assets. In this blog, we’ll explore the intricacies of the covered call strategy, particularly focusing on how to manage the position when the call option moves in-the-money (ITM). Using a real-world example from the Bitcoin options market, we’ll break down the strategy, discuss its dynamics, and provide actionable insights.

What is a Covered Call Strategy?

(OSS)

A covered call strategy combines:

- A long position in an asset (such as a stock or Bitcoin).

- A short call option written against the same asset, typically with a strike price slightly out-of-the-money (OTM).

This strategy is favored by traders aiming to generate additional income through the premium collected from selling the call option or to partially hedge against the downside risk of holding the underlying asset. The premium acts as a cushion, reducing the effective cost basis of the asset and providing a marginal profit even if the underlying price stagnates or falls slightly.

The Challenge: Managing an ITM Covered Call

While covered call strategies are straightforward in their design, the question arises: What should traders do if the call option moves ITM? If the option expires OTM, it’s a non-issue—the trader can simply repeat the process. However, when the call goes ITM, things get more interesting.

- Be Prepared to Sell the Underlying Asset: Writing a call option creates an obligation to sell the underlying if exercised. If you’re unwilling to part with the asset, this strategy may not be suitable for you. However, reaching max profit with an ITM call is a favorable outcome, so no worries if it goes ITM.

- Understand the Style of the Option: Before discussing how to manage a covered call strategy, it’s essential to understand the style of the option being used. In the options market, contracts can either be American-style, which allows the holder to exercise the option before expiry (even in some cases when it is out-of-the-money), or European-style, which can only be exercised at expiry. In this blog, we discuss the European-style options. It’s important to note that the risk management of these options differs slightly due to this limitation on early exercise.

Example: Managing a Bitcoin Covered Call

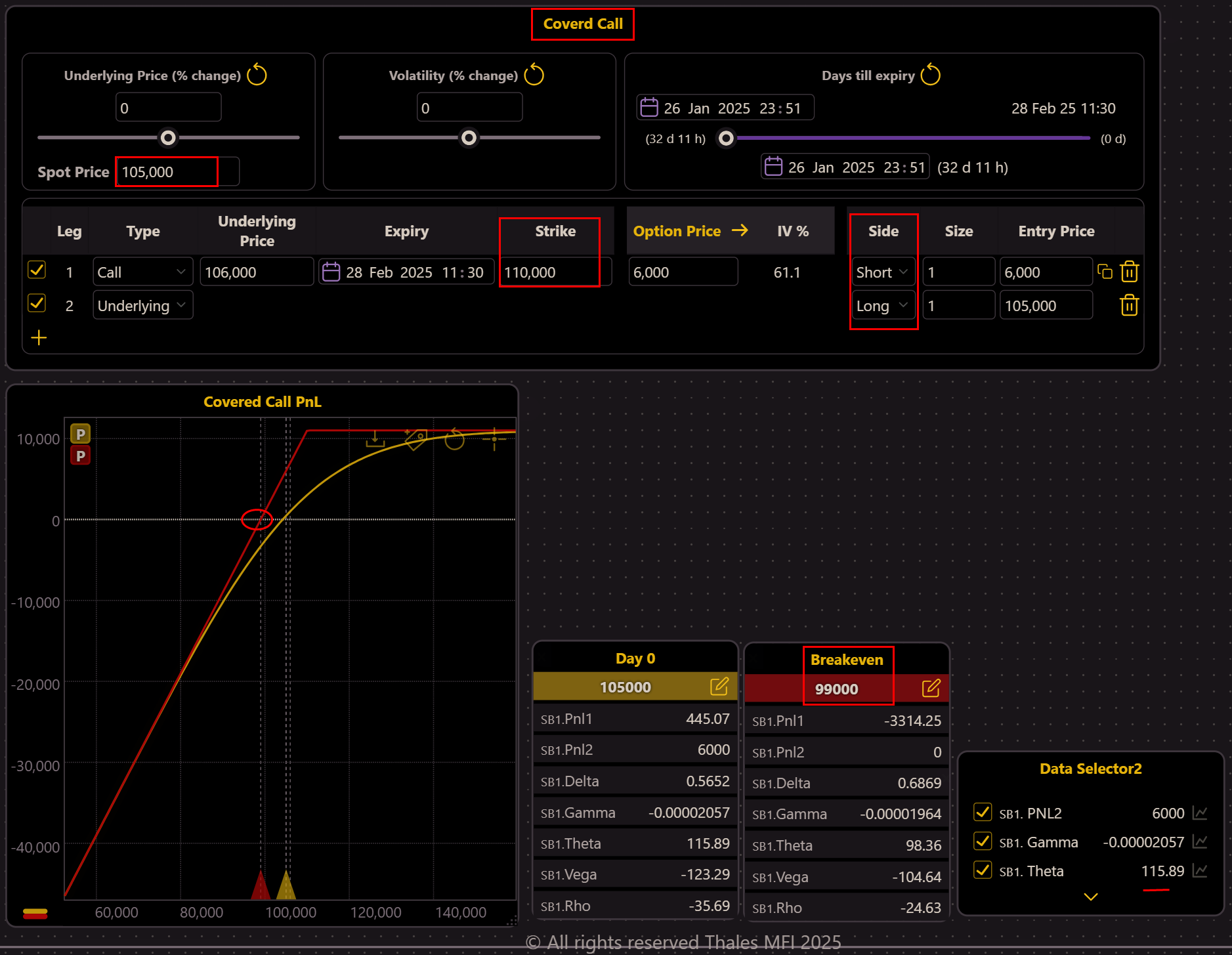

Initial Position Setup

(OSS)

In this setup, the trader holds a long position in Bitcoin at $105,000 and writes a short call option with a strike price of $110,000. The premium collected from the call option is $6,000.

Key Details:

- Underlying price: $105,000

- Call strike price: $110,000

- Premium received: $6,000

- Break-even price: $99,000

The break-even price being $99,000 (while the trader bought Bitcoin at $105,000) shows that, compared to someone who simply holds the asset without selling a call option, their break-even point is effectively lowered by $6,000. This highlights how the covered call strategy can act as a hedge for underlying asset holders, providing a buffer against potential price drops.

Additionally, as seen in the Data Selector, the position currently has a Theta value of $115. This means that, under the present market conditions, the strategy earns an unrealized $115 per day. However, this value is dynamic and will fluctuate as market conditions evolve.

As Time Passes: Theta Decay and Risk Considerations

(OSS)

As we approach expiry, let's consider a scenario where Bitcoin's price as the underlying asset remains unchanged at $106,000. However, with time decay, the dynamics of the strategy have shifted. According to Marker 1, the current PnL stands at $4,900, which is approximately 70% of the strategy's maximum profit of $7,000.

At this stage, and while the call is still OTM, the trader faces two primary choices:

- Close the Position: Exiting both the underlying and call positions allows the trader to lock in the $4,900 profit. This ensures a realized gain without exposing the strategy to further market fluctuations.

- Hold the Position: Near expiry, Theta is significantly high, as seen in the Data Selector widget ($217 per day). This means the position earns $217 in unrealized profit daily due to the rapid decay of the call option's extrinsic value. Since Theta works in favor of the option seller, the trader might decide to hold the position until expiry to potentially capture the full $7,000 profit.

Both options carry trade-offs. Closing locks in gains early, while holding takes advantage of Theta but leaves the position exposed to last-minute market volatility.

When the Call Moves ITM

(OSS)

Now, suppose the underlying price increases to $115,500, pushing the call option into in-the-money (ITM) territory. At this stage, if the price remains above or at the strike price of $110,000, the strategy will achieve its maximum profit at expiry.

The trader, therefore, has two main options:

- Hold the Position Until Expiry

If the trader expects the price to remain stable or continue rising, they may choose to hold the position and earn the full profit, which is close to the maximum PnL of $11,000. - Close the Position Early

As shown in the graph, the Gamma curve (purple) is at its peak, indicating that the strategy is now highly sensitive to small changes in the underlying price. A slight decrease in the price could quickly erode a significant portion of the gains. Prudent or conservative traders might opt to lock in more than 80% of the maximum profit (as shown by the $9,222.75 PnL in the widget) by closing the position early.

However, the options market provides additional flexibility. Rather than simply closing the position, the trader could roll the strategy forward to the next month (or beyond). This approach allows the trader to capture additional income while maintaining the position’s structure.

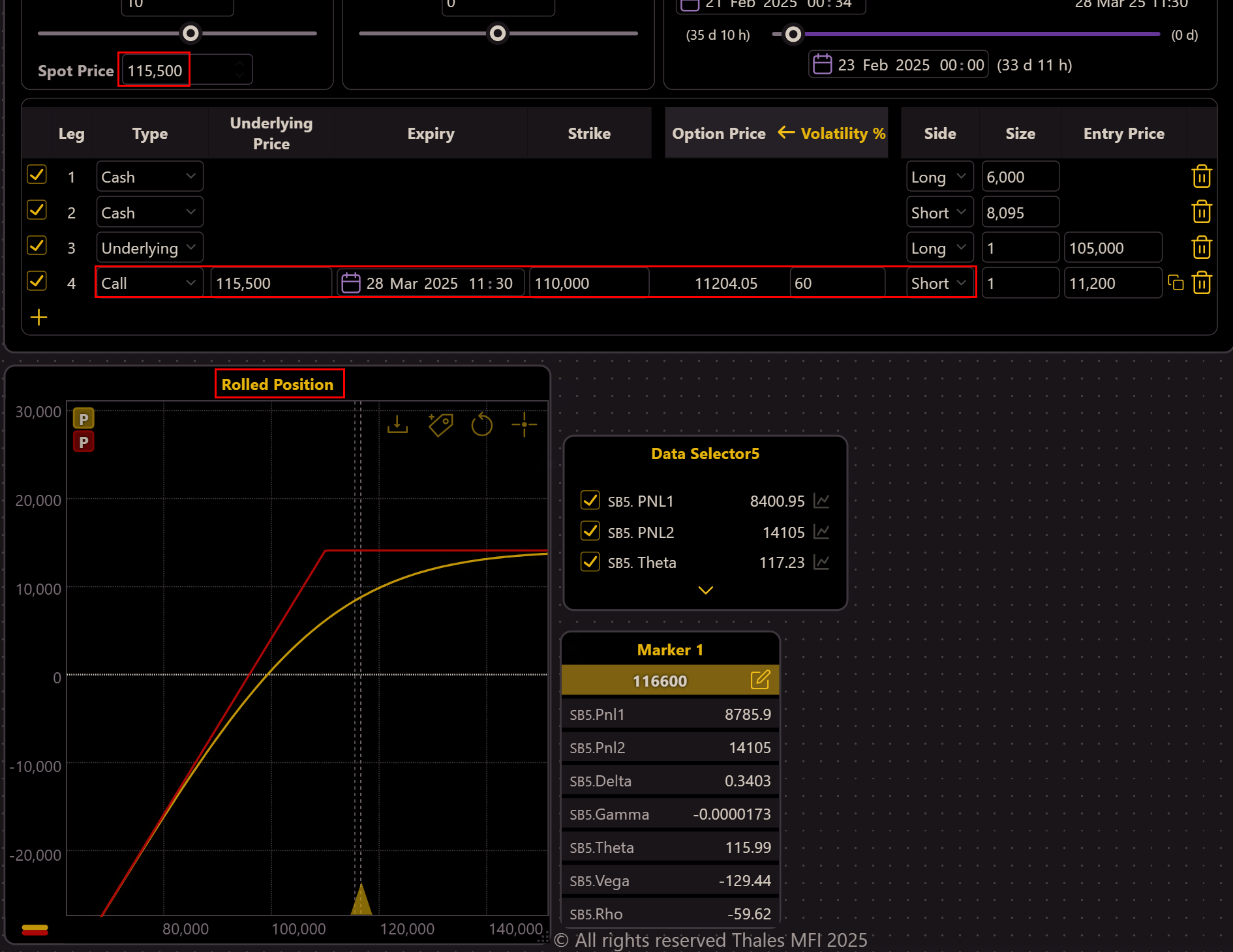

Rolling the Position

(OSS)

At this stage, instead of holding the position until expiry or closing it entirely, the trader has opted to roll the covered call forward to a later expiry.

As seen in the Strategy Builder, the trader has bought back the original call option (now ITM) and simultaneously sold a new call option with the same strike price but for a later expiry. This process allows the trader to extend the position and potentially capture additional premiums.

Key Points:

- Adjusting the Strike Price:

When rolling forward, the strike price can also be increased to higher levels. This adjustment provides greater flexibility and increases the chance of profit if the underlying asset's price continues to rise. - Intrinsic Value Consideration:

Although the premium paid to buy back the ITM call is higher than the premium received for selling it, this difference primarily reflects the intrinsic value due to the increase in the underlying asset's price. It’s important to note that this intrinsic value is effectively offset by the trader’s long position in the underlying asset, mitigating the cost impact of the roll.

By rolling the position forward, the trader maintains exposure to the underlying asset while creating an opportunity to generate further income from the new call option.

Bottom Line

Covered call strategies offer a practical way to generate income and hedge downside risk. However, managing the position, particularly when the call goes ITM, requires careful consideration. As shown in this blog, traders can choose to close the position, hold it for additional theta decay, or roll it to a later expiry to extend the strategy. Each decision depends on the trader’s risk tolerance, market outlook, and profit objectives.

By leveraging tools like the OSS simulator to analyze real-time data, traders can make informed decisions and optimize their strategies for varying market conditions.

Disclaimer

This blog is for informational purposes only and does not constitute financial advice. Trading options involves risk, and readers should consult with a qualified financial advisor before engaging in options trading.