Introduction

January was marked by major volatility, fueled by the U.S. presidential inauguration on January 20 and the high-stakes Bitcoin options expiry on January 31. With over 80,000 open interest and $8 billion in notional value.

In this Outlook, we examine how traders positioned themselves leading up to the expiry, identifying a dominant pattern of Short Risk Reversals—a hedging strategy suggesting long exposure in the spot market. We also analyze the final settlement price and the impact on open interest and market structure.

Finally, we shift our focus to the next expiries, where early positioning is forming for 7 February and 28 February, as well as the key quarterly expiries. With the market adjusting post-expiry, the first signs of new trends are beginning to take shape.

Short Risk Reversal Leading Up to January 31 Expiry

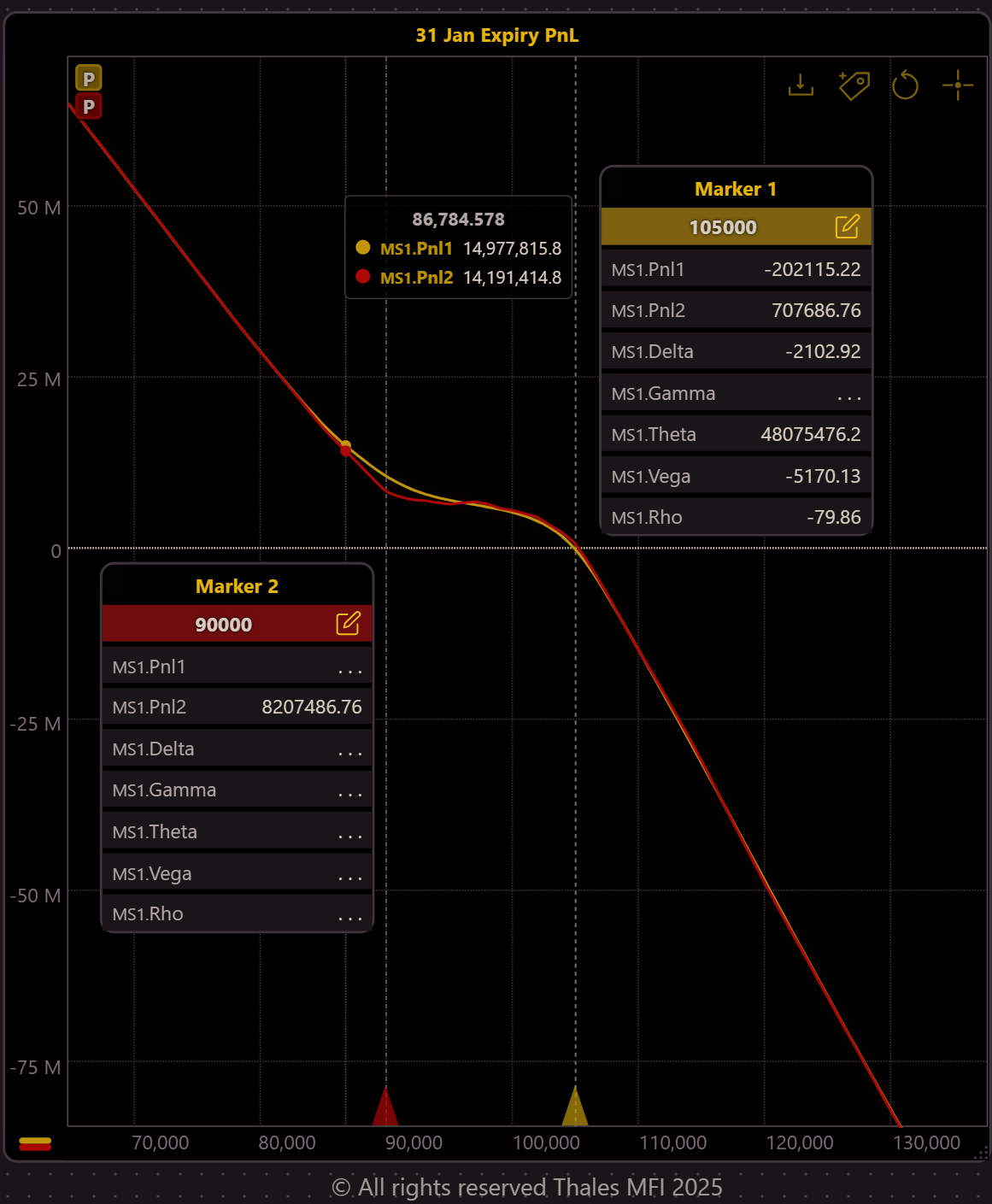

Over the past week, from January 24 to January 30, we analyzed Bitcoin option trades on Deribit set to expire on January 31 using the Market Screener. The Graph above illustrates these trades, with no additional filters applied, providing a comprehensive view of trader positioning for this expiry.

At first glance, the PnL graph appears bearish, with a structure that slopes upward on the left and downward on the right. However, seasoned options traders will recognize this familiar pattern—a short risk reversal strategy. This strategy typically involves:

- Selling an OTM call (right leg sloping downward)

- Buying an OTM put (left leg sloping upward)

While it may seem like traders are positioning for downside move, this setup is usually paired with an opposing position in the spot market. In fact, rather than being outright bearish, this structure often complements a long Bitcoin position, acting as a hedging mechanism against market fluctuations.

The relatively flat section in the middle of the curve, approximately between $90,000 and $105,000, suggests that traders who may already be long in Bitcoin spot, are comfortable tolerating price movements within this range.

Bullish Stance with Risk Management

(OSS)

The Short Risk Reversal strategy, as constructed in the Strategy Builder, consists of a short call and a long put legs, mirroring the trade patterns observed in the 31 Jan Expiry trades.

(OSS)

By adding a long underlying leg to the Short Risk Reversal, the strategy transforms into a hedged position, resembling a Vertical Call Spread in terms of its PnL profile. This setup suggests a bullish outlook with limited risk and capped profit, aligning with the observed trading activity for the 31 Jan expiry.

If traders have indeed used the options market to hedge their long Bitcoin positions, this could indicate a bullish sentiment in the market—yet one that is cautiously hedged against potential price corrections.

31 Jan Expiry Concludes

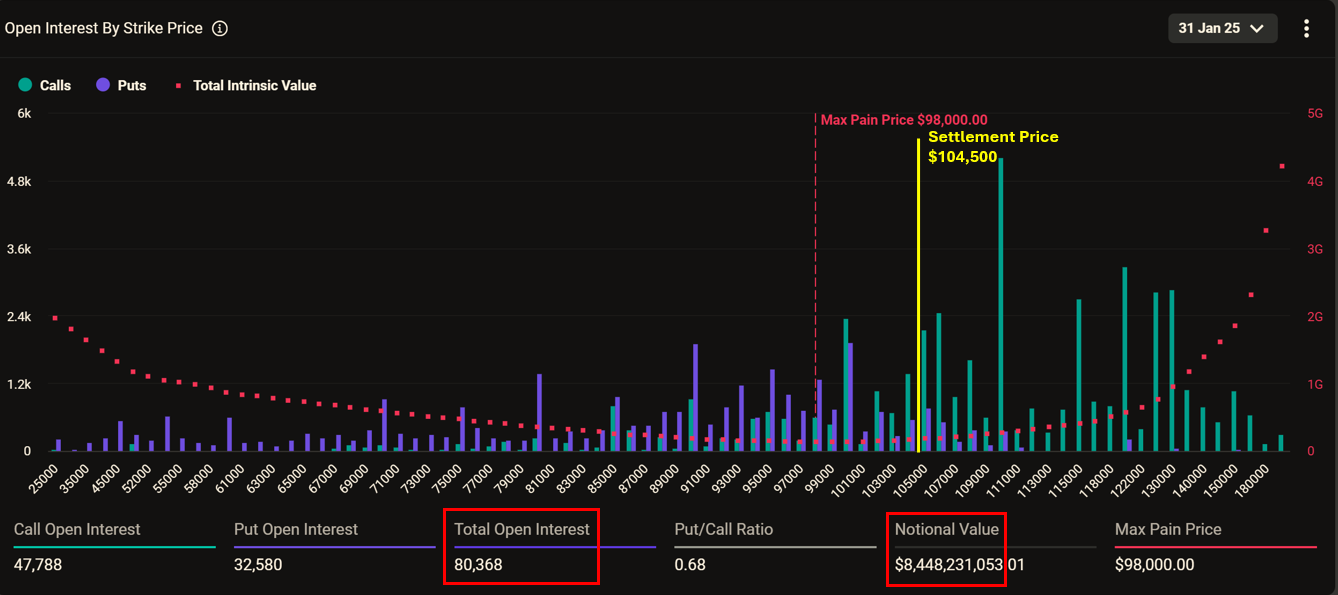

What we examined above about the Short Risk Reversal reflected traders' activity in the past week, but this expiry had been building significant open interest across various strike prices for a longer period. Today, the 31 Jan 2025 options expiry concluded at 8 UTC, marking a significant milestone with over 80,000 contracts in open interest and a notional value exceeding $8 billion. The settlement price landed at approximately $104,500, not far from the max pain level of $98,000.

This expiry disappointed traders who were betting on Bitcoin surpassing $110,000, as this strike held the highest open interest. Similarly, put buyers at strikes of $80,000, $90,000, and $100,000 saw their contracts expire worthless.

For this expiry, option sellers once again seemed to have the upper hand. The large buildup of open interest at the $110,000 strike and other tall green columns ultimately disappointed their optimistic holders as the price settled well below those levels. On the put side, the outcome was similar—puts at $80,000, $90,000, and $100,000 expired worthless. The only notable winners among buyers were those who secured $100,000 strike calls early enough to maintain a breakeven below $104,000, along with a handful of other option holders. A few profitable positions can be seen in the chart, with some green columns behind the settlement price at $104,500 and a few purple columns positioned ahead of it.

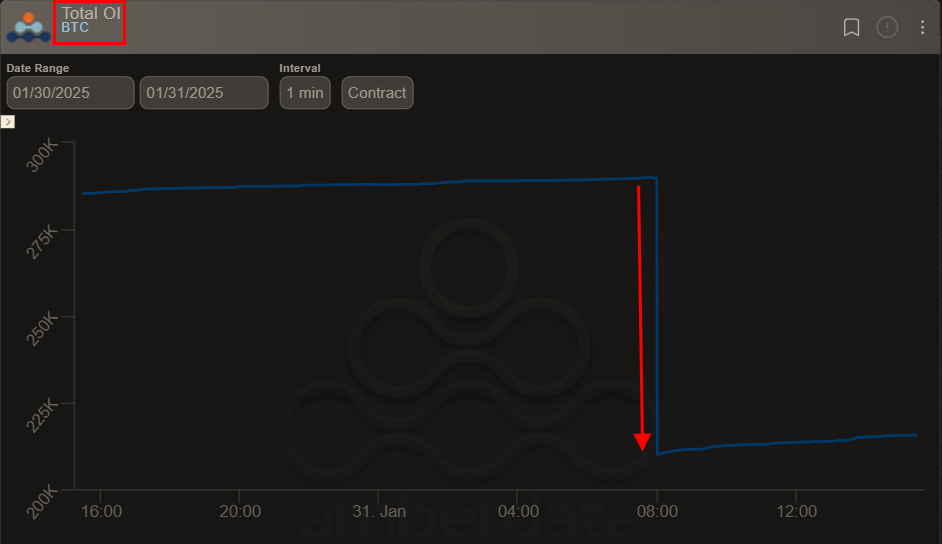

Sharp OI Drop

As expected, the total open interest (OI) in the Bitcoin options market dropped sharply following the expiration of the 31 Jan 2025 contracts, as seen in the chart. However, such drops are a natural part of the options cycle, and OI is likely to rise again soon as traders position themselves for the next major expiries.

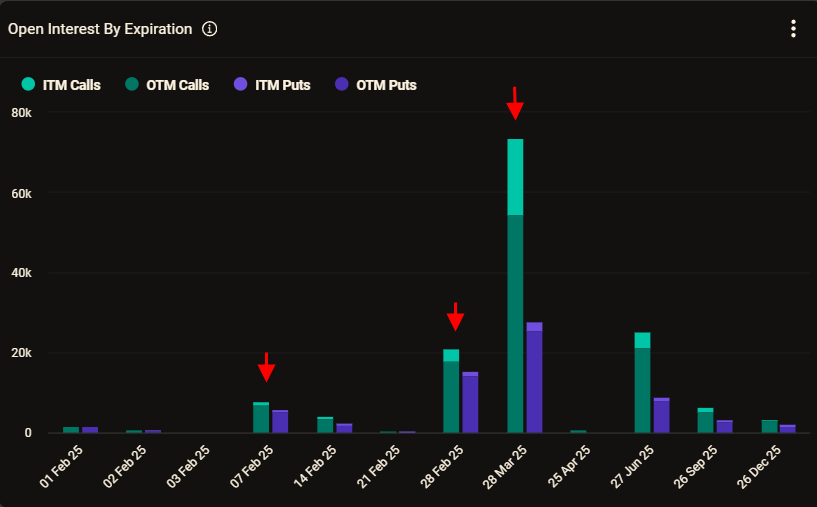

Next Stops

With the 31 Jan expiry behind us, the focus now shifts to the next key expirations in the Bitcoin options market. While the quarterly expiries on 28 March and 27 June remain dominant, two shorter-term expiries stand out. The 7 Feb 2025 expiry is relatively smaller but still notable for its potential impact on short-term positioning, while the 28 Feb 2025 expiry holds a significant concentration of open interest and warrants close monitoring.

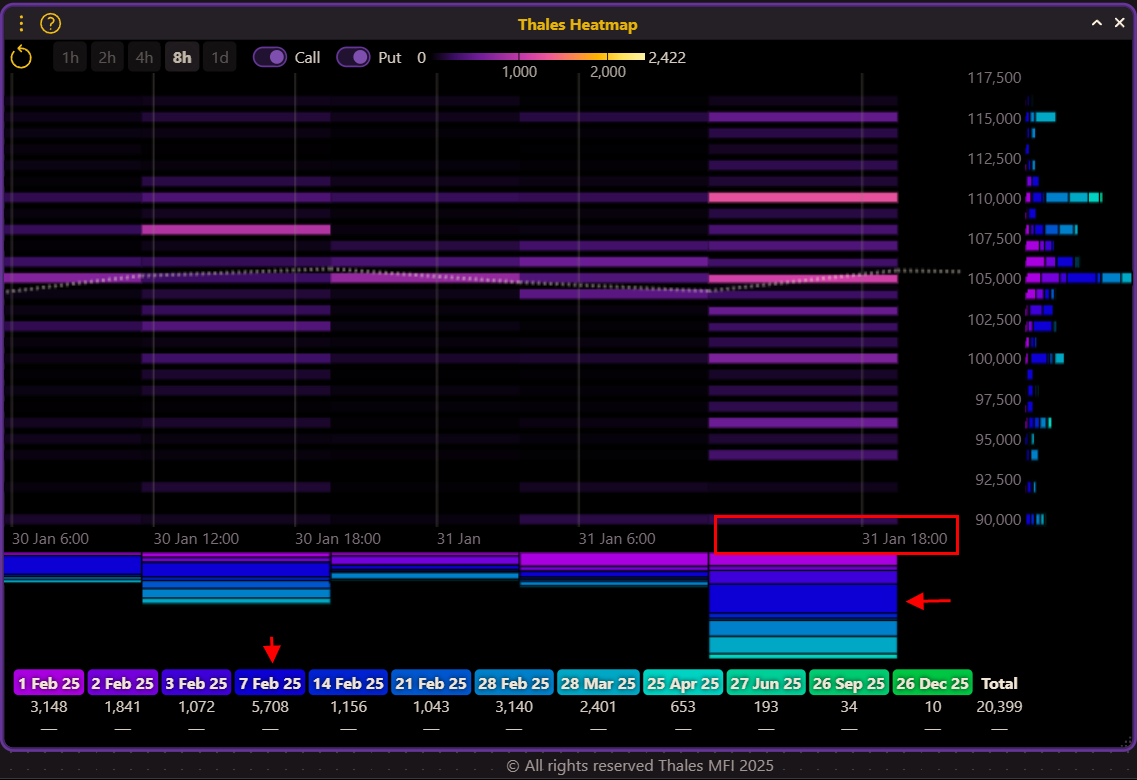

Heatmap

(OSS)

The heatmap reveals a relatively high level of trading activity on Friday, 31 January, particularly focused on the 7 February expiry.

A Short Strangle Emerges

(OSS)

Now we can analyze the same activity using the Market Screener, filtering for the 7 February expiry. The PnL graph of trades executed within this timeframe resembles -roughly- a short strangle, indicating that most options were sold within a relatively safe range between 98,000 and 111,000.

However, this positioning must be closely monitored in the coming days to capture market dynamics. In future Outlooks, we will continue tracking this activity and major market events.

Bottom Line

While most buyers didn’t walk away from the 31 January expiry with gains, the core function of the options market—risk management—remains as strong as ever. This was evident in last week’s short risk reversal positioning, a strategy often used by experienced traders to hedge their exposure. The options market isn’t just a battleground for speculation; it’s where professionals leave their footprint across expiries, strikes, and strategic positioning. Follow our Outlook to stay in tune with market sentiment, and explore OSS tools to analyze the market yourself.

Disclaimer

This report is for informational purposes only and does not constitute financial advice. Options trading involves risk, and past market activity does not guarantee future performance. Traders should conduct their own research and consider their risk tolerance before making any investment decisions.