Rolling the Straddle: A Dynamic Approach to Managing Risk and Preserving Profits

Introduction

The straddle is a well-known options strategy designed for traders expecting significant price movement in an asset but uncertain about the direction. It involves buying both a call option and a put option at the same strike price and expiration. The strategy benefits from high volatility but carries an inherent weakness—if the price moves significantly in one direction and then reverses before expiration, the accumulated profits can erode due to time decay (theta), leaving the trader with losses.

(OSS)

This blog will explore how to address this problem by rolling the straddle dynamically, using a real-world Bitcoin options example. By systematically rolling the straddle to follow price movements, traders can lock in profits, reduce risk, and prevent profit erosion due to price retracements.

Understanding the Straddle Strategy

(OSS)

A straddle consists of:

- Buying a call option at a specific strike price, typically at-the-money (ATM), meaning near the current price of the underlying asset.

- Buying a put option at the same strike price and expiration.

This setup profits from large price swings in either direction, making it attractive in high-volatility environments. However, for every reward in the options market, there is a cost.

- Because we are long two ATM options—which typically have the highest Theta decay—time is working against us. As expiration approaches, if the underlying price does not move far enough, the value of the position declines rapidly.

- Additionally, since we have paid two premiums (one for the call and one for the put), our breakeven points are farther apart compared to holding a single call or put. The price must move significantly beyond these breakeven levels for the trade to turn profitable.

This combination of high reward potential but rapid time decay is what makes straddles effective for capturing volatility but also inherently risky if the expected move does not materialize quickly.

Because of this, it is crucial to capitalize on price movements and not let them escape. Since the straddle is a heavy debit strategy, we must actively lock in profits from favorable price moves rather than relying solely on a final outcome at expiration. By securing gains along the way, we can improve portfolio stability and reduce the risk of profit erosion due to time decay or price reversals

In the next section, we introduce a real-world Bitcoin options scenario and show how a rolling approach can mitigate this issue.

Bitcoin Options Example: Identifying the Problem

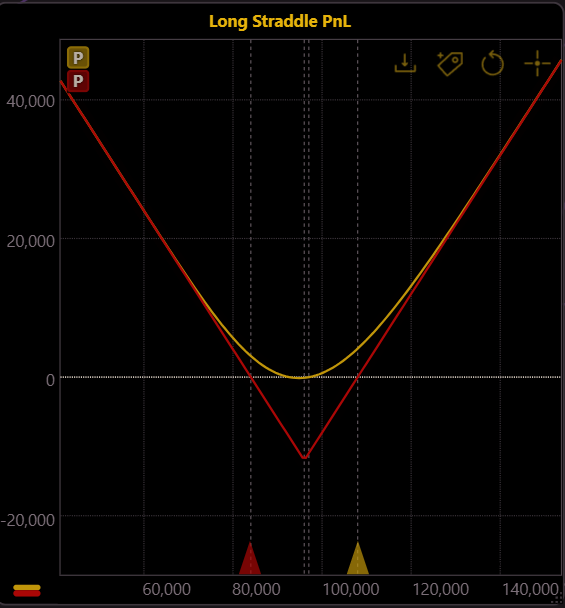

Setting Up the Initial Straddle

(OSS)

This is an example of a long straddle in the Bitcoin options market. With the underlying asset (Bitcoin) priced at $96,000, we establish the position by purchasing:

- 1 Long Call at $96,000 (ATM)

- 1 Long Put at $96,000 (ATM)

The graph above illustrates the PnL profile of this straddle. The key observation is that between the breakeven points ($84,000 and $108,000), the strategy remains at a loss if held until expiration. Only when the price moves beyond these breakeven levels does the position start generating profit.

A notable challenge of this strategy is that the breakeven points are relatively far from the current price, meaning Bitcoin must make a significant move to offset the cost of entering the trade.

The yellow curve represents the current PnL of the position, which fluctuates based on price movement and implied volatility. Over time, this curve will converge toward the red expiration PnL curve, reflecting the effect of theta decay as the options lose value approaching expiration.

In the following sections, we analyze the impact of an increase in the underlying price together with passage of time, and explore potential hedging strategies to manage the position effectively.

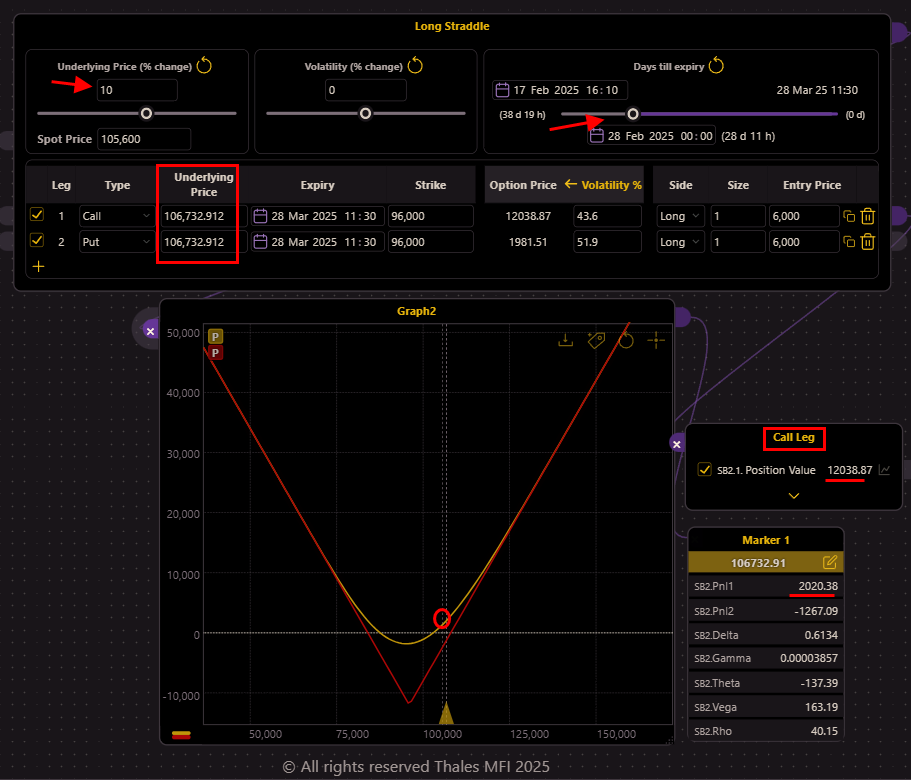

Bitcoin Moves Up by 10%

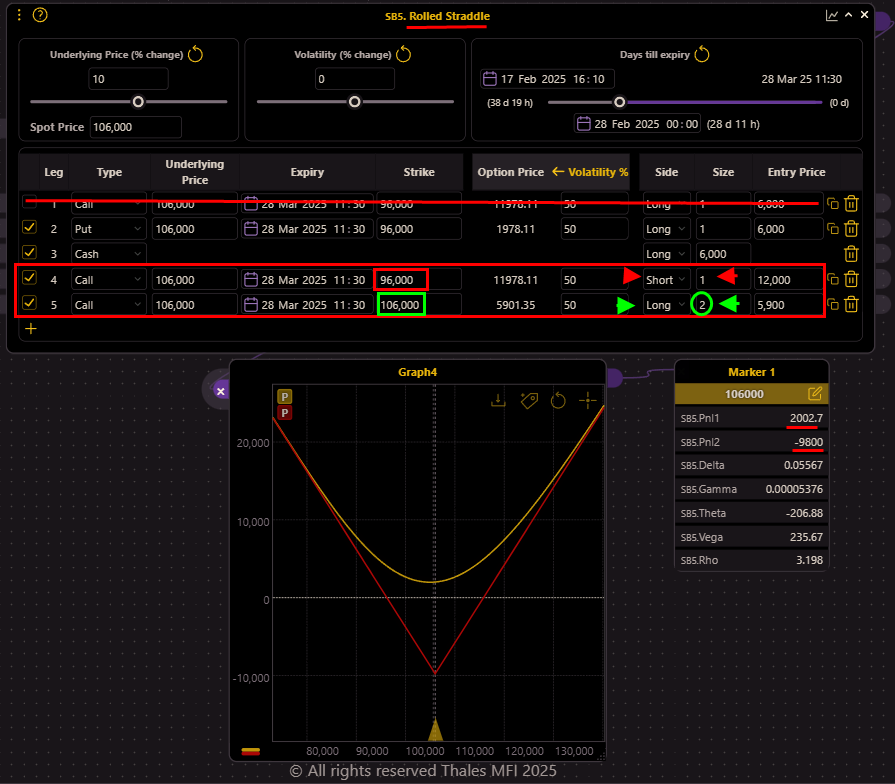

(OSS)

Suppose Bitcoin's price increases from $96,000 to $106,000.

- The call option at $96,000 becomes deep in the money, generating substantial profit.

- The put option at $96,000 loses value but retains some premium due to time remaining until expiration.

At this stage, the trader faces a choice:

- Hold the position, risking that Bitcoin may return to $96,000 and erase gains.

- Roll the straddle to a higher strike, locking in profits and maintaining exposure to further price movement.

Closing the ITM Call

(OSS)

At this stage, we have the opportunity to close the call option, which has now moved in the money (ITM). By selling this call, we recover a portion of the premium we originally paid. The net result, after subtracting the initial cost from the premium received, is a realized profit of 6,000 USDT, which has been added to the Strategy Builder (see the image above).

After closing the call position, we are now left with a long put option, as reflected in the updated PnL graph. However, to effectively roll the straddle and maintain exposure, a few more steps are required.

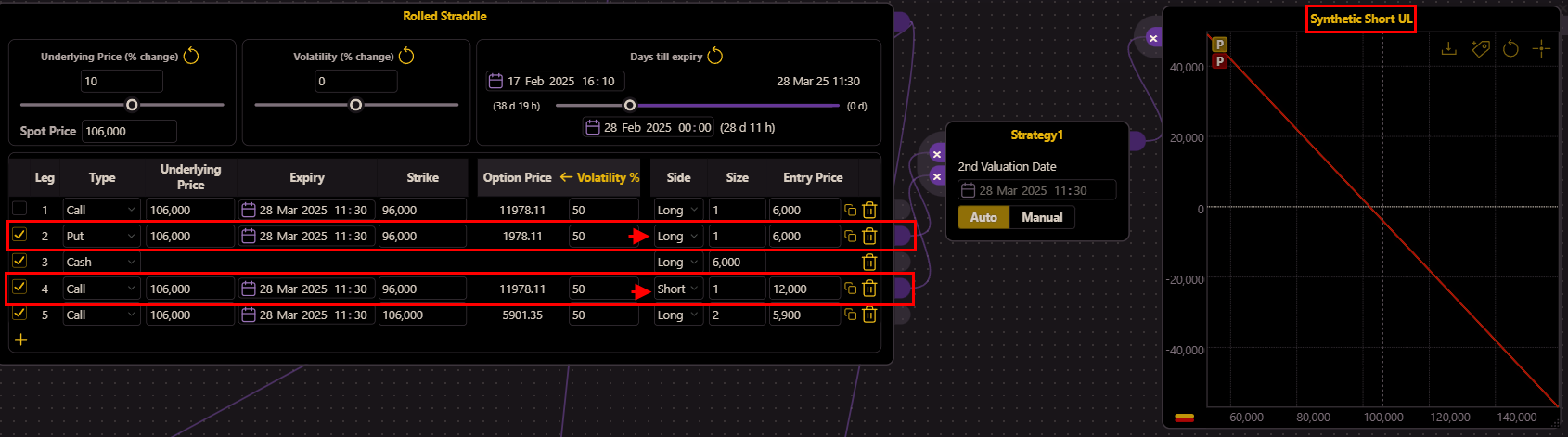

Short One More Call

(OSS)

At next step, we short one additional call option at the $96,000 strike. This adjustment results in a position consisting of:

- 1 Long Put at $96,000

- 1 Short Call at $96,000

This combination represents a synthetic short position, meaning that the portfolio now behaves as if we are short 1 Bitcoin in the spot market. This transformation is clearly reflected in both the Strategy Builder and the PnL graph, where the payoff structure aligns with that of a direct short position in the underlying asset (see the image above).

Long Two ATM Calls

(OSS)

Finally, we buy two at-the-money (ATM) call options at the $106,000 strike.

Before this adjustment, our position was effectively a synthetic short Bitcoin due to the combination of a long put and a short call at $96,000. By adding two long call contracts at $106,000, we transform the synthetic short back into a straddle, but now at a higher strike price.

The impact of this adjustment is clearly visible in the PnL graph:

- The new straddle is now centered at $106,000 instead of $96,000.

- The maximum loss has been reduced, decreasing from $12,000 to $9,800.

- The position retains its ability to profit from further price movements, while reducing downside exposure.

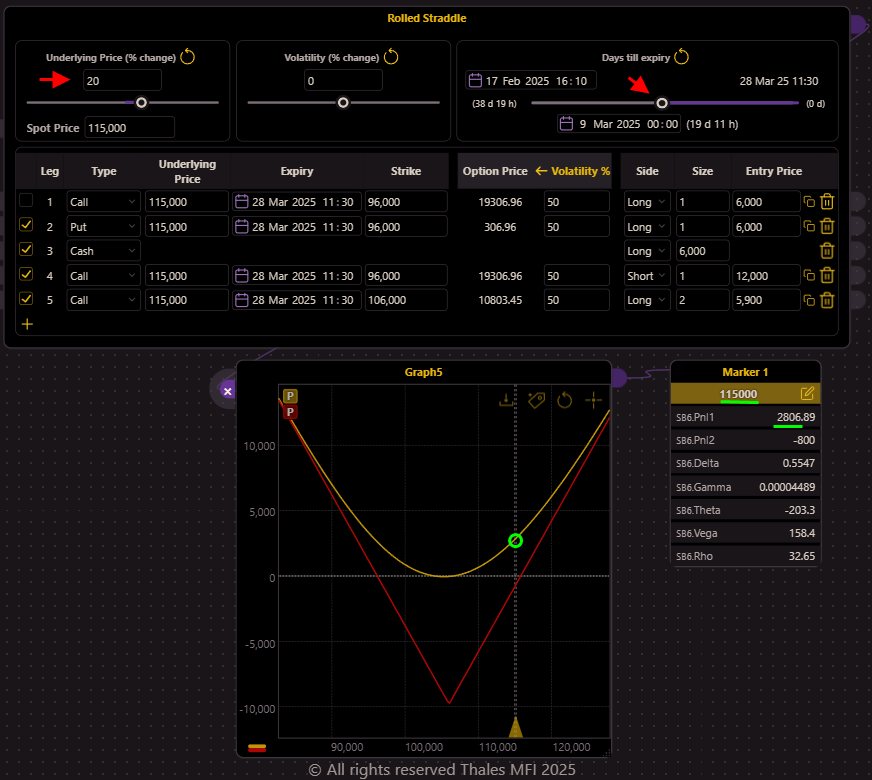

Bitcoin Moves Up Another 10%

Now, assume Bitcoin continues its upward trend, reaching $115,000 as some time passes as well.

(OSS)

From the yellow curve, which represents the current PnL of the position, we can see that we are in profit ($2,506, as shown in the marker). However, the red expiration curve is still slightly below the zero line.

Let’s roll it one more step.

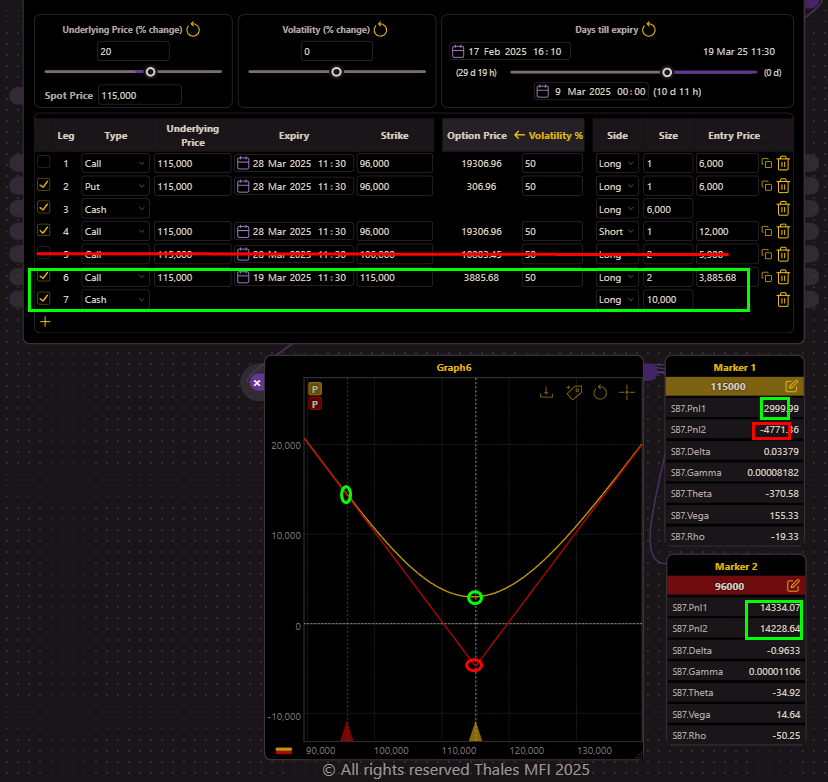

Next Roll

(OSS)

In this step, we close the two in-the-money (ITM) call options at the $106,000 strike. The net cash received—the difference between the premium initially paid and the proceeds from selling them ITM—is added to the Strategy Builder, as reflected in the updated position.

Following this, we buy two new at-the-money (ATM) call options at the $116,000 strike.

A key observation here is that we receive more from selling the ITM calls than we pay for buying the new ATM calls. This results in an overall credit, which is visually represented in the yellow PnL curve, now positioned well above the zero line.

Additionally, this roll further reduces the maximum possible loss, as seen in the red expiration PnL curve—its lowest point moves closer to the zero line, reflecting a lower downside risk.

Most notably, even if the price fully reverses back to $96,000, the position remains highly profitable. As shown by the red marker, a return to $96,000 would now result in a profit exceeding $14,000. This demonstrates how dynamically rolling the straddle not only locks in profits but also strengthens the overall position, allowing it to withstand potential reversals effectively.

In the example we explored, we focused on a scenario where the underlying price moved upward, allowing us to hedge the straddle using call options. However, it’s important to note that the same hedging strategy applies if the price moves downward. Just as we rolled the position upward by selling call spreads, traders can hedge a falling market by using put or call spreads to offset losses and reduce risk.

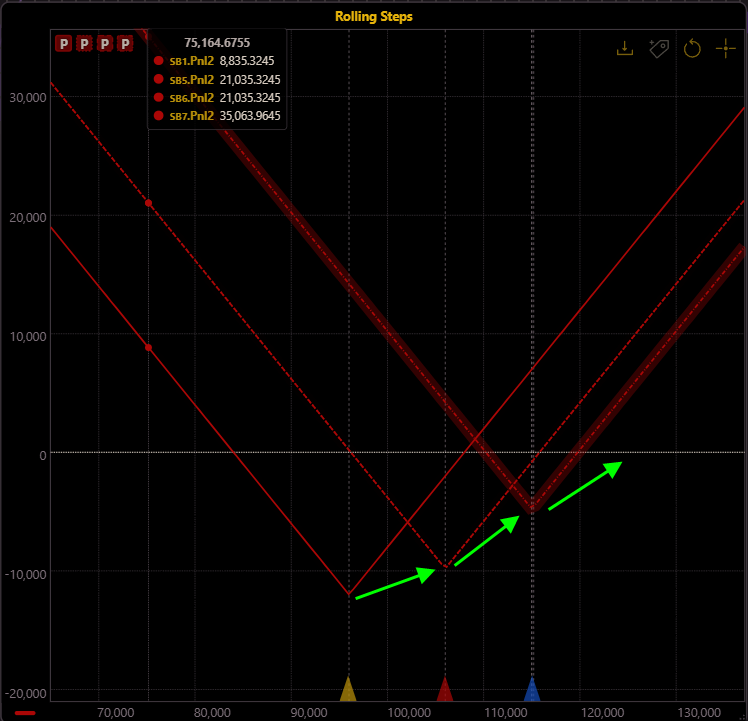

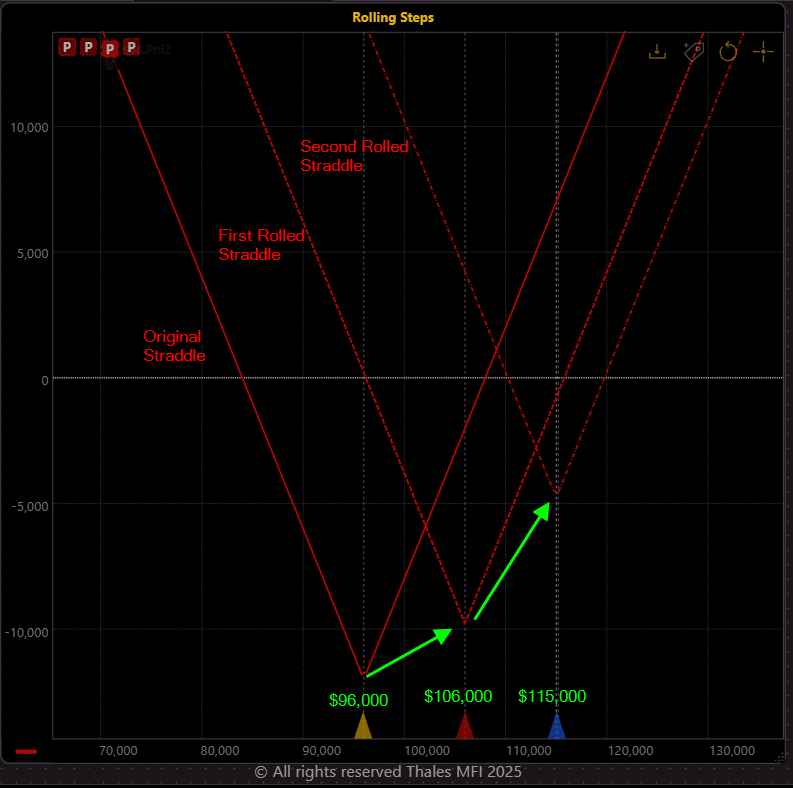

In One Frame

(OSS)

In this chart, we have combined all three stages of the rolling process into a single graph, allowing for a clear juxtaposition of each adjustment within the same frame. This visualization provides an intuitive way to observe how the straddle has followed the price movement, effectively reducing risk and hedging against retracements.

However, it is important to acknowledge that this is not a miracle—in financial markets, every advantage comes with a cost. While rolling the straddle has managed risk and minimized potential losses, it has also lowered the maximum potential profit. This is evident in the fact that at $115,000, the original straddle would have yielded the highest profit, whereas the rolled versions sacrifice some gains in exchange for improved risk control.

This highlights a fundamental principle of trading: strategy selection depends on individual risk tolerance and approach. There is no single universal solution—some traders may prefer to maximize profit potential at the cost of higher risk, while others may prioritize stability and controlled risk exposure. Understanding and balancing these trade-offs is crucial in developing a trading strategy that aligns with one’s objectives.

Bottom Line

The rolling straddle strategy provides a dynamic approach to managing risk and adapting to price movements in volatile markets. Instead of allowing profits to erode due to reversals or time decay, rolling systematically locks in gains, repositions exposure, and reduces maximum loss with each adjustment. However, as with any strategy, it comes with a trade-off—risk is reduced, but so is potential profit.

By integrating this approach into your trading framework, you can navigate uncertain markets with greater control and confidence, ensuring that every price move works in your favor, rather than against you.

Disclaimer

This article is for informational and educational purposes only and should not be considered financial or investment advice. Options trading involves significant risk, and strategies such as rolling a straddle may not be suitable for all investors. Past performance does not guarantee future results. Always conduct your own research and consult with a qualified financial professional before making any trading decisions.