Introduction

As Bitcoin hovers near key price levels, the options market provides valuable insights into traders’ sentiment and positioning. In this Bitcoin Options Outlook, we take a deep dive into the current state of the market, examining volatility trends, open interest distribution, and recent trading activity to uncover the prevailing themes.

This issue highlights the persistently low implied and historical volatility, the role of max pain in last week’s expiration, and the shifting focus of traders toward new strike levels. We analyze the contrast between short-term caution and long-term optimism, as reflected in traders’ positioning across major platforms.

Finally, in The Takeaway, we bring all the data together to assess whether the market is approaching a decisive breakout or if deeper corrections lie ahead.

Market Snapshot

Low Volatility Market

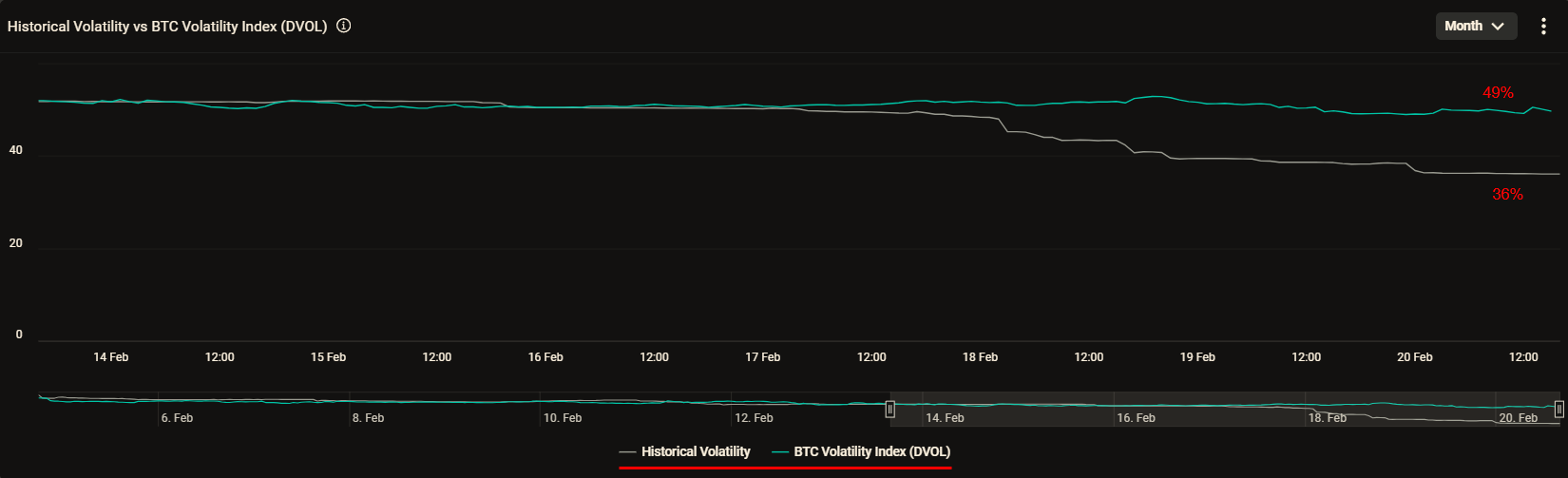

Implied volatility (IV) in the Bitcoin options market is currently at a relatively low level, with the BTC Volatility Index (DVOL) sitting on 47.

Historically, IV has only been this low around 3% of the time over the past 12 months. Despite Bitcoin's recent price movement from $95K to $98K within the last 24 hours, IV has continued to decline rather than increase, suggesting that traders are not expecting heightened volatility in the near term.

Historical Volatility vs. Implied Volatility. (Deribit)

Historical volatility of Bitcoin has dipped even lower than implied volatility (IV), currently sitting at 36%.

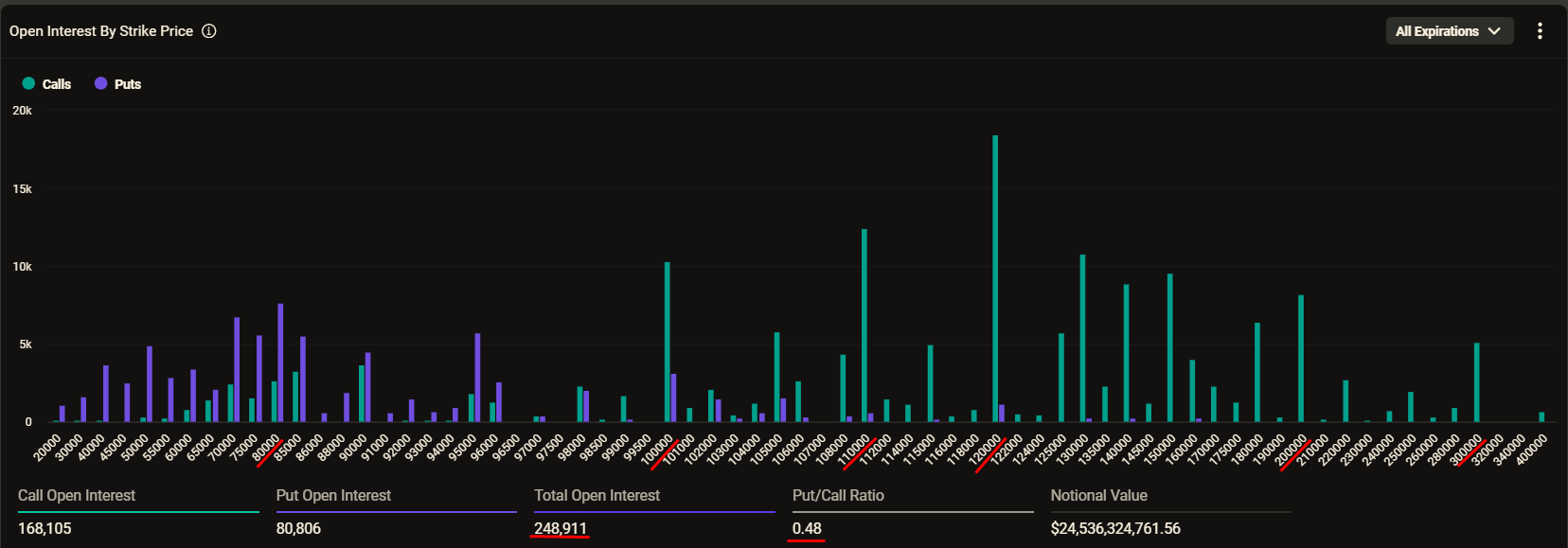

A Wide-Angle Lens on Bitcoin Options

The chart displays open interest (OI) across various strike prices for all expirations on Deribit. Currently, there are approximately 250,000 open option contracts, with a notional value of $24.5 billion. Call options outnumber put options by nearly 2 to 1, which is not unusual in Bitcoin's market.

For the call side, key strike levels—120K, 110K, and 100K, along with ultra-high strikes like 200K and even 300K—suggest speculative positioning for a long-term Bitcoin price surge. On the other side, the put options around the 80K and 70K strikes have higher OI that are likely bought as protection against potential downside risk.

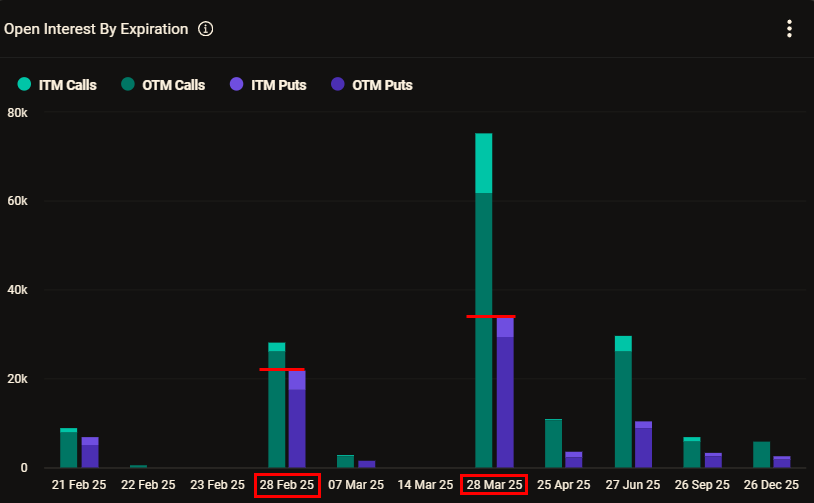

Hedging the Present, Betting on the Future

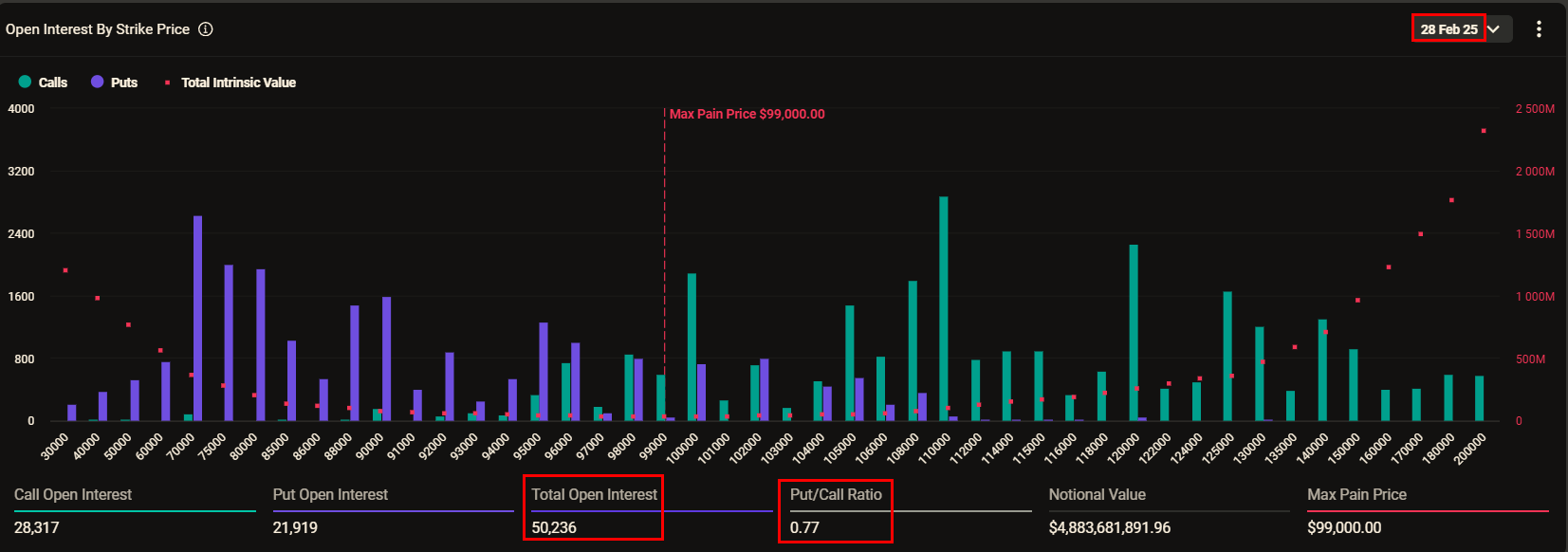

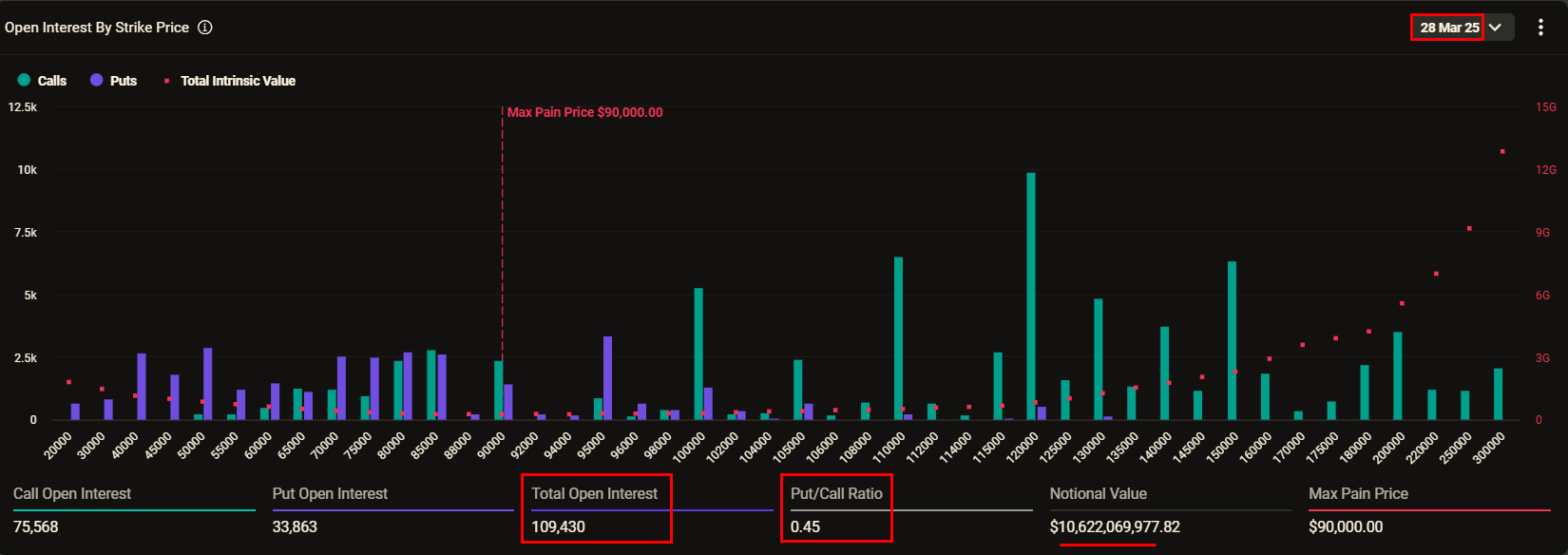

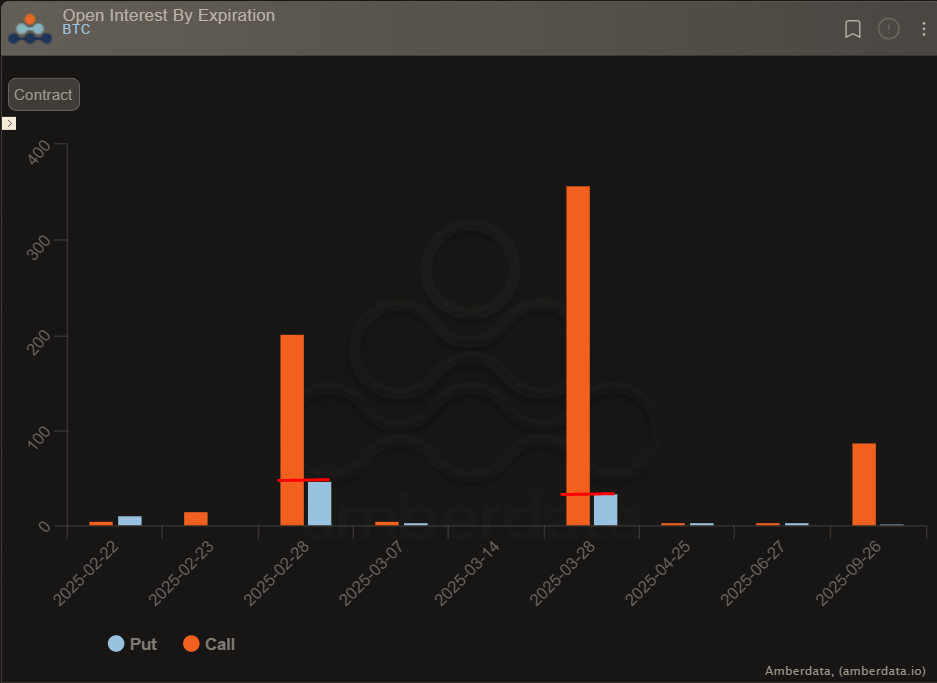

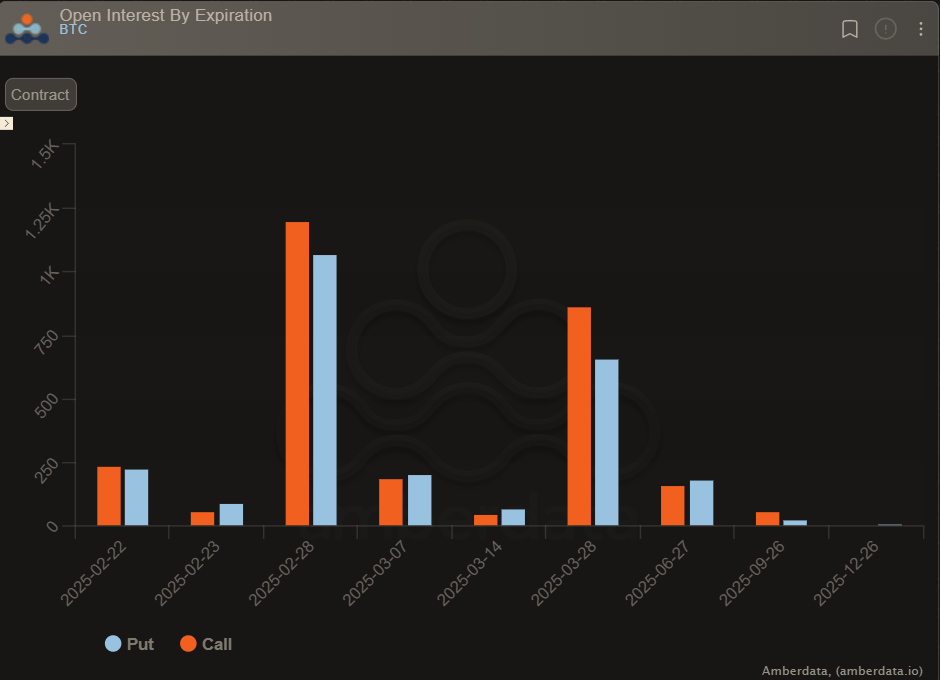

At the time of writing, the 28 March and 28 February expirations hold the highest open interest, with 110,000 and 51,000 contracts, respectively.

The put/call ratio for 28 March stands at 0.5, whereas for 28 February, it is 0.8. This suggests that in the short term, traders are more cautious, potentially hedging against further corrections, while in the longer term, positioning appears more bullish, reflecting expectations of higher Bitcoin prices. However, it’s important not to misinterpret this chart—long-term strike OI has been accumulating over time, particularly when market sentiment was more optimistic.

Markets Differ

While Deribit, as the largest Bitcoin options market, provides a broader outlook, it's essential to recognize that different platforms may reflect different trading behaviors. For example, in Derive, a smaller DeFi-based options market that is more accessible to retail traders, the put/call ratio is notably lower (see the chart below), suggesting a more bullish and speculative approach.

In contrast, on Bybit, a centralized exchange, the put/call ratio is much closer to 1 (see the chart below), indicating a more balanced sentiment, possibly driven by a mix of hedging and directional positioning.

These variations serve as a reminder that interpreting open interest requires context, as different platforms cater to different trader profiles and strategies.

Market Recent Activities

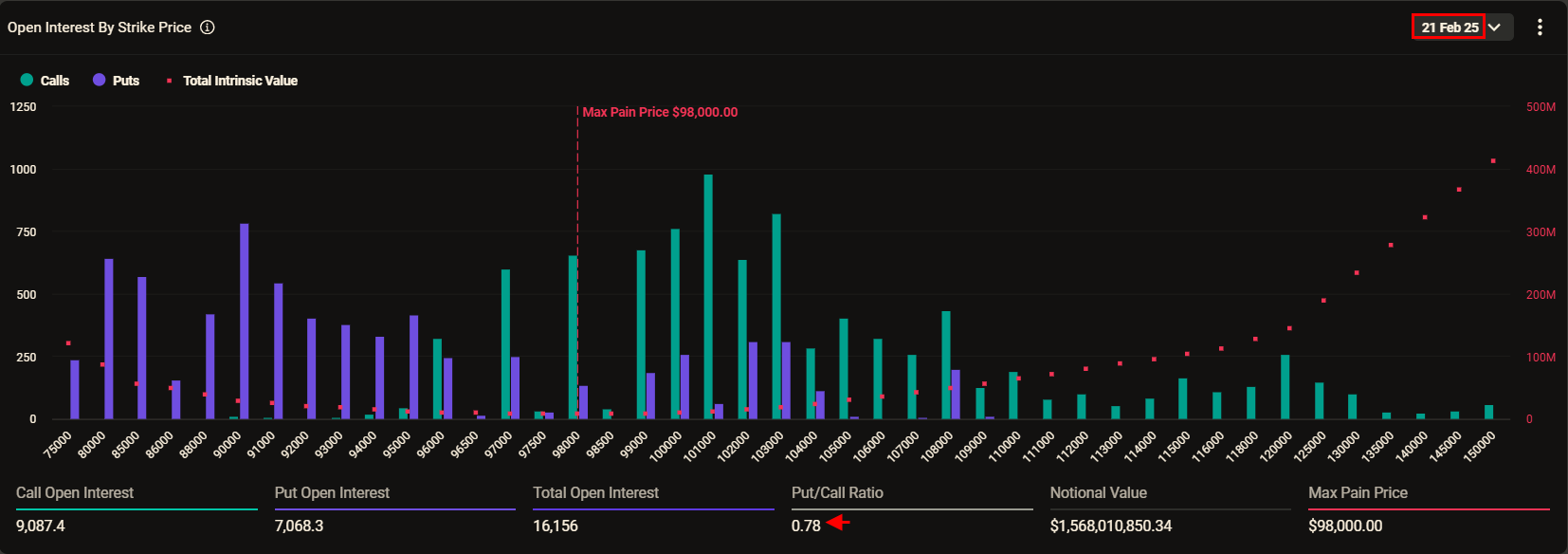

Max Pain Strikes Again: Feb 21 Expiry Settles Near $98K

The Feb 21 Bitcoin options expiry, with over 16,000 open interest, settled at $98,320, aligning closely with the max pain level of $98,000. Once again, option buyers saw their positions expire worthless, as the market gravitated toward this key level.

Notably, just hours before expiry, Bitcoin surged from $95K to $98K, seemingly maximizing the pain for holders of out-of-the-money options.

Having walked away empty-handed from this expiry, let’s take a look at how option traders positioned themselves over the past 10 days for the upcoming expiries.

120K Calls: A Key Level on Traders' Radar

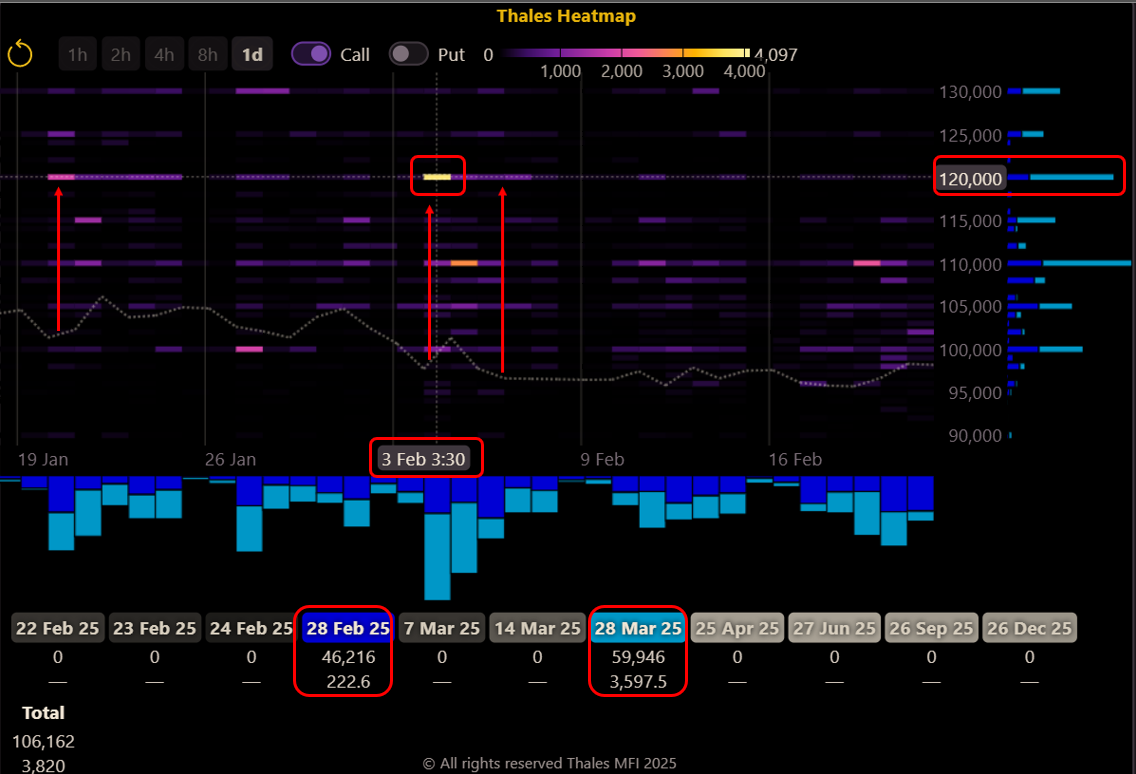

(Heatmap)

From early January to mid-February, the $120K call option has remained a focal point for Bitcoin options traders. As highlighted in our heatmap, which filters for February 28 and March 28 expiries, traders have repeatedly targeted this strike whenever Bitcoin experienced a correction.

One of the most significant trading surges for this strike occurred on February 3, where both expiries saw a notable increase in volume. Interestingly, we've already observed that the 120K call holds the highest implied volatility (IV), suggesting that traders see it as a key speculative level, particularly for the end-of-March contracts.

However, despite its prominence, activity around this strike has declined over the last 10 days, possibly reflecting shifts in sentiment or positioning adjustments.

Shifting Focus: 110K Calls Gain Traction

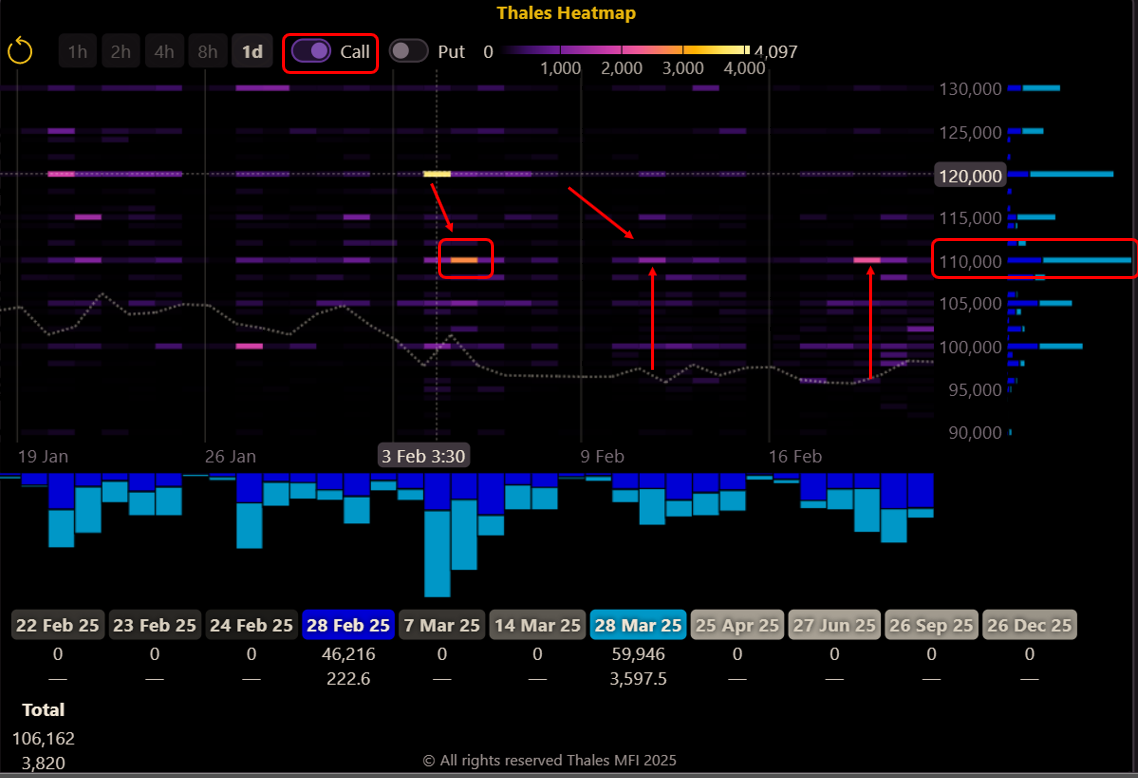

(Heatmap)

As Bitcoin failed to break above 100K, traders appear to have redirected their attention from the 120K strike to the 110K call option.

The heatmap data shows a clear pattern—while 120K calls previously dominated activity, recent trading has intensified at the 110K level. This suggests that market participants are adjusting their expectations, favoring a more conservative upside target.

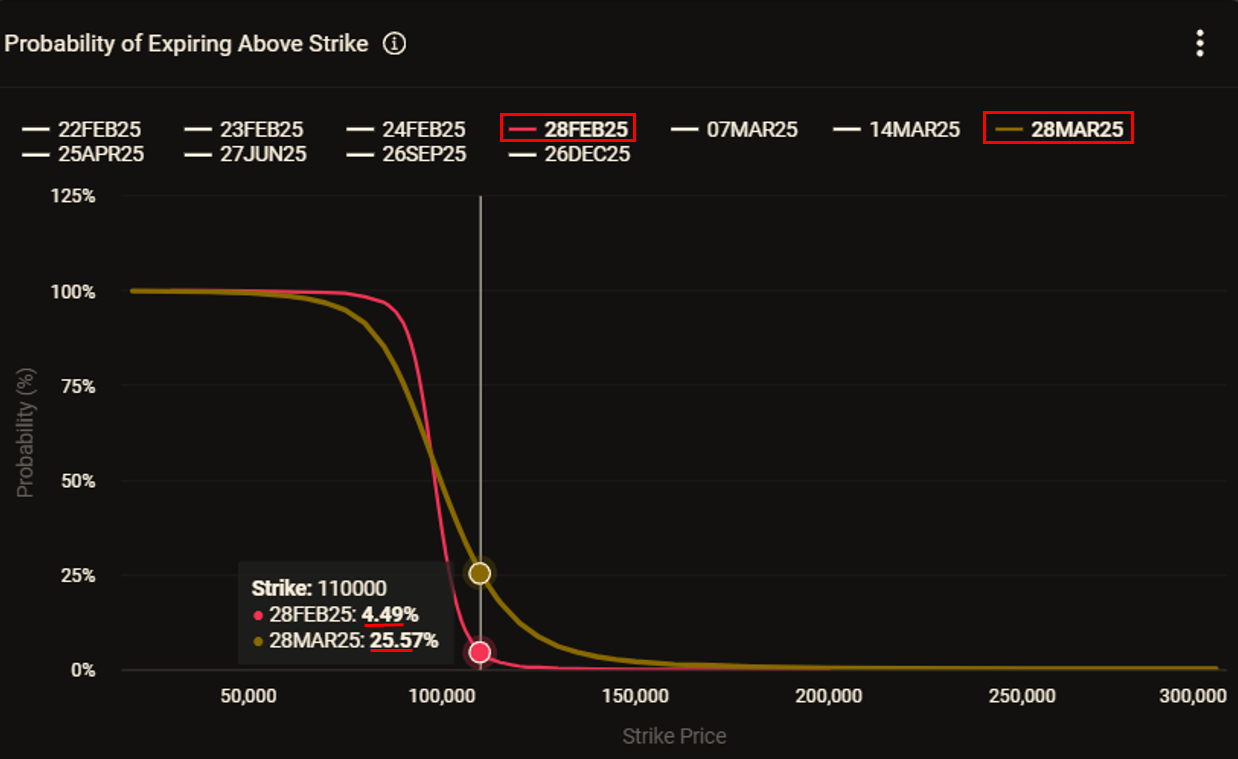

Is Bitcoin’s 110K Call Expiring In the Money?

According to Deribit’s probability model, the 110K Bitcoin call option currently has a 4.5% chance of expiring in the money for the February 28 expiry. However, for the March 28 expiry, this probability significantly increases to 25.5%.

It’s important to note that this model calculates probabilities based on current market conditions. Given the dynamic nature of the market, these probabilities can shift dramatically in the blink of an eye.

Market Screener

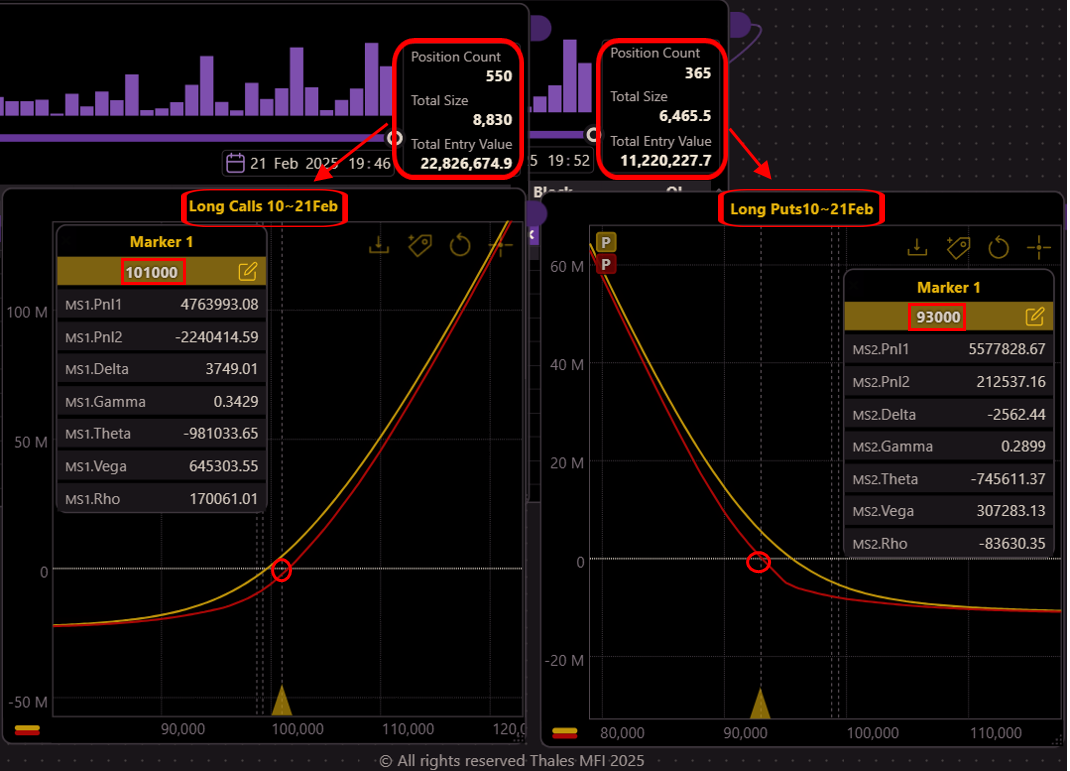

(OSS)

To assess Bitcoin options traders’ activity over the past 10 days, we examined the Market Screener, filtering for long positions in 28 February and 28 March expiries, with strikes ranging from 90K to 120K.

- The left chart represents long call positions taken during this period, while the right chart shows long put positions.

- A total of 8,830 call contracts were bought, with traders spending approximately $22.8 million in premiums.

- Meanwhile, 6,456 put contracts were acquired, with a total premium of $11.2 million—nearly half of what was paid for call options.

Reading the Graphs

Since the graphs represent cumulative trades, aggregating positions across different strikes, determining an exact breakeven point is challenging. However, if we consider all the trades as a single position:

- Long call positions appear to be betting on Bitcoin moving well above $101,000 by expiration.

- Long put positions suggest traders are hedging against a price drop below $93,000.

The Takeaway

The majority of option contracts for the February 21 expiry settled out of the money (OTM) as Bitcoin’s settlement price landed near its max pain level of $98,000. This outcome aligns with the broader stagnation in volatility, with IV and historical volatility both sitting at their lowest levels.

However, history suggests that stale markets don’t last forever. Periods of low volatility are often followed by sharp price movements, and Bitcoin option traders appear well aware of this. For the near term (end of February), we observed increased demand for put options, likely reflecting concerns about further price corrections. Yet, for longer-dated expiries, traders continue to place significant bets on the upside. Open interest has been strong around 120K and 110K strikes for March, while for even further expiries, we saw speculative interest extending toward 150K and beyond.

It appears that the Bitcoin market is approaching a decision point—whether it breaks past 100K into new all-time highs or faces deeper corrections. The coming weeks will provide more clarity, and we’ll continue to track these developments in the next editions of Outlook.

Disclaimer

This report is for informational and analytical purposes only and should not be considered financial advice, investment recommendations, or a trading signal. The Bitcoin options market is highly volatile, and market conditions can change rapidly. Any probabilities, trends, or interpretations discussed in this outlook are based on current data and do not guarantee future performance.

Readers should conduct their own due diligence and consult with a qualified financial professional before making any investment or trading decisions. The authors and publishers of this report are not responsible for any financial losses incurred from actions taken based on the information provided.