Introduction

The options market is a treasure trove of insights—not just about price speculation, but about how traders structure risk and reward based on their market outlook. Recently, our Market Screener detected a significant options trade—a Long Call Ladder strategy—executed with a 300 BTC volume. This structured position stood out, not just for its size but for the clear market expectations it reflects.

In this blog, we break down the strategy, simulate its risk-reward profile, and compare it to alternative setups like a simple long call or call spread. We’ll explore the key trade-offs—from cost efficiency to the potential for unlimited loss—and what this setup tells us about the trader’s outlook on Bitcoin’s price trajectory.

By the end of this analysis, you’ll gain a deep understanding of how a Long Call Ladder works, when it might be used, and the risks traders must carefully consider before deploying it in the market.

A Ladder in Market Screener

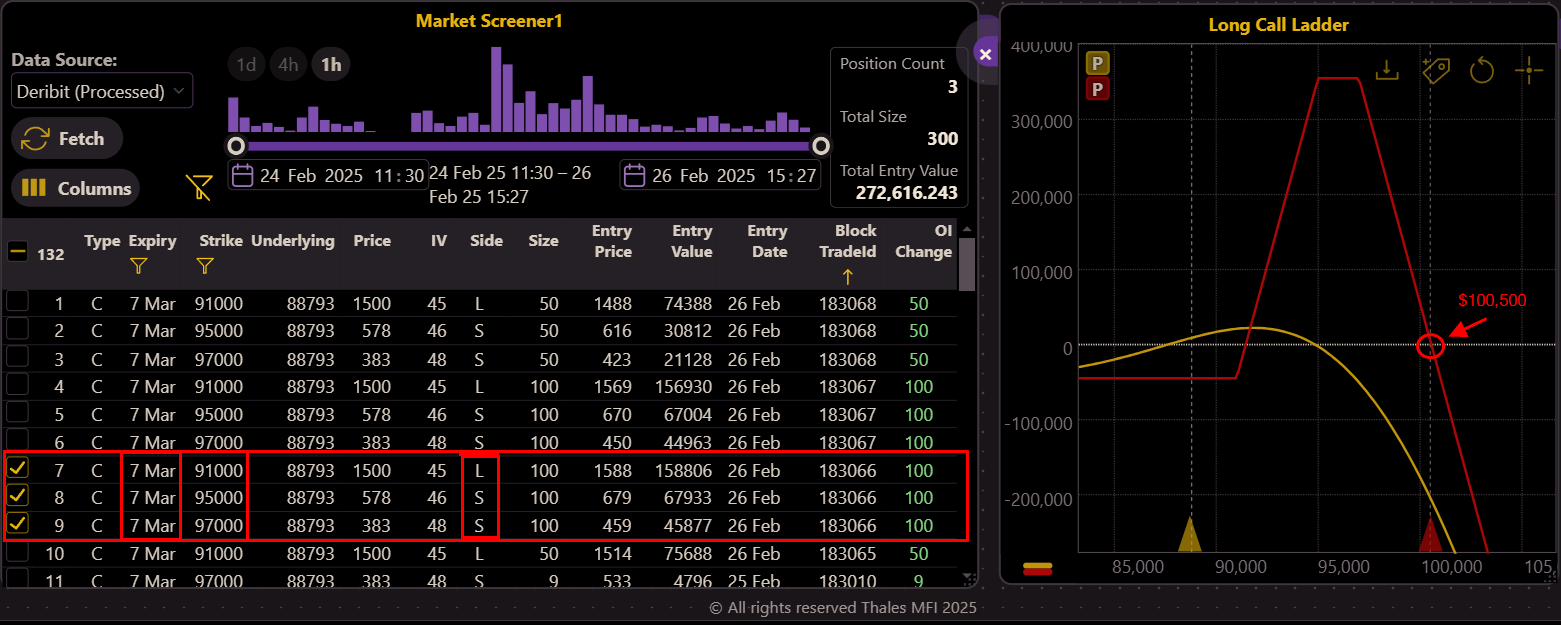

In The Market Screener, we recently detected an interesting options strategy—a Long Call Ladder—executed by a trader with a volume of 300 Bitcoin.

(OSS)

The position consists of three legs:

- Long 100 call contracts at the $91,000 strike

- Short 100 call contracts at the $95,000 strike

- Short 100 call contracts at the $97,000 strike

All options in this setup share the same expiration date—March 7—indicating a near-term outlook. The trader initiated this position when Bitcoin was around $88,000, structuring a bet on a defined price movement within a short timeframe.

What is a Long Call Ladder?

(OSS)

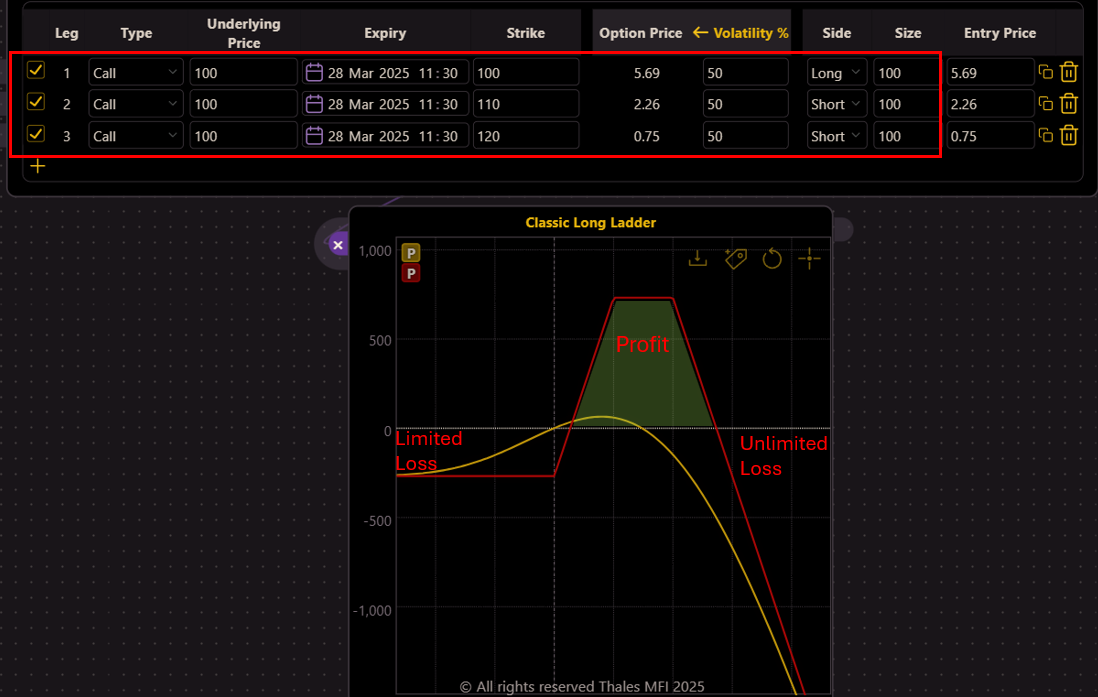

To understand the mechanics of this strategy, we have simulated a typical long call ladder.

- It consists of a long at-the-money (ATM) call (Leg 1)

- A short out-of-the-money (OTM) call (Leg 2)

- An additional short, more OTM call (Leg 3).

As shown in the PnL graph, the strategy is bullish but within a limited range. Initially, as the underlying price increases, the trade becomes profitable. However, due to the negative delta of the two short calls outweighing the positive delta of the long call, at a certain price level, the strategy transitions into unlimited loss.

Simulating the Trader’s Long Call Ladder

(OSS)

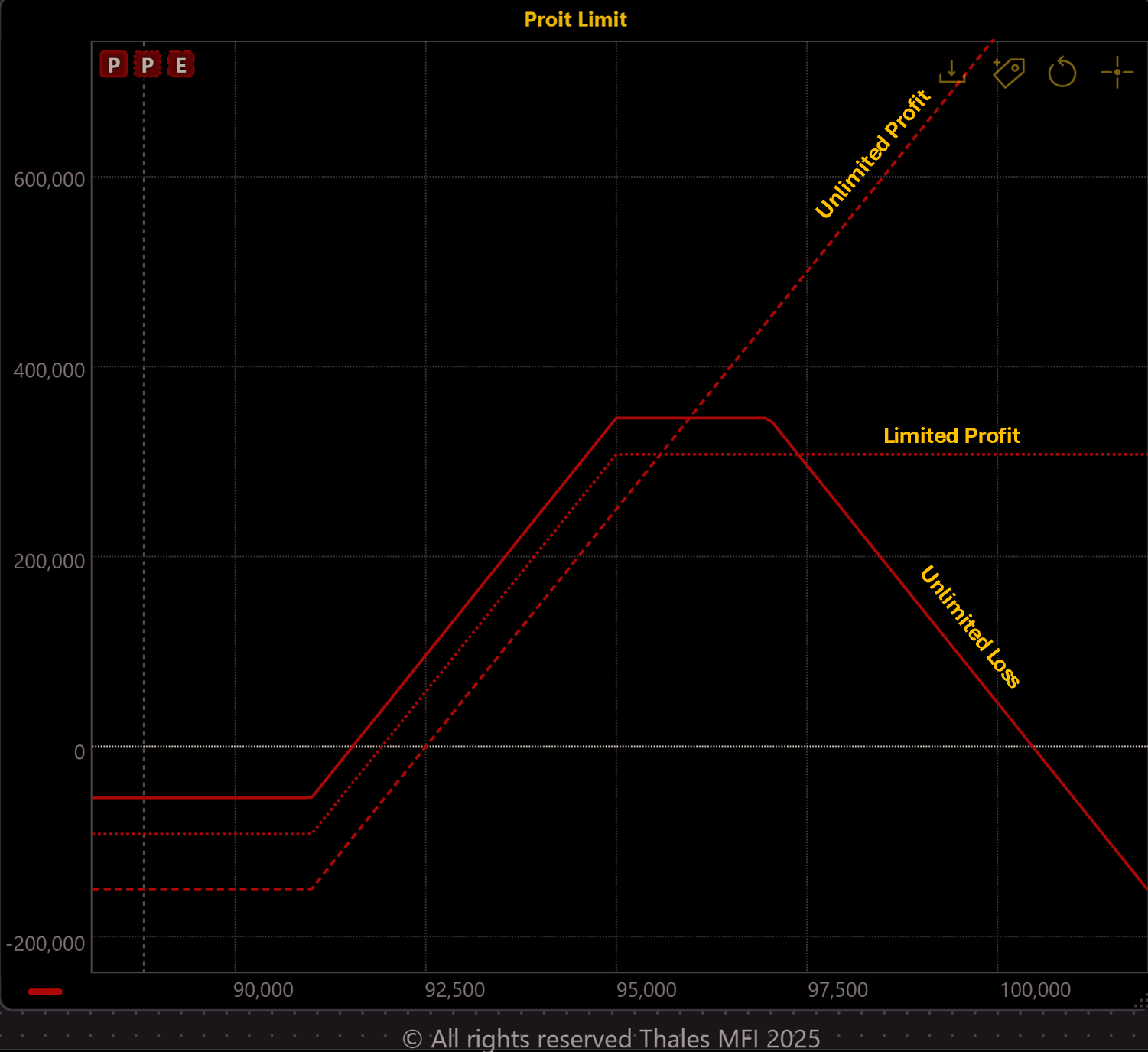

In the Strategy Builder, we have replicated the Long Call Ladder strategy we initially detected in the Market Screener. The solid line represents the PnL curve of the original ladder strategy. To enhance our comparison, we have overlaid two additional components separately:

- Leg 1 (Dotted Line): A single long call option.

- Leg 1 + Leg 2 (Dotted Line): A basic Long Call Spread, which consists of a long call and a short call.

At first glance, the initial cost difference is evident. The single call requires the highest premium, making it the most expensive to enter. The call spread reduces this cost by incorporating a short leg. Finally, the ladder strategy has the lowest initial cost, as it includes an additional short leg that further offsets the premium.

Trade-Offs

(OSS)

While the Long Call Ladder had the lowest initial cost and the least downside risk compared to the Long Call Spread and Single Call, this advantage comes at a cost. The graph clearly illustrates this risk-reward trade-off:

- Single Call: The most expensive upfront but offers unlimited profit potential as Bitcoin's price rises.

- Call Spread: Reduces cost by selling an OTM call, but in return, profits are capped beyond the short strike.

- Ladder Strategy: Further minimizes cost by adding another short call, but introduces unlimited loss if Bitcoin surges far beyond expectations.

Delta Shifts & Price Sensitivity

(OSS)

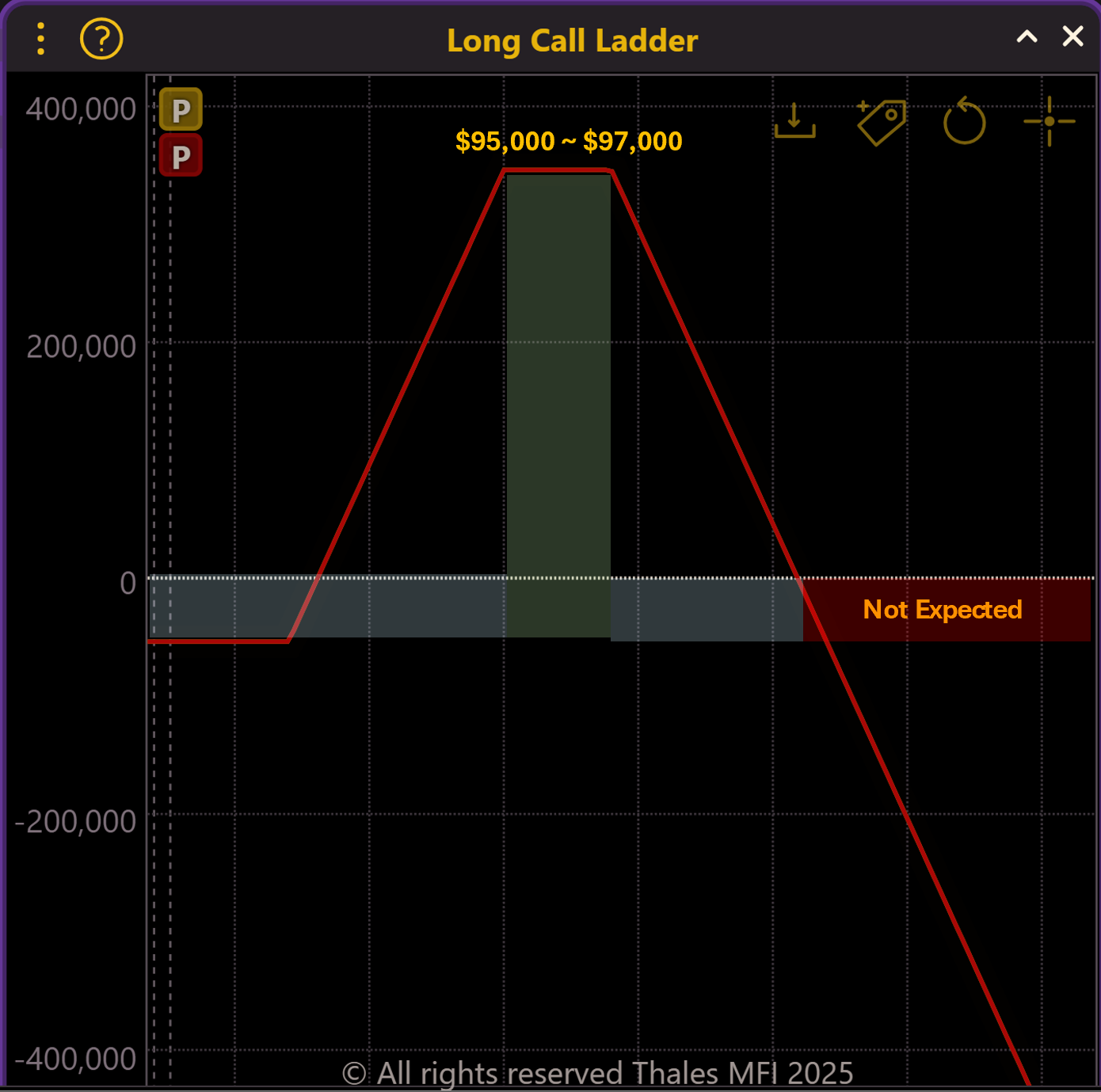

Now, let’s analyze how this strategy reacts to price movements and compare it with the alternatives by overlaying Delta at expiration (yellow) onto the PnL curves (red).

- Below $91,000, all three strategies have a Delta of 0, meaning they are unaffected by Bitcoin’s price movements.

- Between $91,000 and $95,000, the Delta is 100 for all strategies, making them equally sensitive to price increases. Interestingly, during this range, the Long Call Ladder achieves the same exposure at a lower cost than the other two strategies.

- Between $95,000 and $97,000, the Delta of the Call Spread and Call Ladder drops to 0, meaning they stop benefiting from further price increases, while the Long Call continues gaining at $100 per $1 increase in Bitcoin.

- Beyond $97,000, the Call Ladder's Delta flips to -100, meaning each $1 increase in Bitcoin now results in a $100 loss. It continues losing until it reaches its breakeven at $100,000, after which the losses theoretically extend indefinitely as it goes down the Ladder!

A Precision Trade: Targeting a Narrow Range

Now, we can characterize this strategy as a point missile, precisely aimed at a price range between $95,000 and $97,000 by expiry. Given the near-term expiration and significant trade size, such strategies deserve close attention.

However, it’s important to note that this is not a purely bullish strategy. If the trader had been confident in a strong price increase, a simple long call or call spread would have been a better choice. Instead, the Long Call Ladder carries substantial risk if Bitcoin rises too high, as we previously examined.

Ignoring delta-hedging tactics for now, this structure suggests that the trader does not expect Bitcoin to break above $97,000. By selling twice as many calls as purchased, they effectively reduce their initial cost and limit downside risk if Bitcoin fails to rally. Instead of an outright bet on upside, the trader is taking a conditional chance—profiting only if Bitcoin lands in the targeted range by expiry.

Bottom Line

The Long Call Ladder is a nuanced strategy—not just a bullish bet but a targeted wager on a specific price range. While its lower initial cost makes it an attractive alternative to a simple long call or call spread, its trade-off is the potential for unlimited loss if Bitcoin rallies too far.

In this case, the trader’s positioning suggests a controlled expectation—Bitcoin reaching between $95,000 and $97,000 by expiry but not exceeding it. This strategic structuring highlights how options traders can fine-tune their positions, balancing risk, cost, and probability to match their market outlook.

With expiry approaching, all eyes will be on Bitcoin’s price action—will it land within the target zone or break out beyond expectations?

Disclaimer

This blog is for informational and educational purposes only and should not be considered financial or investment advice. Options trading carries significant risk, and traders should conduct their own research and consult with a financial professional before making any trading decisions. The strategies discussed are based on observed market data and do not guarantee future performance.