Call Options: A Smart Strategy for High Returns with Low Risk

All the simulations are available inThales Options Strategy Simulator.

The Challenge of Financial Markets

Navigating the financial markets often feels like navigating a stormy sea, where maximizing returns without significant risk is a constant challenge. Traditional stock buying demands substantial capital and brings the anxiety of unlimited risk if prices plummet. Enter Long Call option—a strategic solution offering high returns with minimal investment and capped risk. The options market opens up specific opportunities for traditional traders, and even the simplest strategy, like buying a call option, can unlock new avenues for profit. We'll explore the humble strategy, with more advanced strategies to come in future blogs.

How Call Options Work

Call options grant you, as holder of the contract, the right, but not the obligation, to purchase an underlying asset at a predetermined price (Strike Price) before or at a specified date (Expiry) for a reasonable price (Premium). This setup lets you profit from price increases without committing large sums upfront. To better understand the potential benefits, let's use Bitcoin as an example. Imagine you expect Bitcoin, currently at $60,000, to rise. Instead of buying Bitcoin directly, you purchase a call option for $5,000 with a strike price of $60,000 and an expiry of four months. (we use this example for the following scenarios below.)

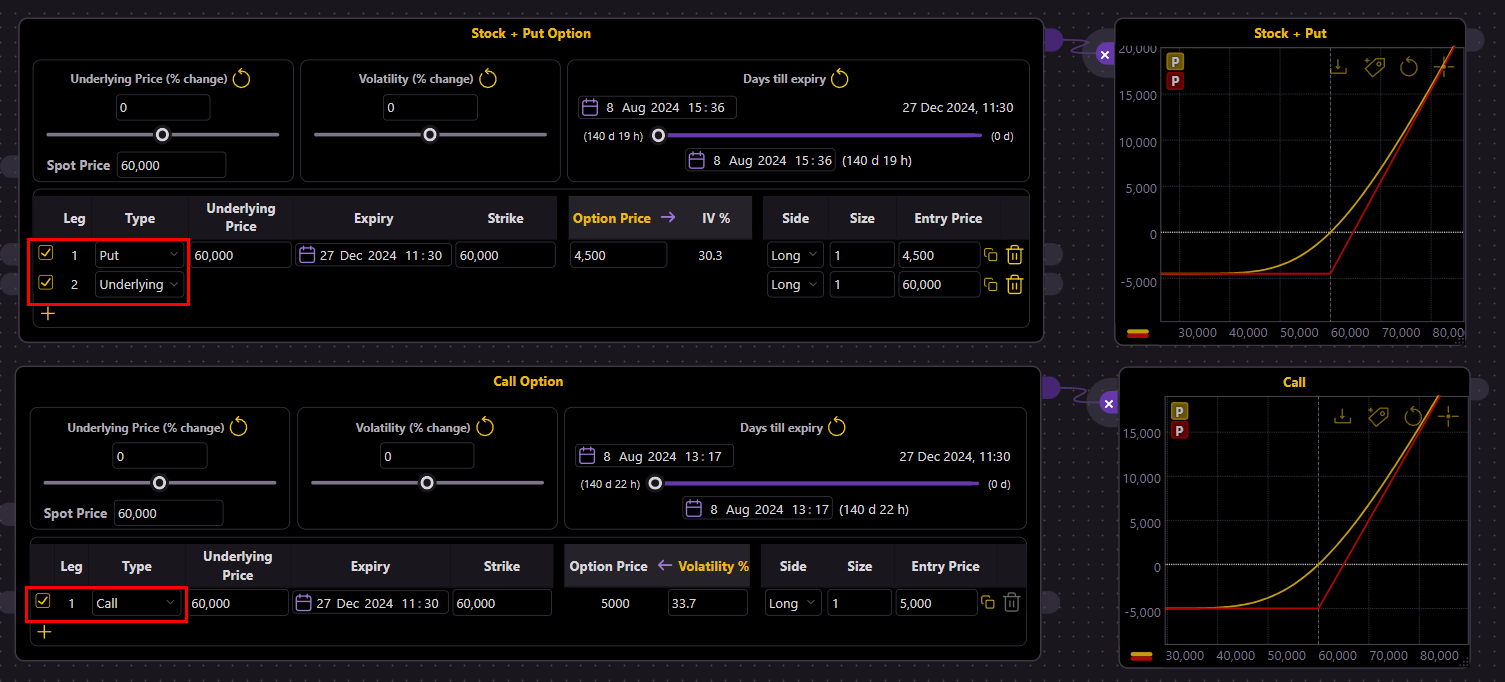

C = S + P

When you buy a call option, it is essentially like buying the stock and a put option to insure it. This is represented by the formula C = S + P, where C is the Call option, S is the Stock, and P is the Put option. This means that for a relatively small premium being paid, you gain the potential upside of the stock while protecting yourself against significant downside risk.

(simulation 🔗)

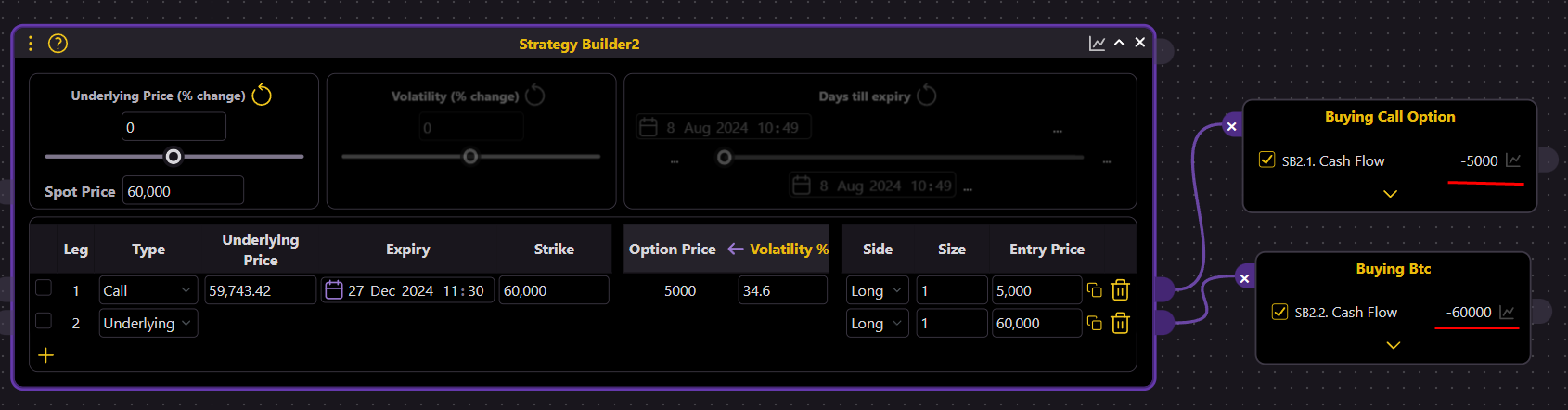

Simple Long Call allows you to control a large position with a smaller investment.

(simulation 🔗)

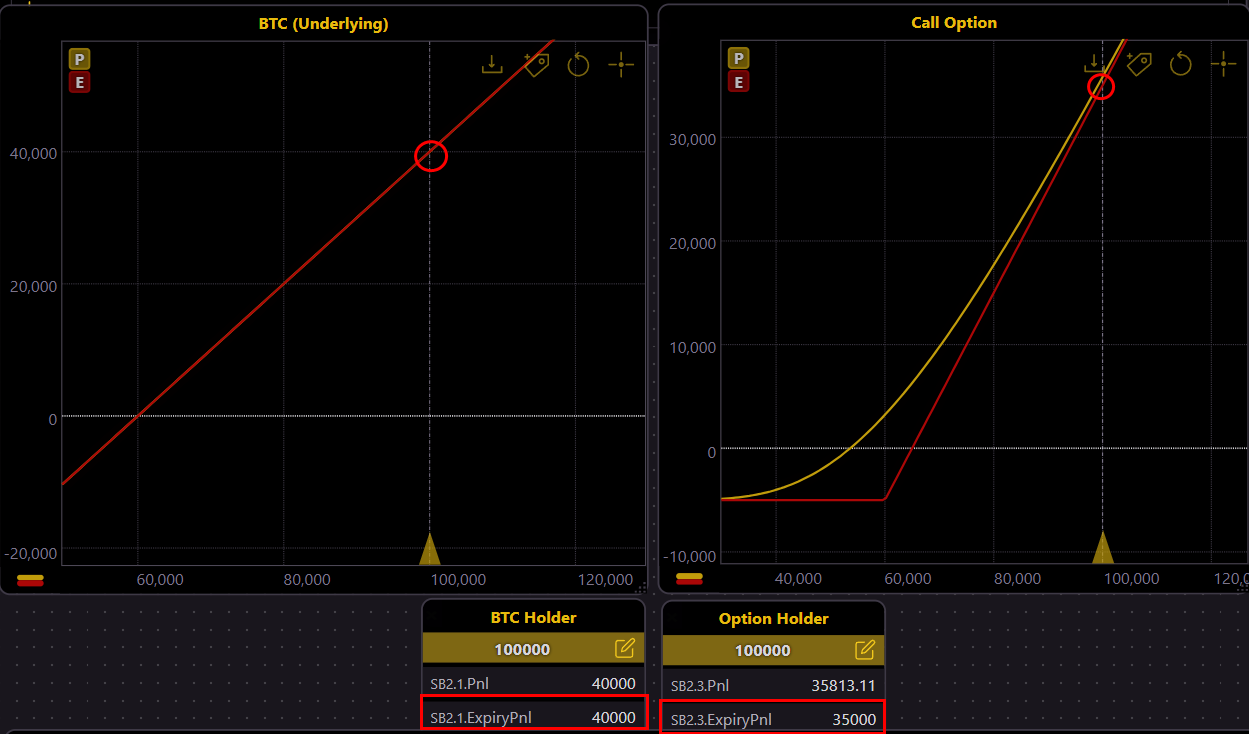

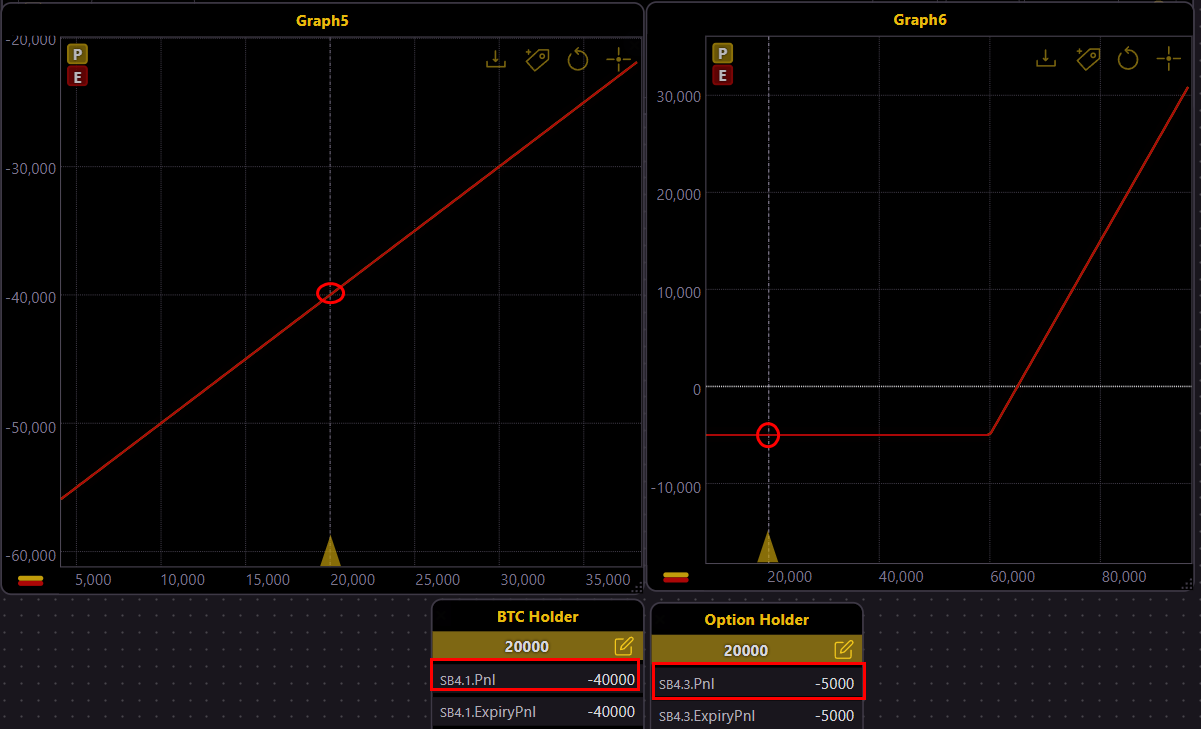

If Bitcoin's price soars to $100,000, both the Bitcoin holder and the call option holder gain around the same profit ($40,000 for the Btc holder and the same amount minus the Premium paid for the Option holder). However, if the price drops to, say, $20,000, the Bitcoin holder faces a $40,000 unrealized loss, while the call option holder’s loss is limited to the premium.

Visualizing the Strategy with OSS

Thales Option Strategy Simulator (OSS) helps visualize this strategy. Using OSS, you can see how a call option mimics an insured stock position, providing exposure to potential gains while limiting downside risk.

To illustrate this, let's consider two scenarios: Bitcoin's price rising to $100,000 and Bitcoin's price falling to $20,000.

Scenario 1: Bitcoin Rising to $100,000

Having the same example, imagine the price of Bitcoin reaches $100,000 at expiry of the call option. In this case, the call option shows a profit near to holding underlying (Btc) with the same size. The scenario is simulated by OSS:

(simulation 🔗)

Scenario 2: Bitcoin Falling to $20,000

Now, imagine at expiry, the price of Bitcoin falls to around $20,000. The Bitcoin holder would lose approximately $40,000, while the call option holder’s loss is limited to the $5,000 premium:

(simulation 🔗)

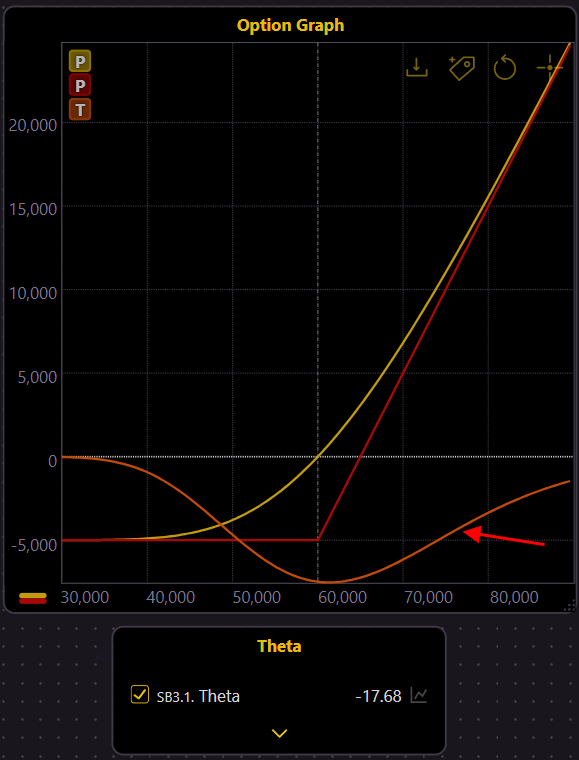

Time Decay (Theta)

Up until here, we were talking about the PnL at the expiry of the call option contract. However, it's worth mentioning that the contract itself has a time value (other than its possible intrinsic value). For the holder of the contract, this extrinsic value decreases each day due to time decay, technically referred to as Theta. This means that the passage of time gradually erodes the time value of the call option. (we will discuss this subject more on later blogs.) This parameter also can be displayed by OSS.

(simulation 🔗)

Risk

It's crucial to acknowledge the risks of buying call options. If the underlying asset's price does not change significantly or moves against your expectations, the call option can expire worthless, and you lose the premium paid. This is a vital consideration when planning your strategy.

Last word

Comparing this simple option strategy with traditional asset holding reveals significant advantages. Holding assets ties up capital and carries greater risk. Buying call options offer high leverage and limited risk, making them attractive for risk-tolerant investors.

In conclusion, call options can be your secret weapon for navigating market movements with finesse, offering the thrill of high returns while keeping risks in check. Why not add this strategy to your trading playbook? With tools like the Thales Option Strategy Simulator (OSS), you can experiment and fine-tune your approach before diving in. So, give it a try—your future self might just thank you with a knowing smile. Happy trading!

Disclaimer

The content provided in this blog is for informational and educational purposes only and should not be considered financial or investment advice. Trading options carries significant risk and may not be suitable for all investors. The examples provided are hypothetical and are not guarantees of future results. Always consult with a qualified financial advisor before engaging in any trading strategies, including the use of call options. Simulations were created using Thales Options Strategy Simulator (OSS) and are intended to illustrate potential outcomes but may not reflect actual market conditions. It’s essential to fully understand the risks involved before participating in the market.