Introduction

Options trading is more than just selecting a strategy—it’s about managing risk dynamically as market conditions evolve. While some traders prefer to establish a position and wait, experienced traders continuously adjust their exposure to ensure their strategies remain aligned with shifting market dynamics.

One of the most effective ways to introduce this flexibility is through morphing, a technique that allows traders to modify an existing position rather than closing and rebuilding it. Morphing can be applied to some options strategies, providing an efficient way to shift risk and reward characteristics without fully resetting a trade.

In this blog, we introduce the Condor strategy, a four-leg structure that benefits from a stable market. We explore how it can be constructed using either call spreads (Call Condor) or put spreads (Put Condor) and demonstrate that their payoff structures are identical. We then compare these strategies to the Short Iron Condor, a widely recognized approach that incorporates both calls and puts.

Finally, we examine how traders can morph these strategies—modifying their positions with a simple adjustment to shift their market bias. Using examples from Bitcoin options, we illustrate how a neutral Condor or Iron Condor can be transformed into a bullish or bearish trade in response to changing conditions. By the end of this discussion, you’ll see how morphing acts as a powerful risk management tool, offering flexibility without requiring a complete restructuring of a position.

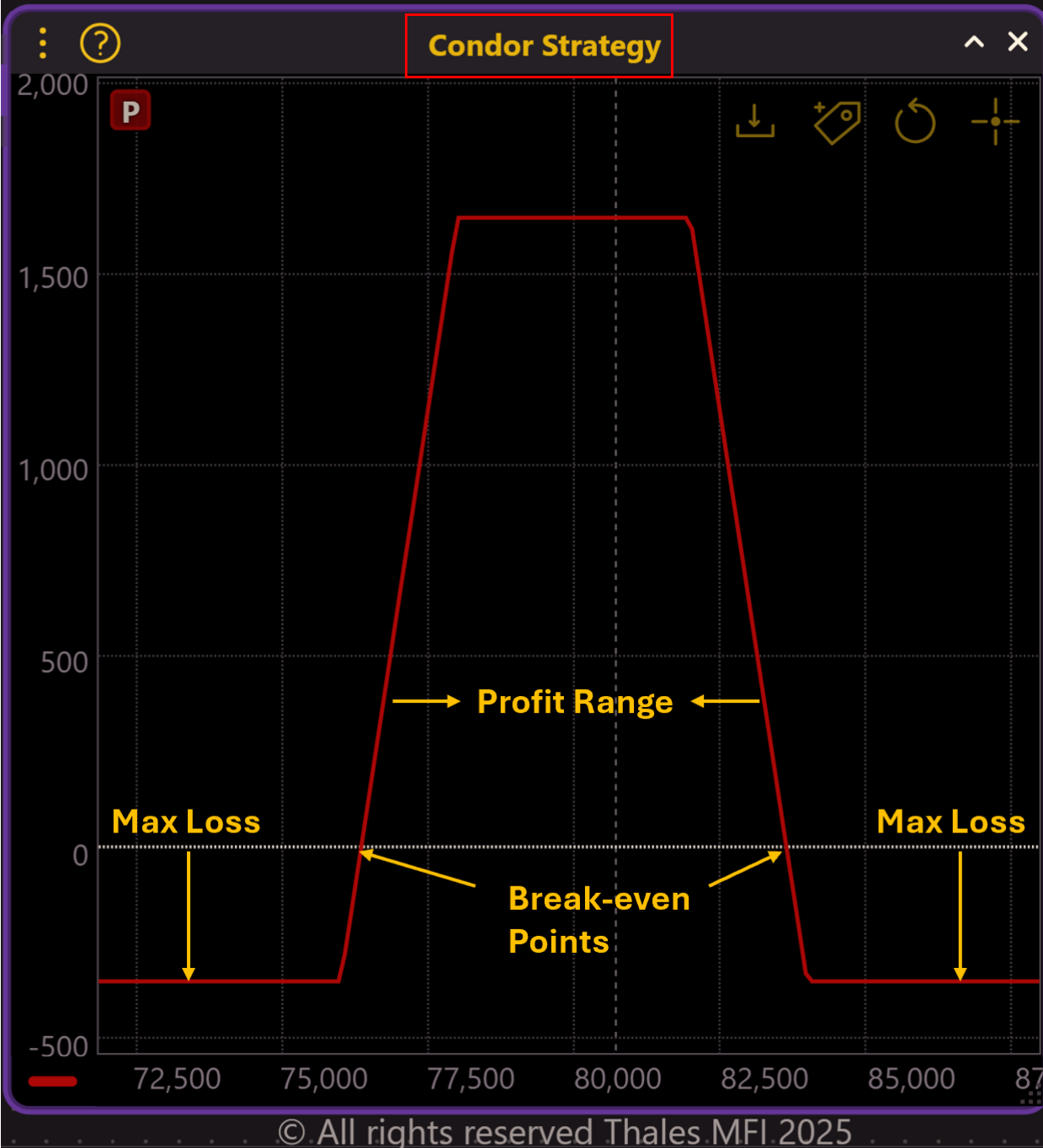

The Condor Strategy: A Range-Bound Approach

(OSS)

A Condor is a four-leg options strategy structured to profit when the underlying price stays within a specific range. It is composed of two vertical spreads:

- A debit spread, which requires an initial cost.

- A credit spread, which offsets some of that cost.

The strategy is typically deployed when traders expect low volatility and believe the price will remain stable.

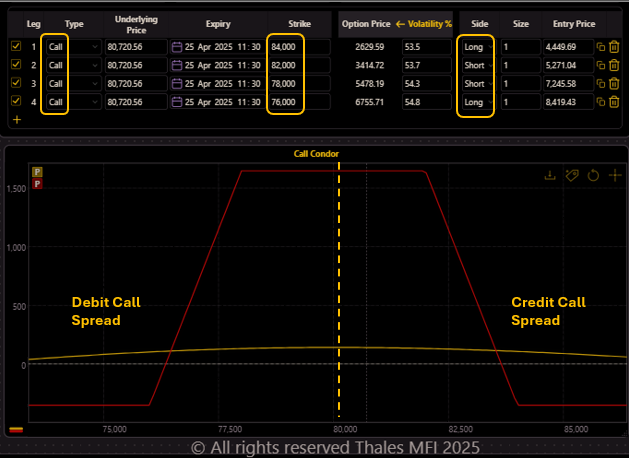

Call Condor: A Neutral Strategy Built with Calls

(OSS)

In our Bitcoin options example, a Call Condor is constructed using four call options at different strike prices:

- Buy 76,000 Call

- Sell 78,000 Call

- Sell 82,000 Call

- Buy 84,000 Call

At the time of entry, Bitcoin is priced at $80,000, making these strikes strategically placed around the current market price.

The debit call spread (76,000–78,000) represents the lower portion of the structure, while the credit call spread (82,000–84,000) forms the upper part.

✅ Maximum profit occurs if Bitcoin remains between $78,000 and $82,000 at expiration.

✅ Maximum loss is limited to the net premium paid if Bitcoin moves beyond the breakeven points.

✅ Best suited for low-volatility environments where Bitcoin is expected to stay within a range.

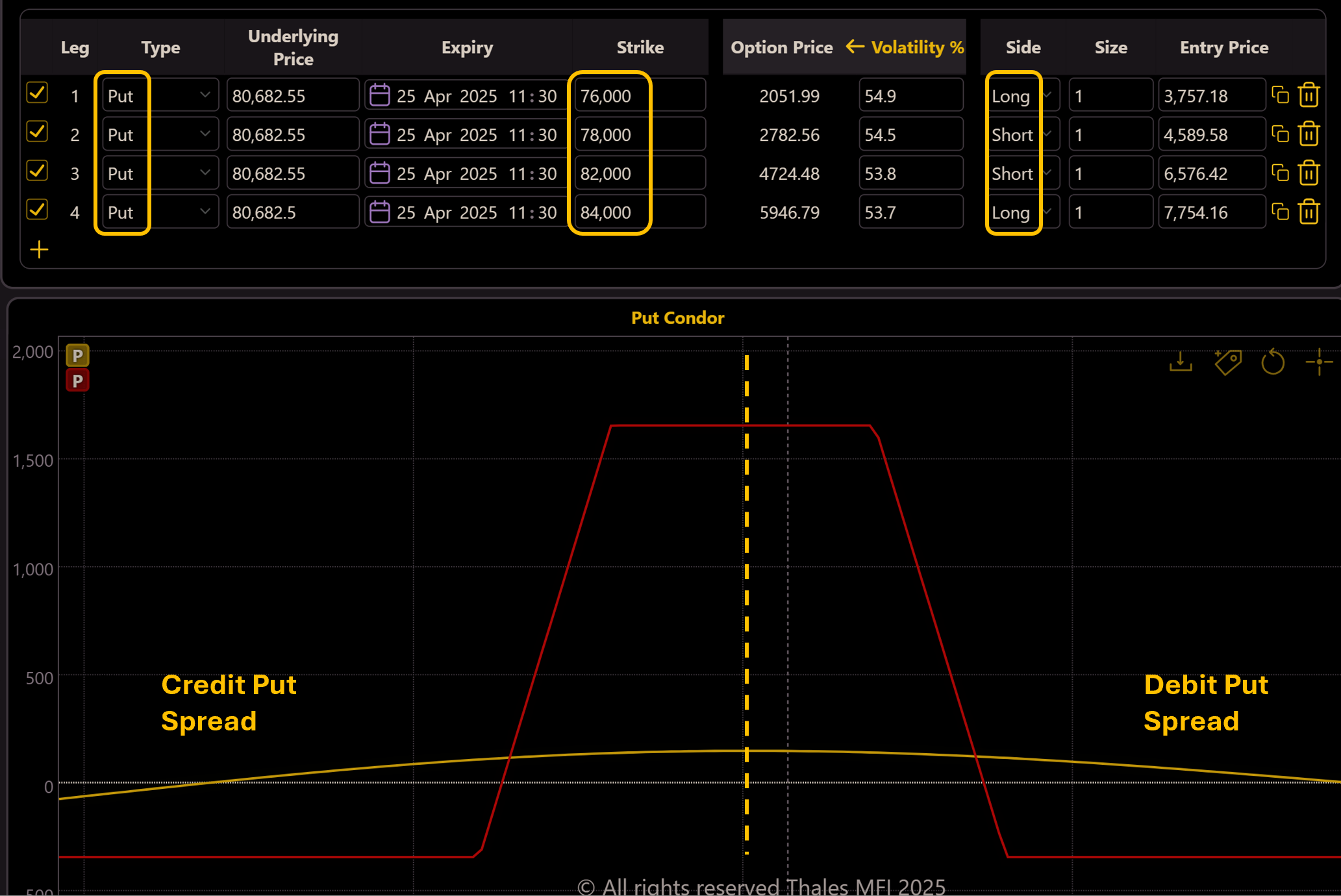

Call vs. Put Condor: Identical Structures, Different Components

The same Condor structure can be created using put options instead of calls. The result? A Put Condor, which has an identical risk-reward profile.

(OSS)

In our Bitcoin example, the Put Condor consists of:

- Sell 78,000 Put

- Buy 76,000 Put

- Sell 82,000 Put

- Buy 84,000 Put

Since both Condors share the same risk profile, the choice between calls and puts depends on factors like liquidity, implied volatility skew, and trading costs.

Key Takeaway: Regardless of whether a trader chooses calls or puts, the payoff structure remains identical. The decision is based on execution preferences and market conditions.

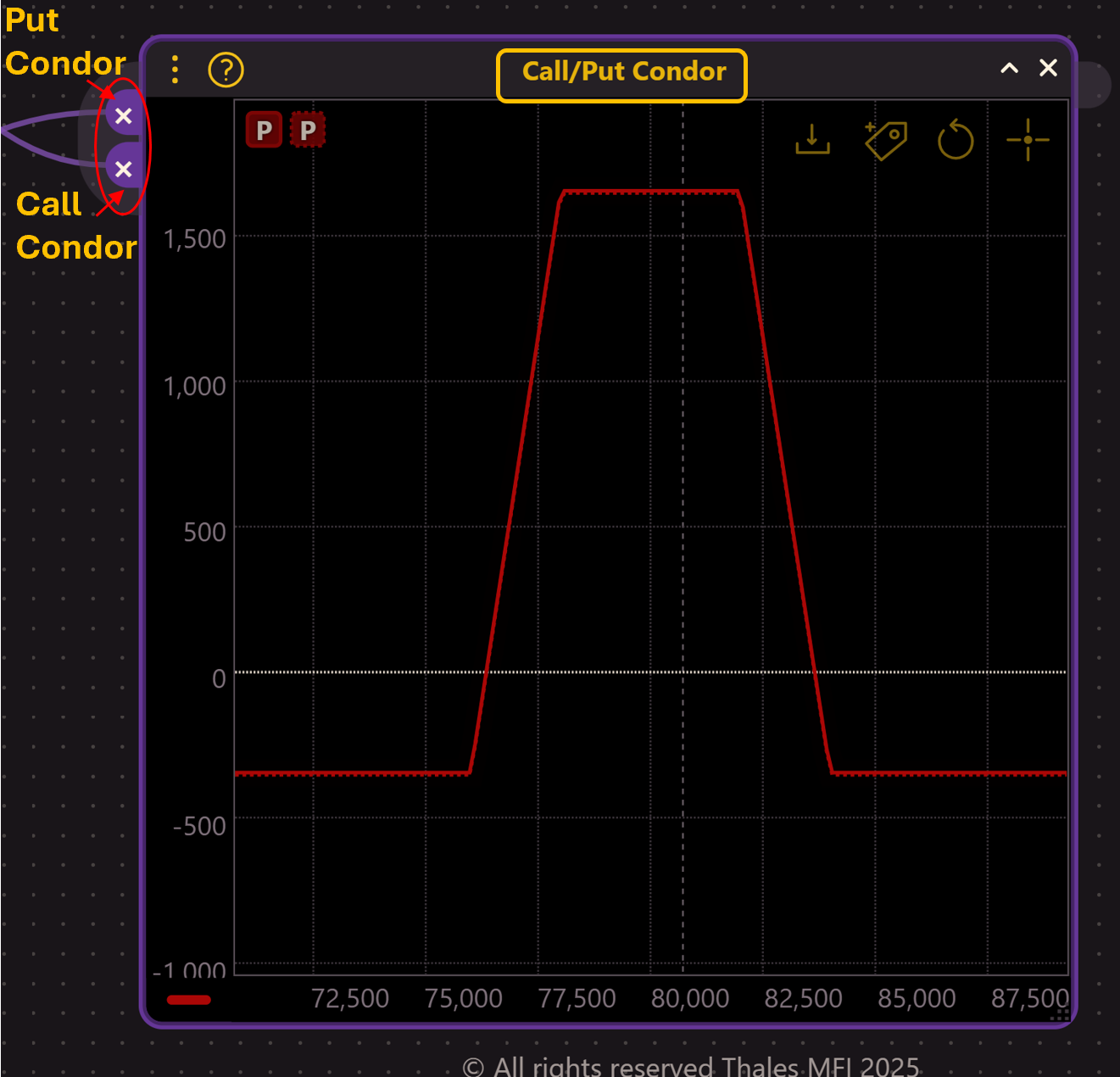

The Iron Condor: Combining Calls and Puts for Enhanced Flexibility

An Iron Condor is a variation that incorporates both calls and puts, making it a more versatile strategy. The term "Iron" in options trading indicates a spread that combines both types of options.

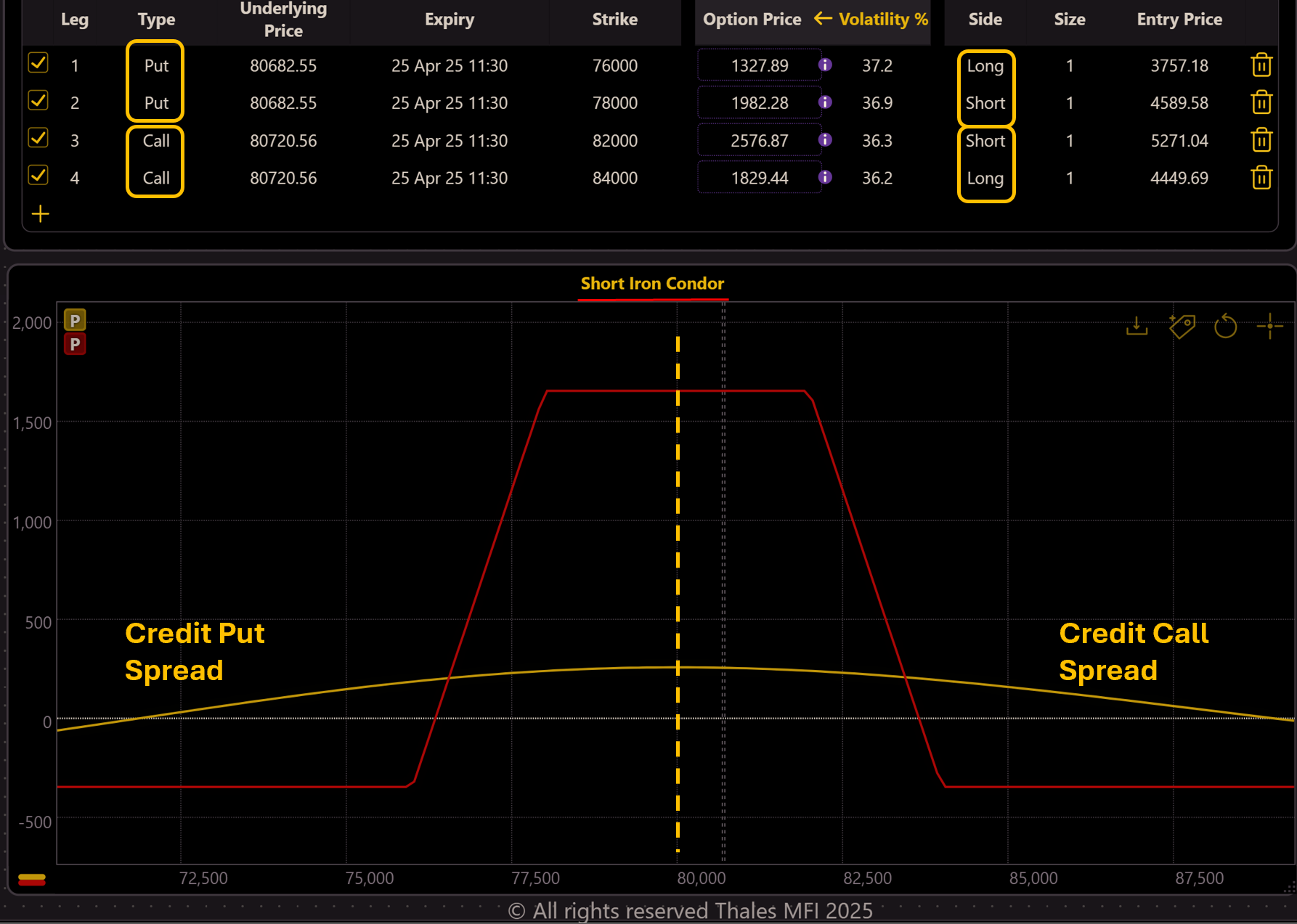

(OSS)

The Short Iron Condor is a neutral, net credit strategy that profits when the underlying asset—Bitcoin in this case—remains within a defined range. As shown in the chart, it is constructed using two credit spreads: a credit put spread on the left and a credit call spread on the right. This setup allows traders to collect premium while limiting risk.

The maximum profit occurs when Bitcoin stays between the two short strikes, ensuring that all options expire worthless. However, if Bitcoin makes a significant move beyond the breakeven points, the strategy incurs a limited but defined loss. Traders typically deploy this strategy when implied volatility is low and they expect minimal price fluctuations until expiration. While initially a passive trade, we will later explore how morphing can transform this structure into a more aggressive directional position.

Response to Market Shifts

Markets are unpredictable. What happens if Bitcoin breaks out of the expected range? A static Condor trader incurs a loss, but an adaptive trader morphs their position to align with the new outlook.

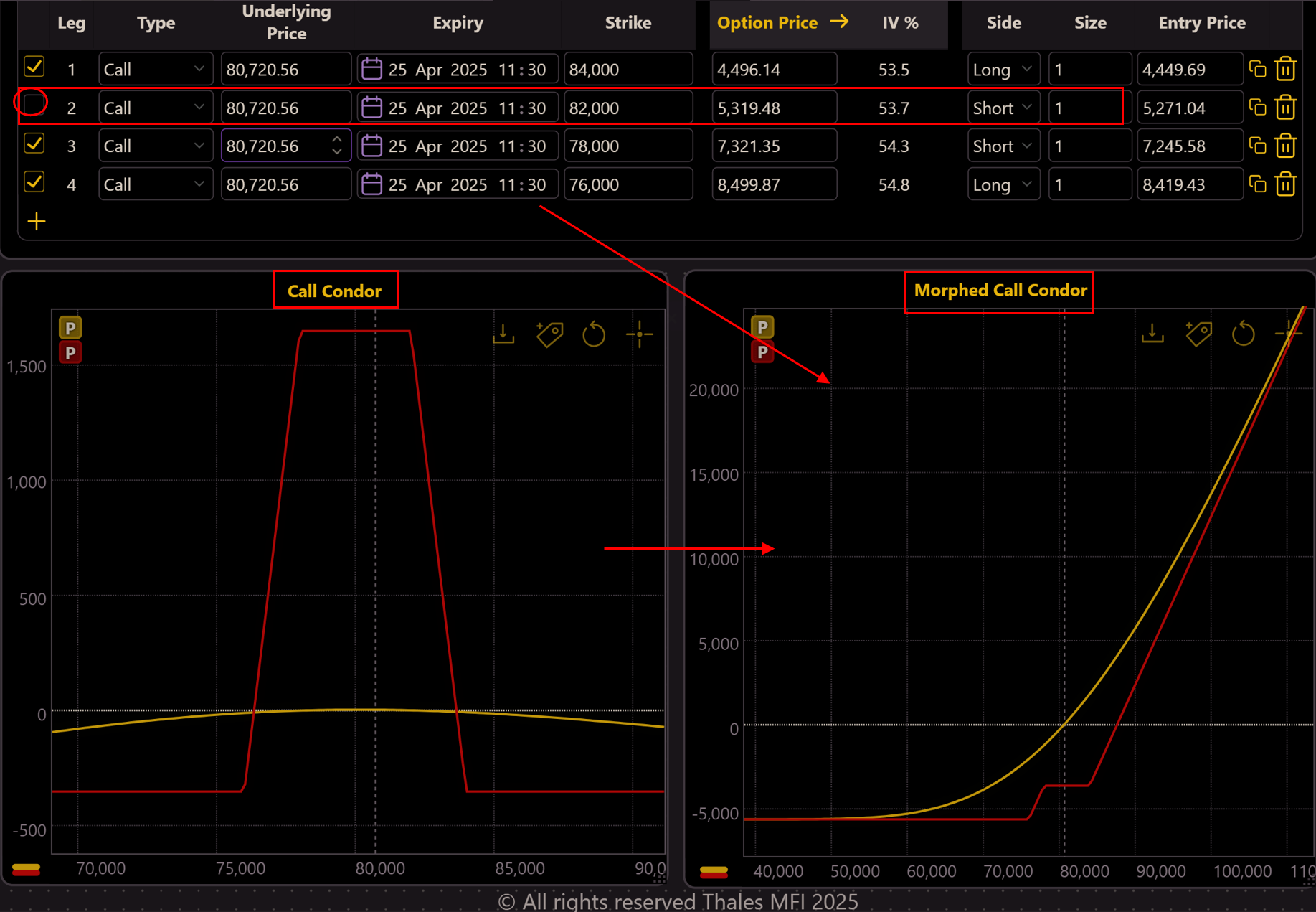

Morphing the Call Condor: A Shift to a Bullish Outlook

(OSS)

In the event that market conditions shift or the trader adopts a more bullish stance, the Call Condor has the built-in flexibility to evolve into a more directional strategy with just one simple modification. By closing the short call at the higher strike, the structure undergoes a fundamental change—removing the cap on profit potential.

As reflected in the PnL graph (above), once the short call is removed, the strategy mimics a long call position, where the trader benefits from an unlimited upside as Bitcoin's price increases. This ability to morph into a directional bet makes the Call Condor a dynamic tool, allowing traders to adjust their exposure without fully abandoning the original trade. Instead of exiting the position entirely and opening a new one, they can adapt in response to changing market conditions, preserving capital efficiency while aligning with a revised outlook.

Morphing the Put Condor: Adapting to a Bearish Outlook

(OSS)

If the market sentiment turns bearish or the trader decides to position for a potential downside move, the Put Condor can be transformed into a bearish strategy with just one adjustment. By closing the short put at the higher strike, the position is no longer capped on the downside, allowing the trader to profit from an extended decline in Bitcoin's price.

As shown in the PnL graph, once the short put is removed, the trade begins to resemble a long put position, where potential gains increase as Bitcoin's price falls. This morphing capability gives the trader flexibility without needing to exit and re-enter the market, making it a cost-effective way to adjust risk exposure. By strategically modifying the structure, the trader can seamlessly transition from a neutral to a bearish stance, ensuring that the position aligns with the evolving market outlook.

Iron Condor Morphing: Dual Flexibility

(OSS)

One of the key advantages of the Short Iron Condor is its dual flexibility—it can be morphed into either a bullish or bearish strategy with a single adjustment.

If the trader anticipates a bullish breakout, they can simply close the short call leg, leaving a long call in place. This transforms the position into a bullish trade with unlimited upside potential, similar to a long call (see the right graph above). Conversely, if the market outlook shifts bearish, the trader can close the short put, turning the position into a bearish trade with unlimited downside potential, resembling a long put (left graph above).

This dynamic flexibility makes the Short Iron Condor a powerful tool for traders who want to start with a neutral stance but remain ready to adapt quickly based on evolving market conditions.

Bottom Line: The Power of Adaptability in Options Trading

The Condor strategy is a structured, range-bound approach that traders can construct using either calls or puts, resulting in identical risk-reward profiles. The Short Iron Condor, a well-known strategy among options traders, introduces further flexibility by combining both call and put spreads to create a neutral, premium-collecting position.

However, options trading is not just about selecting a strategy—it’s about adapting to market changes. What starts as a neutral position does not have to remain static. Through morphing, traders can easily adjust their exposure, shifting from neutral to bullish or bearish with a simple modification.

Using Bitcoin options as a case study, we demonstrated how:

✅ A Call Condor can morph into a bullish strategy by closing a short call.

✅ A Put Condor can become a bearish trade by closing a short put.

✅ A Short Iron Condor offers dual flexibility, allowing traders to morph into either a bullish or bearish stance by removing a single leg.

Morphing enables traders to react rather than endure when markets move beyond expectations. It is a tool for active risk management, allowing traders to adjust their positions efficiently without the cost and complexity of restructuring their entire trade.

In the ever-volatile Bitcoin options market, where sudden price swings are the norm, the ability to morph a strategy is an invaluable edge—one that ensures traders remain in control rather than being caught off guard.

Disclaimer

This content is for educational purposes only and does not constitute financial advice. Options trading involves substantial risk, and traders should conduct their own research before executing trades.