Introduction

The Bitcoin options market is constantly evolving, with each expiry providing new insights into trader sentiment and positioning. While past expirations reveal how traders fared, upcoming expiries hold clues to where the market may be headed next. By analyzing open interest, implied volatility skew, and the latest trading activity, we gain a deeper understanding of how traders are structuring their bets—and, more importantly, their hedges.

In this outlook, we first assess the recently settled March 14 expiry, examining how it played out relative to expectations. We then shift our focus to the broader market, analyzing open interest trends across all expirations, before narrowing in on the most significant upcoming expiry—March 28. Most notably, we uncover the latest trades leading into this key date, revealing a pattern of hedging that hints at traders’ concerns and expectations for Bitcoin’s price by month-end.

Explore these market dynamics firsthand with the Thales Options Strategy Simulator (OSS)

Market Snapshot

March 14 Expiry Settled Below Max Pain

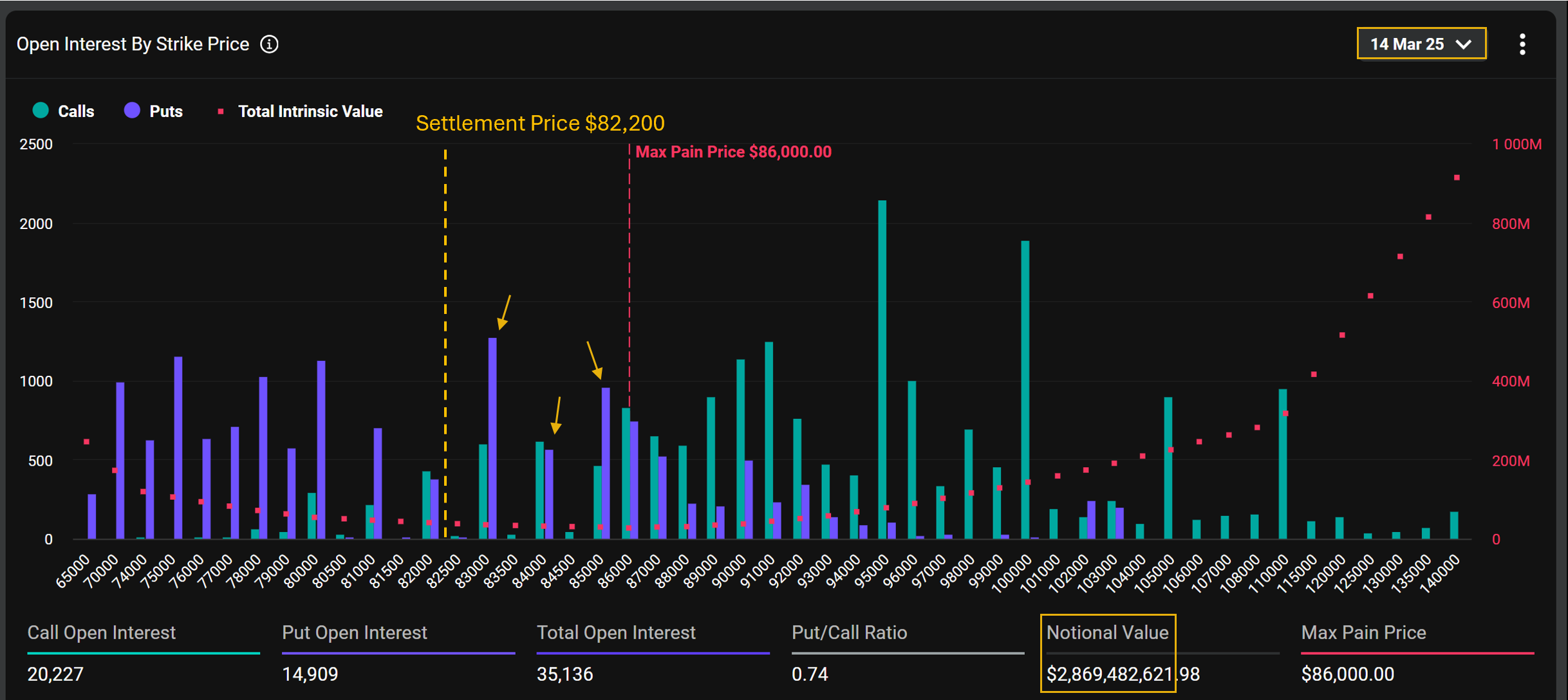

The 14 March expiry on Deribit saw over $2.8 billion in notional value settle at $82,200. Max Pain price stood at $86,000 leading into expiry. With the actual settlement falling well below this level, most call options expired out of the money (OTM), leaving call holders with worthless contracts. Conversely, put options with strikes at $83,000 and higher settled in the money (ITM), allowing holders to benefit from the downward move.

Big Picture

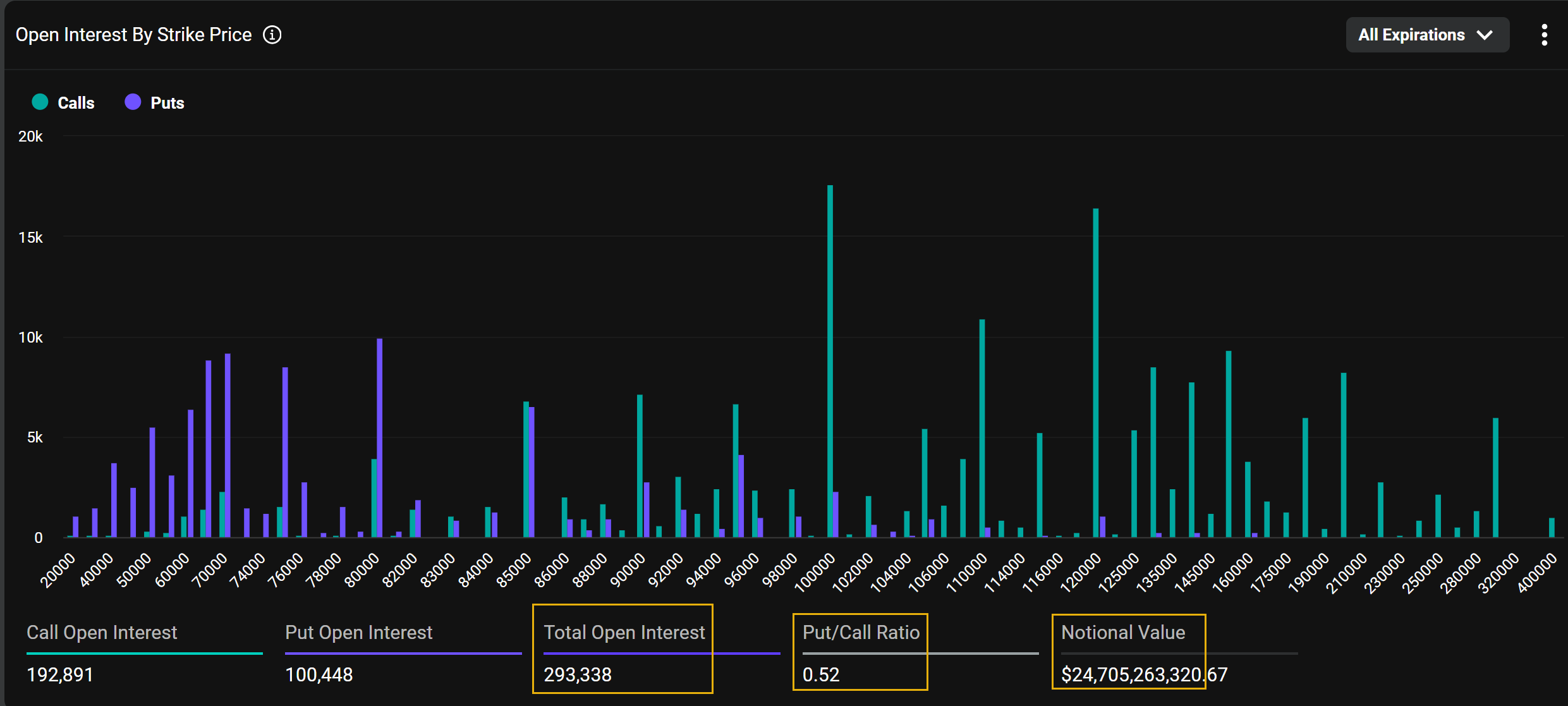

In a broader perspective, Bitcoin options open interest on Deribit currently stands at nearly 300,000 contracts, with a notional value of approximately $24.7 billion across all expirations. Notably, call open interest is nearly twice that of puts, with call positions at $100,000 and $120,000 strike prices standing out.

While the broader market structure remains normal to optimistic, shorter-term expirations still reflect signs of caution, with traders hedging downside risk.

Skew Toward Puts

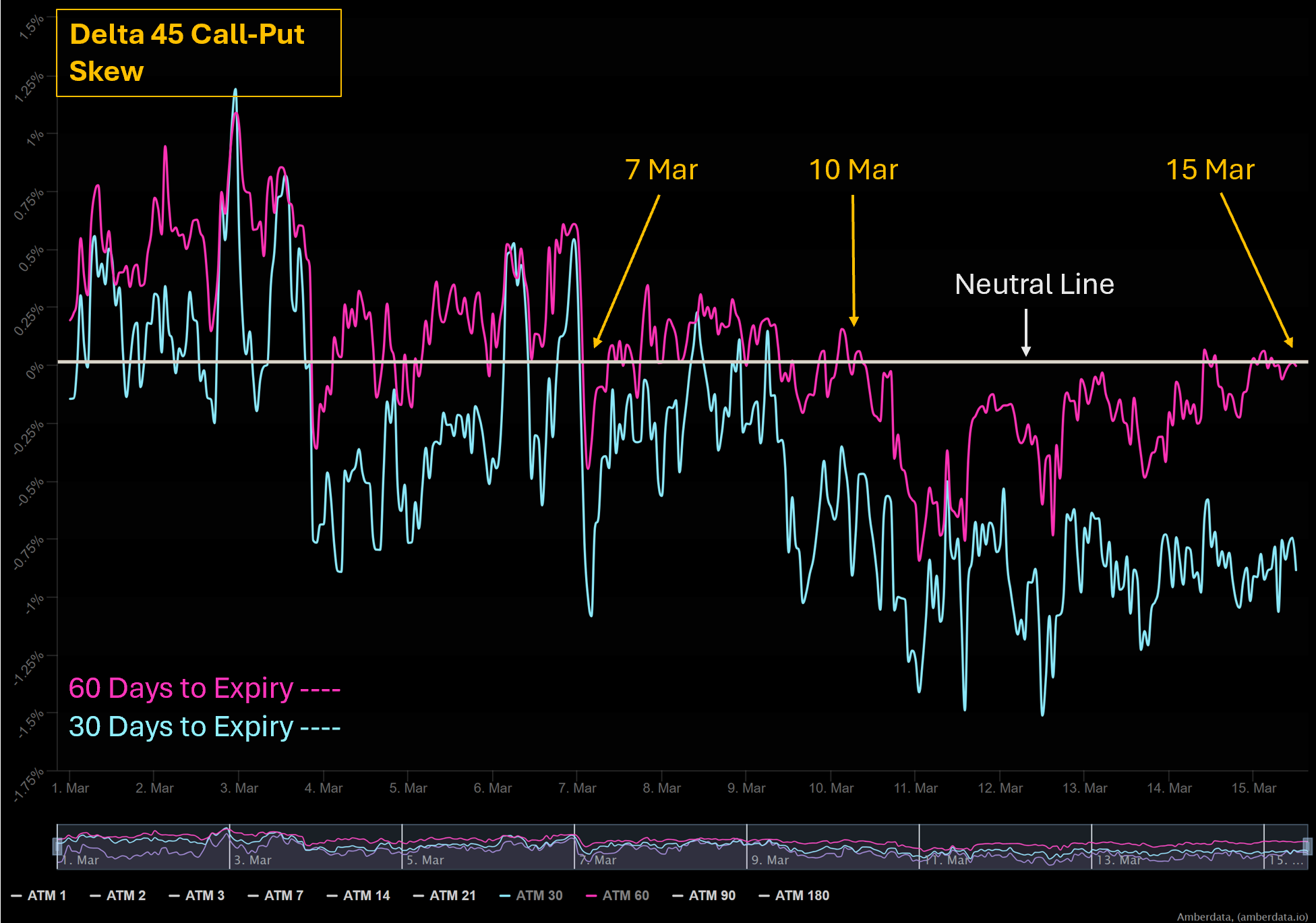

Recently, we have observed a relative increase in the put-call ratio, particularly in shorter-term Bitcoin options. This shift suggests a rising level of concern among market participants, aligning with key price movements. Notably, on March 7, Bitcoin dropped below $90,000, and by March 10, it tested the lower support level of $77,500. These events likely contributed to heightened hedging activity via put options.

One of the most reliable indicators of this sentiment shift is the implied volatility (IV) skew between calls and puts. The chart below tracks the Delta 45 Call-Put Skew for options with 30 days (short-term) and 60 days (medium-term) to expiry.

As evident in the graph:

- March 7: The 30-day skew dropped below zero, indicating that puts began trading at a premium relative to calls, reflecting increased demand for downside protection.

- March 10: The 60-day skew also turned negative, reinforcing a broader market concern beyond just short-term fluctuations.

Currently, 60-day options have reverted to a neutral stance, suggesting some stabilization. However, 30-day options remain in negative skew territory, signaling that short-term downside fears persist in the market.

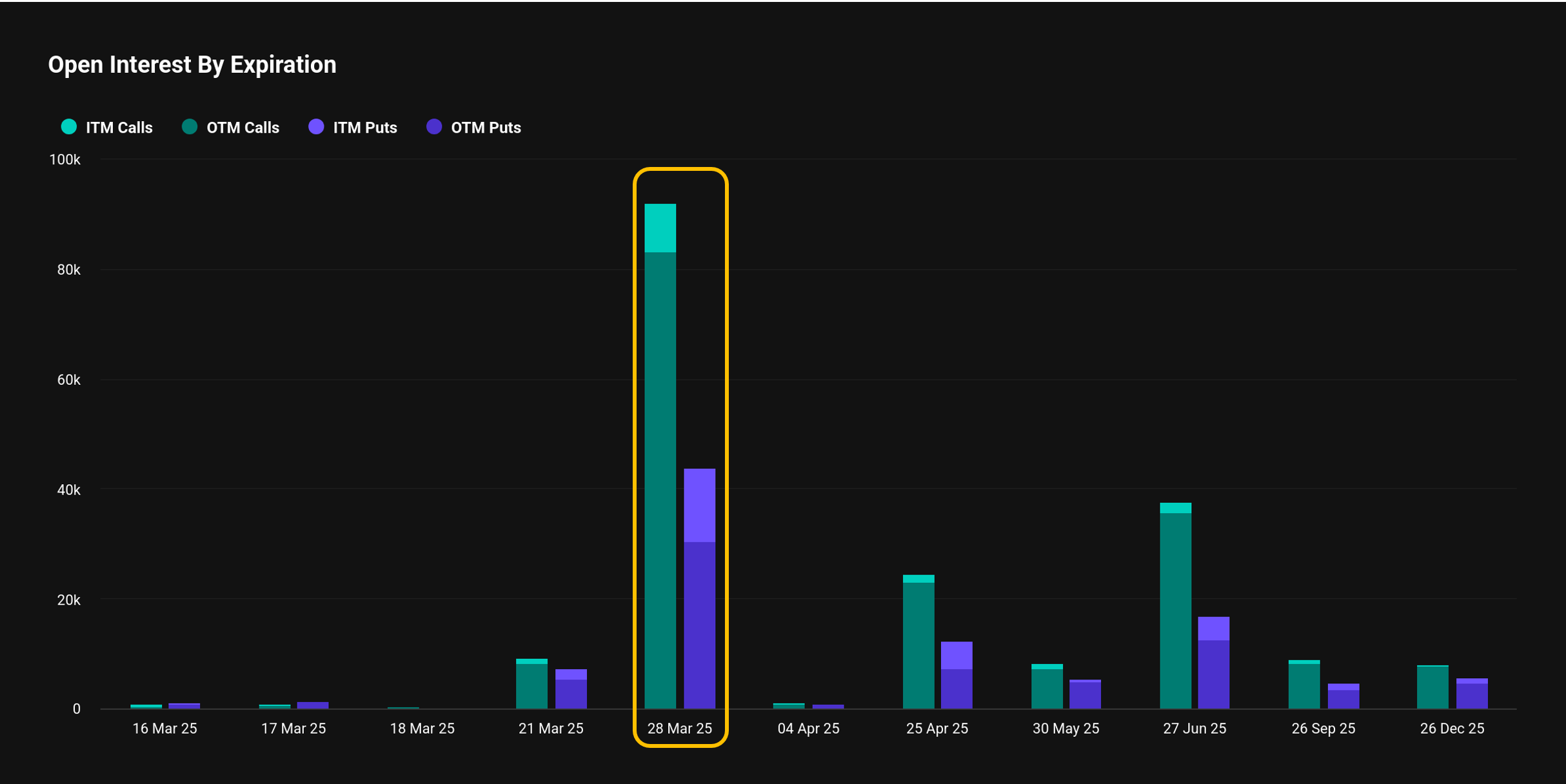

Eyes on March 28

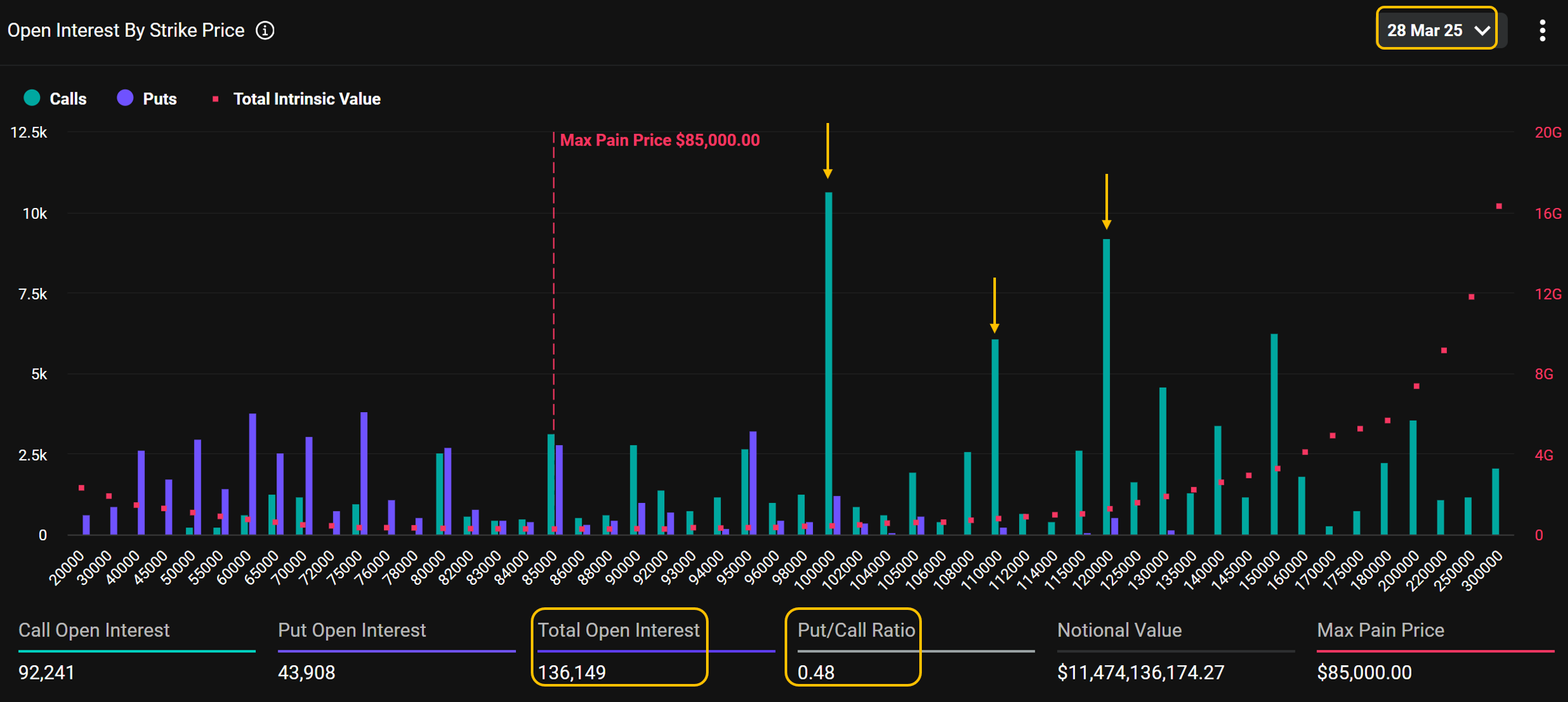

Among upcoming expirations, March 28 remains the dominant expiry, holding the highest level of open interest across all strike prices.

This concentration suggests significant positioning by traders, making it a key date to watch for potential market moves and volatility shifts.

With just under two weeks remaining until the March 28 expiry, this options cycle holds significant weight in the market, boasting a total open interest of 136,000 contracts on Deribit. A closer examination of the data reveals a strong bullish bias, with call open interest nearly double that of puts. Notably, traders have concentrated their positions at the $100,000, $110,000, and $120,000 strikes, signaling optimism for a potential upside move in Bitcoin’s price.

However, these call options currently sit far out of the money (OTM), and their fate hinges on Bitcoin’s ability to rally in the coming days. The max pain level—the price at which option sellers would experience the least payout—sits at $85,000, a safe distance from these bullish positions. Whether Bitcoin can close this gap remains uncertain, but this expiry warrants close attention, particularly if volatility increases and price action approaches these key strike levels.

Recent Activities

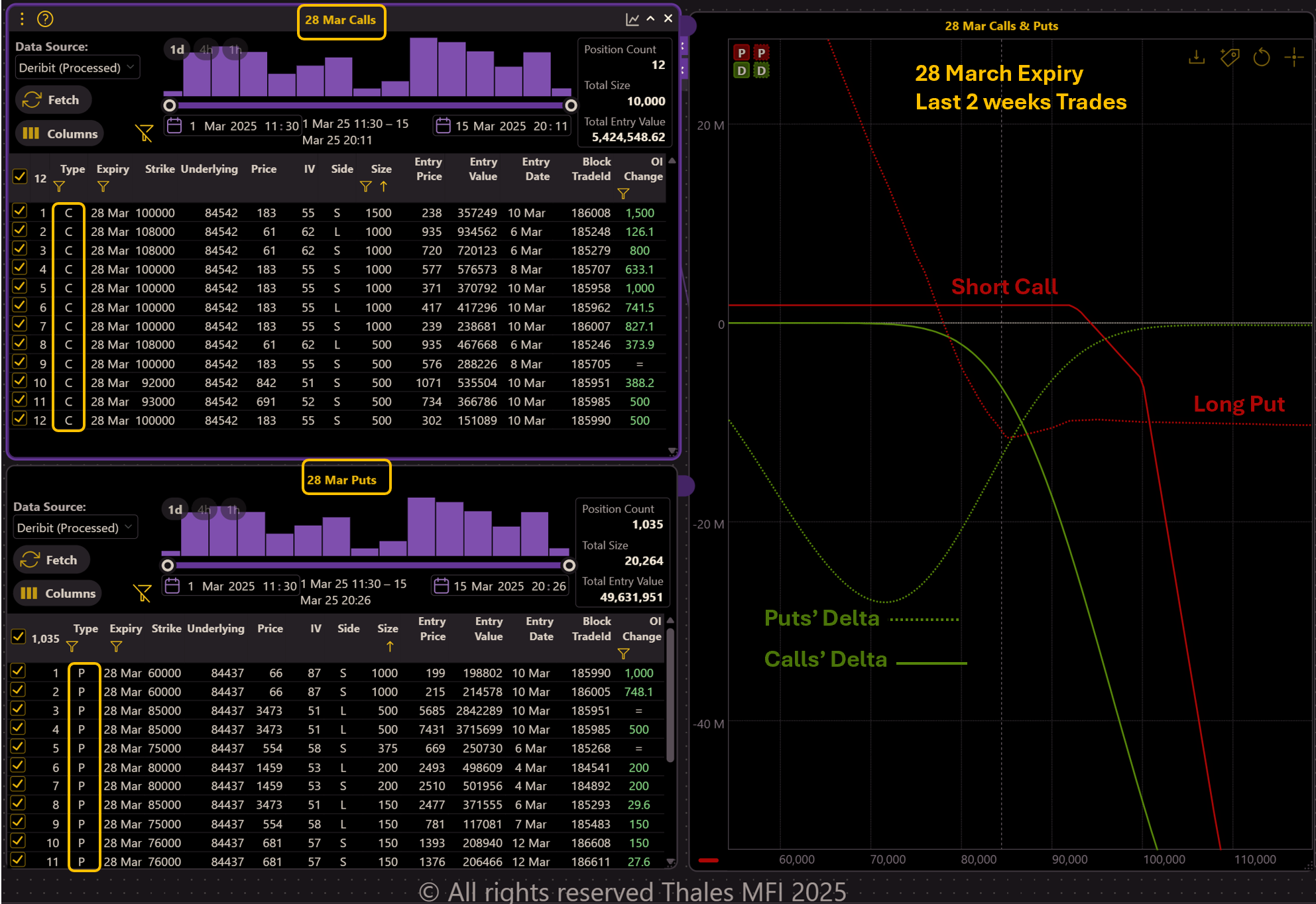

While the open interest for the March 28 expiry reflects months of accumulated positions, understanding the most recent trades provides a clearer picture of current market sentiment. Using Thales Market Screener, we filter for trades executed between March 1 and March 15, distinguishing between calls and puts.

(OSS)

The top table filtered for call options, showing the latest transactions for March 28 expiry, while the bottom table presents similar data for put options. To visualize the aggregated impact of these trades, we have overlaid the respective call and put trade structures on a single risk graph (right panel).

From the graph, we observe that recent call trades resemble a short call position, with significant activity concentrated around the $92,000 strike. Meanwhile, put trades exhibit characteristics of a long put position, with the $85,000 strike standing out as a key level.

(OSS)

When we combine the most recent call and put trades into a single aggregated risk graph, a clear hedging structure becomes evident. The most notable trades include:

- Short Call at $92,500 – Traders are selling upside exposure, indicating they do not anticipate Bitcoin to rise beyond this level.

- Long Put at $85,000 – This key hedge suggests concern about downside risk, with traders preparing for potential declines.

- Short Put at $60,000 – Likely used to partially fund the long puts, this positioning implies traders see it as an extreme floor unlikely to be breached.

The overall structure reflects a risk reversal strategy, where traders are primarily focused on downside protection. The combination of short calls and short out-of-the-money puts helps finance their long put hedges, emphasizing that market participants in March have been more defensive than speculative.

This setup suggests that while recent trades do not expect Bitcoin to surge past $92,500 or collapse below $60,000, they remain concerned about potential declines toward $85,000 by the end of March.

Bottom Line

As we dissect the Bitcoin options market, a few key takeaways emerge. The March 14 expiry settled below max pain, reinforcing the significance of positioning around major strike levels. Broader market trends suggest a long-term bullish bias, yet short-term sentiment appears more cautious, with an increasing demand for put protection reflected in the implied volatility skew.

With the March 28 expiry approaching, open interest remains heavily concentrated at optimistic strike levels, but recent trading activity tells a different story. The structure of new positions suggests traders are hedging against downside risk rather than speculating on aggressive upside moves. The combination of short calls around $92,000 and long puts at $85,000 signals that market participants do not expect Bitcoin to break out above recent highs and are preparing for potential declines. Whether this defensive positioning proves prescient or excessive remains to be seen, but for now, caution appears to be the dominant theme heading into the final weeks of March.

Disclaimer

This analysis is for informational purposes only and should not be considered financial advice. Market sentiment and positioning are dynamic and can shift rapidly, making any interpretation subject to change. Past trends and recent trades provide insights but do not guarantee future price movements. Traders should conduct their own research and risk assessments before making any decisions.