The Protective Power of Put Options: Hedging Your Portfolio in Volatile Markets

All the Simulations are available in Thales Options Strategy Simulator.

The Importance of Protecting Your Portfolio

Investing in financial markets can often feel like navigating a ship through turbulent waters, where sudden storms can wipe out your gains in an instant. The fear of watching your portfolio's value plummet during a market downturn is a concern shared by many investors. Traditional stock holdings, while potentially lucrative, expose your portfolio to significant risks, especially in volatile times. But what if there were a way to safeguard your investments while still allowing for growth? Enter long put strategy that offers a safety net for your portfolio, allowing you to hedge against market downturns without giving up potential gains.

Understanding Put Options

So, what exactly is a put option? In simple terms, a put option gives you the right, but not the obligation, to sell an underlying asset at a predetermined price (Strike Price) before a specified date (Expiry). This setup acts as a form of "insurance" for your portfolio. If the market declines, the value of the put option increases, offsetting some or all of the losses in your stock holdings. The cost of purchasing this protection, known as the premium, is often a reasonable price to pay for the peace of mind it provides.

Examining Market Downturns

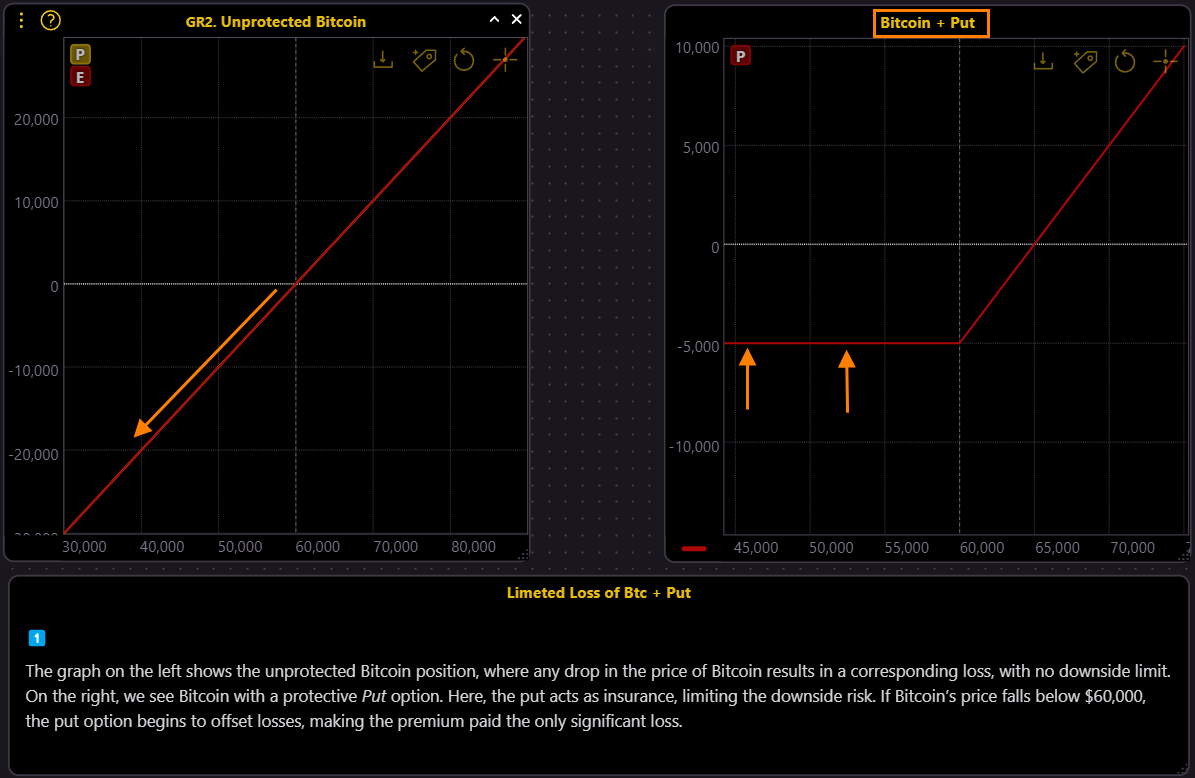

To better understand how put options can protect your portfolio, let’s consider a hypothetical scenario with Bitcoin. Suppose you hold Bitcoin, currently priced at $60,000, and you’re concerned about a potential market downturn. You decide to purchase a 2-month ATM (At The Money) put option with a strike price of $60,000, costing you a $5,000 premium. Imagine running two parallel simulations—one where you hold Bitcoin without any protection, and another where you’ve hedged with the put option.

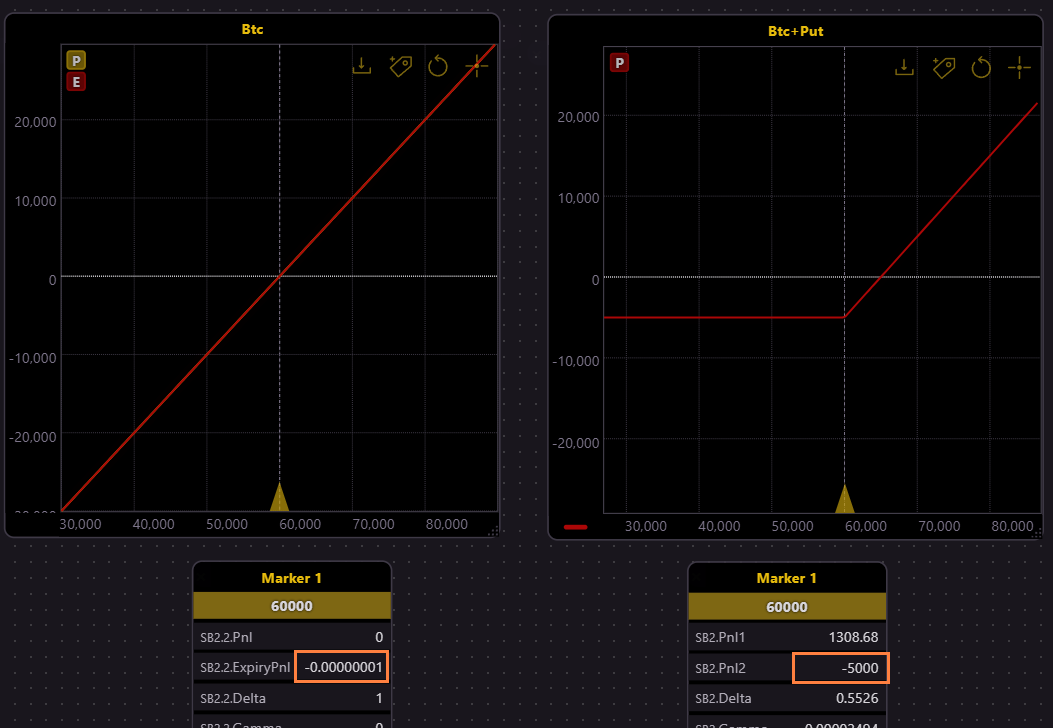

While put options provide valuable protection, it's important to remember that this protection comes at a cost. As shown in the image (below), the position with the put option starts at a $5,000 loss, which reflects the premium paid for the put. This initial expense is the price of securing your portfolio against significant downside risks.

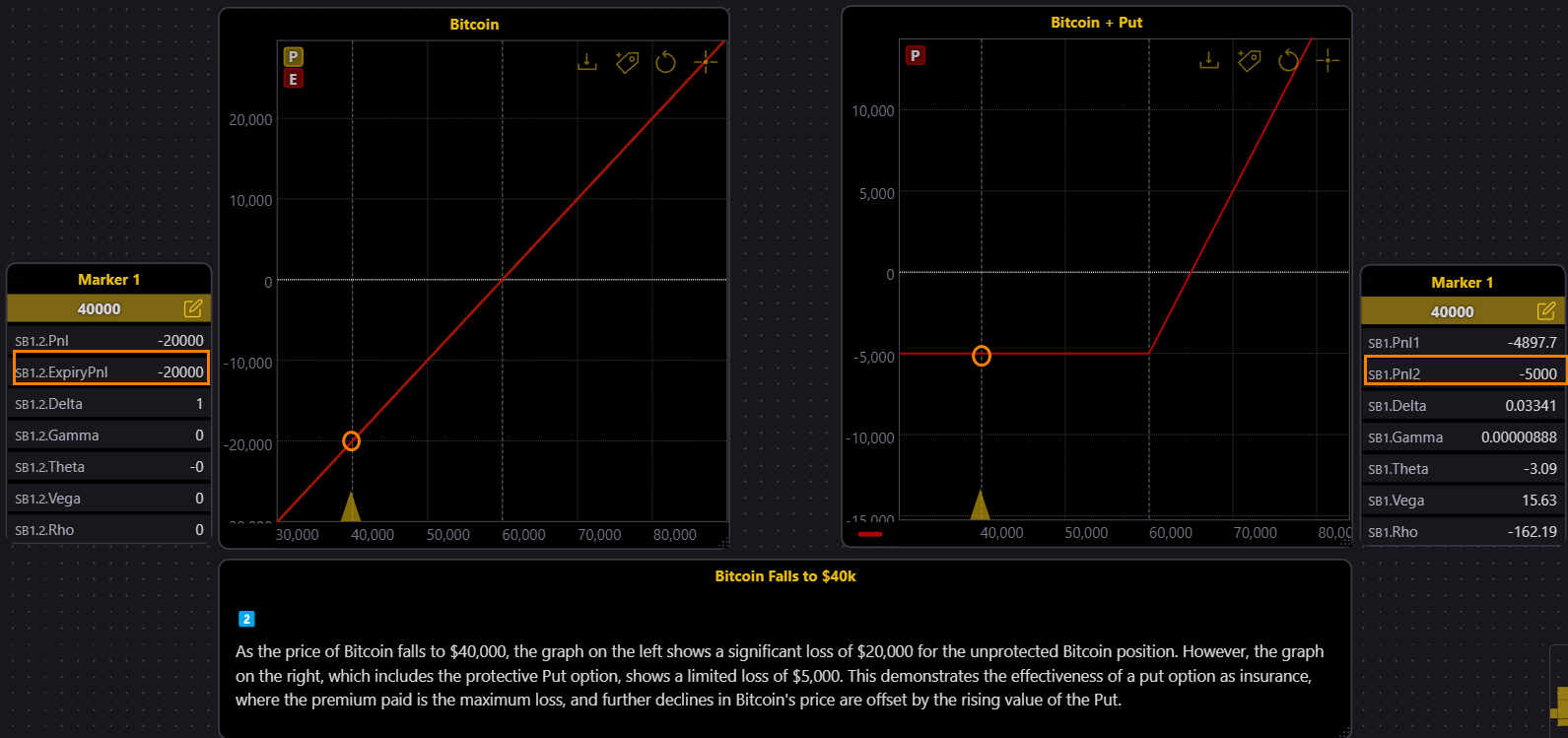

Now in case Bitcoind price drops to, say, $40,000, your portfolio faces a significant loss of $20,000 per Bitcoin held. However, in the second scenario, the put option acts as a safety net (see the image below). As Bitcoin's price drops, the value of the put option increases, offsetting the $20,000 loss with a gain from the option, minus the $5,000 premium. This leaves you with a net loss of only $5,000, significantly less than the unprotected scenario. Exploring these outcomes through simulated models highlights the protective power of put options, showing how they can effectively cap losses and provide peace of mind during uncertain times.

Using Put Options to Hedge Against a Defined Drawdown

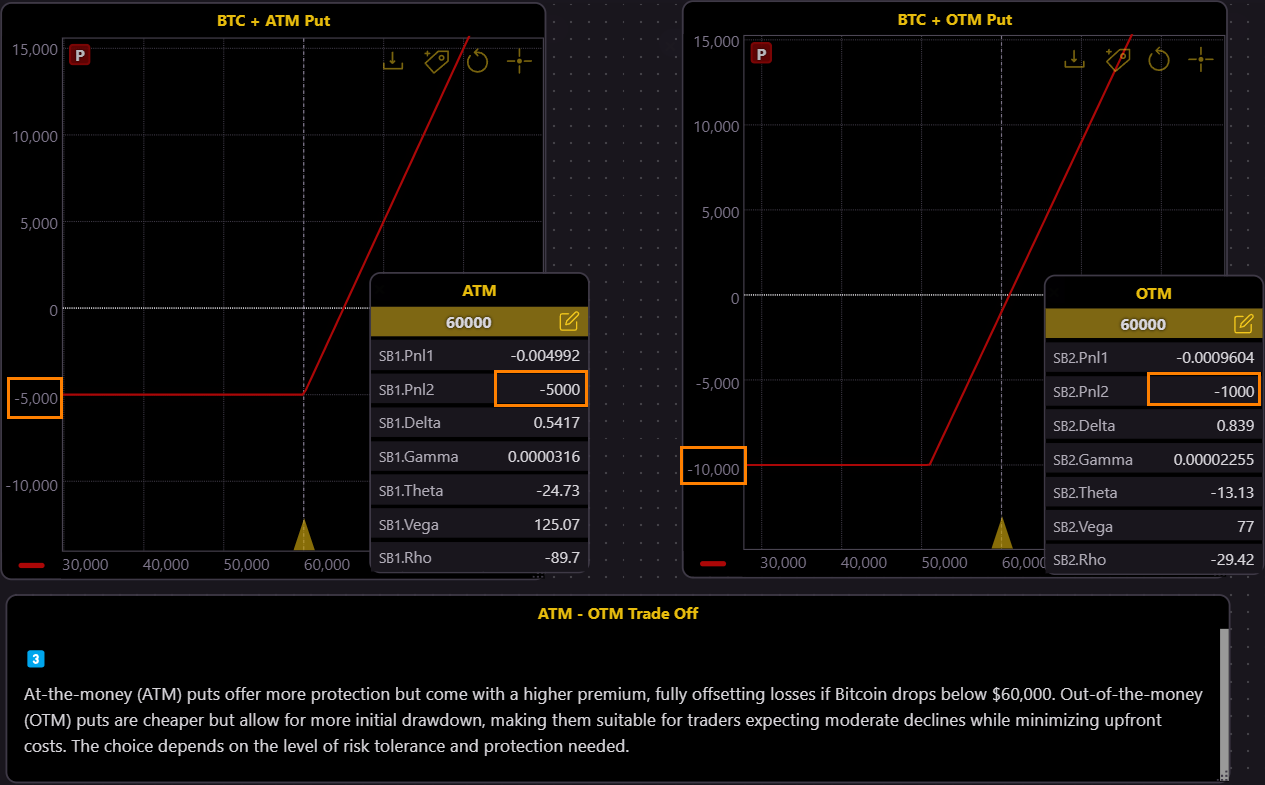

While ATM put options provide robust protection, they come at a higher premium. If you're looking to minimize costs, you might consider an Out of the Money (OTM) put option. This type of option costs less but offers partial protection, allowing for some degree of loss before the protection kicks in.

For instance, if you want to protect your Bitcoin investment from a 15% drawdown, you might choose an OTM put option with a strike price of $51,000 instead of $60,000. The trade-off here is clear: by paying a lower premium, you accept a higher level of risk before the put option starts to protect your portfolio. This approach can be ideal for investors who can tolerate some level of drawdown but still want a safety net for more severe market drops.

This choice reflects a balance between cost and protection, allowing you to tailor your strategy to your risk tolerance and market outlook.

Timing and Market Conditions: Maximizing the Benefit of Put Options

The effectiveness of put options isn’t just about the strike price and expiry date—it’s also about timing and market conditions. Factors like Implied Volatility (IV) play a significant role in determining the cost of a put option. For example, purchasing a put option when IV is low means you’re buying protection at a lower cost. However, if the market is already in turmoil and IV is high, the cost of protection increases. By analyzing different market conditions, you can find the optimal time to buy a put option, ensuring that you’re not only protecting your portfolio but also doing so in a cost-effective manner.

Considerations and Risks

While put options offer valuable protection, they are not without their risks and limitations. One key consideration is time decay, also known as Theta. As the option approaches its expiry date, its value decreases, which means the longer you hold the option, the less it may be worth. Additionally, if the market doesn’t decline as expected, the put option could expire worthless, leaving you with the cost of the premium. Therefore, timing and market outlook are critical factors in successfully implementing this strategy.

Wrapping Up: Protecting Your Investments for the Long Haul

In the end, put options can be a powerful tool in your investment arsenal, acting as a safety net during turbulent market conditions. By incorporating them into your portfolio, you can protect your investments from significant losses while still leaving room for growth. Exploring and simulating these strategies beforehand ensures you’re prepared for whatever the market throws your way. So, why not add this layer of protection to your portfolio? After all, peace of mind in volatile times is priceless.

All the Simulations are available in Thales Options Strategy Simulator.