Introduction

Bitcoin’s decisive move below the long-held $100,000 support has pushed the options market into a period of recalibration rather than panic, revealing how much the landscape has evolved. Last week’s $97,200 settlement exposed persistent downside pressure, yet implied volatility remains capped near 50%—a clear signal that a deep pool of institutional volatility sellers and arbitrage desks is actively absorbing demand. Across maturities, we see renewed put-spread hedging, concentrated downside protection, and a surge in box-spread activity, while selected directional traders pursue range-bound short-vol structures or low-cost bullish expressions. Together, these flows highlight a market that is becoming more structured, more sophisticated, and increasingly driven by disciplined premium-selling and arbitrage, rather than reactive speculation.

Explore these market dynamics firsthand with the Thales Options Strategy Simulator (OSS)

Market Snapshot

Expiry Recap — 14 November 2025

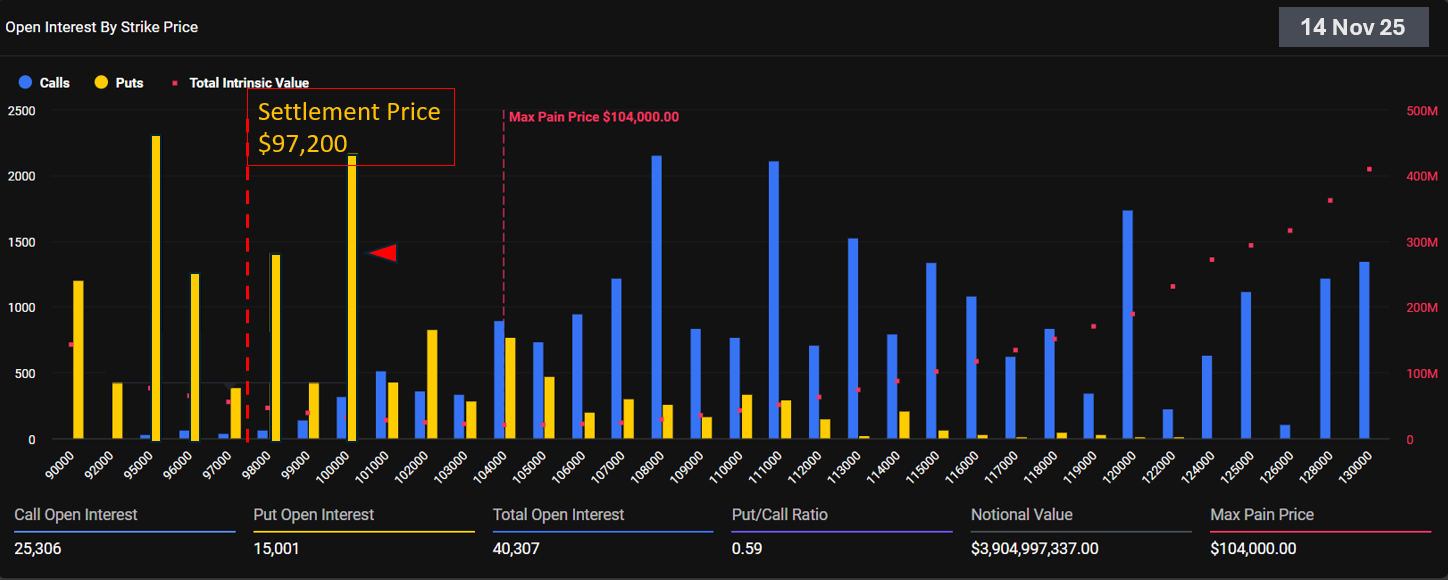

This week’s expiry settled at $97,200, marking the first time since May 7 that Bitcoin closed below $98,000, and only rarely had it dipped under $100,000 during this period. Yet, precisely on Friday, price broke this multi-month support, settling at $97.2k and later sliding further intraday toward $95k.

In our previous Outlook, the max pain level for this expiry was $107k; this has then shifted lower to $104k, reflecting the persistent downward pressure on Bitcoin throughout the week.

The put spread highlighted in last week’s report turned out to be the clear winner — buyers of that spread captured the move exactly as anticipated. Meanwhile, the call side, which represented roughly 63% of total open interest, mostly expired worthless. And the puts with strikes below $97k also lost all intrinsic value.

Despite the sharper-than-expected move below long-standing support, this expiry was not a damaging event for option writers. Settlement did not deviate dramatically from the max pain zone, and most option sellers avoided major losses, especially compared to what a deeper breakdown could have caused.

Next Friday

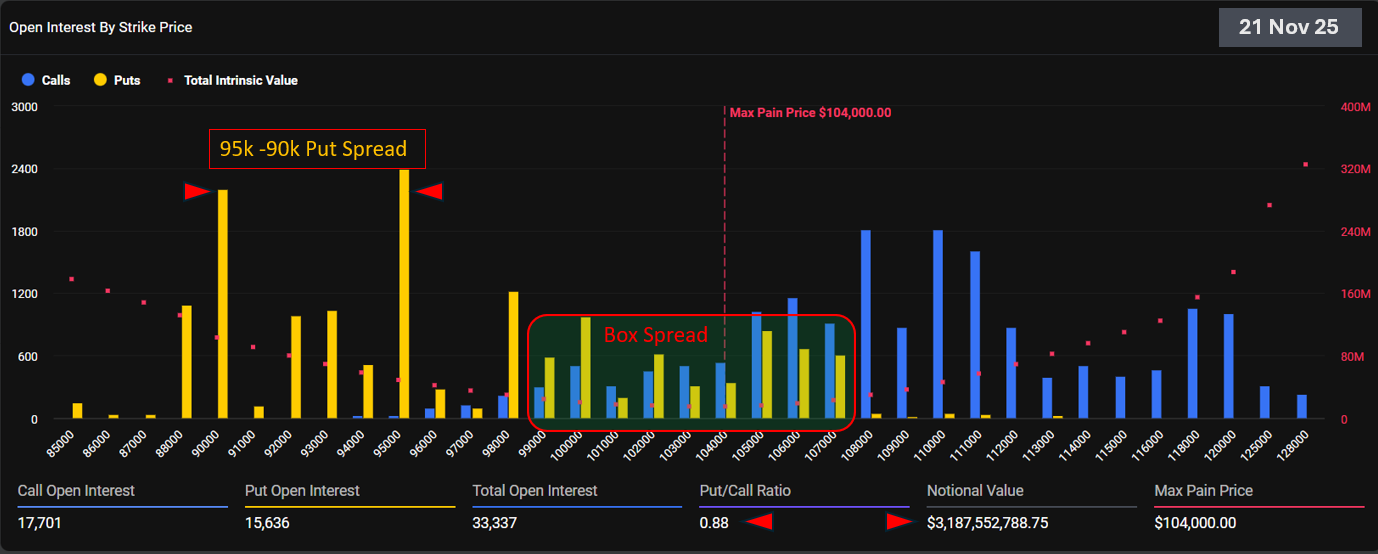

Open interest for next Friday currently stands above 33,000 contracts, which is typical for a weekly cycle. The put/call ratio at 0.88 reflects a relatively elevated level of downside hedging — a natural reaction in a market that has been shaken by Bitcoin’s recent break below the $100k handle.

A familiar structure appears again this week: a put spread concentrated at the 90k–95k strikes, consistent with traders protecting against further weakness while not expecting an extended decline below 90k.

Reserve Army of Option Sellers

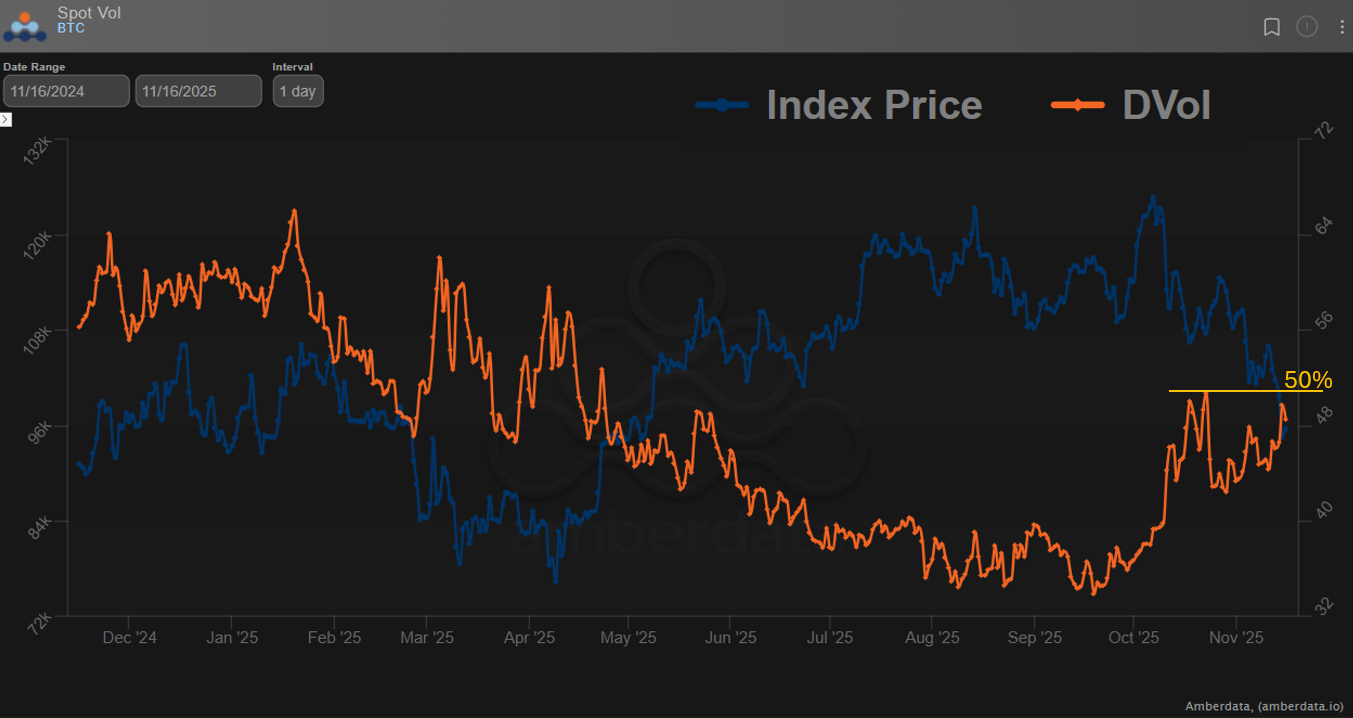

Despite the sharp swings in Bitcoin’s price, implied volatility (IV) continues to struggle to break above the 50% level. This persistent ceiling hints at the presence of a reserve army of volatility sellers—large, well-capitalized participants who systematically sell premium whenever IV drifts higher. Their footprint is visible across maturities and strikes, suggesting that institutional traders are actively arbitraging the IV–realized volatility spread, treating volatility as an asset class rather than reacting emotionally to spot moves.

If this interpretation is correct, it signals a more mature and healthier market, one where big hands are comfortable taking risk and absorbing demand shocks. The side effect is straightforward: consistent volatility selling suppresses realized volatility, potentially leading to calmer market behavior even in the face of meaningful price moves.

Another notable pattern is the cluster of balanced call and put open interest around the mark price, highlighted on the chart. This symmetry strongly suggests the presence of box spread constructions, which we will examine later in this Outlook.

28 November

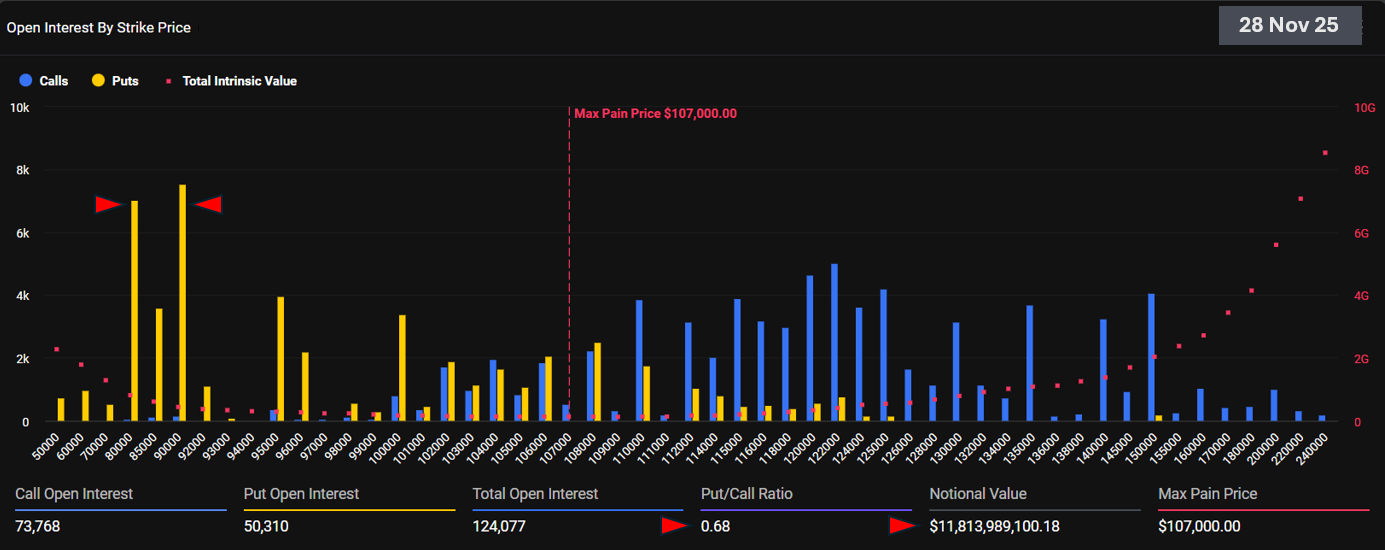

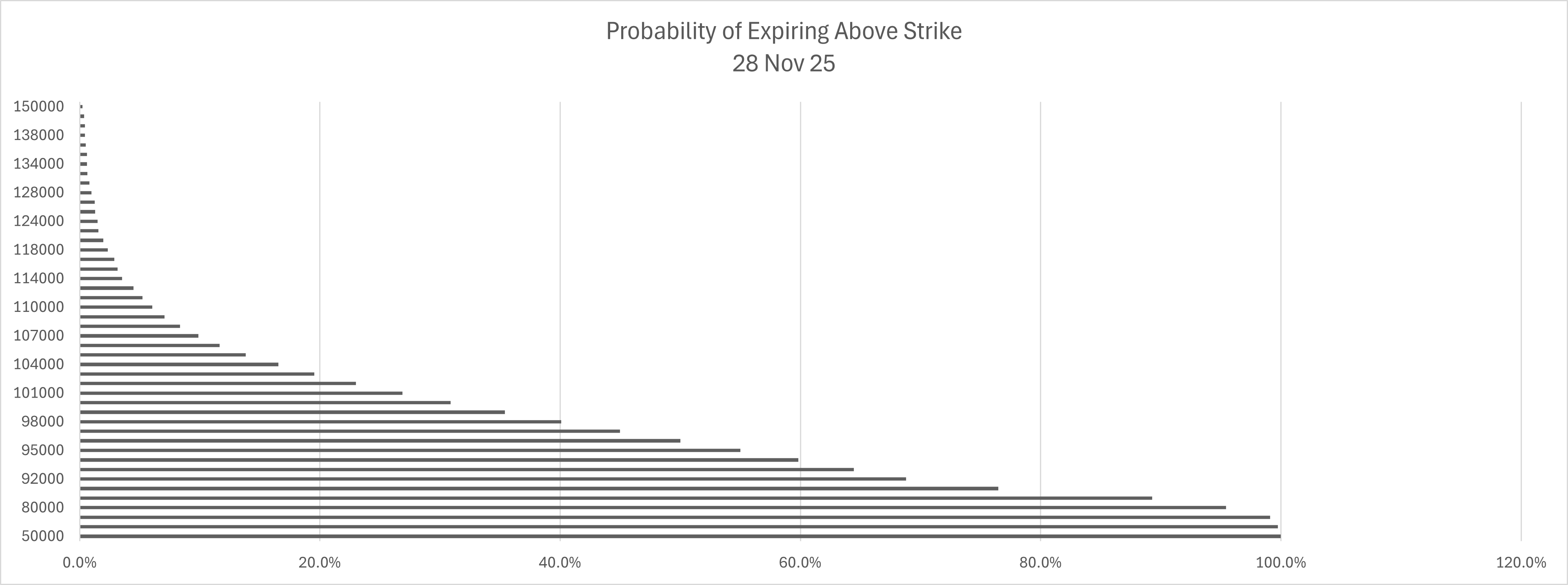

For a broader view of positioning beyond the immediate week, the 28 November expiry stands out with nearly $12 billion in notional open interest and a put/call ratio near 0.70. The structure is dominated by two large put positions at 80K and 90K, creating a notable gap between put-heavy lower strikes and the call-dense upper range. With max pain at $107K—well above the current ~$97K spot—the skew clearly reflects downside concern and cautious positioning.

The probability chart reinforces this sentiment: for strikes above $100K, the likelihood of finishing in the money is currently below 25%, while put strikes at 95K and 100K remain influential. Still, the options market is highly dynamic, and these probability distributions can shift quickly as volatility and spot price evolve.

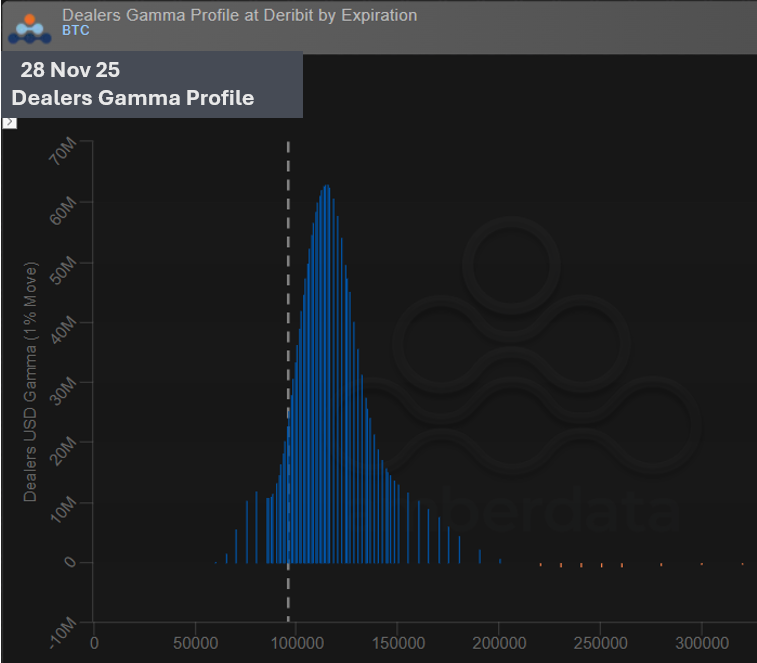

The dealer gamma profile for the 28 Nov expiry is broadly positive, with its strongest concentration at strikes between 100K and 130K. A positive gamma profile indicates that dealers are long gamma, which means the market—on aggregate—has been selling options at these upper strikes. This positioning aligns well with the probability distribution discussed earlier: traders collectively signal that levels above 100K are unlikely to be reached by month-end. The profile reinforces the idea of a market leaning defensively, pricing in capped upside and prioritizing protection rather than aggressive bullish structures.

Recent Activities

Box Pressure

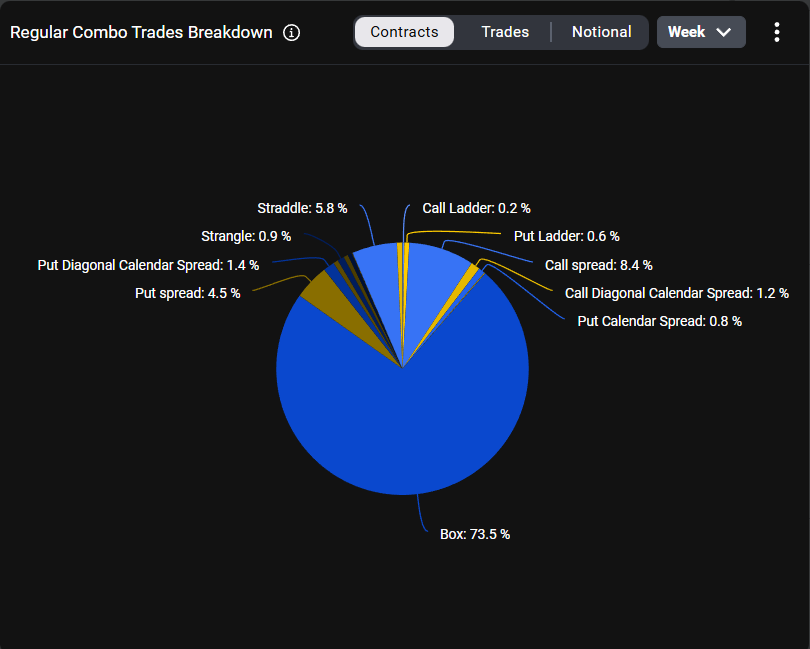

Earlier in this report, we observed a cluster of balanced call and put open interest around the mark price. At first glance this might look like a typical straddle, but Deribit’s Regular Combo Trades Breakdown tells a different story. In the past week, nearly 75% of all multi-leg trades were Box Spreads—a classic arbitrage structure.

A Box Spread combines two opposing vertical spreads using both calls and puts. For example, with BTC trading near $95,000, a trader may buy the 94K call and sell the 96K call, while simultaneously selling the 94K put and buying the 96K put. (see the simulation below)

(OSS)

If the net cost of this four-leg structure is less than the strike difference (2,000 USD), the trader locks in a risk-free return at expiry.

This opportunity typically appears when one or more OTM options are mispriced or carry excess implied volatility.

The dominance of box spreads is another sign that the composition of big players in Bitcoin options is changing.

Speculators and hedgers no longer dominate flows; instead, arbitrage desks and yield-harvesting players have become highly active, systematically capturing IV mispricings.

This helps solve the puzzle of why Bitcoin’s implied volatility repeatedly stalls around 50%, even during sharp market swings.

When a “reserve army” of sophisticated sellers is constantly providing liquidity and absorbing volatility risk, realized volatility becomes more contained—and IV has difficulty breaking higher.

Strategy Spotlight

Short Strangle

(OSS)

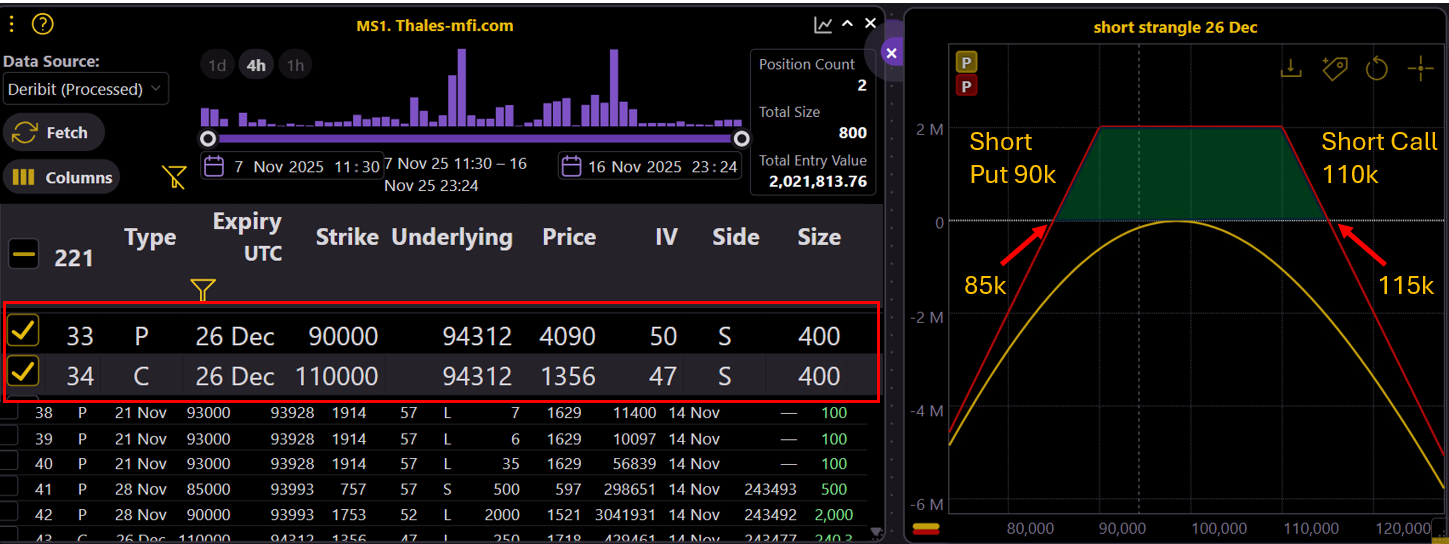

In this week’s snapshot, we identified a sizeable 800-contract short strangle set for 26 December (the final expiry of 2025). The structure consists of selling 400 puts at $90,000 and 400 calls at $110,000, creating a classic range-bound premium-harvesting position (collecting $2M premium).

As the payoff diagram shows, the trader’s profit zone spans roughly from $85,000 to $115,000, with maximum profitability achieved if Bitcoin drifts within the 90k–110k corridor through year-end. The positioning suggests a view that, despite recent volatility, Bitcoin will remain contained within this broad range for the rest of 2025, allowing the trader to benefit primarily from time decay and elevated options premiums.

Bullish RiskReversal

(OSS)

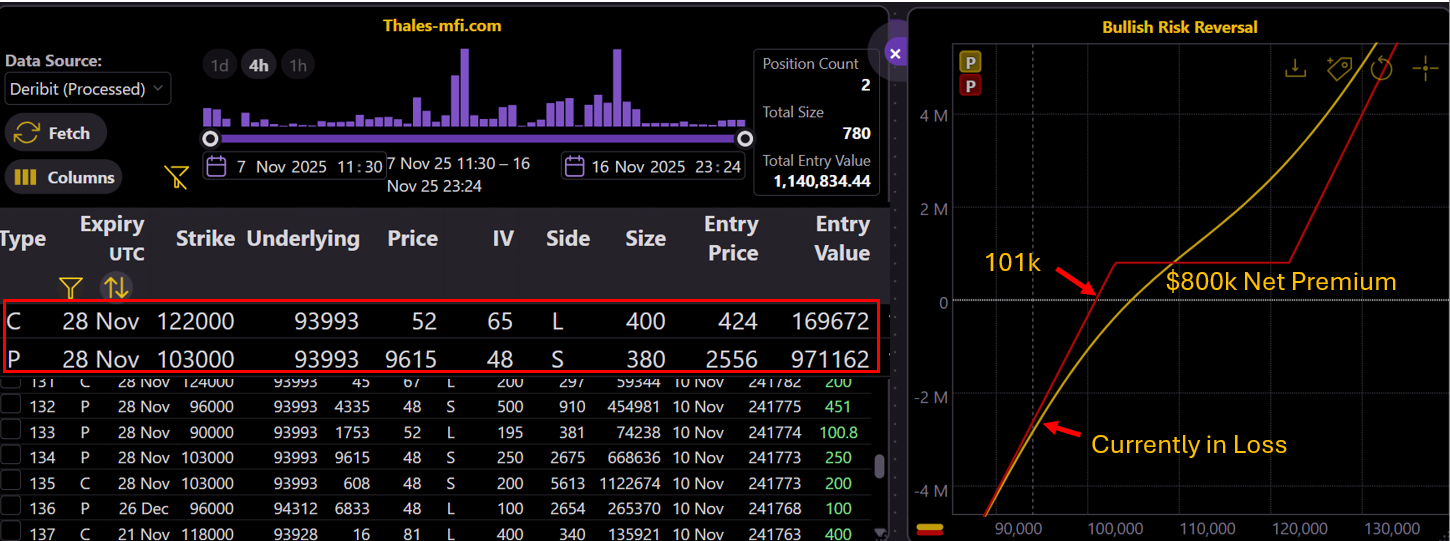

Another spotted strategy in our Market Screener this is a bullish risk-reversal built through selling 380 put options at $103,000 and buying 400 call options at $122,000 for the 28 November expiry. The structure is a credit trade, with the trader already collecting roughly $800,000 in net premium. Functionally, this position behaves like a synthetic long, financing upside exposure by taking on downside risk.

Two observations stand out. First, as of the time of writing, the strategy sits in a floating loss of nearly $2 million, reflecting the sharp pullback in spot prices. Second, this structure is often used as a hedge for an existing short BTC position, giving the trader low-cost upside protection while keeping the downside open. Regardless of which interpretation applies here, the position clearly assumes that Bitcoin will recover above $103,000 by month-end.

Together with the box spreads, put spreads, and short strangles detected this week, this trade illustrates the diversity of views currently shaping the market—from arbitrage flows to directional bets in both directions—highlighting how the options market continues to offer tools for every conviction and every risk appetite.

Bottom Line

Bitcoin’s break below $100k has shifted sentiment, but the options market shows no signs of disorder—only structure. Put spreads, cautious hedging, and bearish skew point to genuine concern, yet the persistent ceiling on IV and the dominance of box spreads reveal a market increasingly shaped by disciplined volatility sellers and arbitrage desks. Directional traders remain active, expressing both -a mild- bullish, and range-bound views through risk reversals and short-strangle structures, but it is the systematic premium-selling flows that continue to anchor volatility and frame the market’s behavior. It seems that the real battle is being fought not on price, but on volatility and yield.

Disclaimer

This Outlook is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Options involve significant risk and are not suitable for all investors. Market conditions can change rapidly, and any interpretations or opinions presented here reflect observations at the time of writing. Always conduct your own analysis or consult a qualified advisor before making trading decisions.