Harnessing the Bullish Call Spread: A Cost-Effective Strategy for Bitcoin Traders

All simulations are available in Thales Options Strategy Simulator.

Navigating financial markets requires not only precise timing but also sophisticated strategy. While many traders utilize Options to capitalize on market fluctuations, the high premiums driven by volatility often make this approach less attractive. The Bullish Call Spread offers a more refined alternative, allowing traders to balance potential gains with the need for cost efficiency and risk management. In this blog, we will thoroughly examine this strategic tool, with a particular focus on Bitcoin, demonstrating how it equips traders to approach market dynamics with greater confidence and control.

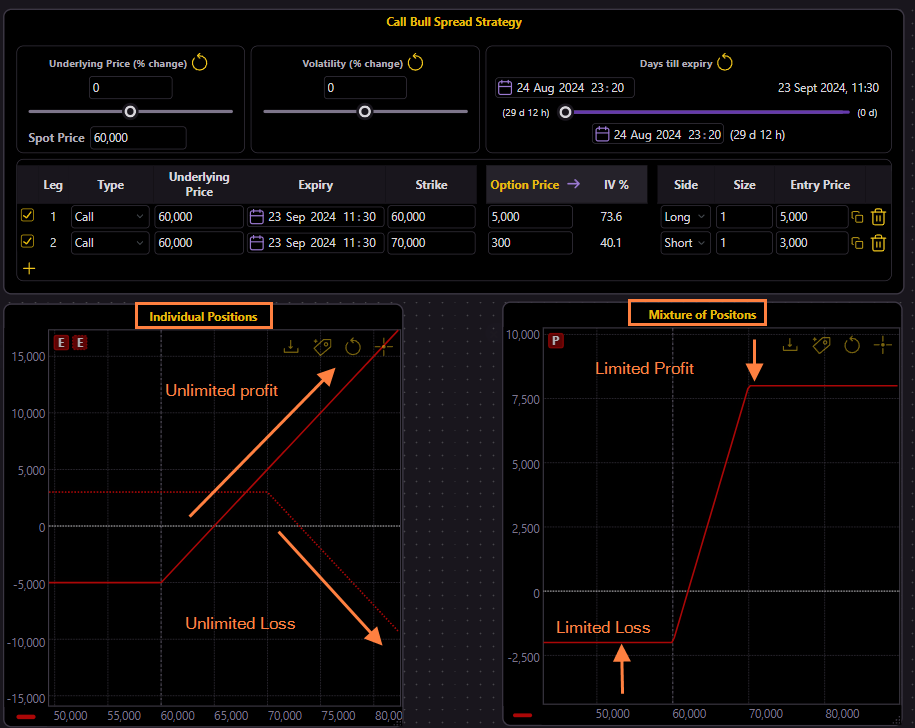

Setting Up a Bitcoin Bullish Call Spread

Imagine Bitcoin is currently priced at $60,000, and you anticipate that it will rise. Instead of buying a single call option, which could be expensive, you decide to set up a bullish call spread:

- Buy a call option with a $60,000 strike price, with certain expiry,

- Sell a call option with a $70,000 strike price, with the same expiry.

This setup limits both your maximum potential profit and your maximum potential loss, providing a balanced approach to market participation.

(Simulation 🔗)

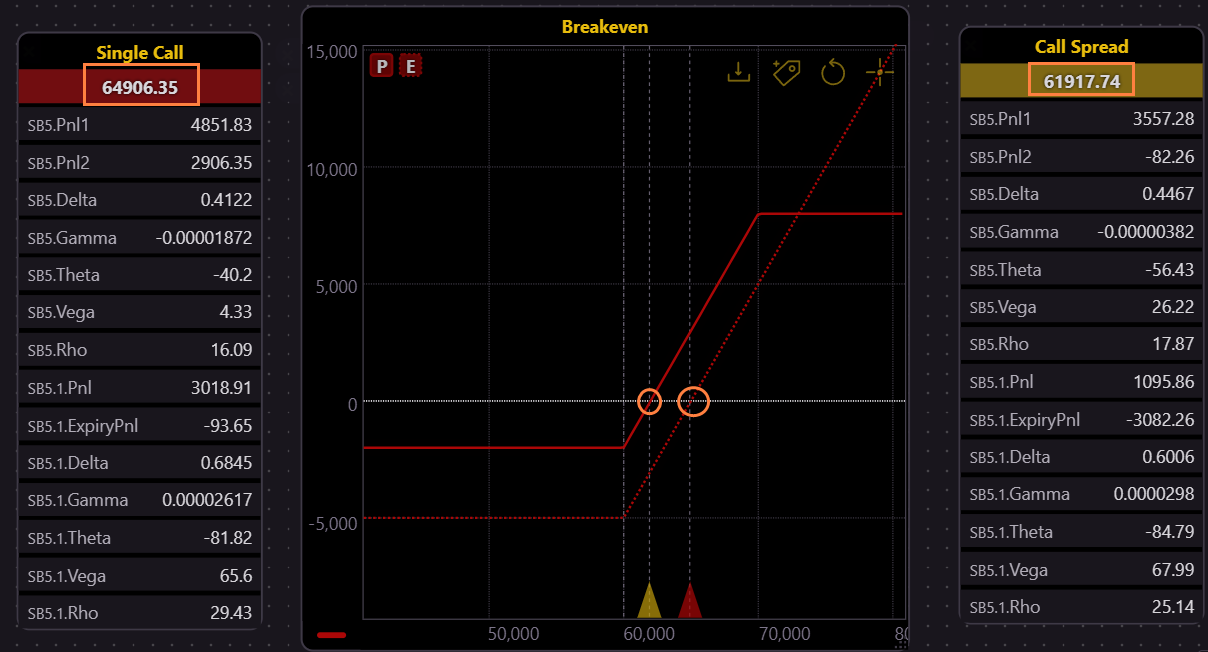

As illustrated in the simulation, the left graph shows the individual positions—the long call with unlimited profit potential and the short call with unlimited loss potential. On the right, the combined spread caps both profit and loss, demonstrating the strategy's effectiveness in managing risk while still allowing for market participation.

What If Scenarios: Exploring Market Outcomes

Now, let’s explore how this strategy plays out under different market conditions.

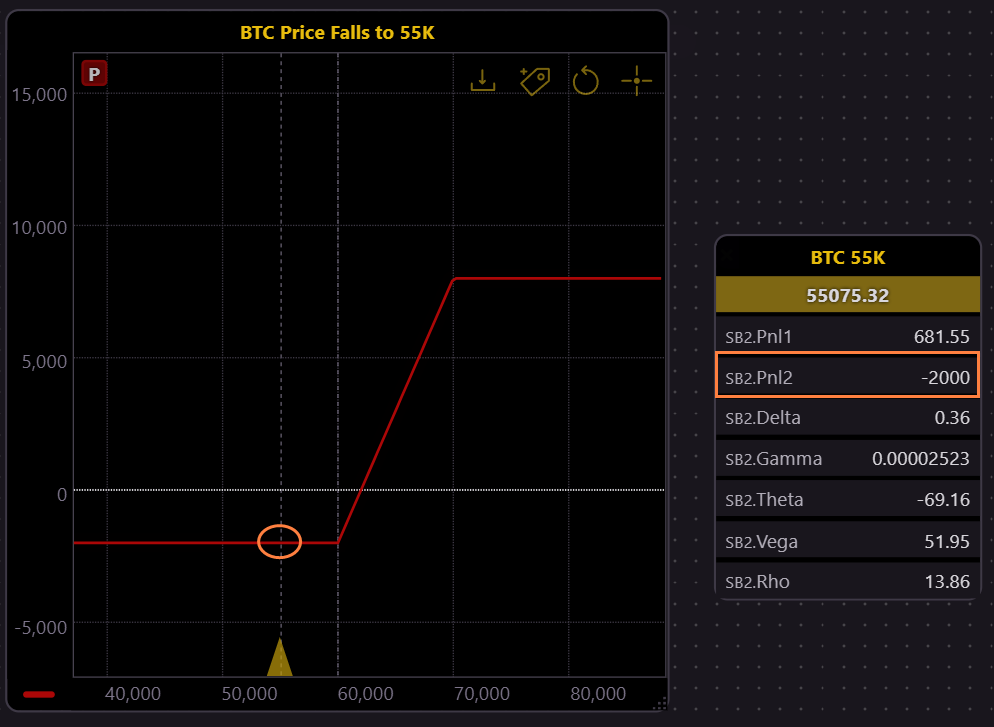

1. Bitcoin Falls to $55,000: If Bitcoin’s price drops to $55,000 at expiration, the bullish call spread limits the loss to $2,000. The simulation shows how this strategy caps your downside, offering a buffer against significant losses in a bearish market.

(Simulation 🔗)

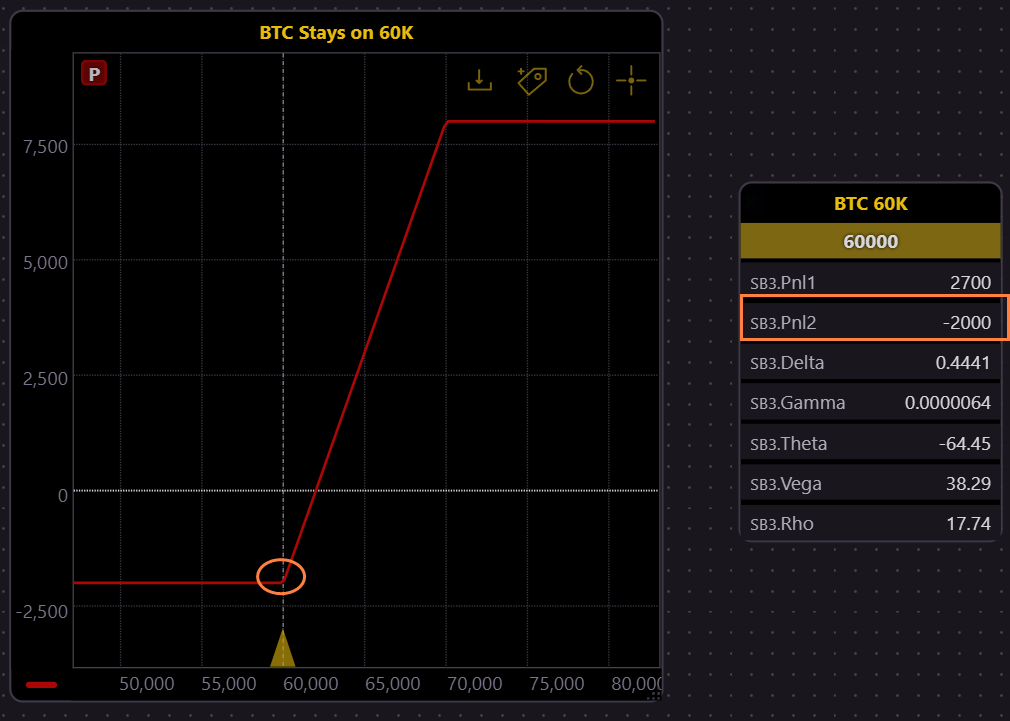

2. Bitcoin Stays Flat at $60,000: If Bitcoin's price remains around $60,000 at expiration, the call spread helps minimize losses. As seen in the simulation, the loss is limited to $2,000, highlighting the strategy's ability to manage risk when the market does not move as expected.

(Simulation 🔗)

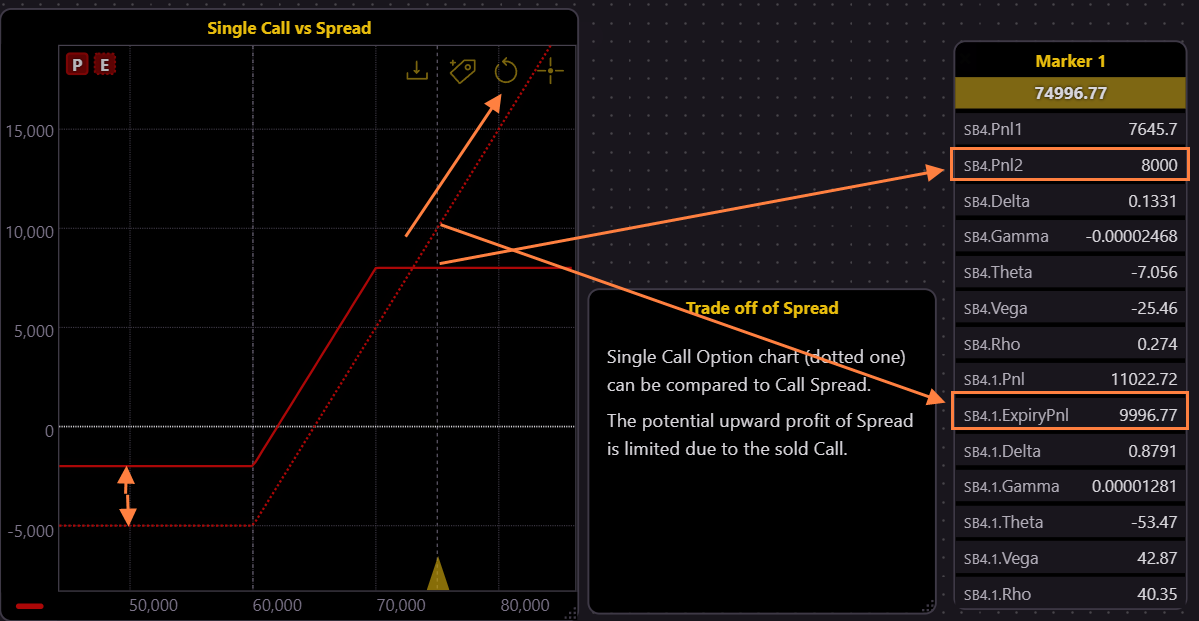

3. Bitcoin Rises to $75,000: Should Bitcoin’s price increase to, say, $75,000, the bullish call spread strategy caps your profit at $70,000. The simulation contrasts this with the unlimited profit potential of a single call option, emphasizing the trade-off between cost, risk, and potential reward.

(Simulation 🔗)

Break-Even Analysis for Both Strategies

Understanding where you break even is crucial in any trading strategy. The OSS simulation illustrates the breakeven points for both a single call option and a call spread. The call spread’s lower breakeven point at approximately $62000 makes profitability more achievable, especially in high IV environments, compared to a single call option which requires Bitcoin to reach around $65000 to break even.

(Simulation 🔗)

Time Decay Impact on Single Call vs. Call Spread

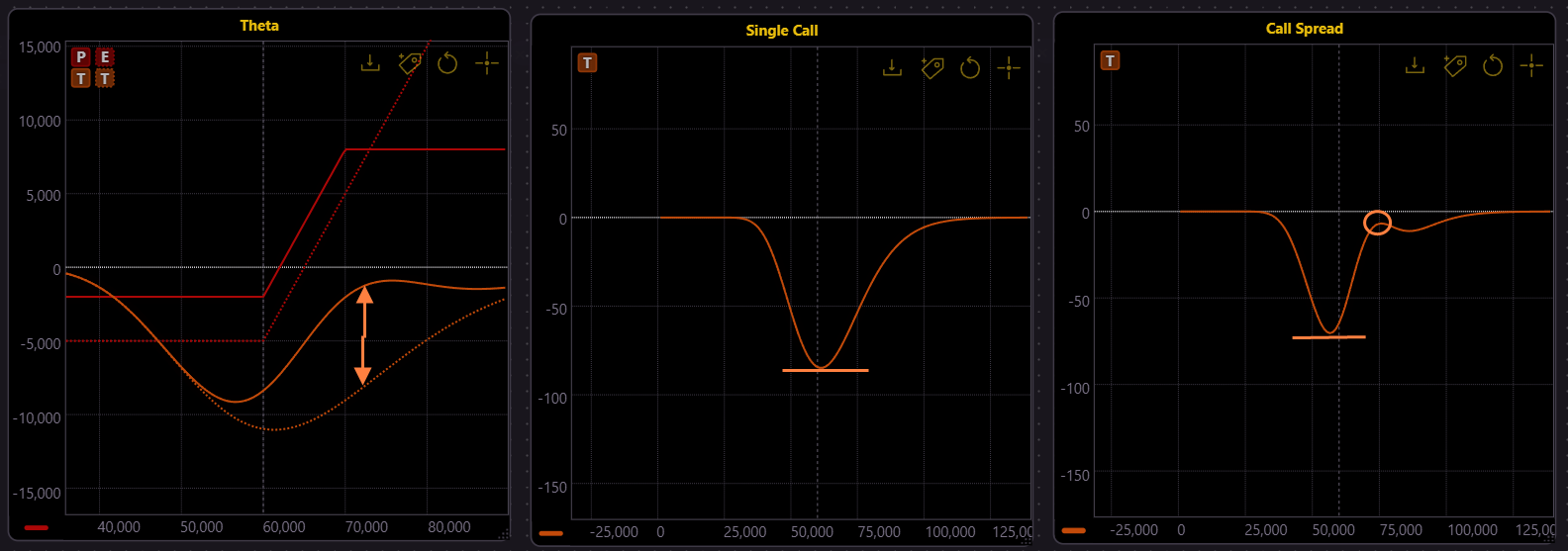

Time decay, or Theta, is another critical factor in options trading. The simulation demonstrates how time decay impacts both a single call option and a call spread.

(Simulation 🔗)

- On the left, the single call option suffers more from time decay, particularly as expiration approaches.

- On the right, the call spread shows a moderated impact from Theta, indicating a more stable strategy over time.

This comparison underscores the advantage of using a call spread to manage time decay, especially in volatile markets.

Conclusion: A Balanced Approach to Trading

The Bullish Call Spread offers traders a balanced approach to participating in bullish market movements, with capped risk and reduced cost. While it limits the maximum potential profit, the trade-off for lower cost and managed risk makes it an attractive strategy, especially in high volatility environments. By leveraging the Thales Option Strategy Simulator (OSS), traders can visualize and fine-tune their strategies, ensuring they are well-prepared to navigate the complexities of the market.

Disclaimer:

The content in this blog is for educational purposes only and does not constitute financial or investment advice. Trading options involves significant risk and may not be suitable for all investors. Ensure you fully understand the risks and seek advice from a qualified financial advisor if needed. The tools and simulations provided by Thales are for illustrative purposes and do not guarantee specific outcomes. Thales is not responsible for any losses resulting from trading decisions based on this information.

All simulations are made by Thales Options Strategy Simulator.