Covered Call Strategy: Enhancing Returns While Managing Risk

Simulations are available in Thales Options Strategy Simulator.

Navigating the market, often feels like a high-wire act. You want to capture as much upside as possible without exposing yourself to unnecessary risks. This is where the covered call strategy comes into play. It offers a way to generate additional income from your existing asset holdings while managing potential downside risk. But like any strategy, it’s not without its trade-offs. In this blog, we’ll explore the nuances of the covered call strategy using a series simulations to illustrate its strengths and limitations.

What is a Covered Call?

A covered call involves holding an underlying asset (in our case, Bitcoin) and selling a call option on that asset. The premium received from selling the call option provides immediate income, which can be an attractive proposition, especially in sideways or slightly bullish markets. However, the trade-off is that your potential profit is capped at the strike price of the sold call, limiting your upside if the asset price surges.

(Simulation 🔗)

Setting Up a Covered Call

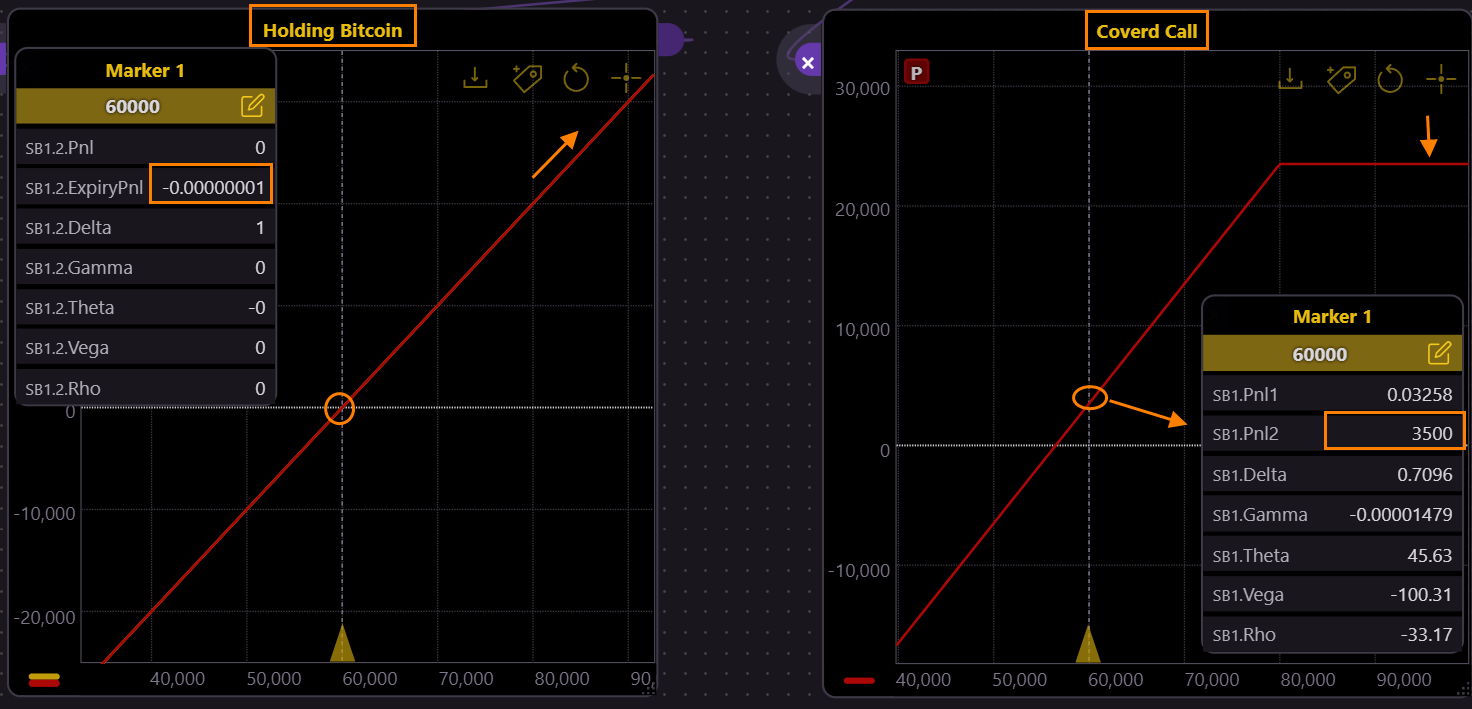

Let’s start with the basics. Suppose you own a Bitcoin currently priced at $60,000. You decide to sell a call option with a strike price of $70,000. The premium for this option in the options market is $3,500, providing you with an immediate income. The simulation below shows how this covered call position is set up.

(Simulation 🔗)

By selling the call, you generate income through the premium, while still benefiting from the potential price gains up to the strike price. However, your profit is capped beyond $70,000.

The Trade-Off - BTC Surges to $80,000

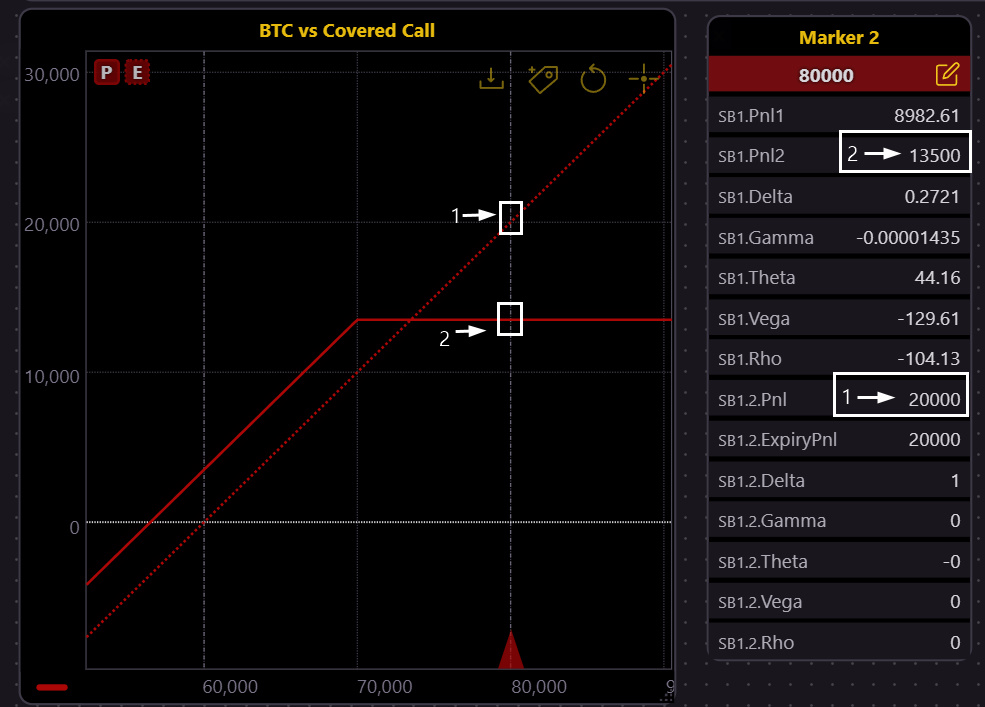

Now, imagine that Bitcoin's price surges to $80,000 by the time of expiration. Here’s where the trade-off becomes clear. While the value of your Bitcoin holdings increases significantly, your profit from the covered call strategy is capped at the strike price of $70,000. This is because the call option you sold is now deep in the money, and the buyer of that option has the right to purchase Bitcoin from you at $70,000, regardless of its market price.

(Simulation 🔗)

As shown in the simulation, while holding Bitcoin outright (the dotted red line) would have yielded a $20,000 profit, the covered call strategy (the solid red line) caps your profit at $13,500 due to the obligation to sell at $70,000. This is because the call option you sold is now deep in the money, and the buyer of that option has the right to purchase Bitcoin from you at $70,000, regardless of its market price.

Downside Protection - BTC Falls to $55,000

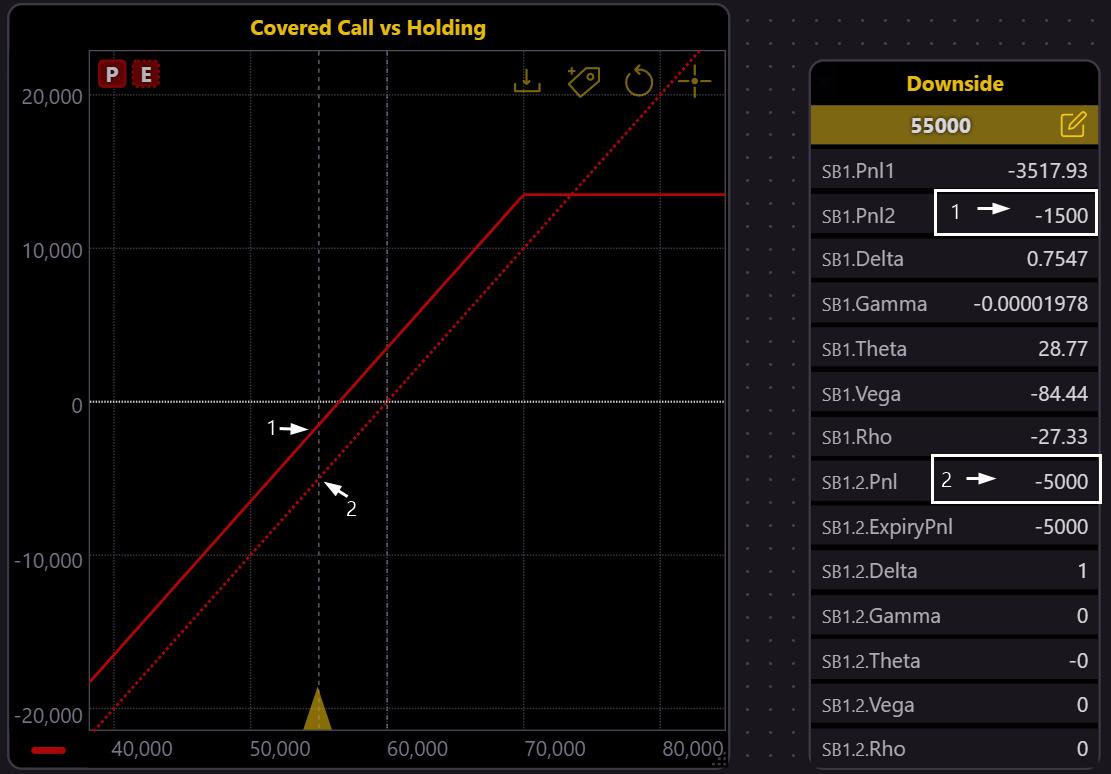

What happens if Bitcoin's price falls to, say, $55,000? This is where the covered call strategy shows its protective side. While your Bitcoin holdings would show a loss, the premium received from the sold call option helps offset this loss partly, reducing the overall impact on your portfolio.

(Simulation 🔗)

The simulation demonstrates that while the holder of Bitcoin without selling call option, would face a $5,000 loss, the covered call strategy results in a reduced loss of $1,500, thanks to the premium received.

Evaluating Early Exit - Locking in Profits Before Expiry

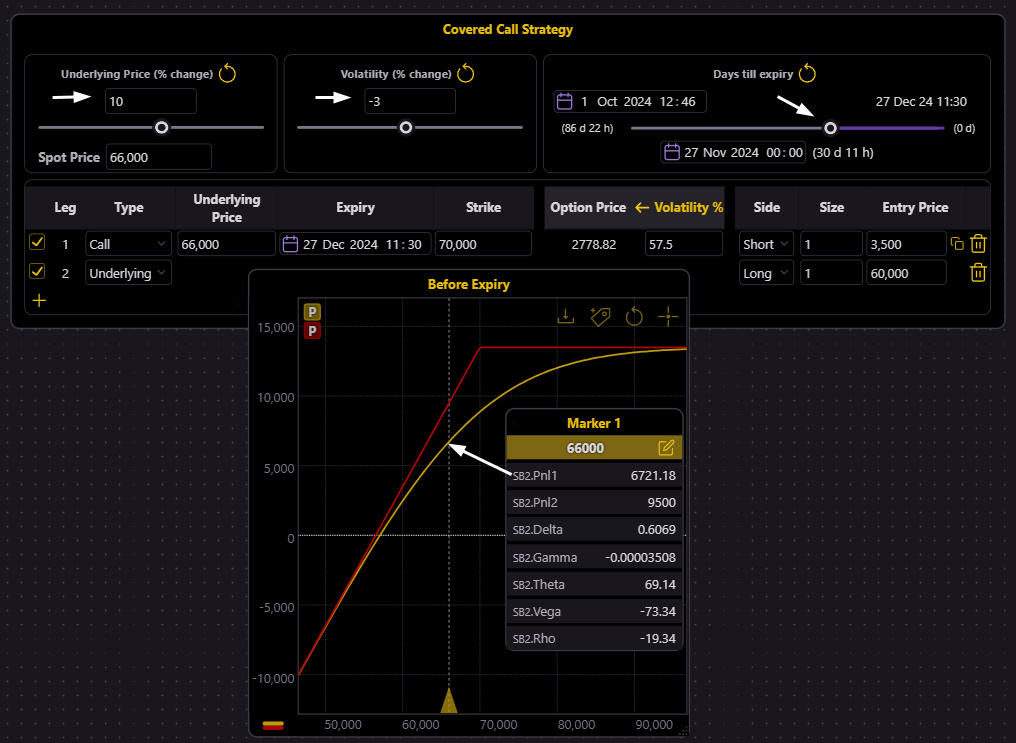

Let's consider a scenario where you might want to close your position before expiration. Suppose 30 days before expiry, Bitcoin’s price reaches $66,000, and the implied volatility has decreased, lowering the option price.

(Simulation 🔗)

In this scenario, closing the position early could lock in a profit of $6721, combining gains from the Bitcoin holding and the reduced liability from the sold call option. After closing the position, you can potentially enjoy the asset's price flying in to the moon. This highlights the flexibility of the covered call strategy, allowing traders to adjust their positions based on market developments.

The Covered Call Trade-Off: Income vs. Limited Upside

The covered call strategy is a powerful tool for generating income and providing some downside protection, but it comes with the trade-off of capping your upside potential. In a strongly bullish market, this can mean leaving significant profits on the table. However, in a stable or slightly bullish market, or when aiming to reduce volatility in your portfolio, the covered call can be an excellent strategy.

As always, it’s crucial to monitor market conditions and adjust your strategies accordingly. The simulations we've explored show how different scenarios can impact the outcome of a covered call strategy, helping you make informed decisions.

Simulations are available in Thales Options Strategy Simulator.

Disclaimer

Trading options involves significant risk and is not suitable for every investor. The strategies discussed here are for informational purposes and should not be considered financial advice. Always consult with a qualified financial professional before making any investment decisions.