Cash-Secured Puts

All the simulations are available in Thales Options Strategy Simulator.

Generating Income While Preparing to Buy Bitcoin at a Discount

Navigating the volatile world of cryptocurrency can be tricky, especially for those looking to generate income while managing risk. The cash-secured put strategy offers an excellent way for investors to collect premiums while being ready to purchase an asset at a discount if prices fall. Here, we’ll explore how this strategy works using two simulations to illustrate the potential outcomes.

Explore the simulations on Thales Options Strategy Simulator (OSS).

What is a Cash-Secured Put?

A cash-secured put involves selling a put option on a stock (or any asset like cryptocurrency, for which there is an Options market), and setting aside enough cash to buy the asset at the strike price if assigned. In return, the seller collects a premium from the buyer of the put option. This strategy is particularly effective when you're prepared to own the asset at a lower price while earning income upfront from the premium.

Let’s consider a practical example from the Bitcoin options market. The following simulation has been created to clearly illustrate how the cash-secured put strategy works in real market conditions.

(Simulation 🔗)

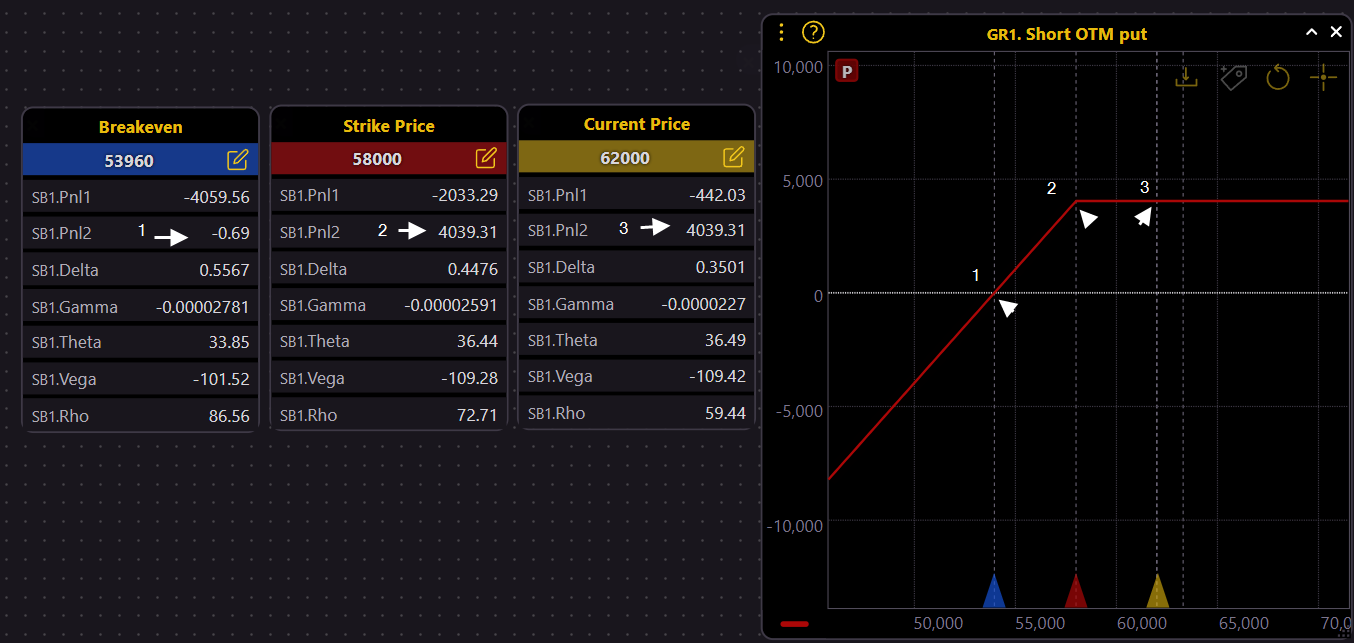

In this simulation, we’ll look at selling an out-of-the-money (OTM) cash-secured put on Bitcoin with the following details:

-Current Bitcoin Price: $62,000 (Yellow marker in the chart)

- Strike Price: $58,000 (Red marker in the chart)

- Premium Collected: $4,039 (as shown in the profit/loss table)

- Breakeven Price: $53,960 (Blue marker in the chart)

Scenario 1: Bitcoin Price Stays Above the Strike Price

In this scenario, the price of Bitcoin stays above $58,000 by the expiration of the option. As the seller of the put option, you keep the entire premium of $4,039 without having to buy Bitcoin. Essentially, this becomes pure income, and no further obligations arise. This outcome is ideal for investors who want to collect income while waiting for better buying opportunities.

The point here is that you can continue selling OTM puts until one eventually ends up in-the-money (ITM), obligating you to buy the underlying asset (in this case, Bitcoin). This approach allows you to repeatedly collect premiums while waiting for the opportunity to buy Bitcoin at a discount, as you originally intended.

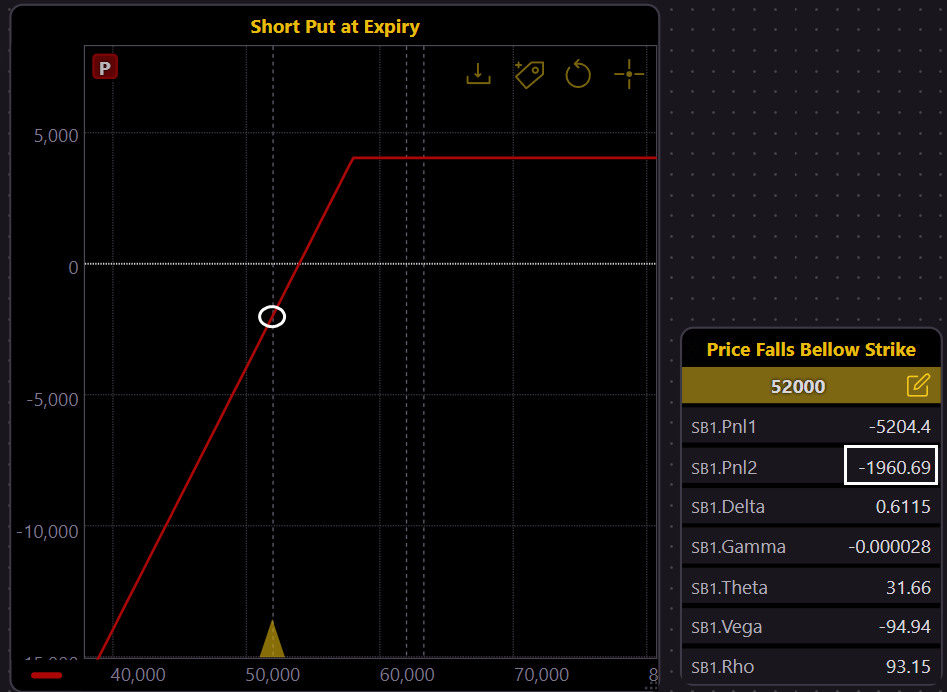

Scenario 2: Bitcoin Price Falls Below the Strike Price

(Simulation 🔗)

In this scenario, the price of Bitcoin drops below $58,000 and falls to $52,000. As a result, your option ends ITM, obligating you to buy Bitcoin at the strike price of $58,000. Although you incur a paper loss of $5,204, the premium collected ($4,039) cushions part of the loss, leaving you with a net loss of $1,960. It’s worth noting that you may have sold several puts that expired OTM before this, allowing you to collect premiums and further reduce risk by the time the option ends ITM.

Why Use a Cash-Secured Put?

The appeal of the cash-secured put lies in its ability to generate income while preparing to buy the asset at a discount. Unlike buying Bitcoin outright at the current price, this strategy allows investors to enter the market at a lower price while earning a premium for taking on the obligation to purchase the asset.

Here’s why this strategy works:

1. Income Generation: The upfront premium provides a consistent income stream, even if the put option is never exercised.

2. Preparedness to Buy at a Discount: If Bitcoin falls below the strike price, you buy it at the lower price, which may be an opportunity you were looking for anyway.

3. Risk Mitigation: The breakeven point (strike price minus premium) provides a buffer against market volatility.

Key Considerations

While the cash-secured put strategy can be effective, it’s important to weigh the risks:

- Obligation to Buy: If Bitcoin falls significantly below the strike price, you could end up buying it at a price higher than the market value, although the premium collected helps cushion the loss.

- Opportunity Cost: By selling the put option, you're locking yourself into the obligation to buy the asset. If the price rises significantly, you miss out on the potential upside from holding the asset directly.

Disclaimer

The content presented in this blog is for educational and informational purposes only and should not be construed as financial advice. Trading in options and other financial instruments involves significant risk and may not be suitable for all investors. It is recommended that you seek the advice of a qualified financial advisor before making any investment decisions. The simulations and examples provided are hypothetical and are not guaranteed to predict future performance.