Mastering Calendar Call Spreads: Leverage Time Decay and Volatility for Profit

All the simulations are available in Thales Options Strategy Simulator.

In the world of options trading, calendar spreads stand out as a smart strategy that takes advantage of time decay and volatility shifts. When you apply this strategy to assets like Bitcoin, you can unlock profit opportunities while minimizing risk. Here, we will dive into how calendar spreads work, trying to analyze its key factors—time, volatility, and underlying price movements. We’ll use a real-world example involving Bitcoin options to bring these ideas to life.

Understanding the Strategy

At its core, a calendar spread is a strategy that involves selling a near-term option while simultaneously buying a longer-term option, both with the same strike price. This method is particularly appealing in stable markets, where the goal is to profit from the passage of time (also known as time decay or theta) and shifts in implied volatility (vega).

Why would a trader use this strategy? Well, instead of relying solely on price movement, the calendar spread gives you the flexibility to profit from time decay and volatility fluctuations. The strategy works best when the price of the underlying asset stays near the strike price, allowing both the short-term and long-term options to balance each other out while time works in your favor.

Let’s Dive into a Real Example

To better understand the calendar spread strategy, let’s explore a real-world example using Bitcoin options. We will break down the different factors that influence the strategy’s performance through a series of simulations using Thales OSS. This will help you see firsthand how factors like time passage, volatility changes, and price movements impact the position both before and at expiration.

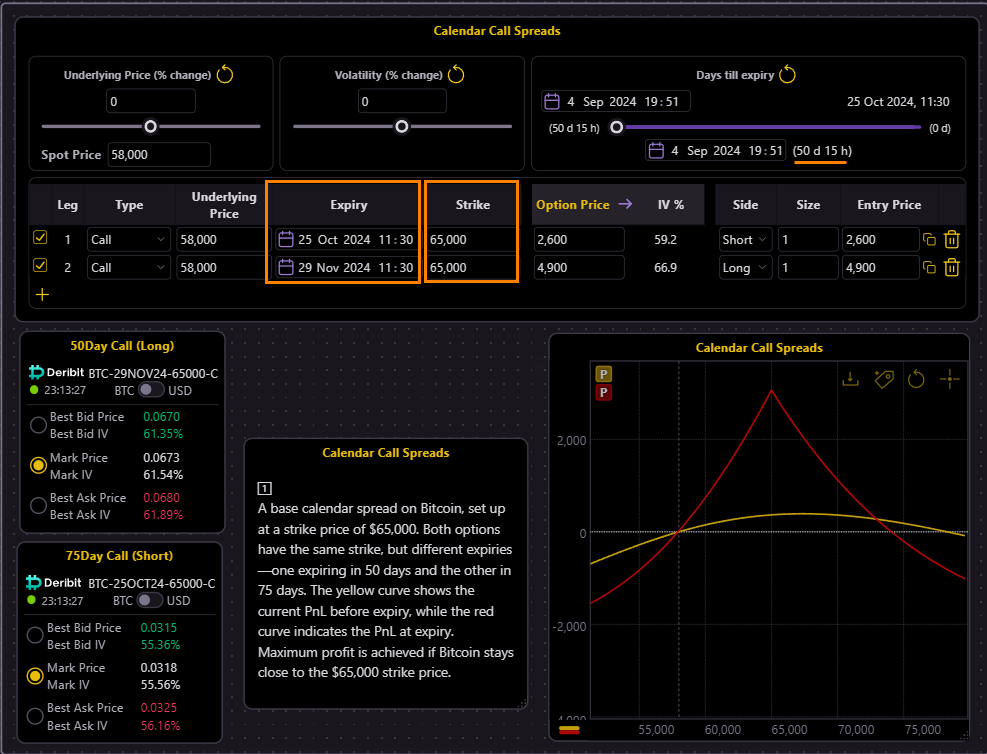

The setup: We sell a call option expiring in 50 days and buy a call option expiring in 75 days. Both have the same strike price of $65,000.

Let’s break it down step-by-step to see how this plays out.

(Simulation 🔗)

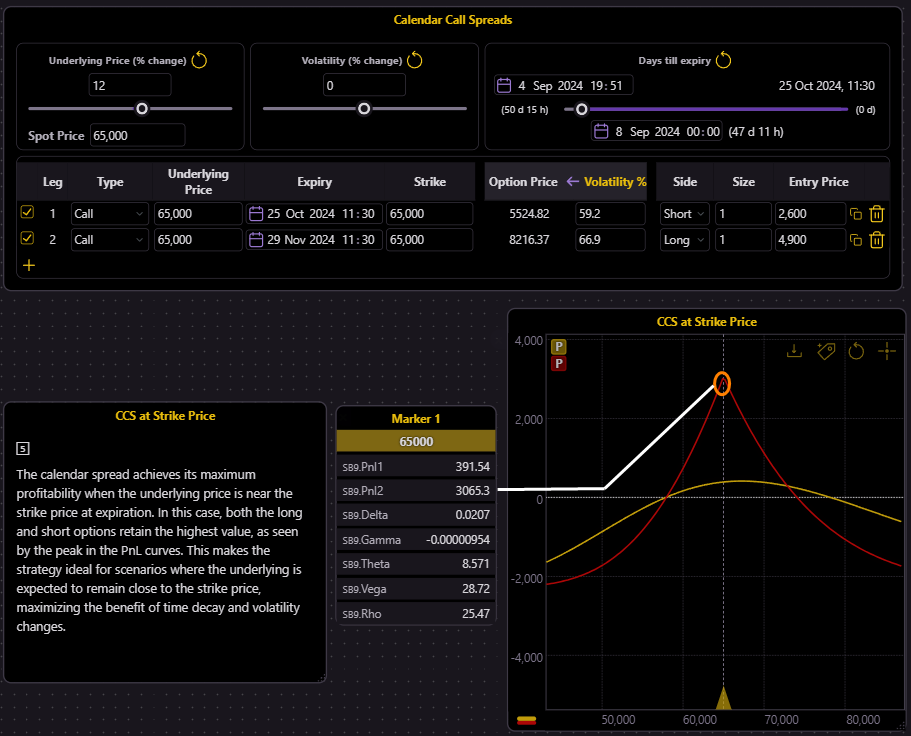

In our initial setup, we have a calendar spread on Bitcoin with a strike price of $65,000. We sell the shorter-term call (50 days) and buy the longer-term call (75 days). The position’s profitability is depicted by two curves: the yellow curve, representing the current PnL before expiry, and the red curve, showing the PnL at expiration, depending where the price of Bitcoin be.

As expected, the strategy generates maximum profit when Bitcoin remains close to the strike price by expiration. This is the ideal scenario where both options work in harmony.

Implied Volatility's Impact on Calendar Spreads

(Simulation 🔗)

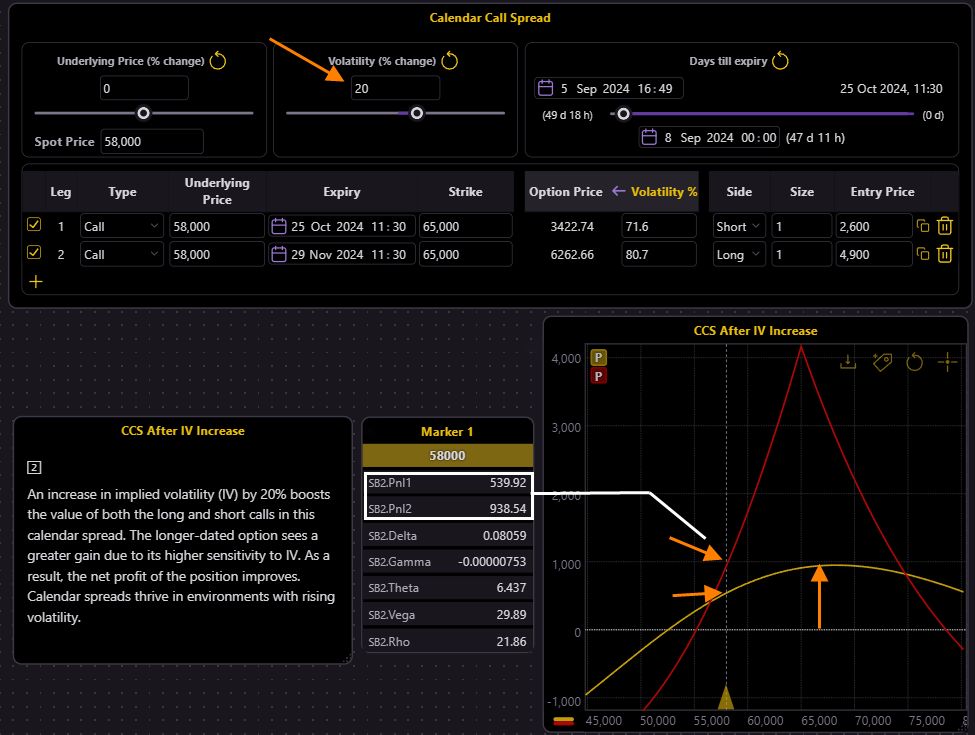

Now, let’s say implied volatility (IV) increases by 20%. Volatility is a crucial factor for calendar spreads. Experienced traders can employ this strategy when IV is low but expected to rise. In essence, they can trade IV, capitalizing on anticipated shifts in volatility. As shown in the simulation, even if everything else remains stable, a rise in IV alone pulls the PnL into profitable territory. This makes calendar spreads particularly effective in environments where significant price movements and volatility increases are anticipated, such as before earnings reports or market events.

(Simulation 🔗)

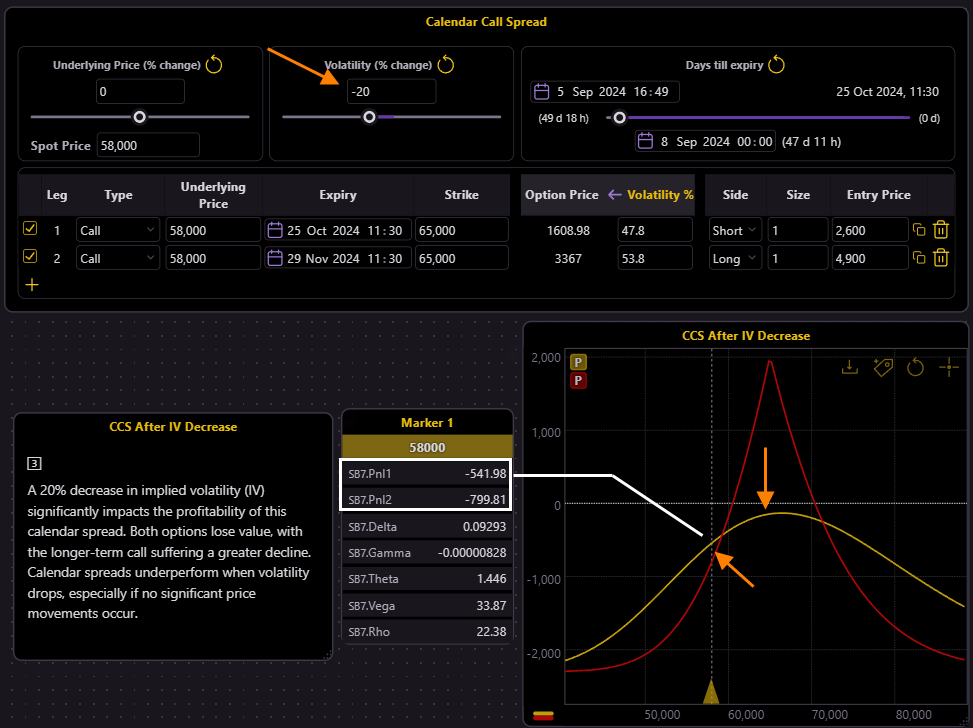

On the other hand, calendar spreads become significantly less effective when volatility decreases. As seen in the simulation, a 20% drop in IV alone can push the position into loss territory, even if other factors like the underlying price remain stable. This reinforces the importance of choosing this strategy when IV is low and expected to rise, rather than when volatility is high and could decline.

Impact of Underlying Price Movements on Calendar Spreads

(Simulation 🔗)

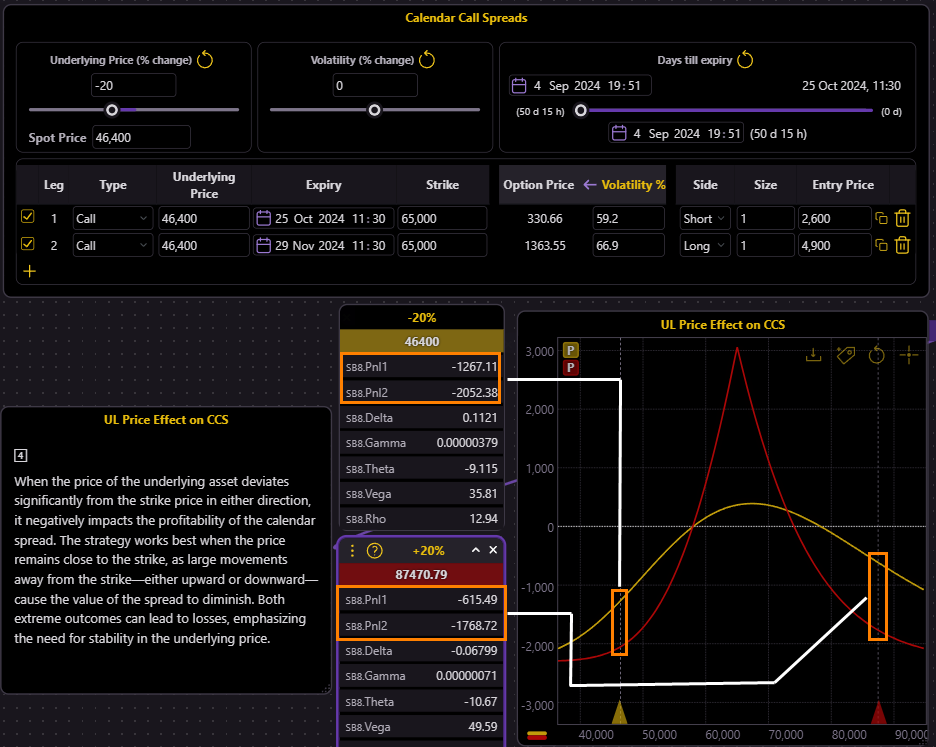

What if Bitcoin’s price deviates too far from the $65,000 strike? Whether it moves significantly higher or lower, the value of the calendar spread diminishes. Large price swings may reduce the effectiveness of the strategy, causing both the short-term and long-term calls to lose value. As seen in the simulation above, the strategy incurs losses during extreme price movements. The best-case scenario is for Bitcoin’s price to remain close to the strike, as large movements away from the strike lead to reduced profitability or potential losses.

Peak of Profit

(Simulation 🔗)

When Bitcoin stays near the strike price—in our example, $65,000—the calendar spread approaches toward maximum profitability. This is because the short-term option we sold decays faster due to its higher theta. As time passes, it loses more extrinsic value quickly and has less and less chance of ending in the money. In contrast, the long-term option has a lower theta, meaning it loses value more slowly and still retains a greater chance of ending in the money. This makes the long-term option more expensive, maintaining its value while the short-term option decays rapidly. The result is a situation where the strategy performs best, generating maximum profit from time decay and the differences in extrinsic value between the two options.

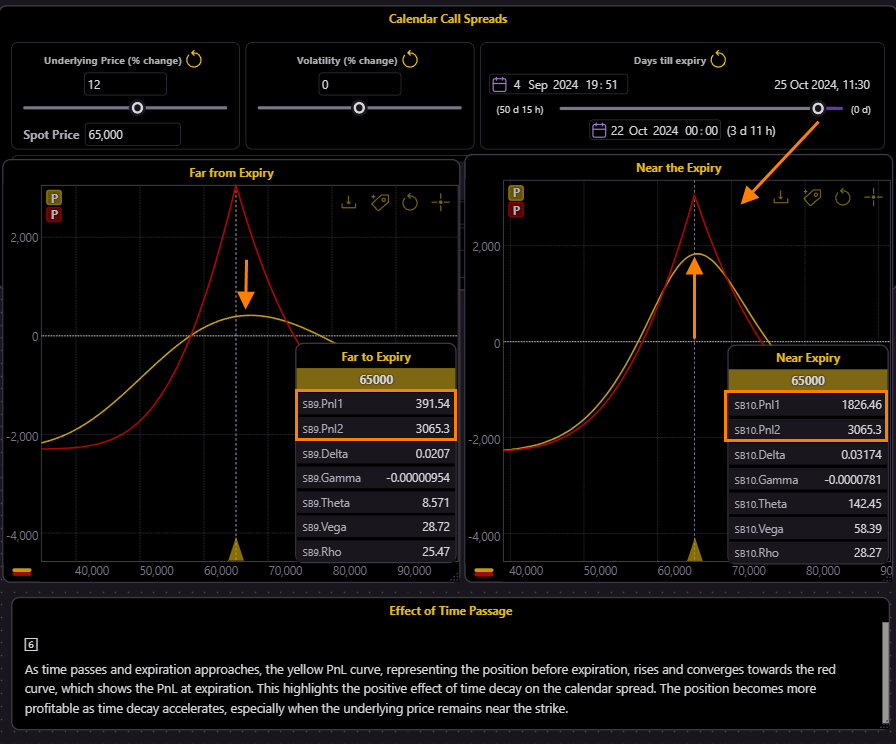

(Simulation 🔗)

As time passes and we approach the expiration of the short-term option, the yellow PnL curve rises and converges toward the red curve, which represents the PnL at expiration. If the short-term option we sold expires at the money or slightly in the money, the loss is minimal or potentially zero. Meanwhile, the longer-term option we hold retains significant extrinsic value, especially since it is also at the money. This favorable positioning results in a high potential profit as the short-term option decays rapidly, while the long-term option still holds substantial time value. This demonstrates the positive effect of time decay on the calendar spread when the underlying price remains close to the strike as expiration nears.

Key Takeaways

The calendar Call spread strategy offers a balanced approach for traders looking to capitalize on time decay and volatility changes. This strategy works best when the underlying asset, such as Bitcoin in this case, remains close to the strike price, allowing the short-term option to lose value quickly while the long-term option retains its extrinsic value. This unique interplay of theta decay and volatility makes the calendar spread a flexible tool for traders, especially in neutral market conditions.

Key insights to remember:

- Time Decay Advantage: The short-term option loses more value due to its higher theta, making the strategy more profitable as expiration approaches.

- Impact of Volatility: Rising volatility benefits the long-term option more, enhancing the position’s overall profit potential, while falling volatility diminishes profitability.

- Price Stability Matters: The strategy performs best when the underlying asset price stays near the strike, as significant price swings, either upward or downward, can lead to reduced profits or even losses.

Disclaimer

The content in this blog is for informational and educational purposes only and should not be construed as financial or investment advice. Options trading involves significant risk and is not suitable for all investors. Before engaging in any trading strategies, including calendar spreads, it's essential to evaluate your financial situation, consider your risk tolerance, and consult with a qualified financial advisor. The examples and simulations provided in this blog are hypothetical and are not guarantees of future results.