Mastering the Short Strangle

All the simulations are available in Thales Options Strategy Simulator.

A Profitable Yet Risky Options Strategy

In the world of options trading, the short strangle stands out as a high-risk, high-reward strategy that involves selling an out-of-the-money (OTM) put and an OTM call simultaneously. This approach allows traders to benefit from stable markets, but it carries significant risks, especially in volatile environments. When applied to Bitcoin, short strangles offer the potential for consistent profits, but they require careful consideration of volatility, delta, and gamma risks.

In a previous blog, we explored the Short Iron Condor strategy. In this blog, we will compare the Short Strangle to the Short Iron Condor and evaluate both strategies in terms of risk, reward, and the impact of key option metrics like implied volatility and gamma.

Setting up the Short Strangle

The Short Strangle involves selling both a call option above the current price and a put option below it. The key difference between a Short Strangle and a Short Iron Condor lies in the lack of protective long options in the strangle. Without this protection, the Short Strangle exposes traders to unlimited risk on the upside and significant downside risk on the put side.

In our case, let’s use the Thales OSS to simulate a Short Strangle on Bitcoin with the following setup:

- Sell Call at $64,000

- Sell Put at $52,000

For comparison, we also simulate the Short Iron Condor with the same strikes but add protective legs: a buy call at $66,000 and a buy put at $50,000.

Both strategies will perform well if Bitcoin stays within a defined range, but as we’ll see, the Iron Condor limits risk while the Short Strangle exposes the trader to more significant potential losses.

Risk and Reward: Potential Profit

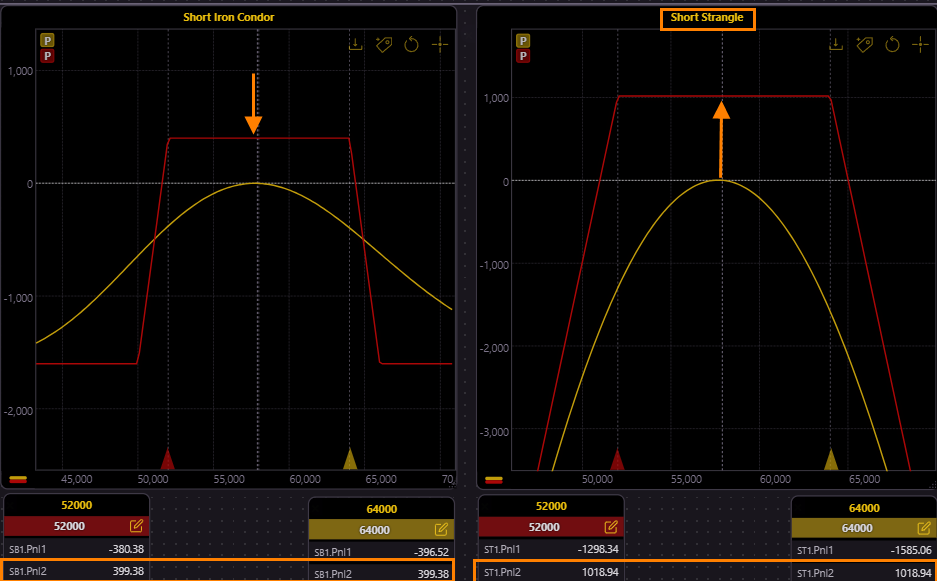

In the first simulation, we compare the profit profiles of Short Iron Condor vs. Short Strangle.

(Simulation 🔗)

The Short Iron Condor produces a max profit of around $400, while the Short Strangle can yield about $1,000 for the same price range.

This higher potential return of the Short Strangle is due to the fact that it doesn’t require the purchase of protective options. However, this also leaves the trader open to substantial risk, as we will explore in the next section. The trade-off here is clear: while the Short Strangle offers higher potential profits, it lacks the defined risk structure of the Iron Condor.

Risk Exposure: Unlimited vs. Capped Losses

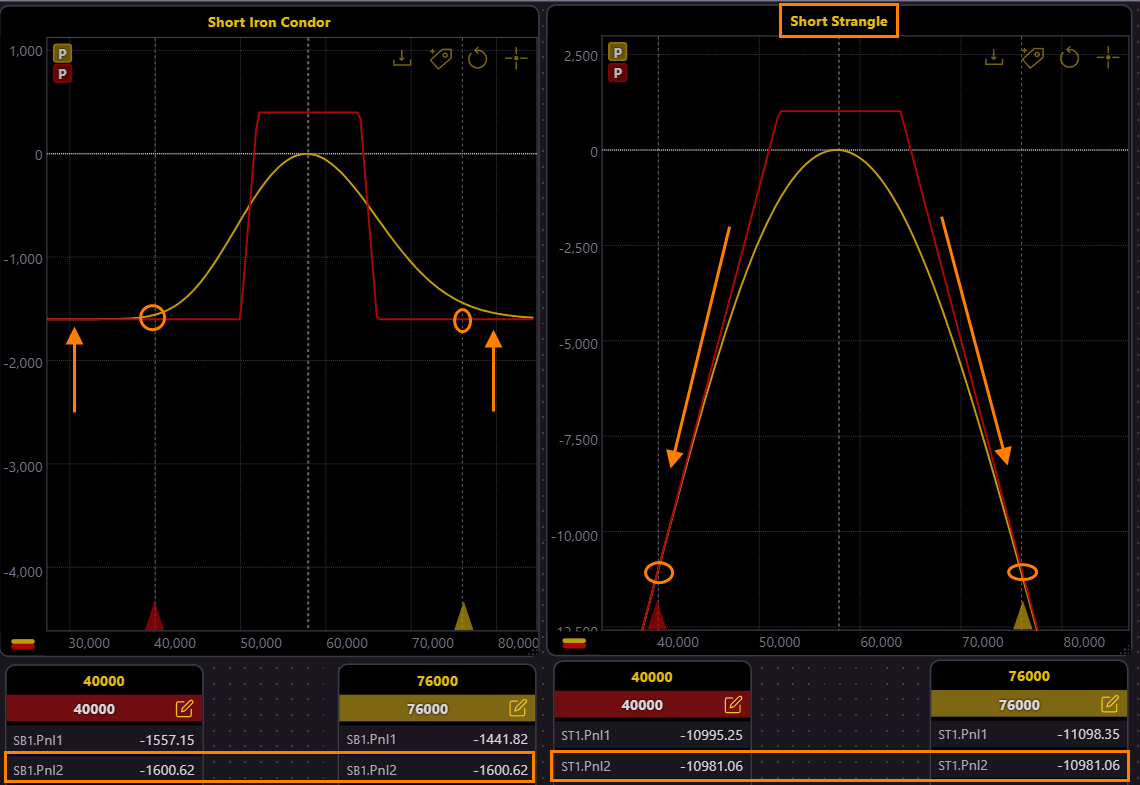

As we move into second simulation, the difference in risk exposure becomes clear.

(Simulation 🔗)

The Short Iron Condor has limited losses because of its protective long options, while the Short Strangle exposes the trader to unlimited risk on the upside if Bitcoin’s price rallies and significant losses if Bitcoin drops.

For example, in our simulation, if Bitcoin’s price falls to $40,000, the Short Iron Condor incurs a loss of $1,600, but the Short Strangle faces a much larger loss of over $10,000 due to the absence of downside protection. On the upside, the Short Strangle could theoretically result in even more catastrophic losses if Bitcoin’s price were to rise dramatically.

Implied Volatility: How Does It Affect Both Strategies?

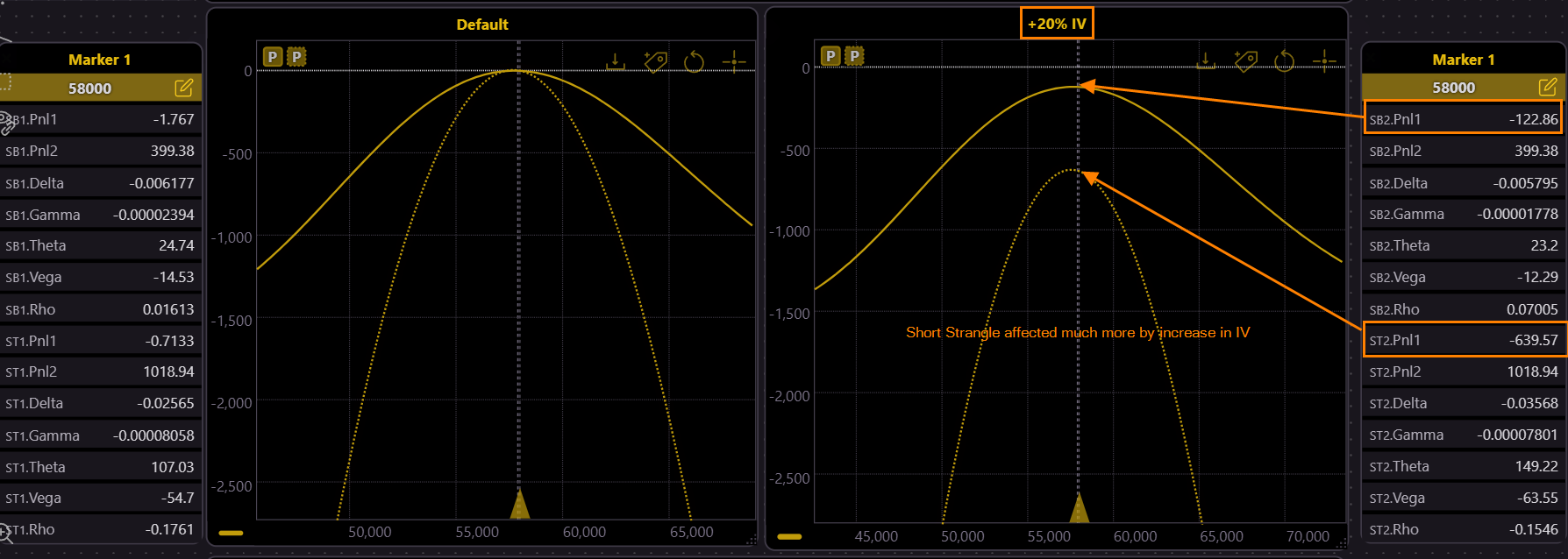

Implied Volatility (IV) plays a crucial role in the performance of these strategies. Let's examine the effect of a 20% increase in IV on both strategies.

(Simulation 🔗)

As expected, the increase in volatility leads to a greater loss for the Short Strangle compared to the Short Iron Condor.

The yellow curves in the simulation represent the current value of each strategy. After the 20% rise in IV, both strategies experience losses, but the Short Strangle (dotted line) faces a much larger impact than the Short Iron Condor (solid line). Specifically, the Short Strangle suffers a loss more than $600 while the Iron Condor incurs a smaller loss of $122.

This demonstrates that although both strategies are vulnerable to rising volatility, the Iron Condor’s defined risk structure cushions the impact.

Theta Decay: Time Is Your Ally

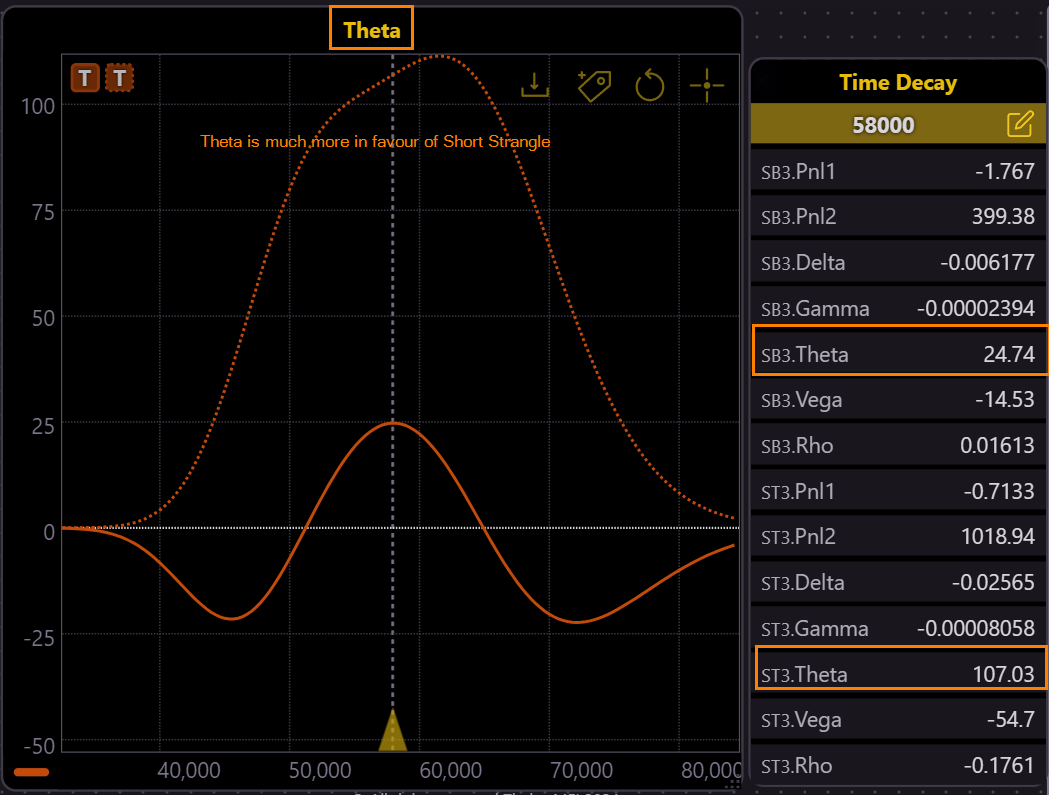

Time decay, or theta, is another crucial factor for traders using short strategies. Theta represents how much the value of the option decreases every day, as it approaches expiration. Using Thales OSS, we explore how theta impacts both strategies.

(Simulation 🔗)

As we see from the graphs, the Short Strangle benefits much more from time decay compared to the Short Iron Condor. The theta value is higher for the Short Strangle, meaning that time works more in its favor as the options approach expiration. On the other hand, the Short Iron Condor even experiences negative theta in some price ranges, indicating a potential loss due to time decay.

This suggests that traders looking to maximize their profits from passage of time may prefer the Short Strangle over the Short Iron Condor, but they must remain mindful of the increased risk.

Gamma Exposure: Sensitivity to Price Movements

Lastly, we look at the gamma of both strategies, which measures how sensitive the delta of the position is to changes in the underlying price.

(Simulation 🔗)

In the gamma simulation, we observe that gamma spikes near the center of the price range (around $58,000), especially as the position nears expiration. Both Short Iron Condor and Short Strangle show heightened gamma sensitivity as we approach expiry, but the Short Strangle demonstrates sharper gamma fluctuations at extreme prices ($44,000 and $90,000). This high gamma makes the Strangle much more sensitive to sudden price movements, which can lead to large swings in delta, increasing the risk of unexpected losses.

To better understand this behavior, we encourage you to explore the dashboard and interact with the DTE (Days to Expiry) slider. You'll see how gamma increases significantly as you move closer to the expiration date. Monitoring and managing this gamma risk is critical to avoid sharp, unexpected price sensitivity. Gamma management will be a crucial topic in future discussions on portfolio management.

Conclusion

The Short Strangle is a high-reward strategy that benefits greatly from time decay, but its risk exposure—particularly in volatile markets—cannot be ignored. For traders willing to take on more risk in exchange for higher returns, the Short Strangle may be an appealing option. However, for those seeking a more balanced approach with defined risks, the Short Iron Condor may be the better choice.

Both strategies have their place in the trader's toolbox, but understanding their nuances, especially in terms of volatility and gamma exposure, is crucial for making informed decisions. As always, traders should carefully consider their risk tolerance and market outlook before employing these strategies.

To explore these strategies further and run your own simulations, you can access them via the Thales OSS dashboard. Don’t worry about tweaking the parameters—each time you click the link, the original setup is restored for you to experiment freely.

Disclaimer

The content provided in this blog is for informational and educational purposes only and should not be considered financial or investment advice. Options trading carries significant risk and may not be suitable for all investors. Always assess your financial situation, risk tolerance, and consult with a qualified financial advisor before engaging in any trading strategies.