Introduction

As option traders, the term "delta hedging" often surfaces, especially in discussions surrounding market makers and their strategies within the options market. In this blog, we delve into the concept of delta hedging, using the robust capabilities of our OSS app to illustrate and clarify this strategy in a tangible and clear manner. We will explore what delta hedging entails, how it can be implemented, and the limitations associated with this widely-used risk management technique.

(Visit Thales Options Strategy Simulator)

What is Delta Hedging?

Delta hedging is a risk management strategy that aims to reduce, or neutralize, the directional risk associated with price fluctuations of an underlying asset in options trading. The core principle of delta hedging is to adjust the position's delta so that it approaches zero, creating a 'delta-neutral' position that is less sensitive to small price movements.

Setting the Stage with a Real-World Example

Let's consider a practical scenario where a trader opts to sell a naked call option, which exposes them to potential significant losses if the underlying asset's price rises sharply.

Initial Setup

(OSS)

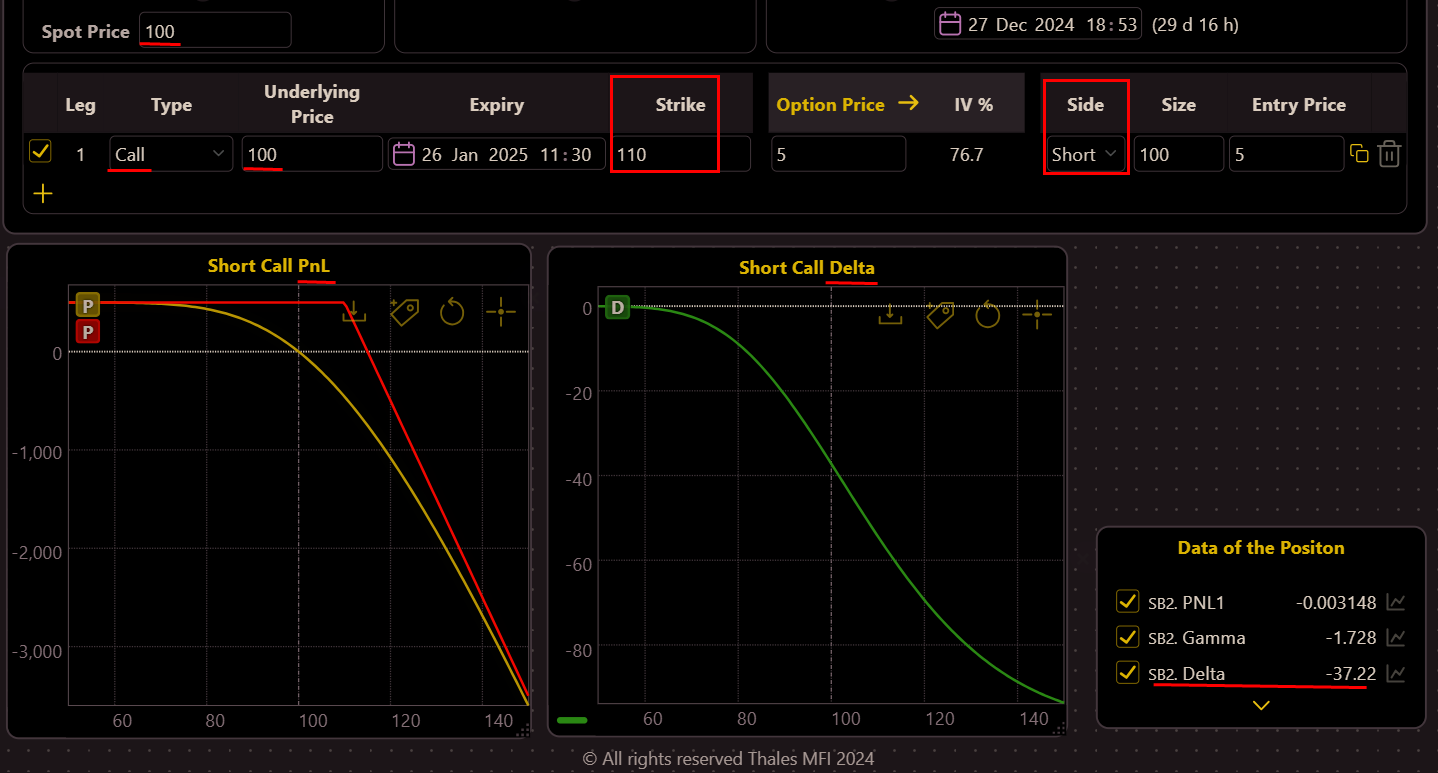

The trader initiates a short call position with a strike price of 110 while the underlying price is 100. The inherent risk of this position is high due to its unlimited loss potential if the underlying price increases significantly.

PnL and Delta

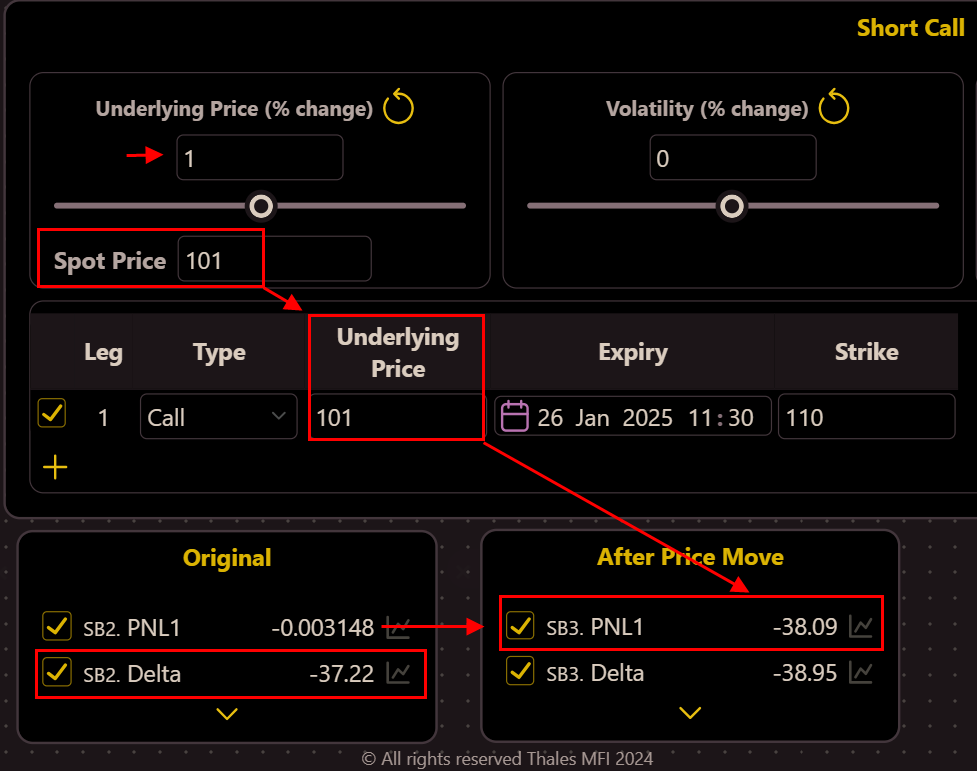

As the spot price increases, the delta of the position changes, reflecting increased sensitivity to price movements. The widgets demonstrate how the PnL deteriorates rapidly as the price moves $1 beyond the strike price.

Delta Adjustment via Hedging

(OSS)

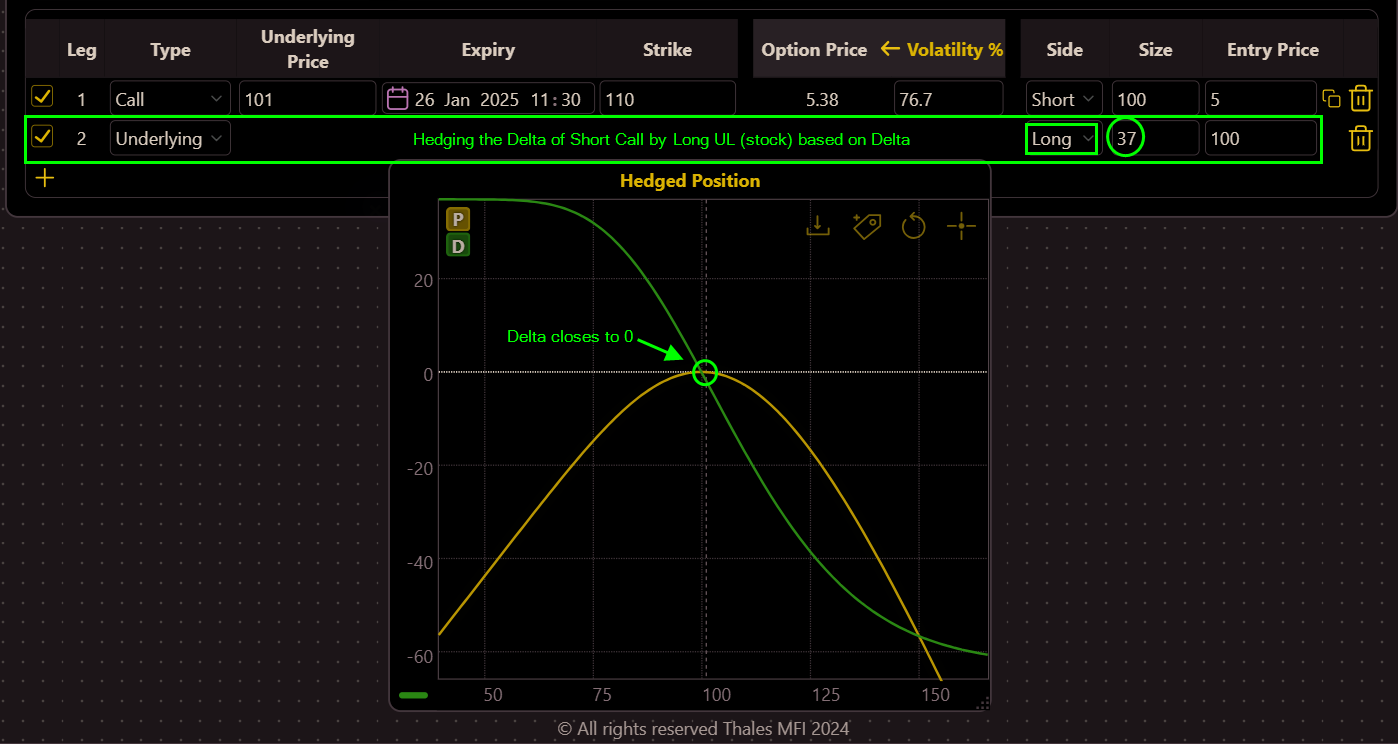

After establishing the initial risky position, the trader implements a delta hedging strategy by purchasing 37 units of the underlying asset. This specific quantity is determined based on the delta of the short call, which, in this case, is approximately -37. Since each unit of stock (or asset in the spot market) typically carries a delta of 1, the trader takes a position in the opposite direction with a size equal to the absolute value of the position's delta. This action is designed to offset the negative delta of the short call, effectively bringing the combined delta of the positions closer to zero. The graph vividly illustrates how the delta moves closer to zero following this transaction, indicating that the position is now better protected against small price fluctuations. This precise approach ensures that the overall position's sensitivity to price movements in the underlying asset is minimized, providing a more stable financial stance amidst market volatility.

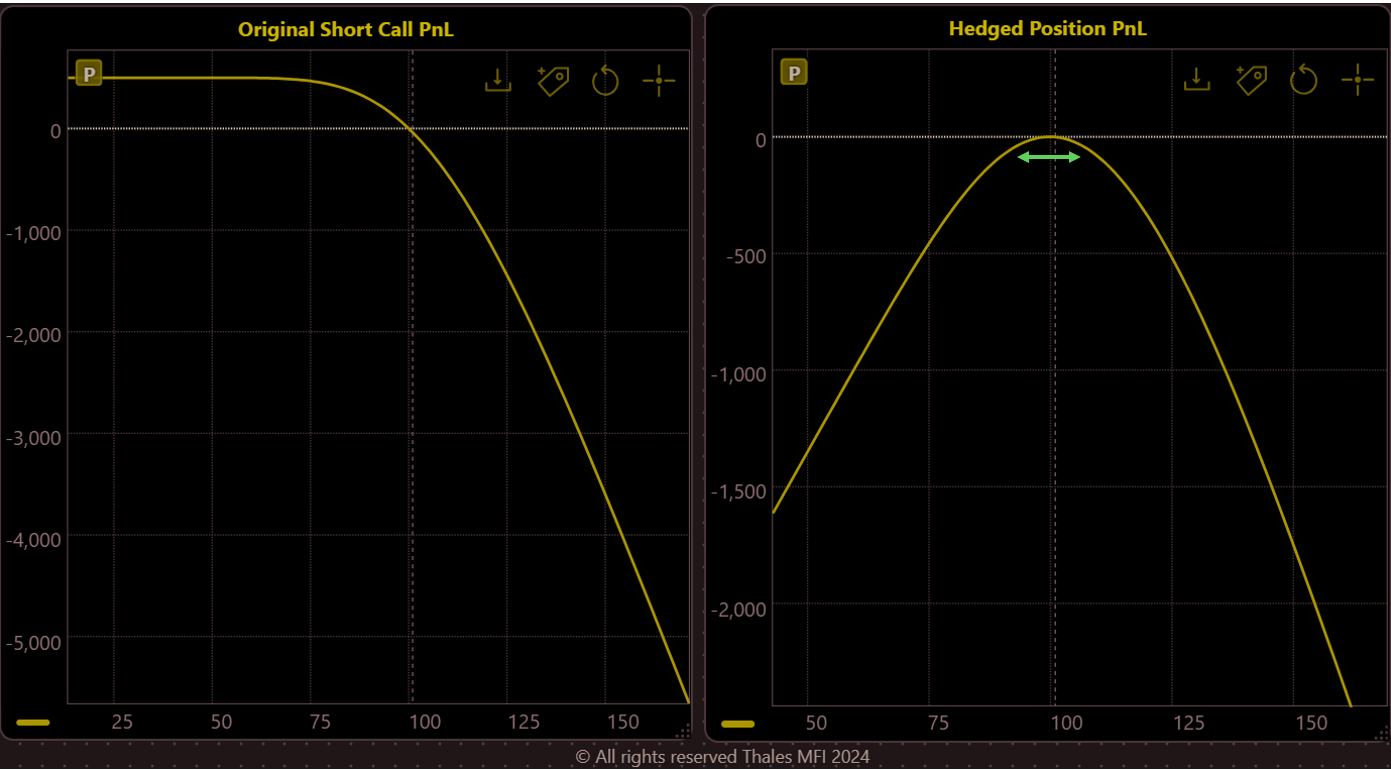

Comparison of PnL - Original vs. Hedged

(OSS)

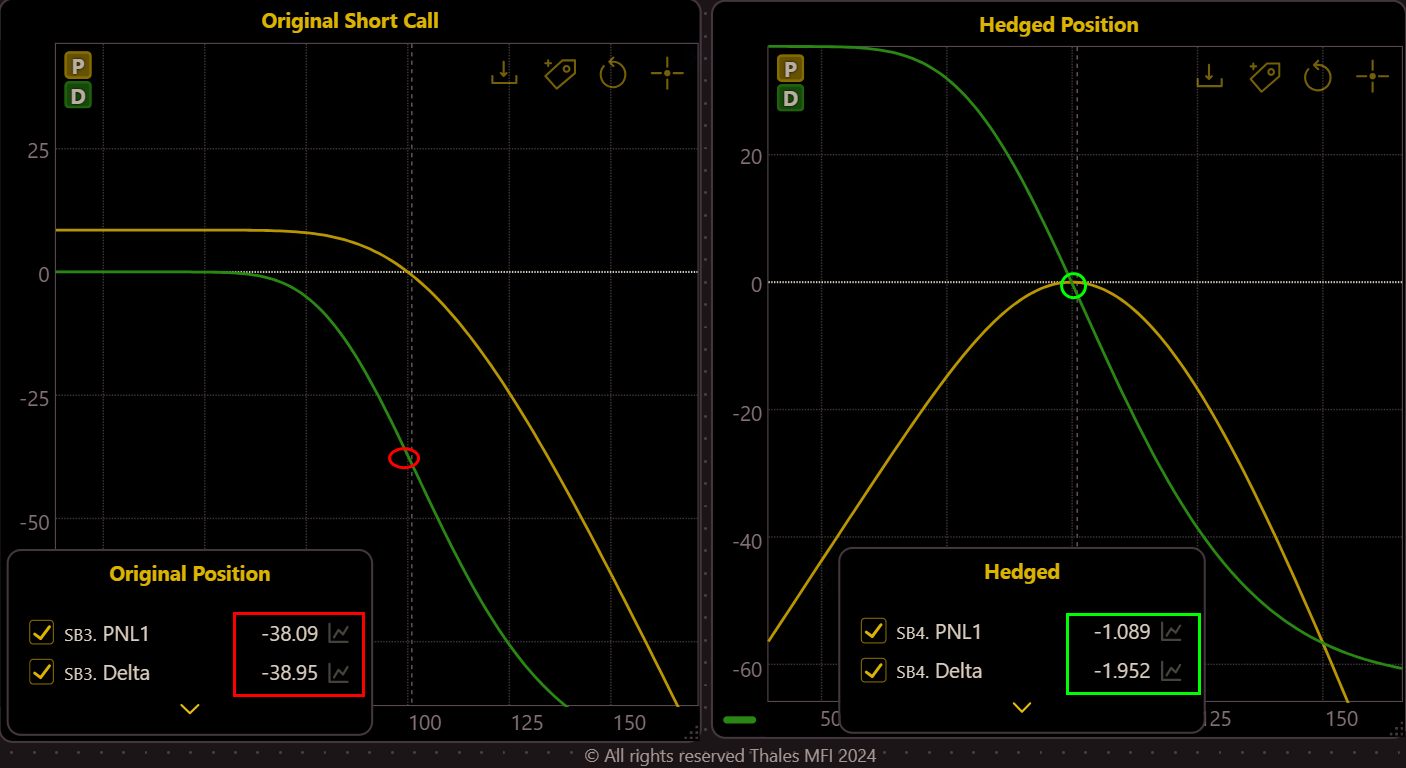

This graph provides a clear comparison between the PnL of the original and hedged positions. The effectiveness of the hedge within a certain range of price movements is evident, as it showcases a more stable PnL profile for the hedged position (Right Graph) as long as the price remains within a moderate increase or decrease. Importantly, the trader who opts to short the call typically aims to collect the premium, striving to maintain this income regardless of the market's directional movements. By implementing a delta hedge, the trader can better manage the risk of price fluctuations that could potentially erode this collected premium.

The Limitations of Delta Hedging

The effectiveness of delta hedging is not without limits. The hedged position remains stable only if the underlying price changes remain within a relatively narrow band.

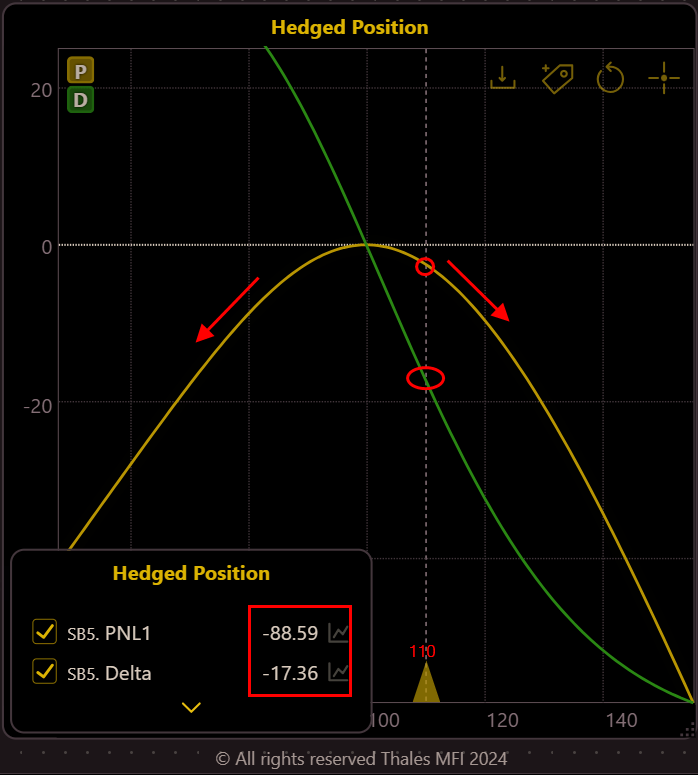

(OSS)

Significant price movements outside this band can quickly render the hedge ineffective, exposing the trader to substantial risks similar to those of the unhedged position.

(OSS)

As illustrated in the above graph, when the price of the underlying asset moves a little more (here to $110), the hedged position no longer maintains its stability. Both the profit and loss (PnL) and delta of the position turn negative, indicating a significant shift in the risk profile of the strategy. So the trader needs to justify their position delta dynamically with market. This point is critical as it shows that while delta hedging can effectively stabilize a position within certain bounds, it may fail when the underlying price reaches key levels such as the strike price of the options involved.

Gamma Hedging

Given the limitations observed with delta hedging, future blog entries will explore Gamma hedging. This strategy considers the rate of change in delta itself, offering a potentially more robust safeguard against a wider range of price movements.

Bottom Line

Delta hedging is an essential strategy for managing risk in options trading, particularly effective against minor price movements. However, traders must be vigilant as its protective capacity is limited to certain price conditions.

(Visit Thales Options Strategy Simulator)

Disclaimer

This educational blog aims to provide insights into delta hedging strategies and is not intended as investment advice. Readers should perform due diligence or consult a professional before applying these strategies in trading scenarios.