Introduction

Bitcoin has become an increasingly attractive market within the broader capital markets, drawing the interest of traders and investors from traditional finance. As more market participants explore Bitcoin, those experienced in stock options may also consider trading Bitcoin options. While the fundamental principles of options remain largely the same, there are certain differences that traders should take into account.

For investors accustomed to stock options, approaching Bitcoin options with the same mindset might not always be ideal. Factors such as trading hours, volatility behavior, settlement methods, and market structure have some distinctions. In this blog, we will highlight these aspects to help traders smoothly transition from stock options to Bitcoin options while understanding the nuances that may require additional consideration. Additionally, we introduce a powerful, must-have tool designed specifically for Bitcoin options traders—one that provides essential market insights, simulation capabilities, and risk assessment features that no serious options trader can afford to overlook.

24/7 Trading

Unlike stock options, which follow regular market hours and close on weekends, Bitcoin options trade 24/7, allowing traders to react to market movements at any time.

This also means that if you have an open position in the Bitcoin options market, there are no breaks where price movements pause. You cannot assume that your position will remain unchanged over the weekend. If your options are sensitive to changes in Bitcoin’s price, implied volatility, or other market factors, you must stay aware of potential fluctuations and be prepared to manage your position accordingly.

Style of Options Contracts

Bitcoin options are predominantly European-style, meaning they can only be exercised at expiration. This is particularly important for option sellers, as they do not have to worry about early assignment if their contracts go in the money. However, for option buyers, this structure requires some additional consideration. Even if their contracts become deep in the money before expiration, they cannot exercise them early.

That said, Bitcoin options traders are not necessarily locked into their positions. They can still sell their contracts before expiry in the market, potentially receiving the intrinsic value plus some extrinsic value. However, liquidity can be an issue, especially for deep in-the-money options. Finding a buyer might not always be easy, and wide bid-ask spreads can impact the price at which they can exit. Traders should be aware of these factors and consider alternative management strategies, such as creating spreads or using the perpetual market to hedge their intrinsic value—especially if they anticipate a price retracement. We have explored these strategies in more detail in a separate blog.

Settlement Method

In some stock markets, options are physically settled, meaning that if a contract is exercised, the underlying shares are transferred between the buyer and seller. However, in the Bitcoin options market, settlement is always cash-based.

At expiration, if a Bitcoin option expires in the money, the exchange automatically calculates the difference between the strike price and the index price at settlement. This difference, multiplied by the position size, is deducted from the seller’s account and credited to the buyer’s account. Since no actual Bitcoin changes hands, traders do not need to worry about handling or transferring Bitcoin as part of the settlement process.

This automatic cash settlement simplifies the process but also means that traders need to be aware of potential cash flow impacts on their accounts at expiration. Understanding this mechanism helps traders manage their risk and ensure they have the necessary funds or margin available for settlement.

Contract Multiplier

Traditional options traders are accustomed to a standard contract multiplier of 100, meaning that each stock option contract represents 100 shares of the underlying stock. However, Bitcoin options work differently—each contract typically represents one Bitcoin, making the contract multiplier 1 instead of 100. This distinction is crucial for traders transitioning from stock options, as position sizing, risk exposure, and margin requirements need to be recalculated accordingly.

Another key difference is the ability to trade fractional contracts, which is not common in traditional stock options. On Deribit, the largest Bitcoin options exchange, the minimum tradable size is 0.1 contracts, meaning traders can buy or sell options that control 0.1 Bitcoin instead of a full contract. Other exchanges have different minimum sizes; for example, Bybit allows trading in 0.01 contracts, meaning each contract controls only 0.01 Bitcoin. Some platforms may offer even smaller fractions, depending on their liquidity structures.

Volatility

Bitcoin, as the underlying asset of options, is generally more volatile than traditional stocks. This increased volatility brings both opportunities and risks for options traders. While stock market traders are accustomed to relatively stable price movements, Bitcoin’s price can experience sharp fluctuations, which directly impacts options pricing and risk management.

One advantage of this higher volatility is that, in the options market, traders are not limited to betting on the direction of the underlying asset—they can also trade factors like implied volatility. Since implied volatility in Bitcoin options tends to be higher than in stock markets, it presents unique opportunities for traders specializing in volatility-based strategies. However, this also means that traders need to be more cautious, as sudden volatility spikes can impact their portfolios significantly.

To manage these risks effectively, traders should regularly monitor implied volatility levels. A useful tool for this is DVOL, an implied volatility index provided by Deribit, which helps traders assess the current market conditions relative to historical levels.

Dividends and Funding Rates

Traders coming from the stock market are familiar with dividend payments, which can impact option pricing—particularly for calls and puts around ex-dividend dates. However, since Bitcoin is not a company and does not distribute profits, there are no dividends to consider when trading Bitcoin options.

That said, there is another important factor in Bitcoin markets that traders should be aware of: the funding rate. Many traders use perpetual futures to hedge or balance their options positions, as these contracts are widely available on most crypto exchanges. However, the funding rate—a periodic fee exchanged between long and short positions in perpetual contracts—can sometimes be significantly high, especially in overheated markets when retail traders flood in and take large leveraged positions.

A high funding rate can increase the cost of maintaining a hedge and impact overall portfolio returns. Therefore, traders considering perpetual contracts alongside their Bitcoin options should monitor funding rates closely and factor them into their risk management strategy to avoid unexpected costs.

On-Chain Data

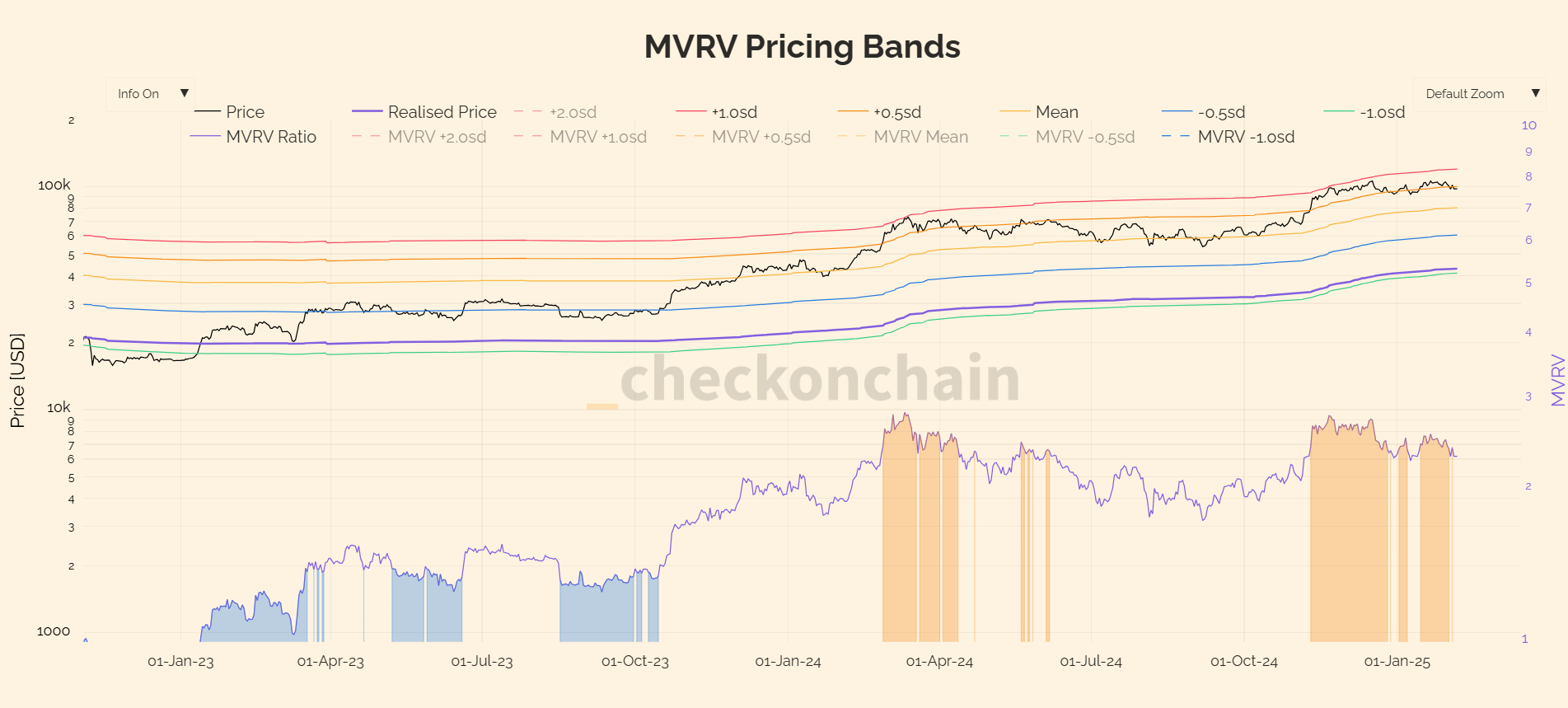

A unique feature of the Bitcoin market—one that is not available in traditional stock options—is the ability to leverage on-chain data for market analysis. Since Bitcoin operates on a transparent blockchain, traders can access valuable transaction data and use it for fundamental analysis of price trends.

On-chain metrics can help traders identify key support and resistance levels by analyzing realized price, MVRV ratio, and other indicators. For example, the MVRV ratio compares the market value of Bitcoin to its realized value, helping traders assess whether Bitcoin is in a potential risk zone—either overvalued or undervalued. Such insights can be useful for options traders looking to gauge market sentiment and adjust their strategies accordingly.

By incorporating on-chain data into their analysis, Bitcoin options traders can gain a deeper understanding of market dynamics beyond just price charts and order books, enhancing their decision-making process.

Bridging the Gap with the Right Tools ⚙️

For traders transitioning from traditional stock options to Bitcoin options, understanding these key differences is essential. However, beyond knowledge, having the right tools to analyze and simulate positions is just as crucial. Unlike stock options, where markets are well-established and tools are abundant, the Bitcoin options market requires a dedicated platform that allows traders to navigate its unique structure with confidence.

This is where a comprehensive dashboard becomes invaluable. With features like a market screener, and heatmaps, traders can monitor the market in real-time and identify opportunities.

More importantly, the ability to simulate trades—adjusting key factors such as days to expiry, implied volatility, and underlying price movements—enables traders to fully assess potential risks and rewards before committing capital. Whether fine-tuning a strategy or stress-testing a position under different market conditions, a well-equipped options simulator is an essential companion for any serious Bitcoin options trader.

Bottom Line

Bitcoin options share many core principles with traditional stock options, but they also come with distinct features that traders must consider—from 24/7 trading and cash settlement to higher volatility and on-chain data insights. Understanding these differences is key to navigating the Bitcoin options market effectively.

For traders coming from the stock market, adapting to Bitcoin options requires the right tools to analyze, simulate, and manage risk efficiently. With Thales Strategy Builder and Heatmap, traders can gain deeper insights, refine their strategies, and make informed decisions before executing trades.

As the Bitcoin options market continues to evolve, embracing these tools and insights will give traders the edge they need to succeed in this dynamic space.

Disclaimer

This blog is for informational purposes only and does not constitute financial advice. Trading options involves risk, and past performance is not indicative of future results. Always conduct your own research before making any investment decisions.