Diagonal Spreads

Be Careful Not to Lock in Loss!

All the simulations are available in Thales OSS.

Diagonal spreads, a sophisticated options trading strategy, allow traders to leverage both time decay and price movement to their advantage. These spreads involve buying and selling options contracts with different strike prices and expiration dates, creating a unique risk-reward profile. While they may appear complex at first glance, understanding their mechanics can unlock opportunities to potentially enhance trading outcomes. This blog post, tailored for individuals already familiar with options trading, explores the intricacies of diagonal spreads, highlighting their connection to vertical and time spreads, and providing insights into their construction and management. By understanding when and how to implement this potent strategy, traders can add a valuable tool to their arsenal for navigating diverse market conditions.

Summary: The Diagonal Advantage

Diagonal spreads, as the name suggests, involve a diagonal positioning of options across different strike prices and expiration dates. This unique structure allows traders to:

- Profit from directional price movements: Like their vertical spread cousins, diagonals can be tailored to benefit from both rising and falling markets.

- Mitigate risk through time decay: The inclusion of options with varying expirations introduces the element of time decay, which can work in the trader's favor, potentially reducing the cost of the spread.

Throughout this blog, we'll use interactive visualizations from our custom-built dashboard to illustrate these concepts, bringing the theory to life.

Before diving in, it’s essential to understand that diagonal spreads come in various types, each designed to suit different market outlooks and trading objectives.

All the simulations are available in Thales OSS.

Types of Diagonal Spreads in Options World

Direction

Diagonal spreads can be either bullish or bearish, depending on the trader's market outlook. A bullish diagonal spread profits if the underlying asset price increases, while a bearish diagonal spread profits if the price decreases.

Debit/Credit

Diagonal spreads can be either debit spreads, where the premium paid is greater than the premium received, or credit spreads, where the premium received is greater than the premium paid.

Option Type: Diagonal spreads can be constructed using either call options or put options.

In this blog we consider Bullish Diagonal Call Spread

Setup the Strategy

To bring this strategy to life, let’s explore a real-world example using Bitcoin options. This practical illustration will make the mechanics of a bullish diagonal call spread more tangible and relatable. The strategy includes buying an ATM (at-the-money) call option with a longer expiration and selling an OTM (out-of-the-money) call option with a nearer expiration date.

Selection of Options: Crafting Your Diagonal Masterpiece

Think of constructing a diagonal spread as assembling a well-balanced puzzle. Each piece, represented by specific options contracts, plays a crucial role in shaping the overall strategy.

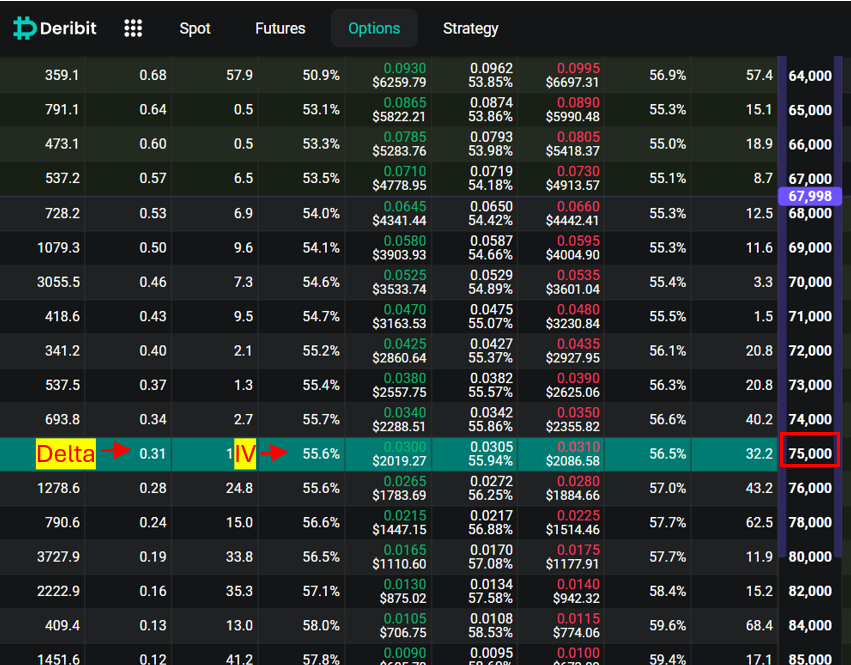

In selecting options for a bullish diagonal call spread, it’s essential to be strategic. Ideally, the call option to be bought should have an ATM delta between 0.40 and 0.60, with a relatively low implied volatility (IV), close to the baseline IV for the underlying asset.

Meanwhile, the OTM call to be sold should have a delta between 0.25 and 0.35, with a higher IV. This setup capitalizes on the time decay of the short position while maintaining a balanced risk-reward ratio with the long call.

All the simulations are available in Thales OSS.

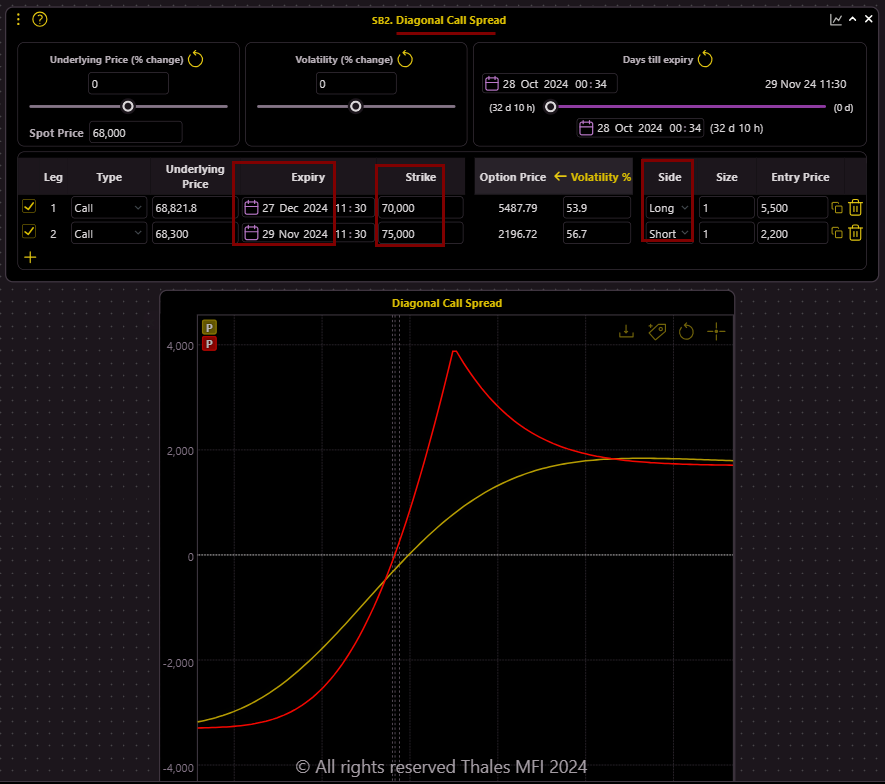

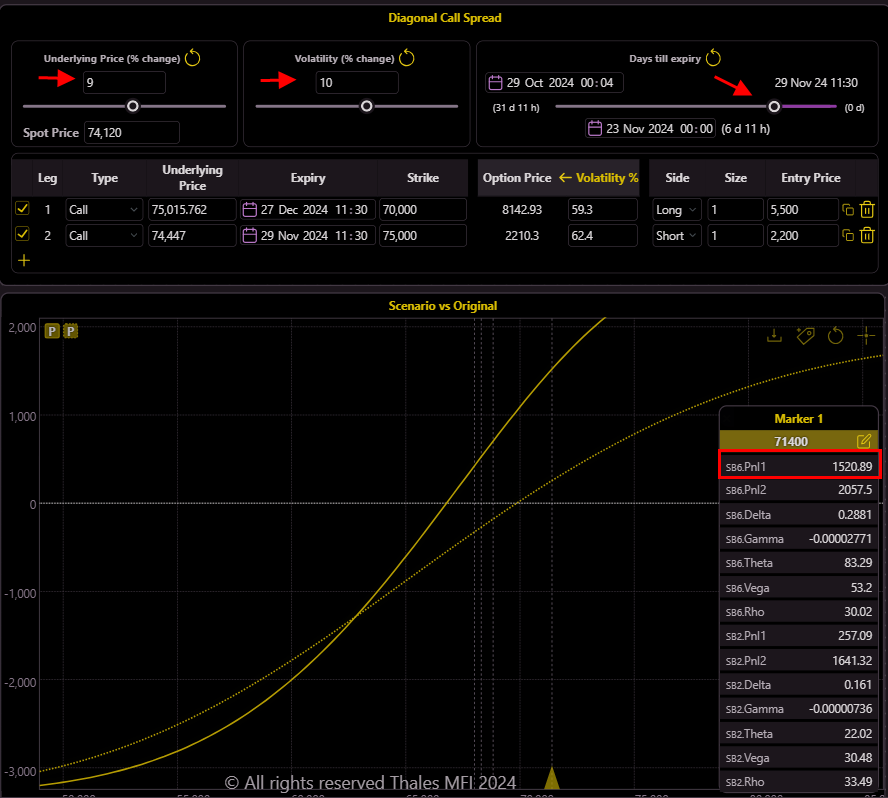

Let's simulate the positions we've selected using Thales OSS to visualize the potential outcomes.

(Simulation 🔗)

We have a long call with a lower strike (ATM) and a later expiration, paired with a short call at a higher strike (OTM) and a nearer expiration.

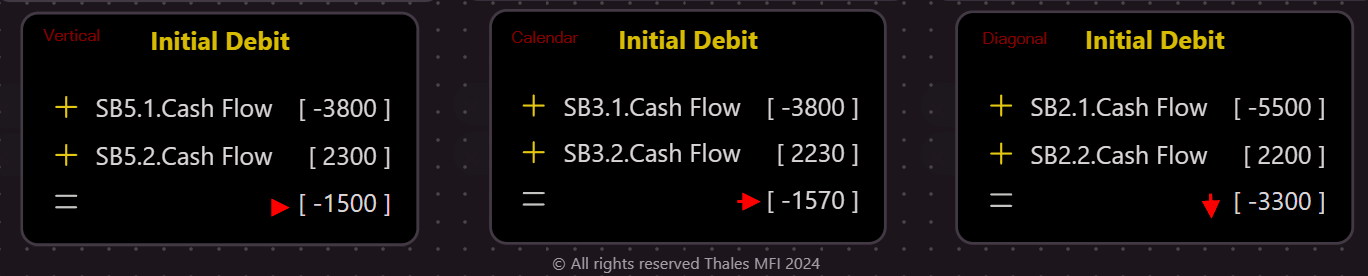

Avoid Getting Stock in the Loss!

Bring your calculator! A key precaution with the diagonal call spread is ensuring that the initial debit—what we pay upfront for the position—is less than the difference between the strike prices of the long and short calls, known as the 'strike spread.' If the initial debit exceeds this spread, we risk locking in a loss. Here’s why: if the underlying asset’s price rises above the strike of our short call, our potential gain is capped at the strike spread. However, if that gain doesn’t exceed our initial cost, we won’t break even. To avoid this trap, it’s essential to calculate carefully and keep the initial debit well below the strike spread, ideally around half or, at most, three-quarters of the spread, to allow room for profit.

(Simulation 🔗)

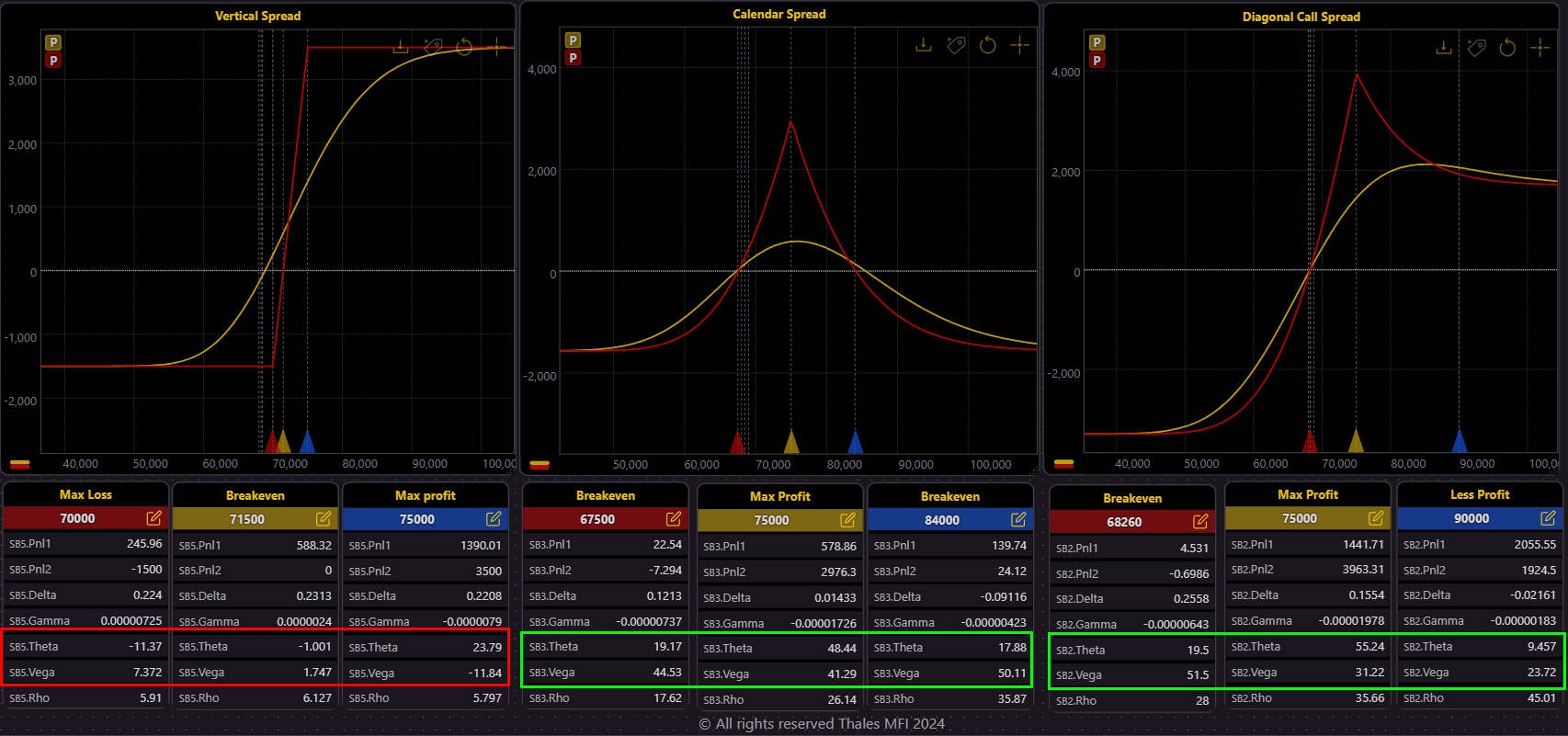

Look at the Graph again! How does it look? Does it resemble any other strategies? Let's take a closer look and break down the elements—revealing how this diagonal spread combines features of both a vertical spread and a calendar spread.

Disassemble the strategy

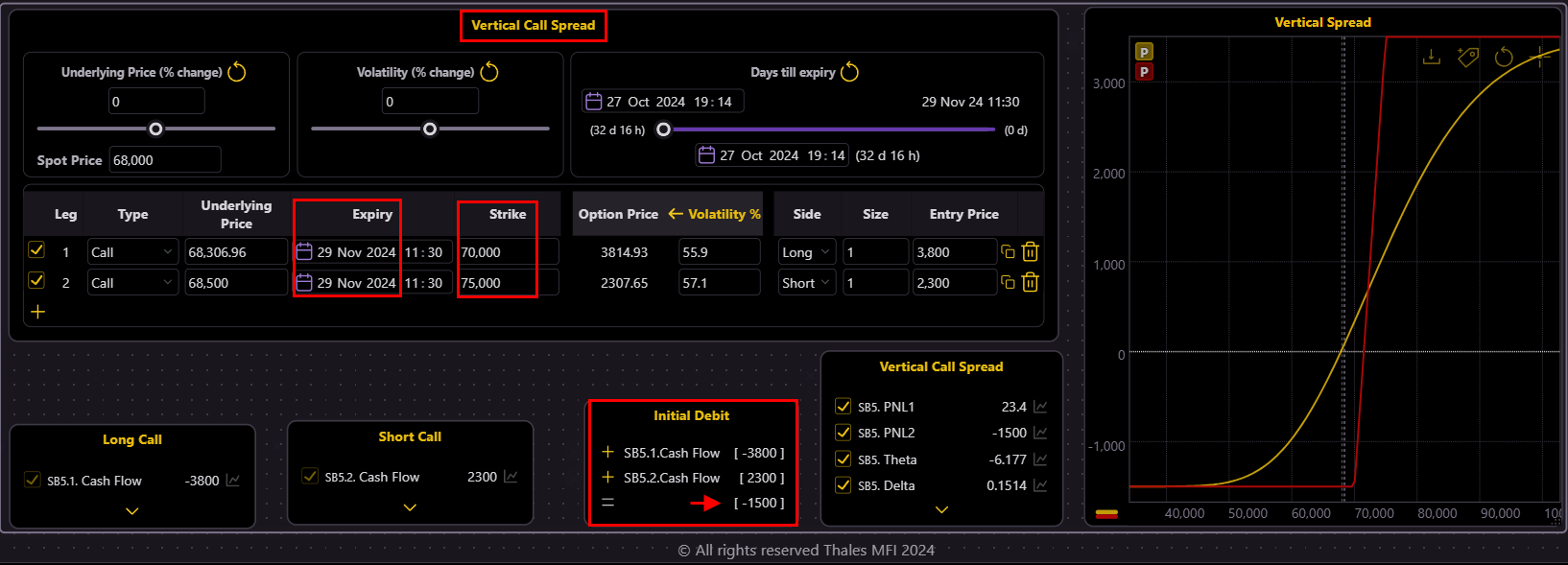

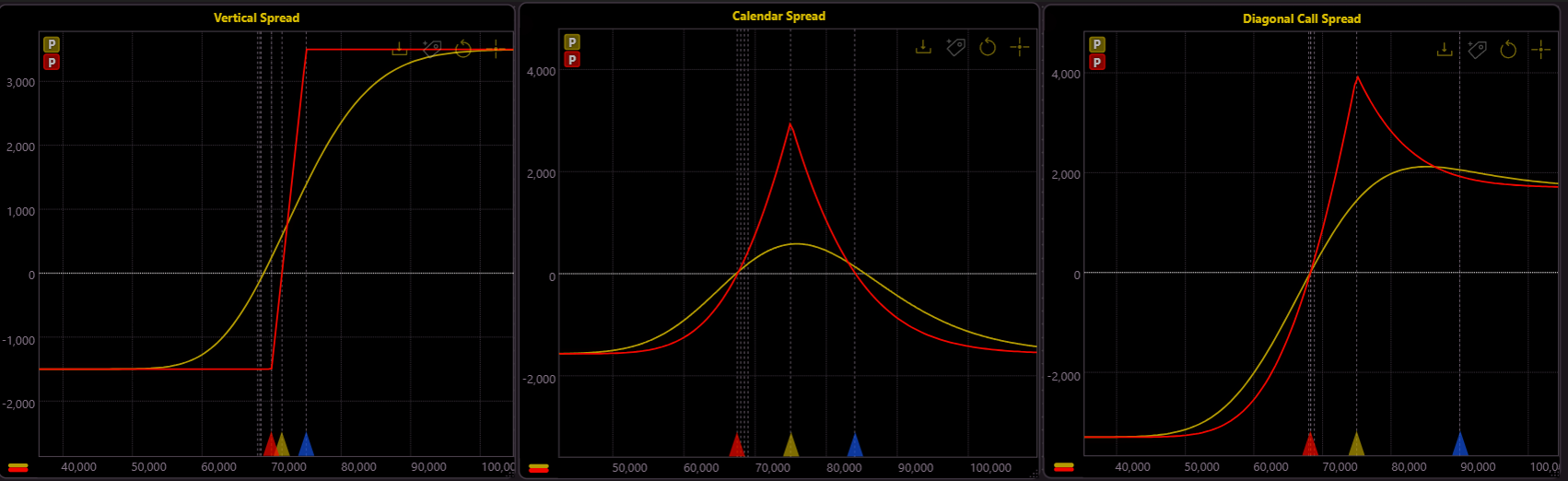

In essence, the Bullish Diagonal Call Spread combines elements of both the Vertical Spread

(Simulation 🔗)

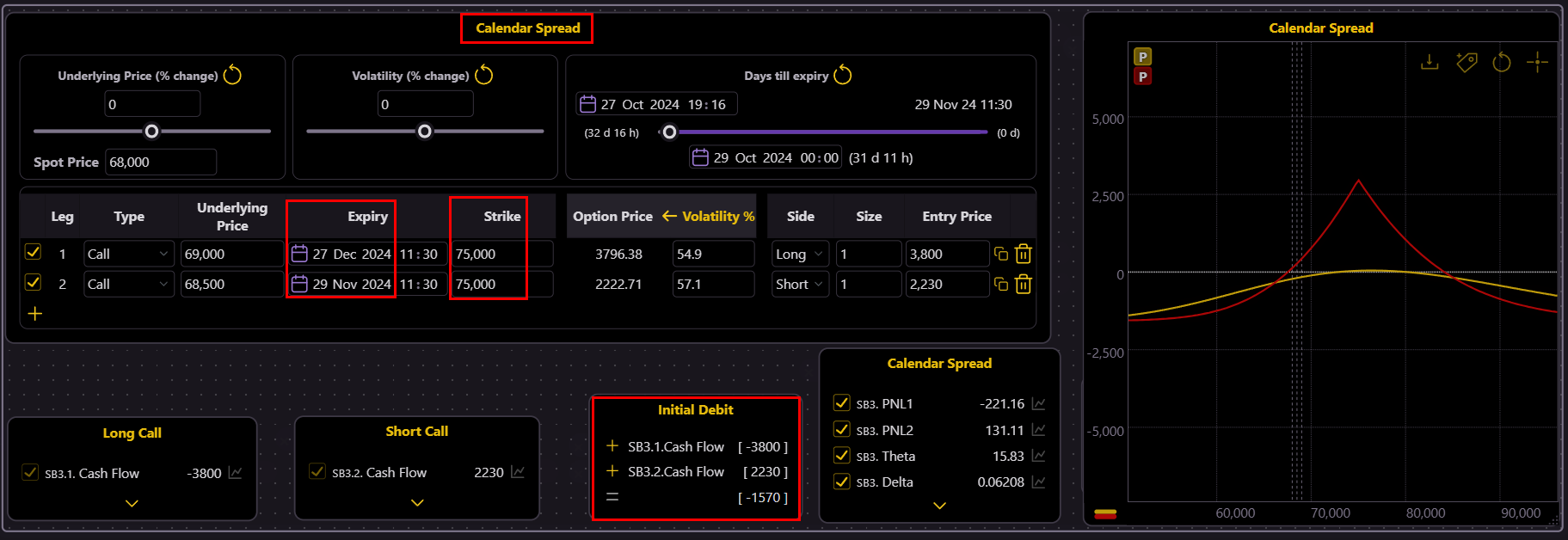

and the Calendar Spread.

(Simulation 🔗)

By integrating these two strategies, traders can capitalize on directional movement (a hallmark of the Vertical Spread) while also benefiting from time decay due to the staggered expirations (a feature of the Calendar Spread). This dual approach offers unique flexibility and potential for generating returns in various market conditions.

(Simulation 🔗)

Interestingly, the premium paid for the Diagonal Spread aligns closely with the combined premiums of the Vertical and Calendar Spreads. This observation serves as a quick check, reflecting how well our option selections fit the strategy’s intended structure.

(Simulation 🔗)

Why Choose a Diagonal Spread?

In the world of options trading, strategy selection hinges on the unique strengths each spread offers. While the Vertical Spread focuses on a directional approach, profiting from clear price movements, the Calendar Spread is crafted to harness time decay and take advantage of implied volatility fluctuations. Each strategy has its merits, but none is inherently "better" or "worse" than the others. Instead, the choice depends on market conditions, the trader's goals, risk tolerance, and anticipated price movements.

When it comes to Diagonal Spreads, their unique structure provides a blend of flexibility and potential benefits that can offer distinct advantages in certain market conditions.

Flexibility and the "Second Chance" Advantage

One of the primary benefits of a Diagonal Spread is its flexibility. If the underlying asset's price doesn’t move as expected, the trader has the option to roll the short call to a later expiration date. This feature of Diagonal Spreads gives traders a “second chance” to adjust their position, something not typically possible with a Vertical Spread. This flexibility allows for better alignment with evolving market conditions, helping to mitigate potential losses while keeping the strategy in play.

With Diagonal there is always a Second Chance (Simulation 🔗)

While the long call alone would incur a significant loss, the shorter expiration and higher time decay of the short call offset some of this loss. This offset provides the trader with an opportunity to roll the short call, extending the position and allowing more time for a favorable market shift.

Positive Theta and the Potential for Income

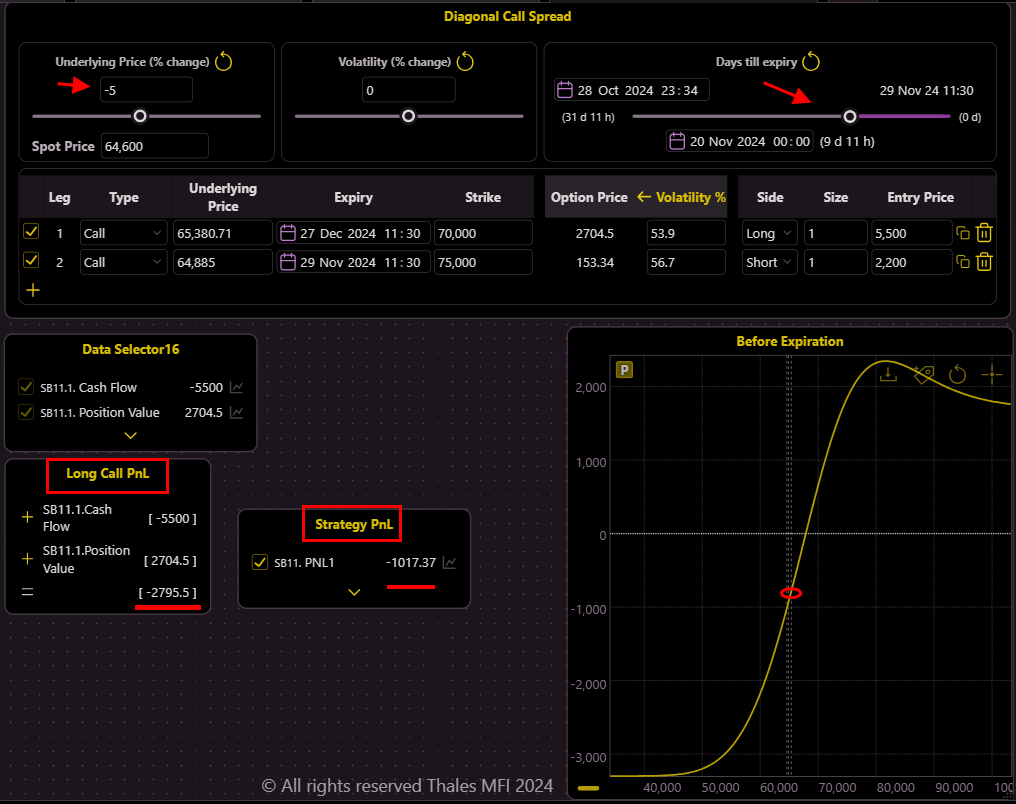

Unlike the Vertical Spread, the Diagonal Spread benefits from positive Theta, which means it can generate income through time decay.

Vertical is Directional, Calendar enjoys Time Decay and IV, Diagonal features Both (Simulation 🔗)

Diagonal call spread maintains a positive Theta, providing income from time decay, unlike the vertical spread. Additionally, the diagonal spread benefits more from an increase in Vega, making it advantageous in environments with rising implied volatility.

This advantage becomes even more pronounced when using Diagonal Spreads as a substitute for covered calls. Here, the ATM call option effectively acts as a replacement for the underlying asset, requiring less capital compared to purchasing the actual asset.

Profit from Volatility and Price Movement

Diagonal Spreads are also well-suited for situations where both implied volatility (IV) and the underlying asset’s price are expected to rise. If these movements occur, traders can exit the position before the expiration of the longer-dated option, potentially locking in a profit. A common take-profit target for Diagonal Spreads is 50% of the initial debit, offering a clear goal that aligns with the strategy's overall purpose.

(Simulation 🔗)

In this scenario, a 9% rise in Bitcoin’s price and a 10% increase in volatility elevate the PnL of our diagonal spread to 1,520.89 for the long call, showcasing how we can close the position profitably before expiration when market conditions align favorably.

Balancing Costs and Features

While the Diagonal Spread offers these advantages, it does come at a higher initial cost compared to the Vertical Spread. This additional cost reflects the added flexibility and Theta advantage, as well as the potential to adapt to price and volatility shifts. Traders should therefore carefully assess these benefits before choosing a Diagonal Spread over a Vertical or Calendar Spread. Only if these unique features align with the trader's expectations and calculations should the Diagonal be preferred.

Bottom Line

the Diagonal Spread is a powerful strategy when used under the right conditions. Its flexibility, income-generating potential, and adaptability to changing volatility make it a valuable tool in the options trader's toolkit—especially when market dynamics favor such a nuanced approach.

All the simulations are available in Thales OSS.

Disclaimer

The information provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Options trading involves significant risk, and readers should conduct their own research and consult with a qualified financial advisor before making any trading decisions. The strategies discussed here are for illustrative purposes, and past performance is not indicative of future results.